Many sellers feel trapped by high fees on big e-commerce platforms. They face slow payouts, steep transaction fees, and data leaks. Did you know OpenBazaar uses smart contracts on public blockchains to let sellers skip subscription fees?

This post will show 7 decentralized marketplaces that cut out middlemen. You will learn how peer-to-peer transactions and blockchain tokens work. You will see ways to save on fees and boost security.

Read on.

Key Takeaways

- Global online sales will hit $7 trillion by 2024, and Amazon owns 37.6% of the U.S. e-commerce market. Many sellers face slow payouts and high fees on big platforms. Seven peer-to-peer marketplaces like OpenBazaar and Origin Protocol now cut out those middlemen.

- These platforms use blockchain to log each sale on a public ledger and run smart contracts to lock in deals. Buyers and sellers link crypto wallets (e.g., MetaMask) to trade directly. Many marketplaces use a DAO model so users vote on fees and platform rules.

- Top alternatives include OpenBazaar, Origin Protocol, Rarible, Mintable, Zora, Boson Protocol, and BlockMarket. Rarible raised $20 million in 2021. Mintable has welcomed thousands of users since 2020 and offers on-demand shipping without warehousing.

- Sellers now pay about 1% in transaction fees versus 5% on eBay. They enjoy faster payouts, stronger data privacy, and full control over listings. Major challenges include the web3 wallet learning curve and varied global regulations.

What Are Decentralized Marketplaces?

Decentralized marketplaces run on blockchain technology, they cut out middlemen. Smart contracts lock in sale terms, they act like digital handshake deals. Buyers and sellers connect in peer-to-peer transactions, no cashier lines slow them down.

A user loads a cryptocurrency wallet, then pays coins straight to the vendor. This model shifts control from giant online marketplaces and auction sites to everyday people.

It works like an auction house without a clerk, bids flow freely. Blockchain logs each sale, it fights off fake listings. Transaction fees stay low, they cost a fraction of what Amazon’s platform charges.

Shoppers browse product categories and choose fixed-price listings or open bids. This e-commerce platform invites small brands and handmade goods to shine.

The Rise of Decentralized Marketplaces in E-Commerce

Markets built on peer-to-peer trades gain traction. Online retail will hit $7 trillion in sales by 2024. Amazon holds 37.6% of the U.S. market. Startups now test distributed ledger integration and smart contracts.

These tools cut out middlemen and slash transaction fees. Sellers keep more profit.

An online marketplace on public ledgers uses digital wallets. They use decentralized autonomous organizations for peer-to-peer transactions and low transaction fees. Sellers list goods with fixed-price listings or auction-style listings.

Buyers pay with Monero or stablecoins in web wallets. Many platforms add smart contracts to hold funds in escrow. Platforms boost data privacy and speed up customer service.

7 Decentralized Marketplaces That Are Gaining Popularity

Like a digital flea market, these platforms tap into distributed ledgers, run on-chain agreements and use token wallets, so keep reading to see why buyers and sellers swarm to them.

OpenBazaar

OpenBazaar runs as a peer to peer online marketplace without a central server. Sellers list fixed price listings or auction style bids in a global online store. The platform uses Bitcoin and other cryptocurrency wallets for payments.

Buyers praise low transaction fees and direct customer service. It feels like a craft fair in your pocket.

Developers lock data with blockchain and smart contracts for strong security. Shoppers link their IPFS node to browse product categories fast. Traders gain control over pricing strategies and shipping.

This scene feels as fun as a summer swap meet. It still needs more users to boost its network.

Origin Protocol

Origin Protocol lives on the Ethereum blockchain. It uses self-executing contracts, so it cuts transaction fees and speeds up deals. It issues Origin Tokens (OGN) to reward users who list, buy, or share items.

It feels like a digital flea market on code.

Sellers list items in fixed-price listings or run auction-style listings, from high-end goods to everyday groceries. This setup removes fees tied to fulfillment by amazon (fba). Buyers enjoy more privacy, fewer data breaches, and clear transaction fees.

Peer-to-peer transactions run on a digital marketplace, not through a giant retailer.

Rarible

Rarible joins six other decentralized marketplaces as top ebay alternatives. The platform uses blockchain tech to power peer-to-peer transactions. Sellers gain lower transaction fees and firm control over personal data, while competitive pricing attracts more bidders.

Smart contracts secure sales while crypto payments speed checkout.

OpenBazaar, Origin Protocol and Particl share this peer-led model. Shoppers browse fixed-price listings or join an auction-style listing for digital art, token art or handmade goods.

Backers injected over $20 million into Rarible in 2021, a clear sign that online commerce will keep shifting toward more user-driven, blockchain-powered shops.

Mintable

Mintable offers sellers more control, privacy, and low costs. The platform sits among seven decentralized marketplaces that challenge eBay and Amazon. It hosts a diverse range of products, from handmade goods to digital art, letting sellers widen their catalogs.

Blockchain locks orders and payments, while smart contracts handle fees and shipment rules. Sellers enjoy reduced transaction fees and can set fixed-price listings or auction-style sales for local buyers.

The site works with peer-to-peer transactions and uses an open governance model, so each user votes on platform rules, updates, and features.

Community-driven rules let sellers shape brand identity and customer service. Local transactions run smooth, with buyers and sellers talking directly, bypassing middlemen and high marketplace fees.

Developers add tools to verify product categories and manage product information via smart contracts. Mintable rivals Amazon’s FBA model by letting sellers skip warehousing costs; they ship on demand.

The mix of token minting tools, secure payments, and shared governance has drawn thousands of users since 2020. This approach gives entrepreneurs a fresh online marketplace where they control pricing, fulfillment, and user engagement.

Zora

Zora sits among seven leading decentralized marketplaces. It runs on a public ledger network and uses smart contracts. It links buyers and sellers in peer-to-peer transactions across online marketplaces.

Sellers set fixed-price listings or auction-style listings. They pay lower transaction fees than on big platforms.

Blockchain upgrades will let Zora handle rentals and services too. People can trade without middlemen found on Amazon.com or eBay. Each sale logs to a shared ledger. Sellers gain privacy and control.

Buyers see clear, competitive pricing.

Boson Protocol

Boson Protocol powers new online marketplaces that rival eBay and Amazon by cutting out middlemen. It locks deals on a public ledger, so every sale runs on smart contracts. Buyers pay with cryptocurrencies from any country, and sellers gain more privacy and security.

This setup trims traditional transaction fees and speeds up peer-to-peer transactions.

Its community drives key decisions through a governance token, so users vote on fees and features. The platform charges lower commission fees than big retail outlets and offers tiered membership perks.

Some projects hit snags over rules in certain regions, and many small shops hesitate to join. Teams are working on batch processing and sidechains to tackle growth and scalability issues.

BlockMarket

BlockMarket links seven digital marketplaces that challenge ebay alternatives. The platform taps blockchain, smart contracts, and peer-to-peer transactions for fast, secure trades.

It waives transaction fees, so sellers snag the lion’s share on each sale. This network serves niches like tech gadgets and fashion. It grows like wildfire in markets worldwide. Venture capital pours tens of millions into its vision.

Each marketplace offers fixed-price listings and auction-style listings. They list handmade goods, luxury goods, and digital art in varied product categories. Smart contracts run on blockchain with a distributed file system.

Buyers pay with a digital wallet or credit card. The model slashes fees and boosts customer engagement.

Key Features of Decentralized Marketplaces

Chain scripts let buyers trade goods without a middleman, and user apps connect through a peer network of nodes. A plug-in wallet handles fee payments and offloads product data to a content network for safe storage.

Blockchain integration

Decentralized marketplaces tap blockchain to lock each transaction in an open ledger. They embed Ethereum smart contracts in an e-commerce platform. The code triggers release of funds once both sides meet terms.

IPFS glues product details across nodes. This setup slashes middlemen and cuts transaction fees.

Shoppers join peer-to-peer transactions without bank gates or PayPal. Sellers list items in fixed-price listings or online auction style. They skip high costs and earn more profit.

A DAO council votes on protocol changes, so governance stays open. Security jumps as no central server can fail or get hacked.

Peer-to-peer transactions

A digital wallet links buyers and sellers directly, so trades do not need a helper. Smart contracts on a blockchain network handle the money instantly, like a judge who never sleeps.

This approach cuts out middlemen, and it slashes transaction fees.

This direct trade feels like a global handshake. Sellers keep more of their cash, and buyers pay less. Online marketplaces built on peer-to-peer transactions feed competitive pricing.

Blockchain integration keeps the record in plain view, no secrets tucked away.

Reduced transaction fees

Decentralized marketplaces cut out middlemen. Sellers face just one percent in transaction fees, versus the five percent they see on eBay. It feels like hidden fees vanish into thin air.

Blockchain integration records each sale in an Ethereum smart contract. A MetaMask wallet handles payments without bank charges. Crypto payments let buyers in Brazil pay a vendor in Japan in minutes.

Peer to peer transactions slash banking costs and sales taxes.

Benefits of Using Decentralized Marketplaces

A file sharing network ties into a public ledger and self-executing code to vault your data, hand you the keys in a digital wallet, and cut out middlemen, so keep reading to learn more.

Increased privacy and security

Decentralized marketplaces use blockchain integration and smart contracts to shield each sale. They shift orders into peer-to-peer transactions. Users link wallets like MetaMask or WalletConnect to pay.

They skip extra transaction fees from banks or central sites. IPFS stores product details off chain, so sellers keep full control of keys.

Confidential Transactions hide payment amounts on chain. RingCT masks sender and receiver details. No outsider tracks bids or addresses. This boost in privacy and security keeps product info and user data safe on online marketplaces.

Greater control for buyers and sellers

Buyers hold personal data keys in a digital wallet on an online marketplace. They guard browsing history and payment info. They buy via peer-to-peer transactions. They scan product categories for the best price.

They dodge middlemen and slash transaction fees.

Sellers set fixed price listings or auction style listings. They run smart contracts and lean on blockchain integration for clear deals. They handle customer service and ship items directly.

They skip fulfillment by Amazon (FBA) and keep more profit.

Elimination of middlemen

Decentralized marketplaces cut out middlemen and let buyers and sellers deal directly in peer-to-peer transactions. This setup slashes transaction fees, often by 30 to 50 percent, compared with fulfillment by amazon (fba) or feebay models.

Sellers pick fixed-price listings or auction-style listings. Shoppers enjoy competitive pricing on handmade goods and digital items.

Platforms use automated agreements on blockchain integration to secure each deal. No bank or broker can block a payment. Smart systems track product categories, support online stores, and handle fulfillment by independent vendors.

This model drives growth in ebay alternatives and diverse online marketplaces.

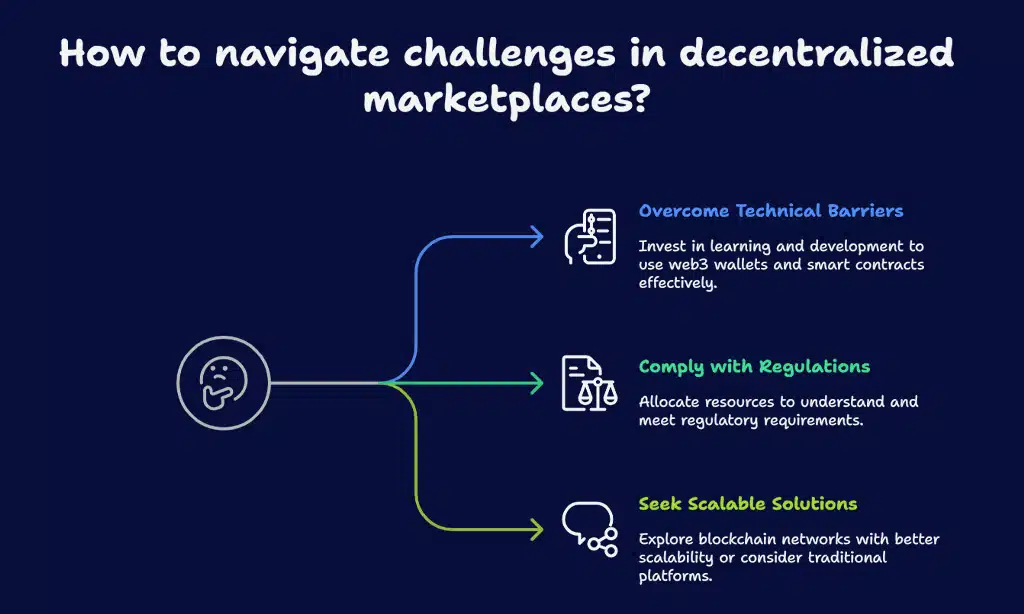

Challenges Facing Decentralized Marketplaces

New sellers stare at the browser wallet plugin like it is ancient hieroglyphics. If your blockchain agreement locks funds, you might feel stuck in a maze with no exit.

Limited adoption

Many users lack technical skills to install web3 wallets. Developers need deep coding know-how to write self executing agreements. These sites promise peer-to-peer transactions but demand steep training.

Such tasks scare off nonexpert sellers.

Regulators across the EU, US and Asia impose varied rules on decentralized marketplaces. Compliance adds cost and slows listings. Small shops stick with ebay alternatives that need no license.

Technical learning curve for users

Users juggle digital wallets, seed phrases, and smart contracts on decentralized marketplaces. They struggle to find product categories and set prices on ebay alternatives. That steep climb kills short-term fun in peer-to-peer transactions.

Scalability lags on top blockchain networks. That snag drives up transaction fees and slows auction-style listings. Some sellers flock back to brick-and-mortar shops or stick with fulfillment by amazon (fba).

The Future of Decentralized E-Commerce

Sharding splits data into chunks to boost speed, it helps shops load faster. Layer 2 scaling zips up transactions on a smart ledger network, it cuts transaction fees. Smart contracts let sellers set fixed-price listings and auction-style listings without brokers.

Blockchain integration and distributed storage systems hold images and product info for handmade goods or digital art. These tools help ecommerce platforms rival amazon’s speed and security.

Investors keep pumping funds into these peer-to-peer venues, they see demand outpacing old ebay alternatives or craigslist. Sites built on Origin Protocol or this distributed storage system draw crafters and small shop owners who need low fees and direct deals.

Sellers that skip fulfillment by amazon (fba) free themselves from high transaction fees while entering new product categories, from handmade goods to digital art. Upgrades in customer service through messenger apps and wallet extensions boost buyer trust in a sale.

This wave will shift business strategy for online retailers, from a business to business model to a sharing economy built on smart contracts.

Takeaways

Fresh market apps cut out the middlemen. You use smart contracts for safe deals. Sellers set fixed-price listings or run auction-style sales. A protocol service like Origin Protocol helps peers trade directly.

Blockchain integration locks in each payment. This swap shakes up big platform rules. Shoppers and sellers gain new power and choice. The future of online trade feels closer every day.

FAQs on Decentralized Marketplaces That Are Replacing eBay & Amazon

1. What are decentralized marketplaces and how do they differ from eBay and Amazon?

They run on blockchain, not in a retail outlet. These digital marketplaces stand as ebay alternatives. They drop Amazon’s FBA, cut out middlemen, and use free software to lower transaction fees. Some hubs act like a blockchain exchange, others like a social hub.

2. How do transaction fees and fixed-price listings work on blockchain trading platforms?

They use smart contracts to lock in deals. Sellers set fixed-price listings, or open auction-style listings. Peer-to-peer transactions sail on the network, small transaction fees fund the nodes. It is like a tip jar, but tiny.

3. Can I sell handmade goods or books on these auction-style sites?

Yes, you can list handmade goods in artisanal product categories. You can open an online bookstore for used reads. Auction-style listings still run on the bargain bazaar, on the city board, or on the kiwi swap site. You pick fixed-price or bid style. It feels like a yard sale in your pocket.

4. How is customer service handled without a big retailer like Amazon?

You talk to sellers directly. Customer service flows in a group chat, not a call center. Some hubs add a support team. It blends b2c and b2b help. It is like emailing a friend, not waiting on hold.

5. What product categories can I find on peer-to-peer platforms?

You can find electronics, fashion, and tools once sold on kmart.com or sears.com. You see parts, collectors items, even stock from buy.com. Sellers manage product categories with tools for managing product information. It is as broad as a mall, yet all online.