Receiving a personal injury settlement often represents a crucial milestone on your path to recovery. While this compensation is intended to help you move forward, many recipients find themselves unprepared for the complex financial decisions that follow. Making thoughtful choices about your settlement funds isn’t just about money management it’s about ensuring this compensation fulfills its true purpose: supporting your recovery and safeguarding your future well-being.

Assessing Your Financial Situation Post-Settlement

Once your settlement arrives, taking stock of both immediate needs and long-term requirements becomes essential. This means looking beyond current medical bills to consider ongoing rehabilitation costs, income replacement, and potential future care expenses. Building a comprehensive budget that balances pressing obligations with anticipated future needs creates the foundation for all subsequent financial decisions.

Key Takeaway: Before allocating your settlement funds, develop a thorough financial roadmap that addresses both current necessities and long-term security.

Common Financial Options for Settlement Recipients

Those who receive settlements typically face several paths for managing their compensation:

Lump-sum payments put the entire settlement amount at your immediate disposal, offering maximum flexibility and control. This approach works well for those with strong financial discipline, but requires careful management to ensure funds aren’t depleted prematurely.

Structured settlements deliver payments according to a pre-arranged schedule over time, providing predictable income and potential tax advantages. While this offers stability, it comes with less flexibility than receiving everything at once.

Investment opportunities may help your settlement grow over time, though these come with varying levels of investment risk that must be weighed carefully against your personal financial circumstances and comfort with uncertainty.

Understanding the full spectrum of financial options following a personal injury settlement empowers you to make choices that support both immediate recovery and long-term security.

Exploring Alternative Funding Solutions

When facing financial gaps during the settlement process, several bridge funding options exist. Pre-settlement funding provides advances while cases are still pending, whereas post-settlement funding helps during the often lengthy waiting period between settlement approval and disbursement.

For those facing urgent expenses, some consider financial products such as loans on settlement of personal injury to access a portion of their expected compensation in advance. Before pursuing such options, however, it’s vital to thoroughly understand all terms, associated fees, and potential impacts on your final settlement amount.

Navigating Cash Flow Challenges After a Settlement

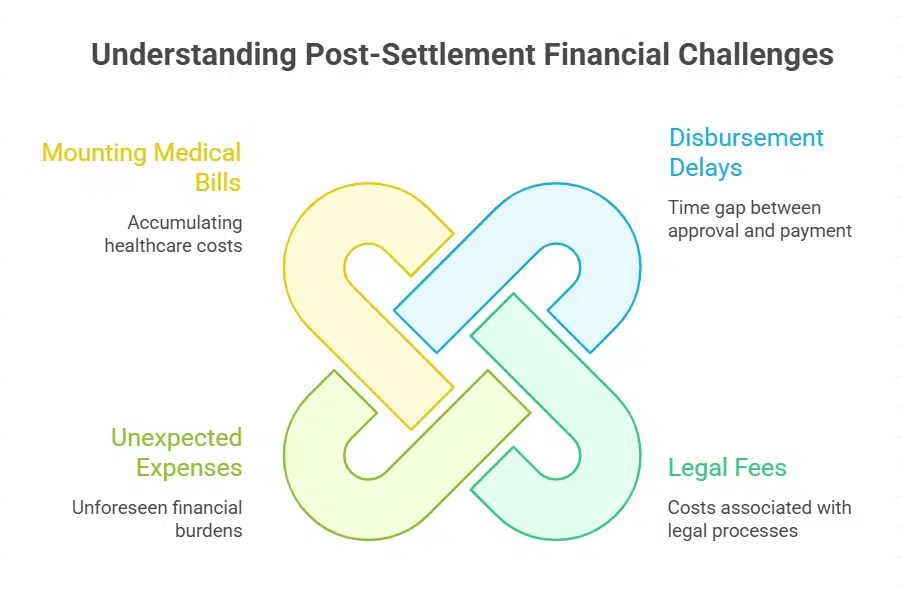

Even with compensation awarded, many recipients encounter periods of financial pressure. Delays between settlement approval and actual fund disbursement, outstanding legal fees, or unexpected expenses can create significant cash flow problems. Consider someone who receives approval for their settlement but must wait six months before receiving payment, all while medical bills continue to mount.

Consulting Financial and Legal Professionals

Major decisions about your settlement funds warrant consultation with qualified financial advisors and legal experts who specialize in settlement management. Look for professionals with specific credentials, demonstrated experience with personal injury settlements, and straightforward fee structures.

When interviewing potential advisors, consider asking:

– What specific experience do you have managing personal injury settlements?

– How exactly do you earn compensation for your services?

– What approach would you recommend for my particular circumstances?

Protecting Your Financial Future

Safeguarding your settlement requires thoughtful planning and careful risk assessment. Without proper management, settlement funds can quickly disappear, compromising both your recovery and long-term financial stability.

Do’s and Don’ts for Managing Settlement Money:

- Do establish a robust emergency fund before considering investments

- Do explore specialized accounts or trusts for asset protection

- Don’t place funds needed for essential care into high-risk investments

- Don’t make significant financial decisions without professional guidance

Conclusion

Understanding the full spectrum of financial options following a personal injury settlement empowers you to make choices that support both immediate recovery and long-term security. By taking deliberate steps, seeking qualified professional guidance, and carefully evaluating each option, you can maximize your settlement’s benefit and build a stable financial foundation. Remember that thoughtful financial planning isn’t merely about managing funds it’s about securing the quality of life and peace of mind you deserve after experiencing a personal injury.