As a medical professional, you manage more than just patient care, you also juggle clinic management, continuing education, and lifestyle goals. At times, fulfilling all these responsibilities requires additional funds. That is where a personal loan for doctors can provide timely support.

Whether you are planning to expand your practice, invest in advanced medical equipment, or fund a personal milestone, a doctor loan offers the flexibility you need. However, before applying, it is important to understand the doctor loan eligibility criteria to ensure a smooth and successful borrowing experience.

Why a doctor loan is useful for medical professionals

Unlike traditional loans, a personal loan for doctors comes with higher loan amounts, customised terms, and faster processing, all tailored to your professional demands. With growing expenses in both clinical infrastructure and personal milestones, a doctor loan allows you to:

- Expand or modernise your practice with minimal financial strain

- Manage cash flow without dipping into long-term savings

- Get access to funding without the need for collateral

- Meet personal goals such as home upgrades, family holidays, or children’s education

It provides a dependable financial cushion so you can continue focusing on providing quality care without financial worry.

Who can apply for a personal loan for doctors?

A personal loan for doctors is designed to meet the financial needs of general physicians, specialists, and consultants across all fields of medicine. You can apply for this loan whether you are running an independent practice or are associated with a hospital.

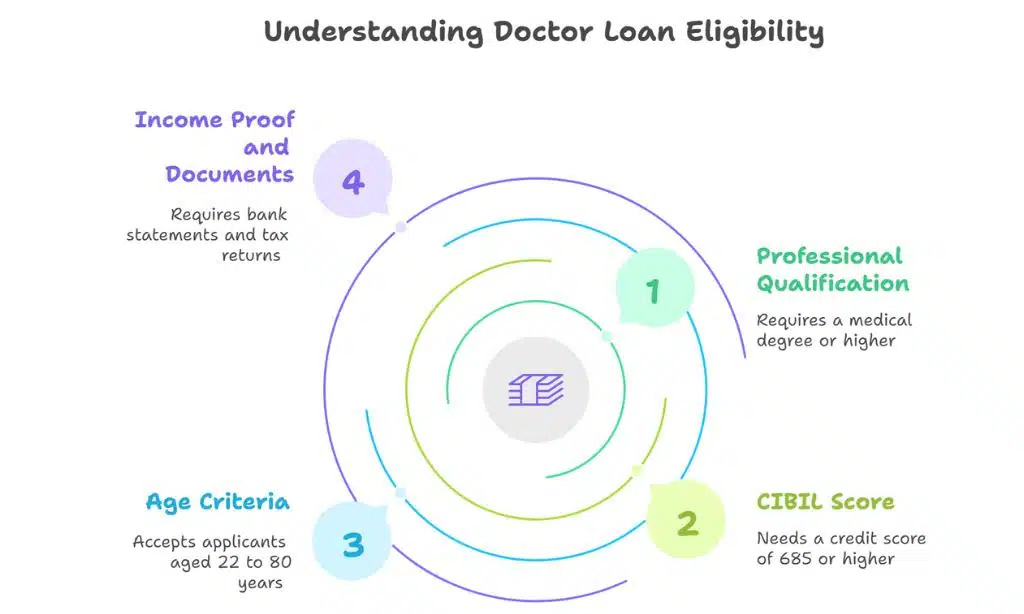

However, like any other loan, a doctor loan eligibility is based on a few standard parameters that help the lender assess your repayment capacity and financial stability. Meeting these conditions improves your chances of approval and gives you access to better loan terms. The exact conditions may vary slightly with each lender, but most financial institutions follow these basic criteria for a personal loan for doctors:

- Professional qualification: You must hold an MBBS degree or higher from a recognised medical council. Specialists such as MDs, MS, BDS, MDS, and BHMS holders are also eligible.

- CIBIL score: A credit score of 685 or higher is often required to ensure good repayment history and creditworthiness.

- Age criteria: Most lenders accept applications from doctors aged between 22 to 80 years.

- Income proof and documents: Bank statements, income tax returns, and a medical registration certificate are required to evaluate the borrower’s financial stability.

By meeting these conditions, you position yourself for higher loan amounts, competitive interest rates, and faster approvals. Once you meet the eligibility criteria, the next important step is selecting the right lending partner. Look for a lender that not only offers competitive interest rates but also understands the unique financial requirements of medical professionals. Bajaj Finserv Doctor Loan stands out by offering a convenient, fast, and fully digital loan solution, helping you access funds without stepping away from your practice.

Key benefits of a Bajaj Finserv Doctor Loan

- Loan amount up to Rs. 80 lakh: Get high-value funding from Rs. 2 lakh to Rs. 80 lakh, depending on your financial requirements.

- Convenient tenures of up to 8 years: Repay the loan comfortably with repayment terms ranging from 12 to 96 months.

- Fast disbursal within 48 hours: Once verified and approved, the loan amount is usually credited to your bank account in just two working days.

- No collateral required: This is an entirely unsecured loan, you need not pledge property, gold, or clinic equipment.

- No part-prepayment charges on Flexi variants: There are three variants available. With the Flexi Term and Flexi Hybrid Loans, you can part-prepay whenever convenient, at no extra cost.

The best part is that you can apply online, all from the comfort of your clinic or home.

Conclusion

Meeting the doctor loan eligibility requirements is the first step towards accessing funds that can support both your personal and professional aspirations. By keeping your documents ready and ensuring you meet the basic criteria, you can secure funding easily and without delay.

And when you are ready to apply, consider choosing a lender that provides high-value funding, longer repayment terms, and a fully online process. Bajaj Finserv Doctor Loan offers a dependable and time-saving solution tailored to your professional life. So, apply today and take control of your personal and professional finances!