Cryptocurrency is an exciting and ever-evolving financial asset that has captured the attention of investors worldwide. However, for beginners, the crypto market can feel like a wild, unpredictable place.

With high volatility, numerous projects, and a seemingly endless list of jargon to understand, it’s easy to make mistakes that can significantly impact your investments.

In this article, we’ll dive deep into the 10 crypto mistakes beginners make and how to avoid them, providing you with essential insights and strategies to ensure that your entry into the world of crypto is as successful as possible.

Why Understanding Crypto Mistakes is Crucial for Beginners

In the fast-paced world of cryptocurrency, mistakes can be costly. When you make the crypto mistakes beginners make, they can lead to significant financial losses, frustration, or even the collapse of your entire investment strategy. These mistakes are often made by those who are new to the space, lacking the knowledge and experience needed to navigate the complexities of the market.

Learning from these common errors is critical for long-term success. By understanding the mistakes that are most frequently made by crypto newcomers, you can better prepare yourself to avoid them and make informed decisions that lead to better outcomes.

How Crypto Mistakes Can Impact Your Investment Journey

Whether it’s a lack of research, poor security practices, or falling for scams, crypto mistakes beginners make can result in substantial financial loss. Since the crypto market operates 24/7 and prices can fluctuate wildly within hours, not having a clear strategy can put you at a disadvantage.

However, with the right approach, you can significantly reduce the risk of making these mistakes. In the following sections, we will explore each of the 10 crypto mistakes beginners make in detail and how to avoid them to secure your position as a well-informed crypto investor.

Mistake #1: Failing to Do Proper Research Before Investing

One of the most common crypto mistakes beginners make is failing to conduct proper research before diving into investments. Newcomers often rely on hype, speculative rumors, or recommendations from social media influencers to make investment decisions.

Unfortunately, these sources can be misleading or unreliable. Without proper research, you might end up investing in a project that has no real value or foundation, risking your hard-earned money.

How to Conduct Effective Research in Crypto

To avoid this mistake, it’s essential to take a structured and analytical approach to researching potential investments. Here’s a guide to effective research:

- Whitepapers: A whitepaper provides essential information about a crypto project, including its goals, technology, team, and plans for the future. Always read the white paper before investing.

- Community Engagement: Participate in forums, social media groups, and online communities related to the cryptocurrency you’re considering. Engaging with the community can give you insights into the project’s credibility and potential.

- Team Backgrounds: Investigate the background of the development team behind the project. Look for experience in blockchain development or related industries.

Tools and Resources for Beginners

- CoinMarketCap: Use this site to research market data, coin statistics, and price history.

- Crypto News Outlets: Websites like CoinDesk, The Block, and Bitcoin Magazine provide up-to-date news and expert analysis.

- Reddit & Telegram: Communities on these platforms often provide real-time discussions and user opinions on emerging projects.

Common Red Flags to Look For

While doing your research, keep an eye out for red flags that indicate a project may not be worth your investment:

- Lack of Transparency: If a project doesn’t clearly explain its goals, technology, or team, it might be a sign to stay away.

- Unrealistic Promises: Be cautious of projects that promise guaranteed returns or sound too good to be true.

- Unverifiable Claims: If there’s little or no verifiable information about the project’s progress or the team’s track record, that’s a red flag.

Mistake #2: Ignoring Security Measures for Your Crypto Holdings

The second of the crypto mistakes beginners make revolves around ignoring security protocols. The decentralized nature of cryptocurrencies means that security is entirely your responsibility. Without proper security measures, you could lose access to your funds or become a victim of fraud or hacking.

Best Practices for Securing Your Crypto Wallets

- Use Hardware Wallets: A hardware wallet, such as a Ledger or Trezor, is one of the safest ways to store your cryptocurrency offline. These devices store your private keys and are highly resistant to hacks.

- Enable Two-Factor Authentication [2FA]: Always enable 2FA on your exchange accounts and wallet applications. This adds an additional layer of security to prevent unauthorized access.

Two-Factor Authentication and Cold Storage Explained

- 2FA: This involves using a second method of verification, such as a text message or authentication app [Google Authenticator], in addition to your password.

- Cold Storage: This refers to keeping your cryptocurrencies offline in a secure hardware wallet, reducing the risk of hacks and malware.

Understanding Phishing and Fraud Protection

Crypto scams and phishing attacks are rampant. Always ensure that you only use legitimate platforms and double-check website URLs before entering sensitive information. Phishing attacks often mimic popular crypto exchanges or wallet services, so being vigilant is crucial.

Mistake #3: Falling for “Get-Rich-Quick” Schemes

Another common mistake among crypto beginners is falling for “get-rich-quick” schemes. Many people are drawn to the idea of overnight wealth, especially when they hear about others making substantial profits from crypto. This desire often leads to rash decisions and investments in dubious projects or risky altcoins.

How to Identify and Avoid Scam Coins

To avoid making the crypto mistakes beginners make when it comes to “get-rich-quick” schemes, it’s essential to:

- Avoid Coins with No Utility: Do your research and ensure that the project has a real-world application, a strong use case, and a sustainable plan.

- Check for a Real Team: Scam coins typically have little or no public information about their creators. Always verify the team’s identity and professional history.

Key Warning Signs of a Crypto Scam

- No Roadmap or Clear Vision: A legitimate project will have a detailed roadmap outlining future goals.

- Unverifiable Claims of High Returns: Be cautious if a coin promises guaranteed profits or extremely high returns in a short amount of time.

- Anonymous Founders: While some projects have anonymous teams, it’s often a red flag, especially when the project’s website and community are vague.

Mistake #4: Overtrading and Emotional Decision-Making

Overtrading is one of the most common crypto mistakes beginners make. The excitement of the market, combined with the fear of missing out [FOMO], often leads beginners to make impulsive decisions. These emotional reactions can result in buying at the top and selling at the bottom, eroding your portfolio over time.

The Importance of a Long-Term Strategy in Crypto

To avoid this mistake, it’s essential to develop a well-thought-out strategy that suits your risk tolerance and investment goals. Crypto should be viewed as a long-term investment, not a quick-win gamble.

Setting Realistic Goals for Your Crypto Portfolio

- Determine Your Risk Tolerance: Assess how much volatility you can handle before making investment decisions.

- Set Profit and Loss Limits: Establish clear exit points and stick to them. Avoid making decisions based on fear or greed.

How to Stick to Your Investment Plan

- Automate Purchases: Use dollar-cost averaging [DCA]to make regular, scheduled investments rather than trying to time the market.

- Revisit Your Strategy Regularly: Periodically assess your portfolio and adjust based on market conditions, but avoid making impulsive changes.

Mistake #5: Not Diversifying Your Crypto Portfolio

Many beginners make the crypto mistakes beginners make by putting all their funds into one cryptocurrency. This is risky because if the coin crashes, your entire investment can be wiped out.

How to Build a Balanced Crypto Portfolio

A diversified portfolio spreads risk across multiple assets, reducing the impact of a single asset’s poor performance. Consider including:

- Bitcoin [BTC]: As the most established cryptocurrency, Bitcoin is often a core holding for any portfolio.

- Ethereum [ETH]: Ethereum’s smart contract capabilities make it a valuable addition for long-term growth.

- Altcoins and Stablecoins: Allocating a portion of your funds into promising altcoins or stablecoins like USDC can help mitigate risk.

Key Cryptocurrencies to Include in a Diversified Portfolio

- Bitcoin [BTC]

- Ethereum [ETH]

- Binance Coin [BNB]

- Cardano [ADA]

- Polkadot [DOT]

- Stablecoins [USDT, USDC]

Mistake #6: Underestimating the Volatility of the Market

Crypto is one of the most volatile markets in the world, and crypto mistakes beginners make often stem from underestimating this volatility. Prices can fluctuate wildly within hours or even minutes, making it essential for beginners to have a clear understanding of market cycles.

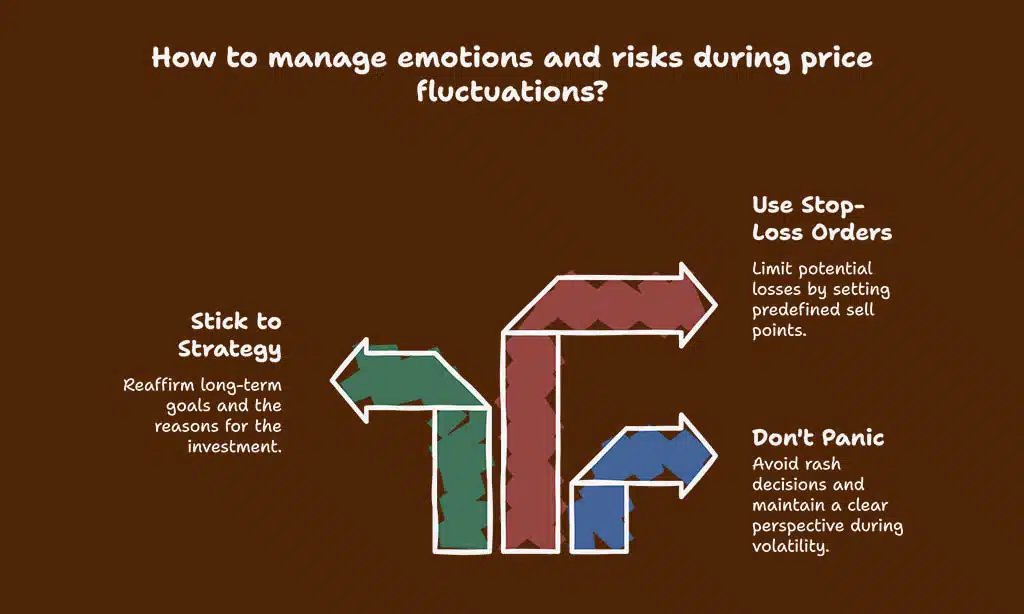

How to Stay Calm During Price Fluctuations

- Don’t Panic: Volatility is a normal part of the crypto market. Take a step back and avoid making rash decisions during times of uncertainty.

- Stick to Your Strategy: Refer to your long-term investment plan and remember why you made the investment in the first place.

Risk Management Techniques for Beginners

- Stop-Loss Orders: Set stop-loss orders to minimize potential losses in case prices fall below a certain point.

- Portfolio Rebalancing: Regularly adjust your portfolio to maintain your desired risk level.

Mistake #7: Failing to Track and Monitor Your Investments

A critical mistake that many crypto beginners make is failing to regularly track and monitor their investments. Crypto prices can be extremely volatile, and small changes in the market can have a significant impact on your portfolio. Without consistent monitoring, you could miss out on opportunities to buy more of your favorite coins at lower prices or sell assets before a downturn.

Tools and Apps for Tracking Crypto Investments

To avoid this crypto mistake beginners make, it’s crucial to use the right tools to track your investments. Here are some popular and effective tools:

- Blockfolio: This mobile app allows you to track your cryptocurrency portfolio in real-time, providing up-to-date price information and performance tracking.

- Delta: Delta is another portfolio management app with support for over 7,000 cryptocurrencies. It also integrates with exchange accounts, giving you a holistic view of your assets.

- CoinTracking: This platform allows you to track and analyze your entire crypto portfolio, including trading activity, capital gains, and taxes.

Using Portfolio Management Software

Portfolio management tools can help you track each asset’s performance and make informed decisions. They offer various features, such as automatic syncing with exchanges, performance charts, and portfolio rebalancing suggestions, which are helpful for managing both short-term and long-term investments.

How to Assess Your Crypto Performance Effectively

- Monitor Portfolio Allocation: Regularly review your portfolio to ensure it aligns with your investment goals. Rebalance it as necessary to minimize risks and maximize returns.

- Set Alerts: Use alerts to notify you when an asset reaches a specific price threshold, allowing you to make timely decisions.

Mistake #8: Ignoring Tax Implications of Crypto Investments

Many beginners fail to understand that crypto is taxable, and they don’t keep track of taxable events. In most countries, crypto transactions like buying, selling, trading, and even staking are considered taxable events. By ignoring the tax implications, you could face hefty penalties down the line.

How to Keep Track of Taxable Events in Crypto

When you trade or sell cryptocurrencies, it’s essential to track:

- Capital Gains: The difference between what you bought and sold a coin for determines your capital gains, which are taxable.

- Mining Income: If you mine cryptocurrency, the income is taxable, and you must report it.

- Staking Rewards: Any rewards you receive from staking your crypto are also taxable as income.

Important Crypto Taxation Guidelines to Know

- Keep Records: Track each transaction and note the date, amount, and price at the time of purchase or sale.

- Consult a Tax Professional: Tax laws around crypto are constantly evolving. A tax professional with experience in cryptocurrency can help you navigate complex regulations.

How to Report Your Crypto Gains and Losses

Crypto tax reporting can be complex, but there are platforms designed to simplify the process. Services like CoinTracking and Koinly allow you to import transactions from exchanges, automatically calculate gains and losses, and generate tax reports. This can save you time and effort when filing your taxes.

Mistake #9: Not Having an Exit Strategy

Another common crypto mistake beginners make is not having an exit strategy. An exit strategy refers to a plan for when to sell or cash out your crypto holdings, whether for profit, loss, or diversification. Without one, you might panic during market dips and sell at a loss or fail to take profits when the market is at a peak.

How to Set Exit Points for Maximum Profit

Establishing clear exit points is essential for both short-term and long-term crypto investments. Here’s how to set your exit points:

- Profit-taking Levels: Set specific price points where you plan to sell a portion of your holdings to lock in profits. For example, you might sell 25% of your position when the price hits 20% higher than your entry point.

- Stop-Loss Orders: Set stop-loss orders to automatically sell your asset if its price falls below a certain level. This helps minimize potential losses in case of a sudden market crash.

Different Exit Strategies for Different Goals

- Long-Term Hold: If you’re investing for the long-term, your exit strategy might involve periodically rebalancing your portfolio, rather than selling all your holdings at once.

- Short-Term Traders: If you’re a short-term trader, your exit strategy might be based on market analysis, trend lines, and technical indicators.

Rebalancing Your Portfolio and Taking Profits

In addition to setting exit points, rebalancing your portfolio regularly can ensure you don’t overexpose yourself to any single asset. Rebalancing allows you to adjust your positions as market conditions evolve and take profits from high-performing assets to reinvest in underperforming ones.

Mistake #10: Getting Caught in the Hype of New Coins

One of the crypto mistakes beginners make is getting swept up in the hype surrounding new cryptocurrencies. With thousands of coins and tokens being launched, it can be tempting to jump in early in hopes of getting in on the next big thing. However, new coins are often volatile and speculative, and many lack a clear roadmap or use case.

Evaluating the Viability of New Crypto Projects

Before investing in a new cryptocurrency, it’s crucial to evaluate its long-term potential carefully. Here’s what you need to consider:

- Whitepaper Review: As mentioned earlier, always read the whitepaper to understand the project’s goals, technology, and future vision.

- Team and Development: Look into the experience and background of the project’s team. A transparent team with a proven track record is often more reliable than an anonymous group.

Key Criteria to Look for in a New Coin

- Use Case and Real-World Problem Solving: Does the project solve a problem that people care about? New coins with no clear use case or real-world application are much riskier.

- Transparency: A trustworthy project should have an active community and clear, transparent communication from its developers.

- Partnerships and Support: Check if the coin has secured partnerships with well-known companies or platforms, which can indicate credibility.

Researching the Team and Technology Behind New Coins

Investigating the team behind a new cryptocurrency is crucial. Look for detailed information about their background, development experience, and track record in the blockchain industry. Ensure that they have the expertise to handle the challenges of building a scalable and secure crypto project.

Takeaways: Navigating the Crypto Market Safely and Successfully

The crypto mistakes beginners make are often avoidable with the right knowledge, planning, and discipline. By conducting thorough research, securing your assets, diversifying your portfolio, managing your taxes, and sticking to a well-thought-out investment strategy, you can increase your chances of success in the volatile world of cryptocurrency.

Investing in crypto is not a sprint; it’s a marathon. It requires patience, continuous learning, and the ability to adapt to new market conditions.

Armed with the insights from this article, you can start your crypto journey on the right foot, avoid common mistakes, and make smarter, more informed decisions along the way.

Remember, success in crypto investing comes not just from making profitable trades but from avoiding the pitfalls that have led many beginners astray. Stay educated, stay informed, and above all, stay patient. With a sound strategy and disciplined approach, the future of your crypto portfolio can be bright.

Happy investing!