The narrative of retail in the Middle East has fundamentally shifted. For decades, the region was an importer of cool, a landing pad for Western franchises. But as we step into 2026, the script has flipped. A new wave of Home-Grown Brands from Dubai and the wider UAE is aggressively exporting a unique blend of high-touch hospitality, digital-first marketing, and “phygital” experiences to the world.

These aren’t just businesses; they are cultural exports. Whether it’s the viral sensation of FIX Dessert Chocolatier captivating Singapore or GymNation rewriting the fitness rulebook in Riyadh, these brands are proving that the “Made in UAE” label is a competitive advantage in global retail. The success of these Home-Grown Brands lies in a specific, repeatable “Store Playbook” that prioritizes community and scarcity over traditional stock-heavy retail.

Key Takeaways

-

Exporting Lifestyle: Success in 2026 is about exporting a “Dubai State of Mind”—high service, luxury aesthetics, and digital integration.

-

The Saudi Opportunity: Riyadh is the primary growth engine for these brands, offering volume and scale that saturating Dubai markets cannot match.

-

Experience is King: The “Playbook” relies on “Phygital” stores and “Community Hubs” to compete with e-commerce.

The Great Retail Reversal: From Importers to Originator

To understand the success of these Home-Grown Brands, we must first recognize the seismic shift in the region’s economic landscape. For decades, the Middle East served as the world’s most lucrative showroom for Western franchises. Malls were dominated by imported logos from New York, London, and Paris, leaving little room for local creativity.

However, the saturation of international chains created an unexpected byproduct: a fierce, hyper-competitive local ecosystem. To survive against global giants, aspiring local entrepreneurs had to offer something undeniably better—higher quality ingredients, sharper branding, and superior service.

By 2026, this pressure cooker environment will have produced a new class of retail concepts. We are no longer looking at tentative startups; we are witnessing the maturation of Dubai’s “Intellectual Property” (IP). These businesses have graduated from local experiments to scalable, export-ready corporate entities.

The transition is distinct and measurable:

| The “Import” Era (2000–2020) | The “Export” Era (2026) |

| Relying on Western franchise licenses | Creating and exporting original IP |

| Malls are viewed as simple shopping destinations | Malls are demanded as “Lifestyle Communities.” |

| Success is defined by “Location, Location, Location.” | Success defined by Community, Hype, and Agility |

| Marketing via traditional billboards | Marketing via “Phygital” content and scarcity |

This evolution is exactly what forged the “Store Playbook” we see today. Because these Home-Grown Brands were born in one of the most competitive retail markets on earth, their survival strategies are battle-tested, resilient, and uniquely adapted to conquer global territories.

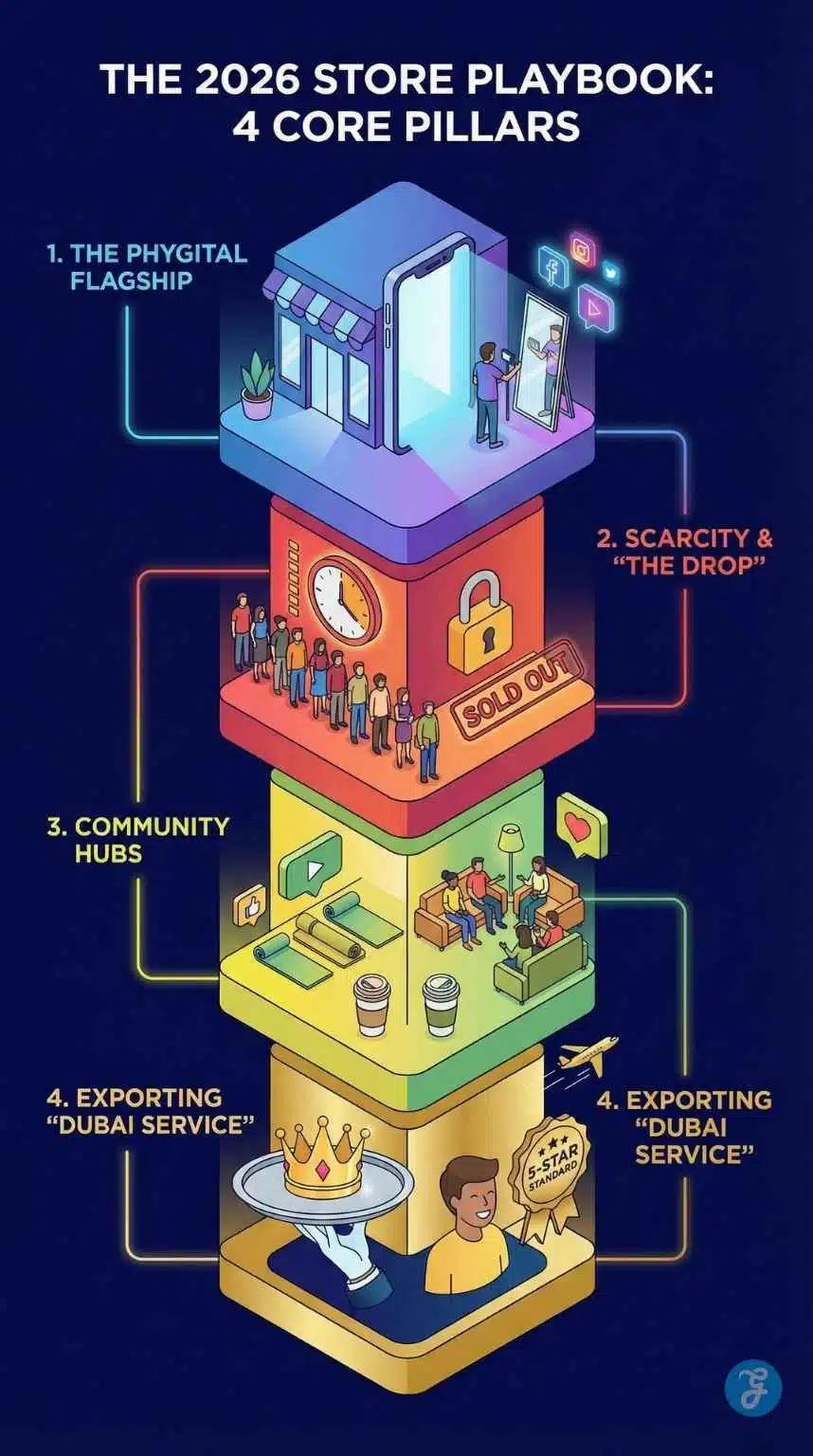

The 2026 Store Playbook: 4 Core Pillars

What makes these brands succeed in competitive markets like London and Riyadh? It’s not just the product; it’s the packaging of the experience.

1. The “Phygital” Flagship

The modern store is a content studio first, and a point of sale second. Brands like The Giving Movement design their physical spaces with “TikTokable” lighting, mirrors, and aesthetics. The goal is to encourage User Generated Content (UGC), effectively turning every customer into a micro-influencer.

2. Scarcity & “The Drop”

Borrowing from streetwear culture, F&B brands are now using “scarcity drops” to drive hype. By limiting stock or operating hours (as seen with FIX and 3Fils), these brands manufacture urgency, creating long queues that serve as powerful, free social proof.

3. Community Hubs

In 2026, a store cannot just be a place to transact. It must be a place to belong. L’Couture doesn’t just sell leggings; it hosts yoga flows. Saddle isn’t just a coffee stop; it’s a cycling club meeting point. This strategy increases “dwell time” and builds deep emotional loyalty.

4. Exporting “Dubai Service”

The most underrated export is the service standard. Dubai’s hospitality—characterized by hyper-attentiveness, speed, and luxury touches—is a stark contrast to the often indifferent service found in mature Western markets. Brands like The Maine succeed in London by importing this superior service ethos.

10 Home-Grown Brands Conquering New Markets

The following brands have successfully transitioned from local heroes to regional and international powerhouses.

1. FIX Dessert Chocolatier (The Viral Phenomenon)

-

The Expansion: After dominating social feeds globally, FIX has moved into physical retail with calculated precision. Their pop-up at Dubai International Airport (DXB) was extended through late 2025 due to demand, and their entry into Singapore (Changi Airport) runs through Jan 2026.

-

The Playbook: “Scarcity Marketing.” FIX doesn’t flood the market. They use “activation zones” rather than standard shops, ensuring that acquiring a bar feels like winning a prize.

2. Pickl (Fast Fine Dining)

-

The Expansion: Pickl has aggressively targeted Saudi Arabia, launching key locations in Riyadh’s Cenomi Al Nakheel Mall and U Walk. Partnering with Sky Restaurants, they are now eyeing expansion into Kuwait for late 2026.

-

The Playbook: “Standardized Cool.” Pickl has perfected a franchise model that feels authentic, not corporate. Their industrial-chic fit-outs (neon, concrete, plants) are easily replicable yet distinctively “cool” in any city.

| Brand | Sector | Key 2026 Market | Playbook Strategy |

| FIX | Confectionery | Singapore / Global Travel Retail | Scarcity & Exclusivity |

| Pickl | F&B (Burgers) | Saudi Arabia (Riyadh) | Franchise consistency |

| Kinoya | Culinary | London (Harrods) | Intimacy at scale |

| GymNation | Fitness | Saudi Arabia (Riyadh/Jeddah) | High-Tech, Low-Cost |

3. The Giving Movement (Sustainable Fashion)

-

The Expansion: With a strong e-commerce foothold in the US and UK powered by Stripe, TGM is now expanding its physical footprint across the GCC. Their move into lifestyle concepts (like their “culture cafe” in City Walk) signals a shift from pure retail to brand immersion.

-

The Playbook: “Sustainable Futurism.” Their stores act as physical manifestos of their eco-ethos, using recycled materials and bold, futuristic designs to signal virtue and style simultaneously.

4. GymNation (Fitness)

-

The Expansion: The “Netflix of Gyms” is making a massive play in KSA. New locations in Riyadh, such as Tala Mall and Localizer Mall, are slated for Q1/Q2 2026 openings.

-

The Playbook: “Democratized Fitness.” Massive warehouses, 24/7 access, and automated entry keep costs low, disrupting markets used to overpriced, exclusive fitness clubs.

5. Kinoya (Culinary)

-

The Expansion: Founder Neha Mishra’s journey from supper club to Harrods, London is the ultimate success story. The brand has proven that Dubai-born concepts can compete with the world’s best in the most prestigious retail locations.

-

The Playbook: “Izakaya Intimacy.” Even in a massive department store, Kinoya creates segmented, cozy spaces (noren curtains, wood counters) to maintain the personal connection of a supper club.

6. Saddle (Coffee & Lifestyle)

-

The Expansion: With over 25 outlets, Saddle is expanding rapidly across the Gulf, including Qatar and Saudi Arabia.

-

The Playbook: “Architectural Landmarks.” Saddle treats every location as an art installation. Their glass-pod designs and equine-themed aesthetics make them destination landmarks, not just drive-thrus.

7. Rikas Group (Hospitality)

-

The Expansion: Known for Twiggy and La Cantine, Rikas is taking its beach club and dining expertise to the Red Sea Project in KSA and key Mediterranean locations.

-

The Playbook: “The Daycation.” They don’t just serve a meal; they capture the guest for 6 hours. By combining dining, pool, and lounge, they maximize revenue per guest.

8. SALT (F&B / Lifestyle)

-

The Expansion: The original “cool” export, SALT has established permanent “camps” across Saudi Arabia, becoming a staple in the Kingdom’s social scene.

-

The Playbook: “The Permanent Pop-Up.” SALT reclaims outdoor spaces. They specialize in turning underutilized desert or park locations into vibrant community hubs using Airstreams and outdoor seating.

9. L’Couture (Athleisure)

-

The Expansion: Building on strong online sales in the UK/US, L’Couture is refining its boutique model in the UAE to serve as a template for future international franchising.

-

The Playbook: “The Feminine Club.” Their stores are sanctuaries—featuring glam rooms and wellness events—positioning the brand as a “girl gang” rather than just a clothing retailer.

10. The MAINE (Dining)

-

The Expansion: Already established in London’s Mayfair and Ibiza, The Maine continues to look for heritage locations in mature markets.

-

The Playbook: “New Old World.” They create instant heritage. The design feels like it has been there for 50 years (velvet, jazz, dim lights), giving them credibility in historic cities like London.

The “Growing Pains”: 3 Challenges to Watch

Expansion is never seamless. As Dubai brands cross borders in 2026, they face specific hurdles that require agile maneuvering.

-

The “Saudization” (Nitaqat) Reality: In Riyadh, it’s not enough to just open a store; you must hire local. Brands like Pickl and Saddle have had to heavily invest in training academies to upskill local Saudi talent to meet their specific service standards, rather than relying solely on the expat labor model common in Dubai.

-

Supply Chain Bottlenecks: With global shipping routes (particularly the Red Sea) facing intermittent disruptions, brands relying on imported ingredients (like Kinoya’s specific Japanese flour or The Giving Movement’s sustainable fabrics) are pivoting to “near-shoring”—sourcing materials from within the MENA region to ensure stock consistency.

-

The “London Rent” Shock: While Dubai malls operate on revenue-share models, prime London locations (Mayfair, Soho) often demand massive upfront premiums and rigid long-term leases. This high burn rate means brands like The MAINE have a shorter runway to prove profitability compared to their home turf.

The Tech Stack: What Powers a Borderless Brand?

Behind the aesthetic storefronts lies a sophisticated, standardized tech stack that allows these brands to plug-and-play in new cities.

-

WhatsApp-First CRM: unlike the email-heavy West, the Gulf runs on WhatsApp. Brands are using AI-driven CRM tools (like Selectiva or custom APIs) that allow customers to order, complain, and reorder entirely within WhatsApp, bypassing clunky websites.

-

Unified Inventory (Shopify Plus/Stripe): Brands like The Giving Movement and L’Couture utilize headless commerce architectures. This allows them to manage stock for the US, UK, and UAE from a single dashboard while offering localized payment methods (Tabby in GCC, Klarna in Europe).

-

Agentic AI: In 2026, we are seeing the rise of “Agentic AI” in customer service—bots that don’t just answer questions but autonomously resolve issues (e.g., “Where is my order?” -> Bot checks logistics -> Bot issues refund or discount) without human intervention.

Investment Verdict: The Cost of Buying In

For investors looking to bring a slice of Dubai to their city, here is a snapshot of the franchise landscape in 2026.

| Sector | Est. Initial Investment | Space Req. | Key Requirement |

| Boutique Gym (e.g., GymNation) | $350k – $600k | 10,000+ sq ft | High-traffic location + 24/7 license capability |

| Fast Fine Dining (e.g., Pickl) | $250k – $450k | 1,200+ sq ft | Extraction capability + Delivery radius density |

| Coffee/Lifestyle (e.g., Saddle) | $150k – $300k | Outdoor/Pod | Drive-thru permission + Iconic architecture build |

Note: These figures are estimates based on market standards for 2026 and vary heavily by territory and real estate costs.

Why Riyadh is the 2026 “Gold Rush”

While London offers prestige, Saudi Arabia (Riyadh) offers scale. The Kingdom’s “Vision 2030” has created an insatiable demand for high-quality, “ready-made” lifestyle brands to fill its new mega-malls and entertainment districts.

-

Ease of Entry: Dubai brands understand the cultural nuances of the GCC consumer better than Western imports.

-

Proximity: Logistics and supply chains are easier to manage within the Gulf.

-

Youth Demographics: Saudi Arabia’s young population is digitally native and hungry for the “cool” factor that Dubai Home-Grown Brands provide.

Frequently Asked Questions (FAQ)

Which Dubai home-grown brand is expanding the fastest in 2026?

Pickl and GymNation are currently seeing the most rapid physical expansion, particularly into the Saudi Arabian market, driven by strong franchise partnerships.

What is the “Phygital” retail strategy?

It is the blending of physical and digital experiences. For Home-Grown Brands, this means designing stores specifically to look good on social media (Instagram/TikTok) to drive digital traffic and physical footfall simultaneously.

Are these brands only expanding to the Middle East?

No. Brands like The MAINE, Kinoya, and FIX have successfully entered rigorous international markets like London, Ibiza, and Singapore, proving the global appeal of Dubai concepts.

Why are pop-up stores so popular for these brands?

Pop-ups allow brands to test new markets with low risk and high hype. FIX used this strategy effectively in global airports to build demand before (or instead of) opening permanent shops.

What makes Dubai brands successful in Saudi Arabia?

They share cultural similarities but bring a “cosmopolitan” edge. Dubai brands are viewed as aspirational and “cool” by Saudi consumers, and they adapt faster to local tastes than Western franchises.

Is it better to franchise or joint venture (JV) with these brands?

Most Dubai brands prefer Joint Ventures (JV) or “Manchise” (Management Franchise) models for major markets like Riyadh or London. They want to retain control over the brand image and quality, rather than handing over full operations to a passive franchisee.

Final Thought: The New Global Franchise

The era of Dubai as a passive consumer of global culture is effectively over. We are witnessing the rise of the “Dubai Franchise”—a retail model that is faster, more experiential, and significantly more service-oriented than its Western counterparts. This isn’t just a fleeting trend; it is a permanent recalibration of the global retail map.

For investors and landlords in London, Riyadh, or Singapore, the message is clear: the most exciting, high-yield tenants are no longer coming solely from New York or Paris. The next legacy brand is just as likely to emerge from an industrial warehouse in Al Quoz. The “Made in UAE” label has evolved from a mark of origin into a seal of quality, innovation, and unstoppable ambition.