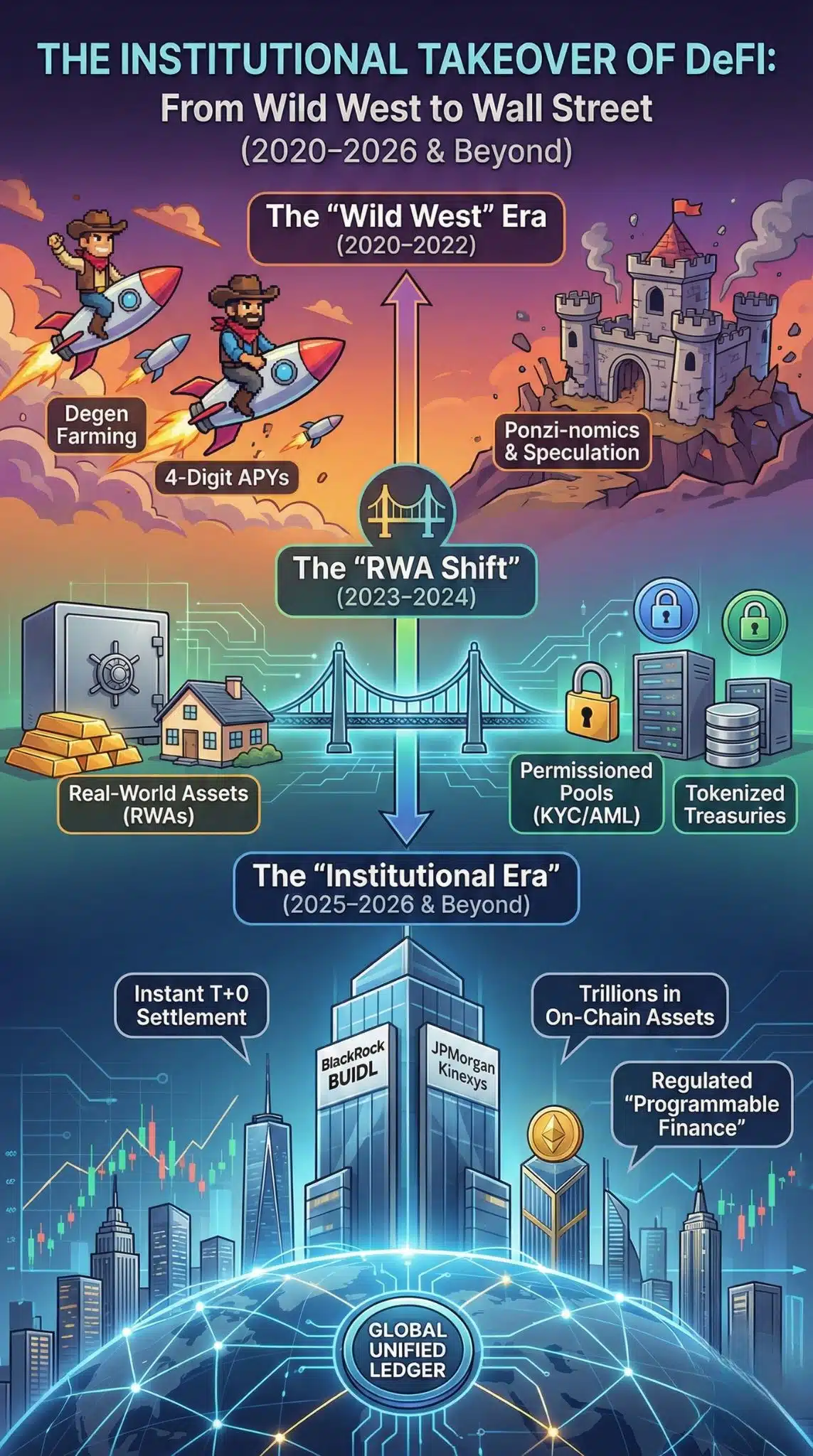

In the summer of 2020, “DeFi” (Decentralized Finance) was synonymous with anarchy. It was a digital Wild West where anonymous developers launched food-themed tokens (Yam, Sushi, Pickle), and retail traders—self-proclaimed “degens”—chased quadruple-digit APYs in a frenzy of high-risk yield farming. It was fast, lucrative, and incredibly dangerous.

Fast forward to 2026, and the landscape has shifted violently. The hoodies have been replaced by suits. The chaotic yield farms have been paved over by regulated, permissioned liquidity pools. Today, DeFi for institutions isn’t just a theoretical concept; it is the new operating system for global finance. Giants like BlackRock and JPMorgan have not merely entered the space; they have effectively co-opted the mechanics of yield farming to optimize trillion-dollar balance sheets.

This article explores how Wall Street tamed the blockchain, turning a revolutionary technology into an efficiency engine for traditional capital. We will look at the mechanics, the major players, and the future of this hybrid financial system.

The Evolution: From Wild West to Wall Street

The journey of DeFi for institutions is a story of maturation. To understand where we are, we must understand what changed. Early DeFi was built on “inflationary rewards”—protocols printed their own tokens to pay liquidity providers. This worked only as long as the token price went up. When the bear market hit, the yields evaporated.

The Collapse of “Degen” Yield Farming

Between 2020 and 2022, yield farming was largely circular. You deposited Token A to earn Token B, which you sold to buy more Token A. There was no external revenue source. For institutions with fiduciary mandates, this was uninvestable. They could not explain to a risk committee why they were leveraging client funds to farm a “governance token” with no legal backing.

The Rise of Real Yield and RWAs

The turning point came when protocols began integrating Real-World Assets (RWAs). Instead of farming a speculative token, liquidity providers began earning yield from U.S. Treasury bills, corporate credit, and real estate revenue, all tokenized on the blockchain. This shift made DeFi for institutions palatable. It offered the speed of blockchain settlement with the safety of traditional collateral.

The Great Shift – Retail DeFi vs. Institutional DeFi

| Feature | Retail DeFi (2020 Era) | Institutional DeFi (2025 Era) |

| Yield Source | Token inflation / Speculation | U.S. Treasuries, Private Credit, RWAs |

| Access | Permissionless (Anyone) | Permissioned (KYC/AML Whitelisted) |

| Identity | Anonymous (0x…) | Verified Legal Entities (LEI) |

| Settlement | Seconds (High Gas) | Instant (Private/L2 Chains) |

| Regulation | “Code is Law” | Compliant with SEC/MiCA/MAS |

| Risk Profile | Smart Contract & Rug Pulls | Counterparty & Credit Risk |

Drivers of Institutional Adoption

Why is Wall Street bothering with blockchain? The answer isn’t “decentralization” or ideology—it’s profit and efficiency. The infrastructure of traditional finance (TradFi) is built on code from the 1970s (COBOL), requiring T+2 settlement times (two days to finalize a trade) and endless intermediaries.

The Search for Yield in a High-Rate Environment

For years, institutions sat on trillions of dollars in dormant capital because moving it was too slow. DeFi for institutions allows them to put idle cash to work instantly. By tokenizing money market funds, a hedge fund can keep its capital earning 4-5% yield in a tokenized Treasury fund (like BlackRock’s BUIDL) until the exact second it is needed for a trade.

Operational Efficiency and T+0 Settlement

In the traditional world, sending money cross-border involves SWIFT, correspondent banks, and days of delay. In DeFi, a billion-dollar transaction settles in roughly 12 seconds on Ethereum or nearly instantly on private chains. This “capital velocity” allows institutions to rotate collateral faster, reducing the amount of cash they need to keep on hand to cover margin calls.

Key Drivers of Institutional Entry

| Driver | Description | Impact on Balance Sheet |

| Instant Settlement | Moving from T+2 to T+0 (Atomic Settlement). | Frees up trapped liquidity; reduces counterparty risk. |

| 24/7 Markets | Blockchain never sleeps; markets trade on weekends. | allows for hedging and risk management during global events. |

| Programmability | Smart contracts automate complex actions (e.g., dividends). | Reduces back-office costs and human error significantly. |

| Global Access | Unified liquidity pools across borders. | Removes friction from cross-border payments and FX. |

Mechanics of Institutional Yield Farming

How does a bank actually “farm yield”? They aren’t logging into Metamask and clicking “Harvest” on a food-themed website. The mechanics of DeFi for institutions are sophisticated and built on “Permissioned DeFi.”

Permissioned Pools and KYC/AML

The primary barrier to entry for institutions was compliance. They cannot interact with a pool if they don’t know who else is in it (funding terrorism or laundering money is a strict no-go).

Protocols like Aave Arc and Compound Treasury solved this by creating “walled gardens.” To enter these liquidity pools, a user must pass strict Know Your Customer (KYC) and Anti-Money Laundering (AML) checks carried out by a regulated custodian like Fireblocks. Once inside, they interact with the same smart contract logic as retail users, but in a sanitized environment.

Under-Collateralized Lending

Retail DeFi usually requires “over-collateralization” (deposit $150 in ETH to borrow $100 in USDC). Institutions, however, work on credit. Platforms like Maple Finance and Clearpool introduced under-collateralized lending. A crypto market maker (like Wintermute) can borrow capital from an institutional pool based on their credit rating and reputation, not just their deposit size. This mirrors traditional credit markets but operates on-chain for transparency.

How Institutions Farm Yield

| Mechanism | How It Works | Target Audience |

| Liquid Staking | Staking ETH to secure the network while retaining liquidity (e.g., Coinbase cbETH). | Asset Managers, Pension Funds |

| RWA Tokenization | Buying tokenized T-Bills (e.g., Ondo, Franklin Templeton) for safe yield. | Corporate Treasuries, Stablecoin Issuers |

| Credit Vaults | Lending USDC to vetted market makers via Maple or TrueFi. | Hedge Funds, Family Offices |

| Repo Markets | Swapping digital assets for cash short-term via JPM’s blockchain. | Global Banks, Broker-Dealers |

Major Players and Case Studies

The landscape of DeFi for institutions is dominated by a few massive entities that have built the rails for everyone else.

BlackRock and the BUIDL Fund

In March 2024, BlackRock launched BUIDL (BlackRock USD Institutional Digital Liquidity Fund) on the Ethereum blockchain. This was the “crossing the Rubicon” moment.

- What it is: A fully tokenized money market fund investing in cash and U.S. Treasury bills.

- The Innovation: Investors receive BUIDL tokens that maintain a $1 value. Yield is paid out daily as new tokens directly into the wallet.

- Utility: Unlike a traditional fund, BUIDL tokens can be transferred 24/7. Other protocols (like Ondo Finance) now use BUIDL as collateral, effectively allowing DeFi to run on BlackRock’s infrastructure.

JPMorgan’s Kinexys (formerly Onyx)

JPMorgan has been quietly building the largest institutional blockchain network in the world. Rebranded to Kinexys in late 2024/early 2025, this platform focuses on “Intraday Repo” and cross-border payments.

- The Problem: Banks often have billions in Treasuries but are short on cash for a few hours. Lending markets are slow.

- The Solution: Kinexys allows banks to tokenize their Treasuries and swap them for tokenized cash (JPM Coin) instantly for a few hours.

- Scale: This platform processes over $2 billion daily, dwarfing most public DeFi protocols.

Project Guardian (Singapore)

Spearheaded by the Monetary Authority of Singapore (MAS), Project Guardian is a collaborative initiative involving policymakers and giants like DBS Bank, UBS, and SBI Digital Asset Holdings.

- Goal: To test the feasibility of asset tokenization and DeFi protocols for wholesale funding markets.

- Outcome: They have successfully executed live pilot trades using “DeFi compatible” liquidity pools for foreign exchange and government bonds, setting the regulatory standard for the rest of the world.

Titans of Institutional DeFi

| Entity | Project Name | Focus Area | Status |

| BlackRock | BUIDL | Tokenized Treasuries / Money Market | Live ($2B+ AUM) |

| JPMorgan | Kinexys (Onyx) | Repo Markets, Cross-Border Payments | Live (High Volume) |

| Goldman Sachs | DAP (Digital Asset Platform) | Bond Issuance, Tokenization | Live |

| Franklin Templeton | FOBXX | Money Market Fund on Polygon/Stellar | Live |

| MakerDAO | Spark / RWA Vaults | Dai Stablecoin backing via Treasuries | Live |

Risks and Regulatory Challenges

Despite the progress, DeFi for institutions is not without peril. The risks have simply shifted from “smart contract bugs” to legal and systemic risks.

Smart Contract vs. Counterparty Risk

In retail DeFi, the fear is a hack. In institutional DeFi, the code is audited aggressively, but the counterparty risk remains. If a tokenized asset is backed by real-world gold or bonds, the physical custodian of that gold becomes a single point of failure. If the custodian commits fraud, the token becomes worthless, regardless of how secure the blockchain is.

The SEC and Global Regulation

Regulation remains the biggest bottleneck. While Europe’s MiCA (Markets in Crypto-Assets) regulation provided a clear framework starting in 2024, the U.S. landscape remains fragmented. Institutions must navigate a maze of SEC rules regarding what constitutes a “security.” This is why most institutional DeFi activity happens in “walled gardens” or offshore jurisdictions like Singapore and Switzerland, where regulators are more progressive.

The Risk Matrix

| Risk Type | Description | Mitigation Strategy |

| Regulatory Risk | Sudden changes in law deeming tokens as illegal securities. | Geo-fencing users; sticking to T-Bill tokens. |

| Oracle Risk | Failure of data feeds (e.g., Chainlink) to price assets correctly. | Using private/permissioned oracles and TWAP. |

| Custodial Risk | The physical asset backing the token is lost or seized. | using regulated, insured custodians (Coinbase, BNY Mellon). |

| Interoperability | Tokens stranded on a private chain with no liquidity. | Cross-chain messaging protocols (CCIP, LayerZero). |

The Future: 2026 and Beyond

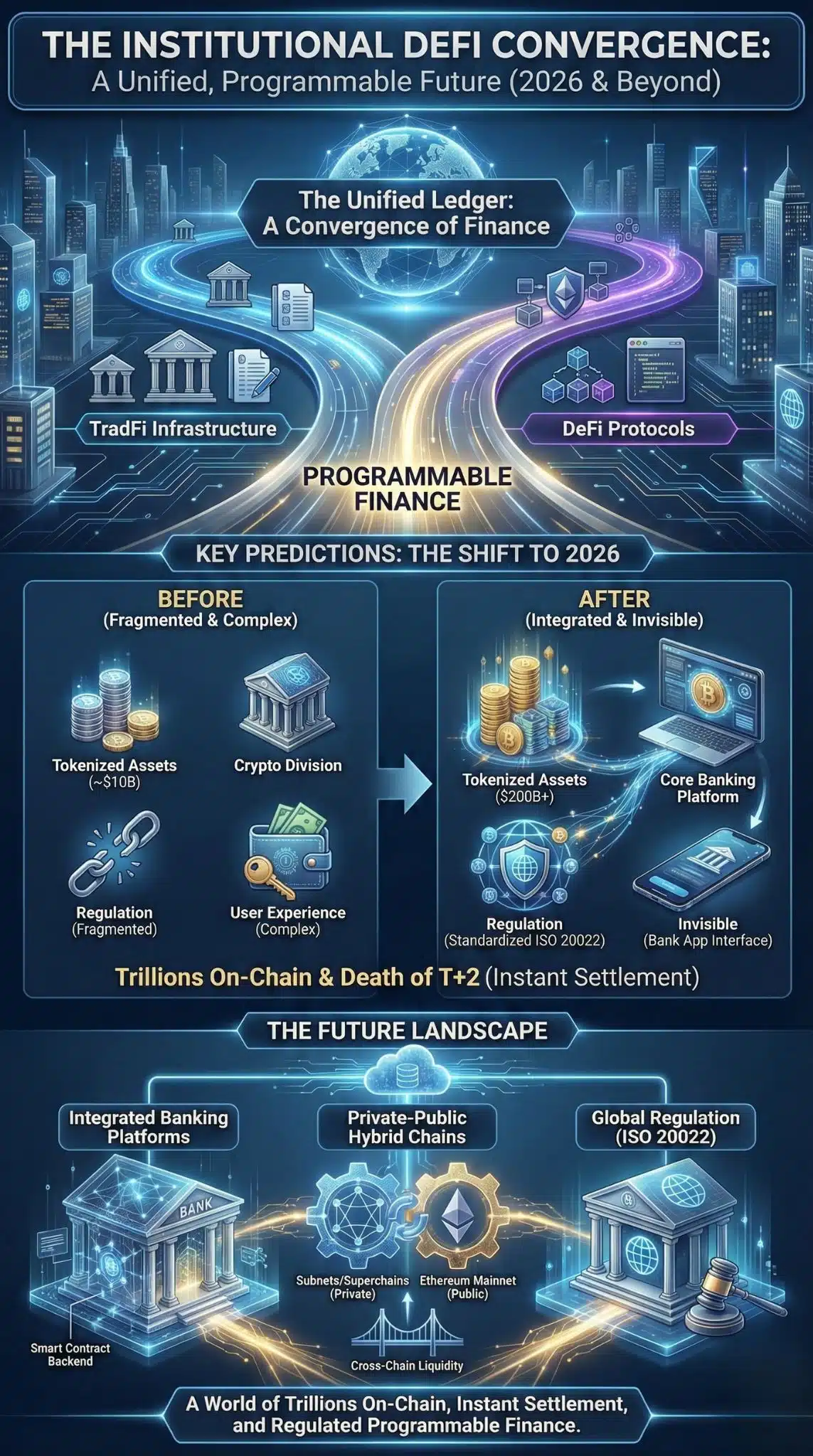

As we look toward the latter half of the decade, the line between DeFi for institutions and traditional finance will blur until it disappears. We are entering the era of the “Unified Ledger.”

The Convergence

We will stop talking about “crypto” and start talking about “programmable finance.” Your bank account will essentially be a wallet. When you buy a stock, you will receive a tokenized share that settles instantly. The “yield farming” strategies of 2020—staking, liquidity provision, lending—will become standard backend processes for banks to generate yield on customer deposits.

Predictions for the Next Era

- Trillions on Chain: By 2030, Citi estimates up to $5 trillion in real-world assets will be tokenized.

- The Death of T+2: Instant settlement will become the global standard, freeing up billions in capital efficiency.

- Private-Public Hybrids: We will see “Subnets” (Avalanche) and “Superchains” (Optimism) where institutions run their own private blockchains that can occasionally “talk” to the public Ethereum mainnet for liquidity.

Future Outlook

| Metric | 2024 Status | 2026 Prediction |

| Tokenized Assets | ~$10 Billion (mostly Treasuries) | $200 Billion+ (Real Estate, Equities, Bonds) |

| Integration | Separate “Crypto Divisions” | Integrated into Core Banking Platforms |

| Regulation | Fragmented / Hostile (US) | Standardized Global Frameworks (ISO 20022) |

| User Experience | Complex (Wallets, Keys) | Invisible (Bank App Interface) |

Final Thoughts

The narrative that “institutions are coming” is outdated. They are already here. DeFi for institutions has successfully stripped the “punk” out of “cypherpunk,” replacing it with profit margins and compliance officers.

Wall Street did not destroy yield farming; they professionalized it. By adopting the technology of distributed ledgers and combining it with the safety of Real-World Assets, they have created a superior financial infrastructure. For the average investor, this validates the technology but also signals the end of the wild, inefficient, and immensely profitable “early days.” The future of finance is on-chain, but it will likely be KYC’d, regulated, and institutionally owned.