Former U.S. President and 2024 Republican presidential frontrunner Donald Trump has made a bold economic promise: to eliminate federal income taxes for American taxpayers earning less than $200,000 annually. According to Trump, this plan would provide significant relief to the middle class and low-income earners while maintaining government funding through an alternative revenue stream—import tariffs.

Speaking at a recent rally, Trump emphasized that instead of collecting income taxes from millions of Americans, the U.S. government could finance its federal operations by increasing tariffs on imported goods. He argued that such a shift would place the burden on foreign exporters rather than domestic workers, adding, “The American people will thank me for this in the future.”

However, the economic feasibility and consequences of such a proposal are under intense scrutiny from economists, trade analysts, and policy experts.

How Much Revenue Does the U.S. Government Collect from Income Taxes?

Federal income tax is the single largest source of revenue for the U.S. government. According to the Congressional Budget Office (CBO), in fiscal year 2023, the federal government collected around $2.18 trillion in individual income taxes, accounting for nearly 47% of its total revenue. This includes taxes collected from wages, investments, and self-employment earnings.

Income taxes fund essential services including:

-

Social Security and Medicare

-

Defense and military spending

-

Infrastructure projects

-

Education and research grants

-

Public safety and law enforcement

Removing this income stream would leave a massive funding gap unless replaced by another reliable revenue source.

Can Tariffs Realistically Replace Income Taxes?

To replace the revenue lost from eliminating income taxes for Americans earning less than $200,000, the government would need to generate nearly $2 trillion annually from alternative sources. Trump believes this shortfall could be compensated by imposing tariffs—taxes on goods imported into the United States.

The logic behind this idea is based on the scale of U.S. imports. In 2023, the U.S. imported over $3 trillion worth of goods from foreign countries. Trump suggests that if tariffs were significantly increased—say to 100% on all imported goods—it could produce the revenue needed to eliminate income taxes for a large portion of Americans.

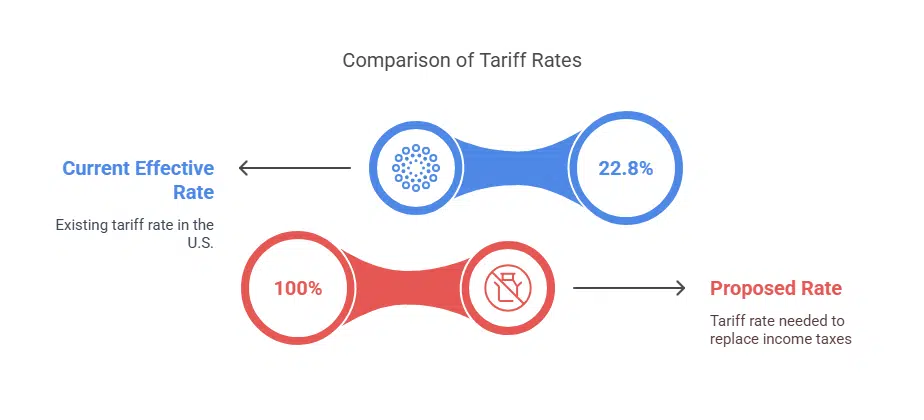

However, Torsten Slok, Chief Economist at Apollo Global Management, cautions that the math doesn’t add up. Based on his economic note to investors, tariffs would have to rise more than four times the current effective rate to replace lost tax revenue.

As of now, the effective tariff rate in the U.S. is only 22.8%, according to Fitch Ratings. To achieve Trump’s goal, tariffs would need to average over 100%, meaning prices of imported goods would at least double—leading to inflation, reduced consumer purchasing power, and potential retaliation from trade partners.

What Would Be the Economic Impact of Massive Tariff Increases?

Introducing tariffs at such high levels could have significant domestic and global consequences:

-

Consumer Prices Would Soar: Higher tariffs mean higher prices on everyday goods, including electronics, clothing, cars, and groceries—many of which are heavily reliant on imports.

-

Retaliation from Trade Partners: Countries affected by the tariffs may respond with their own import taxes on American goods, damaging U.S. exports and hurting domestic industries such as agriculture and manufacturing.

-

Global Trade Tensions and Economic Slowdown: According to The Tax Foundation, even under a scenario where tariffs are moderately increased, they would only generate about $170 billion annually—far short of the amount needed to cover lost income tax revenue. Such policies could trigger a trade war and economic recession, reminiscent of downturns seen during the Smoot-Hawley Tariff era in the 1930s.

-

Historical Precedent Is Problematic: Trump has referenced the 19th-century U.S. economic model where tariffs were a primary revenue source. While true, that era also witnessed crony capitalism, wealth disparity, and frequent economic depressions, ultimately leading the U.S. to adopt a more diversified tax system.

Why Trump Temporarily Suspended Some Tariffs

Despite his firm stance on tariffs, Trump previously suspended tariff impositions on Kenya and over 70 other countries. This move came after experiencing volatility in global markets and increased pressure from trading partners.

By lifting tariffs on certain developing countries, Trump hoped to ease global supply chain tensions and mitigate some of the negative economic impacts. However, he remained aggressive on China, significantly increasing tariffs in retaliation for what he described as Beijing’s “disrespect toward other nations.”

Trump claims China has long engaged in unfair trade practices, including currency manipulation, intellectual property theft, and market dumping. In response, he raised tariffs on hundreds of Chinese products, contributing to what analysts described as the U.S.-China trade war.

Economic Experts Weigh In

Leading economists and geopolitical analysts remain highly skeptical of Trump’s proposal:

-

Aly-Khan Satchu, a prominent economist, called the idea of fully replacing income tax with tariffs “mathematically impossible.”

-

The Peterson Institute for International Economics found that even aggressive tariff schemes might only offset 30–40% of current income tax revenue—and that too would come at a cost of inflation, economic slowdown, and weakened international trade alliances.

-

Ray Dalio, founder of Bridgewater Associates, recently warned in Business Insider that overreliance on tariffs and isolationist trade policies could accelerate the breakdown of the global economic order.

Is Trump’s Plan Economically Viable?

Trump’s proposal to eliminate income taxes for Americans earning under $200,000 and replace that revenue with tariffs is both ambitious and controversial. While it may appeal to populist sentiments and promise relief for millions of households, the economic feasibility is highly questionable.

With federal income taxes making up nearly half of U.S. government revenue, and with tariffs generating only a fraction of that, a complete shift would require massive policy overhauls and could introduce economic risks not seen in decades. It also contradicts longstanding economic consensus that diversified and balanced tax structures are more stable and equitable.

Until further details or economic modeling is released by Trump’s campaign, experts advise treating the proposal with caution and seeking bipartisan solutions for tax reform that avoid potentially destabilizing global trade relationships.