Debt can feel like an unmanageable burden, whether it’s from credit cards, student loans, or personal loans. For many, it can seem as though there’s no way out. However, creating a debt repayment plan that works is the most effective solution to get back on track and achieve financial freedom.

With a well-structured, actionable plan, you can tackle your debts, save money on interest, and finally regain control of your finances.

In this comprehensive guide, we’ll walk you through five crucial steps to help you design a debt repayment plan that works for your unique financial situation.

You’ll learn how to assess your current debt, set clear goals, choose the right repayment strategy, automate payments, and monitor your progress effectively. By the end, you’ll have a clear, actionable plan that will help you take control of your debt and put you on the path to a brighter financial future.

Understanding the Importance of a Debt Repayment Plan That Works

Having a debt repayment plan that works is more than just a strategy for paying off debt; it’s an essential step toward achieving financial stability and freedom. Without a clear plan, it’s easy to fall into the trap of late fees, rising interest rates, and even more debt accumulation.

However, when you create a well-thought-out plan, you’re not just eliminating debt — you’re building a foundation for long-term financial success.

Why Having a Debt Repayment Plan That Works Is Crucial for Financial Freedom?

A debt repayment plan that works is crucial because it helps you prioritize paying off high-interest debt and create a system for reducing your financial obligations efficiently.

Here’s why having a plan is so vital:

- Prioritize High-Interest Debt: By identifying and tackling high-interest debts first, such as credit cards, you can save significant amounts of money in the long run.

- Create a Roadmap: A structured plan allows you to track progress and set clear milestones, keeping you motivated as you move toward becoming debt-free.

- Reduce Financial Stress: Having a clear plan reduces uncertainty, helping to alleviate the anxiety that often comes with owing money.

- Achieve Financial Goals: Once you’re debt-free, you’ll have the financial flexibility to save for other goals like retirement, buying a house, or starting a business.

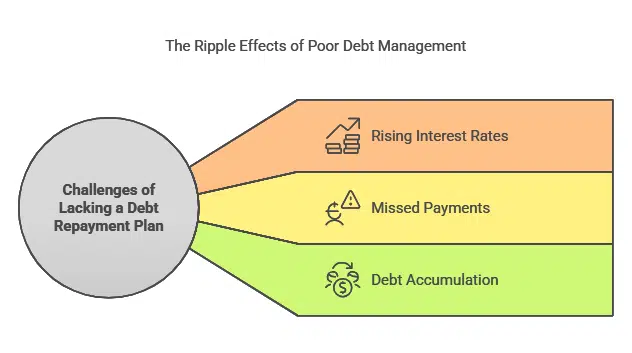

Common Challenges People Face Without a Debt Repayment Plan That Works

Without a well-thought-out debt repayment plan that works, many individuals face the following challenges:

- Rising Interest Rates: Without managing your debts, high-interest rates can quickly make your debt much more expensive.

- Missed Payments: Missing payments, whether intentionally or accidentally, can lead to penalties, late fees, and even increased interest rates, exacerbating your debt.

- Debt Accumulation: Without a plan, it’s easy to keep borrowing to cover existing debt, which leads to a vicious cycle that’s harder to break.

Step 1: Assess Your Current Financial Situation

Before creating a debt repayment plan that works, it’s crucial to fully understand your financial situation. This means assessing the total amount of debt you owe, reviewing your income, and evaluating your expenses. Knowing exactly where you stand will help you create a realistic and effective plan to eliminate your debt.

Calculate Your Total Debt and Monthly Payments

The first step is to make a list of all your debts. Include every credit card, loan, medical bill, or any other financial obligation. Calculate how much you owe and the monthly payments required. This gives you a clear picture of your financial situation and what needs to be tackled.

Example: Tracking Your Debt

Here’s an example of how you can organize your debt information:

| Debt Type | Balance Owed | Minimum Payment | Interest Rate (%) | Debt Priority |

| Credit Card A | $5,000 | $150 | 18% | High |

| Personal Loan B | $10,000 | $200 | 10% | Medium |

| Student Loan C | $25,000 | $300 | 5% | Low |

This breakdown shows you how much you owe, what the minimum payments are, and which debts are the most urgent (high-interest debt should generally be prioritized).

Analyze Your Income and Expenses

Once you have a clear understanding of your debts, the next step is to review your income and monthly expenses. By creating a budget, you can identify areas where you can cut back on spending and allocate more money toward debt repayment.

Example: Budget Breakdown

Here’s an example of how to track your monthly income and expenses:

| Expense Category | Monthly Amount |

| Rent/Mortgage | $1,200 |

| Utilities | $150 |

| Groceries | $300 |

| Debt Payments | $500 |

| Miscellaneous | $200 |

Subtracting your total expenses from your monthly income will help you determine how much extra money you can apply toward paying down your debt.

Step 2: Set Realistic Repayment Goals

With a solid understanding of your debt and finances, the next step is to set clear, actionable repayment goals. A debt repayment plan that works hinges on these goals being specific, measurable, and time-bound. Without them, it’s easy to lose track of your progress or fall off course.

How to Set Achievable Financial Targets:

Setting realistic, achievable goals is key. Here’s how you can set goals that are aligned with your financial situation:

- Start Small: If you have multiple debts, start by paying off the smallest debt first (this is known as the debt snowball method). This will give you a quick win and build momentum.

- Be Specific: Set clear, quantifiable goals. For example, “Pay off $2,000 in credit card debt by the end of the year” is much more effective than saying “Pay off debt.”

- Set Milestones: Break down large goals into smaller, manageable milestones. For instance, “Pay off $500 in credit card debt this month” keeps you focused and motivated.

Short-Term vs Long-Term Goals

Having both short-term and long-term goals will allow you to make progress without feeling overwhelmed. Short-term goals could include paying off a small balance, while long-term goals might involve eliminating all your debt.

| Goal Type | Examples |

| Short-Term Goals | Pay off $500 on credit card A |

| Long-Term Goals | Become debt-free within 2 years |

Step 3: Choose the Right Debt Repayment Strategy

Now that you have a clear understanding of your finances and goals, it’s time to choose the right strategy for repaying your debt. There are several methods available, and the best one depends on your preferences and financial situation. The two most common methods are the Debt Snowball and Debt Avalanche strategies.

Debt Snowball Method

The debt snowball method involves paying off your smallest debts first, regardless of the interest rate. Once the smallest debt is paid off, the money that was used for that payment is rolled over to the next smallest debt, creating a “snowball” effect.

Example: Using the Snowball Method

If you have the following debts:

| Debt Type | Balance Owed | Interest Rate (%) | Minimum Payment |

| Credit Card A | $1,500 | 20% | $75 |

| Personal Loan B | $5,000 | 12% | $150 |

| Auto Loan C | $10,000 | 7% | $250 |

Start by paying off Credit Card A, then once it’s paid off, use that $75 payment to pay off Personal Loan B, and so on.

Debt Avalanche Method

The debt avalanche method prioritizes paying off high-interest debt first, regardless of the balance. This method saves you more money on interest over time, though it can take longer to see progress.

| Method | Pros | Cons |

| Debt Snowball | Quick wins, boosts morale | Might cost more due to interest |

| Debt Avalanche | Saves on interest | Slower to see results |

Both methods are effective, but the debt avalanche method may be better if your primary goal is to save money on interest.

Consolidation and Refinancing Options

If you’re juggling multiple high-interest debts, consolidation or refinancing can simplify your debt repayment plan that works. This involves combining several debts into one with a lower interest rate, which reduces your monthly payments and makes it easier to manage.

| Debt Type | Original Interest Rate | Consolidated Interest Rate | Monthly Payment |

| Credit Card A | 20% | 12% | $200 |

| Credit Card B | 18% | 12% | $150 |

Debt consolidation can save you money on interest over time and simplify your finances.

Step 4: Automate Your Payments to Stay Consistent

Consistency is key when it comes to repaying debt. Missed or late payments can lead to penalties and interest rate increases, making it harder to pay off your debts. Setting up automatic payments ensures that you stay on track with your debt repayment plan that works.

Benefits of Automating Debt Payments

- Avoid Late Fees: Automated payments reduce the risk of missing a payment, helping you avoid costly late fees.

- Better Credit Score: Timely payments contribute to an improved credit score, which can save you money on future loans.

- Peace of Mind: Automation removes the mental burden of remembering due dates, giving you one less thing to worry about.

Tools to Set Up Automatic Payments

There are several tools and apps available to help you set up automatic payments:

- Mint: Tracks all your debts and sends reminders to ensure timely payments.

- You Need a Budget (YNAB): Allocates money for automatic debt payments and tracks them as you go.

- Lender Websites: Many lenders allow you to set up automatic payments directly on their websites.

Step 5: Monitor Your Progress and Adjust as Needed

Even with a debt repayment plan that works, it’s essential to monitor your progress regularly and adjust as necessary. Life changes — from a raise to an emergency expense — may require modifications to your plan.

Track Your Debt Reduction Regularly

There are several tools to help you monitor your progress:

- Mint: Tracks your overall financial health and shows how much you’ve paid off.

- Personal Capital: Provides a detailed breakdown of your financial progress.

Adjust Your Plan If Necessary

If your financial situation changes, such as getting a new job or experiencing an emergency, adjust your plan to stay on track. If you receive a tax refund or bonus, consider putting that extra money toward paying off your debt faster.

Takeaways

Creating a debt repayment plan that works is the key to achieving financial freedom. By assessing your finances, setting achievable goals, choosing the right repayment strategy, automating payments, and monitoring your progress, you’ll be well on your way to becoming debt-free.

With discipline and consistency, you can tackle your debt, save money on interest, and regain control of your financial future. Start today, and take the first step toward a debt-free tomorrow.