Saving for retirement is a big deal, but it’s not always simple. Many people wonder how to grow their nest egg while managing risks. With the rise of digital assets like cryptocurrency, new questions are popping up: Should I include crypto in my plan? Is it too risky?

Crypto assets, known for their high volatility and potential growth, could change the way you save for retirement. But they’re also tricky—think taxes, security issues, and unpredictable values.

This blog will break it all down. You’ll learn how Crypto Can Impact Your Retirement Plan with pros, cons, and strategies to use wisely. Ready to explore? Keep reading!

Cryptocurrency Basics in Retirement Plans

Cryptocurrency can change how people think about retirement savings. It offers new investment options, but it comes with risks and rewards.

Definitions and Key Concepts of Cryptocurrency

Cryptocurrency is digital money. It works on blockchain technology, a secure system that keeps track of transactions. Bitcoin, created in 2009, was the first cryptocurrency. Others like Ethereum and Cardano followed.

These currencies use cryptography to protect data and prevent counterfeiting without needing central banks.

Unlike dollars or euros, crypto exists only online. Investors trade it through platforms instead of traditional exchanges. Prices depend on supply and demand, making values rise or drop sharply.

This high volatility means big risks but also potential rewards for retirement funds if used wisely with tools like exchange-traded funds (ETFs).

Cryptocurrency’s Role in Retirement Strategies

Digital assets like Bitcoin and Ethereum are changing retirement savings. Some employers now let workers add cryptocurrency to employer-sponsored retirement plans, such as 401(k)s.

This option offers a new investment path but comes with risks like high volatility and complex tax rules. Unlike mutual funds or the S&P 500, crypto prices can swing fast, making it harder to plan reliable returns.

Speculative investments often mean bigger risks—and potential rewards. Younger generations like Gen Z may take these chances for higher growth, while older workers may prefer safer options due to fiduciary responsibilities under laws like the Employee Retirement Income Security Act (ERISA).

Financial advisors warn against heavy reliance on these digital currencies in defined contribution accounts because of security issues and fraud concerns involving internet crime. Always weigh risk tolerance carefully before taking that leap into uncharted economic waters!

Cryptocurrency Adoption in 401(k) Plans

Employers are starting to offer cryptocurrency as an option in 401(k) plans. This change allows workers to invest in digital assets like Bitcoin through their employer-sponsored retirement plans.

Fidelity, a major financial firm, began offering this feature in 2022.

High volatility makes crypto risky for retirement savings. Fiduciaries must weigh the risks against potential returns before including cryptocurrencies. High fees and complex tax rules also make crypto tricky in these plans.

The Securities and Exchange Commission keeps a close eye on such investments due to regulatory concerns.

Crypto isn’t just flashy; it’s complicated. Understand it fully before adding it to your future.

Seven Impacts of Cryptocurrency on Your Retirement Plan

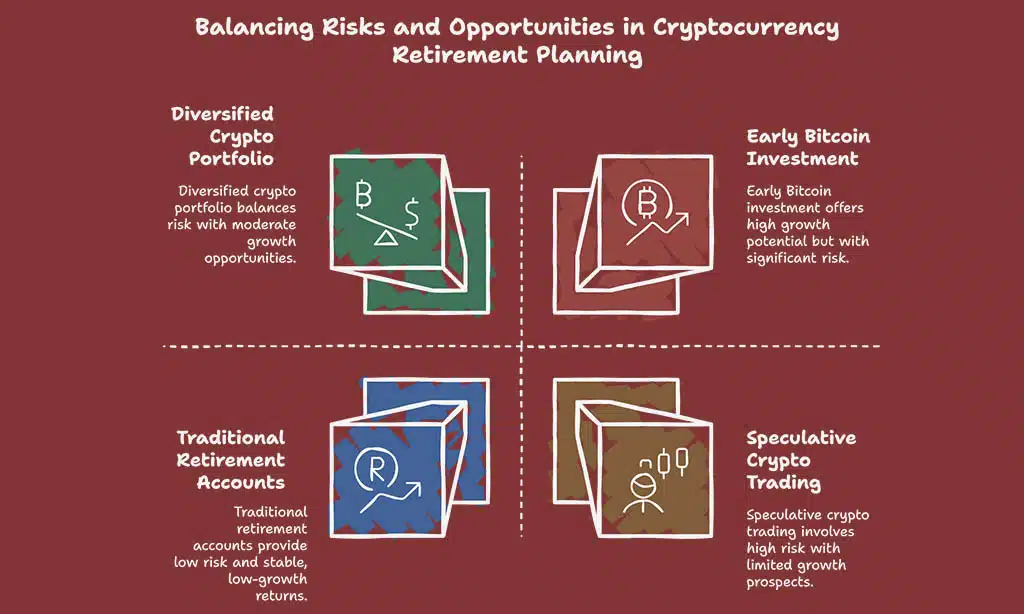

Cryptocurrency can shake up how you plan your retirement. It brings both chances for gains and risks that need careful thought.

Enhancing Portfolio Diversification

Adding crypto assets to retirement savings gives variety to investments. It can act as a hedge against traditional markets like the S&P 500 during economic downturns. Stocks, bonds, and cryptocurrencies each react differently to market changes.

Self-directed IRAs allow access to digital assets for better spread. Though crypto’s high volatility poses risks, its uncorrelated nature may reduce systemic risk in employer-sponsored retirement plans.

Addressing High Volatility and Associated Risks

Crypto changes fast. Prices can swing wildly within hours. This high volatility makes it a risky choice for retirement savings. For example, Bitcoin dropped more than 50% in value during 2022.

Such swings make planning hard and stress investors who need steady growth for their future.

Experts say crypto should not take up too much of a portfolio due to these risks. High fees also add challenges since custodians cannot give advice about digital assets like they do with traditional investments.

To manage potential losses, spread out your investments across safer options like the S&P 500 or bonds instead of relying too much on speculative assets like cryptocurrency.

Navigating Tax Implications of Cryptocurrency Investments

Taxes on crypto can get tricky. The IRS treats digital assets like property, not cash. Selling or trading these counts as a taxable event. Gains are subject to capital gains tax, just like stocks.

If held under a year, short-term rates apply and align with your income tax bracket.

Tracking transactions is key for filing taxes right. Each trade may need reports for the purchase price and sale value. Mistakes or missed entries could lead to penalties. Custodians won’t help here due to strict rules under the Employee Retirement Income Security Act (ERISA).

Exploring Potential for Long-Term Growth

Crypto offers the chance for big growth, but it comes with risks. Digital assets like Bitcoin and Ethereum could rise in value over time. Their limited supply makes them appealing to many investors.

Unlike stocks such as the S&P 500, crypto values can change fast, creating both challenges and opportunities.

Speculative investments might boost your retirement savings if timed right. Some early adopters of Bitcoin saw huge returns after its prices skyrocketed. Still, high volatility means things can go south quickly too.

Balancing these assets with safer options helps reduce risk while exploring growth possibilities.

Accessing Crypto through Individual Retirement Accounts

Individual Retirement Accounts (IRAs) let you invest in digital assets like cryptocurrency. A self-directed IRA offers this option, unlike traditional IRAs. These accounts give you more control over investment choices but often come with higher fees and risks.

Custodians managing these IRAs aren’t allowed to offer financial advice, so due diligence is key.

Tax rules for crypto inside an IRA can get tricky. Gains are usually tax-deferred or tax-free, depending on the account type. However, poor record-keeping could lead to penalties or audits.

Volatility also affects value quickly, making it a high-risk choice for retirement savings.

Understanding Regulatory and Legal Frameworks

Rules about crypto use in retirement plans can be tricky. The Securities and Exchange Commission (SEC) oversees digital assets but doesn’t offer clear rules for 401(k)s. Fiduciaries under the Employee Retirement Income Security Act (ERISA) must act carefully when adding cryptocurrencies to employer-sponsored retirement plans.

They need to know the risks, like high volatility and possible fraud.

Tax issues add more challenges. Crypto investors face complex reporting requirements, which could cause headaches during tax season. Fees might also rise since custodians cannot give advice or handle these specialized investments directly.

Government accountability groups continue pushing for clearer laws as interest in capital markets grows.

Protecting Against Security and Fraud Risks

Crypto investments face risks like fraud and hacking. Digital assets stored in wallets or exchanges can become targets for cybercriminals. Strong cybersecurity measures are a must to reduce these dangers.

Cryptocurrency fraud is rising. Fake investment schemes trick people into losing retirement savings. Always check sources, use secure platforms, and avoid offers that seem too good to be true.

Protecting your funds starts with being cautious and informed.

Strategies for Including Crypto in Your Retirement Plan

Think about how much risk you can handle. Stay updated on crypto rules and changes.

Evaluating Your Risk Tolerance

Gauge your comfort with uncertainty. Cryptocurrencies are highly volatile. Prices can swing 20% or more in a single day. Ask yourself, “Can I handle losing money quickly?” If not, crypto might be too risky for your retirement savings.

Set limits based on your goals and age. Younger investors may afford more risk since they have time to recover losses. Older savers nearing retirement should focus on safer investment options like the S&P 500 or bonds.

Speak to financial advisors if unsure about balancing risks in employer-sponsored retirement plans or IRAs.

Keeping Up with Cryptocurrency Regulations

Staying updated on cryptocurrency rules is critical for smart retirement planning. Rules can change fast, so it’s important to stay informed.

- Check government updates often. Agencies like the Government Accountability Office discuss crypto and retirement plans.

- Follow the IRS for tax news. Crypto investments must follow strict tax rules that need accurate record-keeping.

- Watch changes in 401(k) options. Employer-sponsored retirement plans may include crypto but face legal limits.

- Learn about ERISA guidelines. These protect employees’ investments but may affect adding crypto to your plan.

- Stay informed on fees. Investing in digital assets might come with higher costs due to custodians not giving advice.

- Seek help from financial advisors. Experts can explain risks tied to high volatility in speculative investments.

- Study state laws where you live. Each state may have specific rules impacting your retirement savings with crypto use.

Takeaways

Crypto offers both risks and rewards for retirement savings. It can diversify your investments, but its high volatility demands caution. Taxes, regulations, and security matter greatly when using digital assets in long-term plans.

Always weigh the pros and cons with care. Talk to financial advisors before taking big steps.

FAQs

1. How can crypto impact retirement savings?

Crypto investments are highly volatile, which means their value can rise or fall quickly. This volatility can affect the stability of your retirement savings if you invest heavily in digital assets.

2. Can I include crypto in employer-sponsored retirement plans?

Some employer-sponsored plans may offer self-directed brokerage windows that allow access to speculative investments like cryptocurrencies, but these options might not be widely available yet.

3. Is it risky to add crypto to my retirement plan?

Yes, investing in crypto carries high risks due to limited information, liquidity issues, and speculation-driven valuations. Financial advisors often stress risk management when considering such assets for long-term goals.

4. Should I consult a financial advisor before adding digital assets?

Absolutely. A financial advisor can help you weigh the risks and benefits of leveraging crypto as part of your investment options while keeping an eye on economic trends and regulations like ERISA.

5. Why is understanding risk-taking important with crypto investments?

Risk-taking without proper knowledge or financial literacy could lead to losses from debt financing or contagion effects during market downturns—especially compared to more stable benchmarks like the S&P 500.