Understanding your credit score is essential when applying for personal loans from financial institutions or lenders. It significantly impacts loan eligibility. Your credit score reflects your repayment history, financial behaviour, and outstanding debt status. Lenders evaluate it before approving your application. A higher score may increase your chances of receiving favourable terms. This article will explore how credit scores affect eligibility. We will explain in detail how borrowers can improve loan prospects by maintaining responsible credit practices.

Importance of Credit Score in Personal Loan Assessment

Lenders use credit scores to evaluate borrowers’ reliability and repayment capabilities. Here’s why they matter:

1. Quicker Approvals

Having a good credit score can improve personal loan eligibility and enable quicker and efficient loan approvals by lending partners.

2. Risk Evaluation

Lenders prefer borrowers with high credit scores since they indicate good financial conduct and a reduced risk of default.

3. Interest Rates and Tenure

A good credit score indicates one’s responsibility and consistency in terms of capital. The lenders tend to provide favourable interest rates and longer repayment terms to those with high scores. In general, higher scores translate into flexible loan terms for borrowers.

Credit Score Ranges and Their Impact

Loan eligibility is impacted by various credit score ranges. Here’s how credit score ranges can impact your borrowing options:

- Credit scores usually range between 300 and 900 and are calculated by recognised credit bureaus in the financial sector.

- Scores above 750 are usually seen as favourable by most lenders. These scores often result in quicker approvals and more suitable loan conditions.

- Scores between 600 and 750 may still receive consideration from lenders. However, these scores may lead to restricted conditions and less favourable interest rates.

- Scores below 600 often affect overall loan eligibility. Such scores may lead to rejections or higher rates due to higher credit risk.

- Gradually improving your score can significantly increase your chances of loan approval and strengthen your position when negotiating loan terms.

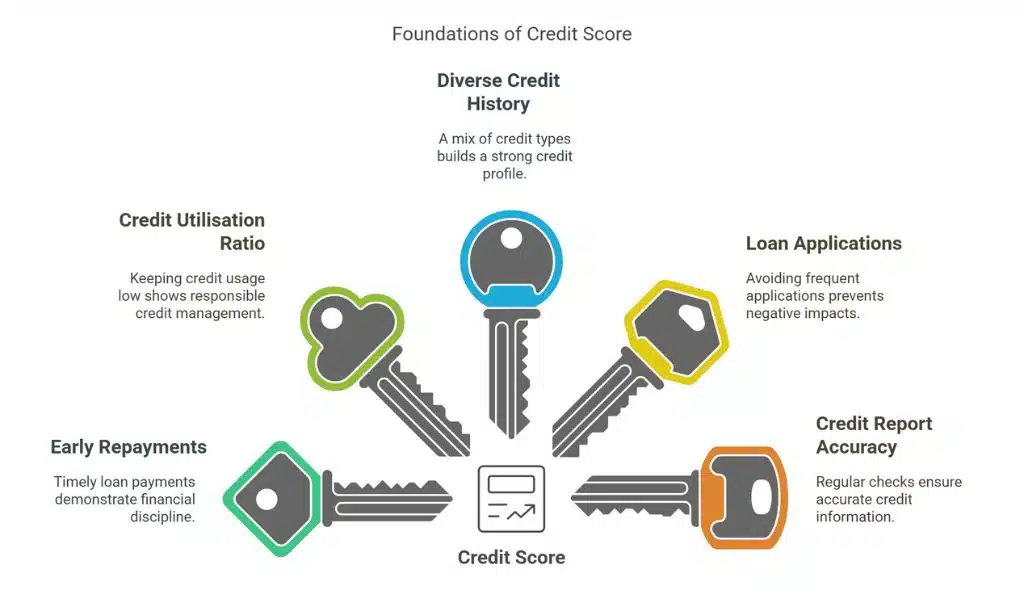

Key Factors That Influence Credit Scores

Your credit score depends on different factors. The following are the key points that may help determine your credit score:

- Early Repayments: Pay your loan EMIs on time without delay or default. Be regular in repayments to improve your credit score. Early repayment can reflect discipline and helps in credit score improvement.

- Credit Utilisation Ratio: Credit utilisation ratio also affects the score. A lower utilisation percentage shows disciplined credit behaviour to credit assessment institutions.

- Diverse Credit History: Having a lengthy and diverse credit history, including loans and cards, strengthens your profile for future loan applications.

- Loan Applications: Frequent loan applications or inquiries within a short time may negatively impact your score and reduce your loan eligibility.

- Credit Report Accuracy: Errors in credit reports can affect your score. Periodically reviewing reports helps identify mistakes and request corrections when needed.

How Credit Score Affects Loan Terms

Your credit score affects both your loan eligibility and the terms offered. Below are the ways it can influence loan conditions:

- Interest Rates: Applicants with higher credit scores often receive loans with competitive interest rates due to perceived lower repayment risk.

- Loan Amounts: Low scores might lead to higher interest rates or reduced loan amounts, affecting financial planning and budget alignment.

- Repayment Tenure: Lenders may reduce repayment tenure for borrowers with lower scores to minimise risks during the lending period.

- Negotiation Power: Borrowers with favourable credit scores can negotiate preferred repayment schedules, interest rates, and overall loan terms.

Steps to Improve Credit Score for Eligibility

Maintaining a favourable credit score requires consistent and disciplined financial habits. The following steps may support credit score improvement:

1. Ensure Timely Repayments

Make all loan EMIs and credit card payments on or before the due date to maintain your credit score.

2. Limit Credit Card Usage

Use only a portion of the approved credit limit. Keeping utilisation low reflects responsible financial behaviour.

3. Avoid Frequent Loan Applications

Do not apply for multiple loans within a short period. Excessive inquiries may indicate credit dependency.

4. Monitor Credit Reports Regularly

Review your credit reports periodically to identify and correct inaccurate or outdated information.

5. Maintain a Longer Credit History

Keep your old credit accounts open and active. A long credit history shows stable borrowing behaviour over time. Lenders view a longer credit history as a sign of responsible financial conduct.

Conclusion

Credit score plays an essential role in personal loan approval and overall loan terms. Higher scores may improve borrowing opportunities. Maintaining responsible credit habits is essential. Lenders assess repayment ability based on score, income, and other financial details. Reviewing reports regularly and repaying dues on time helps improve your score. Responsible borrowers may enjoy favourable personal loan terms aligned with their financial goals and borrowing needs.