Dhaka’s fintech seed rounds this January matter because they arrive as Bangladesh rewires its payment rails and tightens digital-bank rules. Small cheques are funding big infrastructure bets—MSME credit, risk models, and new distribution—setting up the next 12–18 months of competition in 2026 local.

How We Got Here: Dhaka’s Fintech Flywheel And The New Policy Stack?

Dhaka’s fintech story has always been bigger than venture capital. The city became the default launchpad because it sits at the intersection of three forces that reinforce each other: dense commerce, concentrated financial institutions, and a huge informal economy that still needs faster ways to pay, save, and borrow. When these forces line up, even small product improvements can unlock very large volumes. When they do not line up, startups quickly discover that traction in fintech is not just about acquiring users. It is about acquiring permission, trust, and distribution.

Bangladesh’s first big fintech chapter was mobile financial services. It proved that digital money can work at national scale even when traditional banking coverage is limited, as long as cash-in and cash-out are everywhere. That agent-driven model changed the baseline expectations of consumers and merchants. But it also shaped the market in a way that matters for seed funding today: value concentrated in a few rails, and innovation clustered around the edges of those rails rather than inside them.

The second chapter is now opening, and it is more structural. Payments are moving from “platform-specific” to “system-wide,” at least in intent. Interoperability across banks, mobile wallets, and payment service providers is designed to reduce friction and make digital transactions feel as universal as cash. At the same time, Bangladesh is raising the ambition level of what “modern finance” should look like, with new digital bank licensing rules and higher capital requirements that implicitly demand better governance, better compliance, and better risk management from anyone who wants to play at scale.

This combination changes the startup equation. In earlier years, a fintech could win by building a slick interface, spending on marketing, and finding a niche where regulation was unclear or loosely enforced. In 2026, the market is moving toward a different kind of winner: companies that make the financial system work better underneath the interface. That means underwriting, interoperability-ready payments, compliance automation, merchant tooling, and products that can integrate with banks rather than compete with them head-on.

Seed funding fits into this story because it is the stage where founders choose their “operating model.” Do they build a consumer brand and fight for attention, or do they build infrastructure and fight for integration? In Bangladesh, the second path is increasingly attractive because it aligns with the direction of policy and the realities of distribution. It also aligns with what early-stage investors can measure: process improvements, repayment quality, merchant retention, and unit economics that are not dependent on endless marketing spend.

Below is a compact snapshot of the ecosystem context that frames why seed funding feels different in 2026.

| Indicator | What It Suggests For Startups | Why It Matters For Seed Funding |

| Cash still dominates transactions | Massive upside for digitization, but habit change is slow | Seed investors prefer models that work even while cash remains strong |

| Interoperable payments are rolling out | More opportunities for cross-platform products | “Plug-and-play” fintech becomes more viable than closed-loop builds |

| Digital bank licensing is tightening | Compliance and governance become competitive advantages | Early discipline becomes part of valuation, not a later clean-up |

| Public-sector capital is increasing | State-backed funding can crowd in private checks | Seed rounds become less scarce, but also more scrutinized |

| Global fintech funding is selective | Investors want fundamentals, not hype | Dhaka seed winners must show execution early |

The deeper point is that Dhaka is not just producing more startups. It is producing a more specific kind of startup, shaped by policy, macroeconomic pressure, and the need to convert cash-heavy flows into interoperable digital flows. That is why a cluster of seed rounds, even if small individually, can signal a real change in the ecosystem.

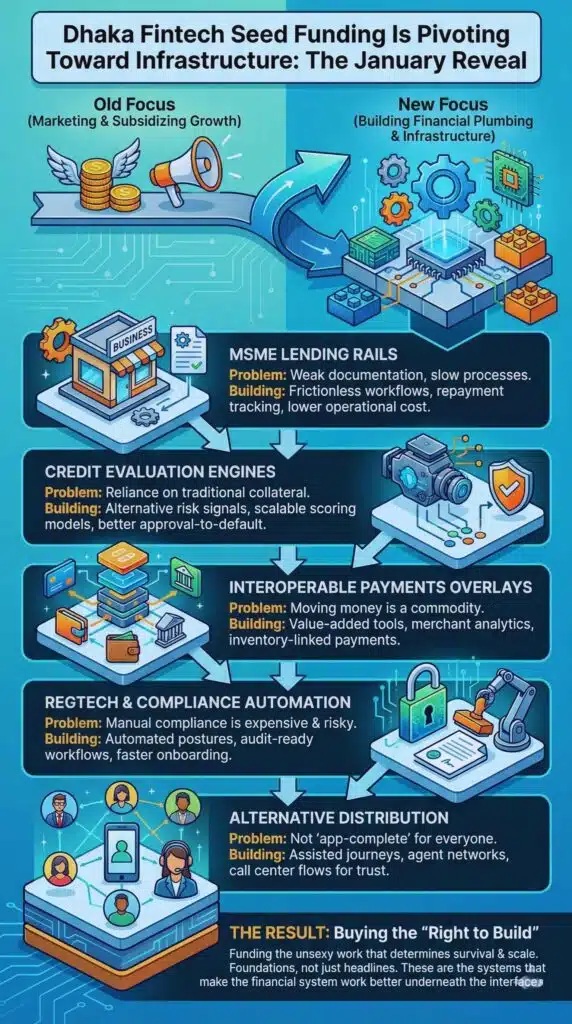

What The January Seed Rounds Reveal: Dhaka Fintech Seed Funding Is Pivoting Toward Infrastructure?

When people hear “three fintechs secured seed funding,” it is tempting to treat it as a feel-good headline: momentum is back, founders are winning, investors are interested again. The more useful interpretation is to ask what these seed cheques are actually paying for.

In Dhaka right now, seed funding is less about subsidizing growth and more about buying the right to build. Build the integrations. Build the credit engine. Build the compliance posture. Build the merchant workflow. Build the distribution partnerships. These are not glamorous investments, but they are the ones that determine whether a fintech can survive its first serious regulatory conversation and its first serious default cycle.

A practical way to understand this shift is to look at the kinds of fintech problems that are getting funded. In 2026, the winners at seed stage tend to fall into a few archetypes:

- MSME credit workflows that reduce friction and improve repayment outcomes.

- Credit evaluation engines that can later plug into multiple lenders.

- New distribution approaches that acknowledge Bangladesh is not “app-complete” for everyone.

- Payments tooling built for an interoperable environment, where moving money is no longer the differentiator.

This is a big departure from earlier waves where many fintech products were essentially digital copies of familiar services. Today’s seed-stage bets are more like financial plumbing. They are not promising to replace banks overnight. They are promising to make banks, merchants, and consumers operate with less friction.

Here is a comparison grid that captures what “infrastructure-first” seed rounds tend to target.

| Seed Archetype | The Real Problem Being Solved | What Success Looks Like By 12–18 Months |

| MSME lending rails | Small businesses need credit, but documentation is weak and processes are slow | Repeat borrowing, lower operational cost per loan, stable delinquency |

| Credit evaluation engines | Lenders need better risk signals than traditional collateral | Better approval-to-default balance, lender partnerships, scalable scoring |

| Interoperable payments overlays | Transfers are getting easier, differentiation shifts to value-added tools | Merchant retention, higher transaction frequency, low failure rates |

| Regtech and compliance automation | Rules are tightening, manual compliance is expensive | Faster onboarding, fewer compliance incidents, audit-ready workflows |

| Alternative distribution | Not everyone will download a new app and self-serve | Higher conversion via call centers, agents, and assisted journeys |

The January framing matters because “early-year” funding often reflects a reset in investor expectations. New budgets. New theses. A clearer view of what worked last year and what did not. If Dhaka fintechs are receiving seed cheques in this period, it likely reflects investors leaning into a thesis that feels durable in Bangladesh products that align with regulation, monetize through business value, and grow through partnerships rather than pure consumer advertising.

There is also a macro layer to this. Bangladesh’s economic outlook is debated across institutions, and those differences shape investor behavior. When forecasts disagree on growth and inflation paths, investors tend to favor models that can survive volatility. That naturally pushes seed funding toward fintech infrastructure rather than speculative consumer plays.

Below is a compact view of why macro conditions influence seed-stage selection so strongly in Bangladesh.

| Macro Variable | What It Does To Fintech | What Seed Investors Usually Prefer In Response |

| Higher inflation | Reduces discretionary spending, increases credit stress | Revenue streams tied to essential payments and working capital |

| FX and reserve pressure | Makes cross-border flows and remittance dynamics more sensitive | Products that can handle compliance and partner with formal channels |

| Uneven growth | Creates pockets of opportunity and pockets of fragility | Business models with clear customer segments and controlled risk |

| Policy reform cycles | Opens new rails but also new enforcement | Founders who build “policy-ready” systems early |

So the interpretation is not “three fintechs raised money.” It is “the ecosystem is funding the unsexy work that makes fintech scale in Bangladesh.” That is the kind of shift that usually precedes a more mature ecosystem, where later-stage funding becomes possible because the early-stage layer is building real institutional credibility.

Where The Battle Will Be Won: MSME Credit, Interoperable Payments, And Distribution In A Cash-Heavy Economy?

Bangladesh’s fintech opportunity is often described as “financial inclusion.” That phrase can become too broad to be useful. In practice, the market opportunity breaks down into a few specific battles that will define which seed-stage fintechs become durable companies.

First is MSME credit. Bangladesh has a large base of small businesses that need short-term working capital and predictable access to credit, but many do not fit neatly into bank underwriting models. The gap is not just about interest rates. It is about time, paperwork, repeat visits, and uncertainty. A fintech that reduces these frictions can create value for both borrowers and lenders, but only if it can manage risk. That is why seed capital in MSME credit tends to fund systems, not marketing: onboarding workflows, repayment tracking, cashflow assessment, and collections discipline.

Second is interoperable payments. As rails become more standardized, moving money stops being the advantage. The advantage shifts to what you can build on top of money movement: reconciliation, inventory-linked payments, payroll tools for small businesses, embedded credit at checkout, and analytics that help merchants make decisions. Interoperability also creates a new kind of competition. If a customer can move funds easily between platforms, loyalty becomes less sticky. Fintechs must earn retention through value, not lock-in.

Third is distribution. Bangladesh has strong mobile penetration, but fintech distribution is still shaped by trust and assistance. Many users prefer guided journeys, especially for products that feel risky like credit or savings. That is why alternative distribution models keep returning: agent-assisted onboarding, call center flows, voice-first transfers, partnerships with large consumer platforms, and embedded finance inside services people already use. In a cash-heavy economy, distribution is not just a growth tactic. It is a risk-control tactic because it helps ensure users understand the product and behave predictably.

This is where Dhaka fintechs are getting more strategic. Instead of asking, “How do we get a million downloads?” they are asking, “How do we plug into an existing flow that already has money movement, trust, and repetition?” That is a more realistic path to scale in Bangladesh, and it is one reason seed-stage investors can justify backing infrastructure plays. The distribution is often cheaper and more defensible, even if it grows slower at first.

A key detail that influences all three battles is pricing and fee structures in the payments ecosystem. When interoperability introduces standardized fees, it compresses margins for incumbents in some cases, and it changes the economics of building payment-dependent startups. If transaction fees are capped and competition increases, fintechs need to find revenue in adjacent services. That pushes innovation toward merchant services, lending, and B2B tooling.

Below is a practical view of the “rails economics” that shape product strategy. Think of this as the new baseline that fintechs must design around, not a detail to be optimized later.

| Transfer Type | Cost Direction | Who Usually Pays | Strategic Implication For Startups |

| Wallet-to-wallet | Fee caps reduce pricing flexibility | Sender | Payment margins are thinner, value must come from add-ons |

| Bank-to-bank | Lower, stable fee structure | Sender | Good for predictable B2B flows and bulk transactions |

| Bank-to-PSP and PSP-to-bank | Standardized, policy-driven | Sender | Encourages embedded finance and merchant service innovation |

| Receiving funds | Typically zero fee | Receiver | Improves user experience and supports higher transaction frequency |

Another crucial reality is that interoperability is not a single switch that flips perfectly on day one. Participation gaps and phased integrations can create temporary fragmentation, and that fragmentation itself becomes a startup opportunity. If large rails are not fully synchronized, customers will still face friction, and fintechs that help bridge the friction can gain early relevance. Over time, as the system stabilizes, those same fintechs must evolve from “workarounds” to “value layers.”

The cash-dominant environment adds a final constraint and a final opportunity. It is a constraint because it slows down digital-only models and makes customer education expensive. It is an opportunity because converting even a small share of cash flows into digital flows creates massive data generation. Data is not just analytics. In financial services, it is the raw material for underwriting, fraud prevention, personalized offers, and lower-cost risk management.

That is why seed funding in Dhaka is increasingly about capturing repeatable, data-generating flows rather than chasing broad, shallow adoption. The goal is not to become famous. It is to become embedded.

A short list of “Key Statistics” makes this logic concrete, because the numbers explain why infrastructure-first fintech is getting funded.

- Cash still represents a large majority share of transactions, despite growing digital volumes.

- The total value of monthly transactions in the payment system is extremely large, making even small percentage shifts meaningful.

- Mobile money accounts and transaction volumes continue to grow, strengthening the data layer.

- Interoperability fee caps and participation issues reshape competitive dynamics.

- Public-sector startup funds and bank-backed capital pools increase the availability of early-stage funding, but also raise expectations.

In 2026, the fintechs that win these battles are likely to be those that treat payments as a commodity, credit as a discipline, and distribution as a trust machine.

Risks And Counterarguments: Why Some Seed-Stage Fintechs Will Still Fail?

An expanded analysis needs to be honest about what can go wrong, because fintech in Bangladesh has always been a sector where failure is often delayed. A product can appear to work, even grow quickly, and then break under the weight of regulation, credit losses, or operational risk.

One risk is regulatory uncertainty and shifting timelines. Bangladesh’s digital bank discussion shows how policy direction can accelerate, pause, and restart depending on broader political and institutional priorities. For startups, the danger is building a strategy around a policy outcome that arrives later than expected. The more resilient approach is to design products that work under multiple futures: with digital banks, without digital banks, with full interoperability, and with partial interoperability.

A second risk is economics under fee caps and competition. Interoperability is good for consumers and for the system, but it can compress margins for players that relied on closed-loop pricing. That makes “payments-only” startups fragile. Seed-stage fintechs must either attach higher-margin services or deliver extreme operational efficiency. In practice, most will need to do both.

A third risk is credit cycle reality. MSME lending is attractive, but it is also where optimism can outpace data. Underwriting models that look strong in early cohorts can degrade when the economy softens, when borrowers learn how to game the system, or when repayment behavior shifts due to shocks. Seed investors increasingly look for evidence of discipline: conservative growth, tight cohort analysis, and a willingness to walk away from risky segments.

A fourth risk is data integrity and reporting gaps. Bangladesh’s digital finance ecosystem includes multiple players, not all of whom report consistently at all times. When data gaps occur, they create uncertainty for startups trying to build models on top of those signals. They also create uncertainty for investors who are trying to measure market growth accurately.

A fifth risk is trust and fraud. As interoperability grows, the attack surface can grow too. More connections mean more opportunities for fraud attempts, social engineering, and weak-link exploitation. This is not a reason to avoid interoperability. It is a reason startups must build fraud prevention and customer education into product design, not treat them as compliance checkboxes.

These risks produce a predictable investor response: seed investors will fund fewer “big story” fintechs and more “boring execution” fintechs. They will prefer founders who can explain the mechanics of their business in plain language, including what happens when the economy turns or regulation tightens.

Here is a grid that summarizes what many investors are filtering for in 2026.

| Investor Question | Why It Matters In Bangladesh | What A Strong Seed-Stage Answer Looks Like |

| What is the distribution edge? | Acquisition can be expensive and trust-driven | Partnerships, assisted flows, embedded finance channels |

| How do you handle compliance? | Regulation is moving toward stricter enforcement | Clear policies, audit readiness, documented processes |

| What is the risk strategy in lending? | Credit losses can appear late | Conservative cohorts, transparent metrics, defined collections playbook |

| What happens when fees compress? | Payments margins can shrink | Value-added services and diversified revenue streams |

| How do you defend against fraud? | Interoperability can increase attack vectors | Strong KYC, transaction monitoring, user education, rapid response |

There is also a broader counterargument: maybe seed rounds are not evidence of a healthier ecosystem, but evidence of a system that cannot generate later-stage outcomes. This is a real concern in frontier markets where early checks are available, but follow-on capital is scarce. If seed funding grows without a matching improvement in later-stage funding, startups can become trapped in permanent early-stage mode.

The way to judge whether Dhaka is escaping that trap is to watch for a few signals over the next year: repeatable revenue, institutional partnerships, and tangible improvements in governance. If those improve, seed funding is a stepping stone. If those do not improve, seed funding becomes a holding pattern.

What Happens Next: Scenarios And Milestones To Watch In 2026–2027?

The forward-looking question is not whether Dhaka fintech seed funding will continue. It is what kind of fintech ecosystem it will create.

One scenario is a “rails acceleration” outcome. Interoperability participation expands, transaction reliability improves, and fee structures become predictable. In this world, fintech startups can build cross-platform products more easily, banks become more open to partnerships, and the ecosystem shifts from fragmented competition to layered specialization. Seed winners become infrastructure providers to many institutions, and follow-on funding becomes more plausible because revenues become more stable.

A second scenario is a “partial interoperability” outcome. The system exists, but key players integrate slowly, and customer experience remains uneven. In this world, startups still find opportunities, but they spend more time solving integration problems and less time building new value. Growth continues, but it is messy. Seed funding remains active, but later-stage investors stay cautious.

A third scenario is a “risk and retrenchment” outcome. Macroeconomic stress persists, inflation remains high, and credit risk increases. Regulators prioritize stability. In this world, fintechs face tighter scrutiny, and seed investors shift away from lending-heavy models unless underwriting is exceptional. Payments and compliance tooling become safer bets than aggressive credit expansion.

These scenarios are not predictions. They are plausible paths based on the interaction between policy, macro conditions, and execution.

Below is a scenario grid that can guide what readers should watch.

| Scenario | What Improves | What Gets Harder | Likely Seed Winners |

| Rails acceleration | Cross-platform payments and partnerships | Differentiation by lock-in | Merchant tools, regtech, underwriting engines |

| Partial interoperability | Some flows get easier | Integration work stays costly | Bridge products, B2B payments, reconciliation tools |

| Risk and retrenchment | Stability focus, compliance clarity | Credit growth, discretionary fintech | Compliance automation, conservative MSME finance, fraud tools |

Regardless of scenario, there are specific milestones in 2026 that will matter more than headlines.

First, the practical adoption curve of interoperability. Not the launch date, but the everyday reliability: transfer success rates, resolution times, customer trust, and how quickly major platforms fully participate. When interoperability becomes boring and dependable, fintech innovation accelerates because founders stop rebuilding the same rails.

Second, the digital bank pathway. Whether licensing moves forward quickly or slowly, the direction is meaningful: higher paid-up capital thresholds, more formal governance expectations, and a clearer view of what “digital-first” banking should be. Even fintechs that never become banks will be judged against these standards when seeking partnerships and investment.

Third, the evolution of public and bank-backed startup funds. Capital availability is helpful, but the real question is whether these funds improve startup quality. Do they encourage better reporting, better governance, and better product discipline? Or do they inflate the number of startups without improving their survivability? The second outcome can create noise. The first outcome can create an investable pipeline.

Fourth, the next wave of platform convergence. Large consumer platforms that already control daily transactions will keep expanding into fintech. That creates both threats and opportunities. Seed-stage fintechs can partner and embed, or they can be outcompeted if they try to build consumer brands from scratch without distribution leverage.

Fifth, the credibility test in lending. The most important leading indicator will be not how many loans are disbursed, but how well cohorts behave as economic conditions fluctuate. If Dhaka’s seed-funded fintech lenders show stable repayment and controlled growth, it will unlock more capital. If they chase volume and later discover losses, it will chill the category.

A final perspective is worth stating plainly: Dhaka’s fintech ecosystem does not need a unicorn tomorrow to prove it is real. It needs a generation of durable, interoperable, compliance-ready companies that can power the financial system quietly. That is what seed funding is buying in 2026. Not hype, but foundations.