Agriculture is the backbone of India’s economy, with millions of farmers depending on it for their livelihood. However, farming is inherently risky due to unpredictable weather conditions, pest infestations, and other natural calamities.

To safeguard farmers from financial losses, crop insurance plays a crucial role. With a variety of crop insurance providers in India, it becomes essential for farmers to choose the right policy that ensures maximum protection and timely claim settlements.

This guide explores the top 5 crop insurance providers in India, offering insights into their policies, benefits, and how they support Indian farmers.

Whether you are a small-scale farmer or an agribusiness investor, understanding the best insurance providers will help you make an informed decision.

What is Crop Insurance?

Crop insurance is a financial protection mechanism designed to cover the losses incurred by farmers due to natural disasters, extreme weather conditions, pest attacks, and diseases. The Indian government, along with private insurance companies, offers various crop insurance schemes to help farmers mitigate risks and ensure financial stability.

How Crop Insurance Works

- Farmers enroll in a crop insurance policy either independently or through government-backed programs.

- They pay a fixed premium, which varies based on the type of crop and coverage amount.

- In case of crop failure due to covered risks, farmers can file claims and receive compensation to recover their losses.

Key Benefits of Crop Insurance

- Protection against crop losses due to unforeseen circumstances.

- Timely financial assistance for farmers.

- Encourages investment in modern farming techniques.

- Supports long-term agricultural sustainability.

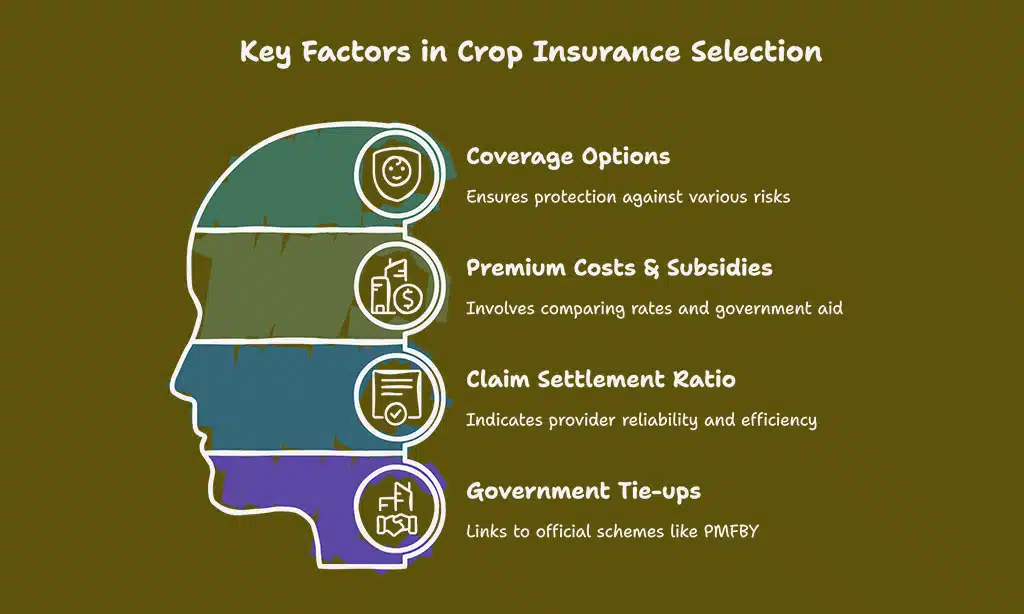

Key Factors to Consider When Choosing a Crop Insurance Provider

Choosing the right crop insurance provider in India is crucial for securing maximum benefits. Consider the following factors before selecting a provider:

- Coverage Options: Ensure the policy covers a wide range of risks, including natural disasters, pest attacks, and disease outbreaks.

- Premium Costs & Subsidies: Compare premium rates and check for government subsidies that reduce the cost burden.

- Claim Settlement Ratio: Opt for an insurance provider with a high claim settlement rate and hassle-free processes.

- Government Tie-ups: Check if the provider is part of government-backed schemes like the Pradhan Mantri Fasal Bima Yojana (PMFBY).

- Customer Support & Accessibility: Look for insurers offering digital services, easy claim filing, and strong customer support.

Top 5 Crop Insurance Providers in India (2025 Edition)

Here are the leading crop insurance providers in India that offer comprehensive policies for farmers. The table below provides an overview of their key details for easy comparison:

| Provider | Established | Type | Key Schemes | Claim Processing |

| Agriculture Insurance Company of India Limited (AIC) | 2002 | Government-backed | PMFBY, WBCIS | Fast and efficient |

| ICICI Lombard General Insurance Company Limited | 2001 | Private insurer | Weather-based crop insurance | Quick and transparent |

| HDFC ERGO General Insurance Company Ltd. | 2002 | Private insurer | PMFBY, AI-powered insurance | AI-driven rapid claims |

| Bajaj Allianz General Insurance Company Limited | 2001 | Private insurer | Index-based insurance | Fast and transparent |

| Kshema General Insurance Co. Ltd. | 2018 | Private insurer | Market price fluctuation coverage | Digital-first approach |

1. Agriculture Insurance Company of India Limited (AIC)

Established in 2002, AIC is a government-owned entity dedicated to providing specialized crop insurance policies. It plays a vital role in implementing government-backed schemes such as PMFBY and Weather-Based Crop Insurance Scheme (WBCIS).

With extensive coverage and affordable premiums, AIC is the preferred choice for many Indian farmers. The company leverages satellite imaging and AI-driven analytics to assess damage, ensuring faster claim processing. AIC also collaborates with state governments to expand its reach to marginalized farmers.

- Key Features: Offers extensive coverage under PMFBY and other government schemes.

- Premium Rates: Affordable, with government subsidies available.

- Claim Settlement Ratio: High, with a streamlined process for farmers.

- Best For: Farmers looking for subsidized insurance with strong government backing.

- Technological Integration: Uses satellite data and AI for damage assessment.

- Government Tie-ups: Works closely with central and state governments for wider implementation.

| Feature | Details |

| Established | 2002 |

| Type | Government-backed |

| Key Scheme | PMFBY, WBCIS |

| Claim Processing | Fast and efficient |

| Technology Used | AI, Satellite Imaging |

| Government Collaboration | Central and State Governments |

2. ICICI Lombard General Insurance Company Limited

As one of India’s leading private insurers, ICICI Lombard provides comprehensive crop insurance solutions, including parametric insurance models that use satellite data and weather patterns for real-time claim assessment.

The company is known for its quick claim settlements and user-friendly digital services. ICICI Lombard leverages AI and machine learning for accurate risk assessment, ensuring better pricing and claims accuracy.

It offers end-to-end digital claim processing, enabling farmers to report losses instantly via mobile applications. Additionally, the insurer collaborates with agritech firms to provide customized solutions tailored to different crop types and climatic conditions, making it a preferred choice for modern farmers seeking advanced insurance solutions.

- Key Features: Provides weather-based and yield-based crop insurance.

- Premium Rates: Competitive pricing with flexible premium payment options.

- Claim Settlement Ratio: Efficient and quick settlement process.

- Best For: Farmers seeking customizable insurance solutions with high service standards.

| Feature | Details |

| Established | 2001 |

| Type | Private insurer |

| Key Scheme | Weather-based crop insurance |

| Claim Processing | Quick and transparent |

3. HDFC ERGO General Insurance Company Ltd.

A joint venture between HDFC Ltd. and ERGO International, HDFC ERGO offers AI-powered crop insurance solutions that provide real-time damage assessments. The company also integrates remote sensing technology to streamline claim settlements.

HDFC ERGO leverages machine learning algorithms to enhance risk assessment, ensuring that farmers receive accurate compensation quickly. Additionally, it offers a user-friendly mobile application that allows farmers to submit claims instantly and track their status in real time.

The insurer collaborates with agricultural research institutes to develop predictive analytics models that help in forecasting potential crop failures, further assisting farmers in planning their investments effectively.

- Key Features: Technology-driven policies with remote sensing for damage assessment.

- Premium Rates: Affordable and subsidy-supported plans.

- Claim Settlement Ratio: High, with an automated claim processing system.

- Best For: Farmers who prefer tech-enabled policies with fast claims.

| Feature | Details |

| Established | 2002 |

| Type | Private insurer |

| Key Scheme | PMFBY, AI-powered insurance |

| Claim Processing | AI-driven rapid claims |

4. Bajaj Allianz General Insurance Company Limited

With a strong reputation in the insurance sector, Bajaj Allianz provides extensive crop insurance coverage, including index-based insurance policies that help assess damage efficiently. The company focuses on minimizing claim settlement time.

Bajaj Allianz leverages advanced satellite imaging and weather data analytics to improve claim accuracy and speed up settlements. Their insurance policies cover a wide range of risks, including drought, floods, pests, and unexpected market price fluctuations.

The company also offers dedicated support to farmers through its digital platform, enabling quick policy enrollment and claim processing.

- Key Features: Wide range of policies covering multiple agricultural risks.

- Premium Rates: Competitive, with flexible payment terms.

- Claim Settlement Ratio: High success rate in claim approvals.

- Best For: Farmers looking for comprehensive insurance with strong customer service.

| Feature | Details |

| Established | 2001 |

| Type | Private insurer |

| Key Scheme | Index-based insurance |

| Claim Processing | Fast and transparent |

5. Kshema General Insurance Co. Ltd.

A newer but rapidly growing insurance provider, Kshema General specializes in market price fluctuation coverage, ensuring farmers receive compensation even if market prices drop unexpectedly. Their digital-first approach is gaining traction in rural areas.

The company offers tailored policies that take into account regional agricultural patterns and market volatility, making it a preferred choice for small and medium-scale farmers. Kshema General also employs blockchain technology to enhance transparency in claim processing, reducing fraud and ensuring quick payouts.

Additionally, it provides financial literacy programs to help farmers understand risk management and insurance benefits, further strengthening its credibility in the sector.

- Key Features: Covers a variety of risks, including market price fluctuations.

- Premium Rates: Varies based on crop type and coverage level.

- Claim Settlement Ratio: Improving steadily with digital claims processing.

- Best For: Farmers wanting specialized coverage with evolving policy options.

| Feature | Details |

| Established | 2018 |

| Type | Private insurer |

| Key Scheme | Market price fluctuation coverage |

| Claim Processing | Digital-first approach |

Takeaways

Choosing the right crop insurance provider in India is crucial for financial security and agricultural sustainability. The top providers listed above offer diverse coverage options, competitive premium rates, and efficient claim settlements to safeguard Indian farmers.

Whether opting for a government-backed policy like PMFBY or a private insurer’s tailored plan, farmers must evaluate their options carefully.

Investing in crop insurance is not just about protection—it’s about ensuring a stable future for India’s agricultural sector. Take the next step today and secure your farming livelihood with the right insurance provider.