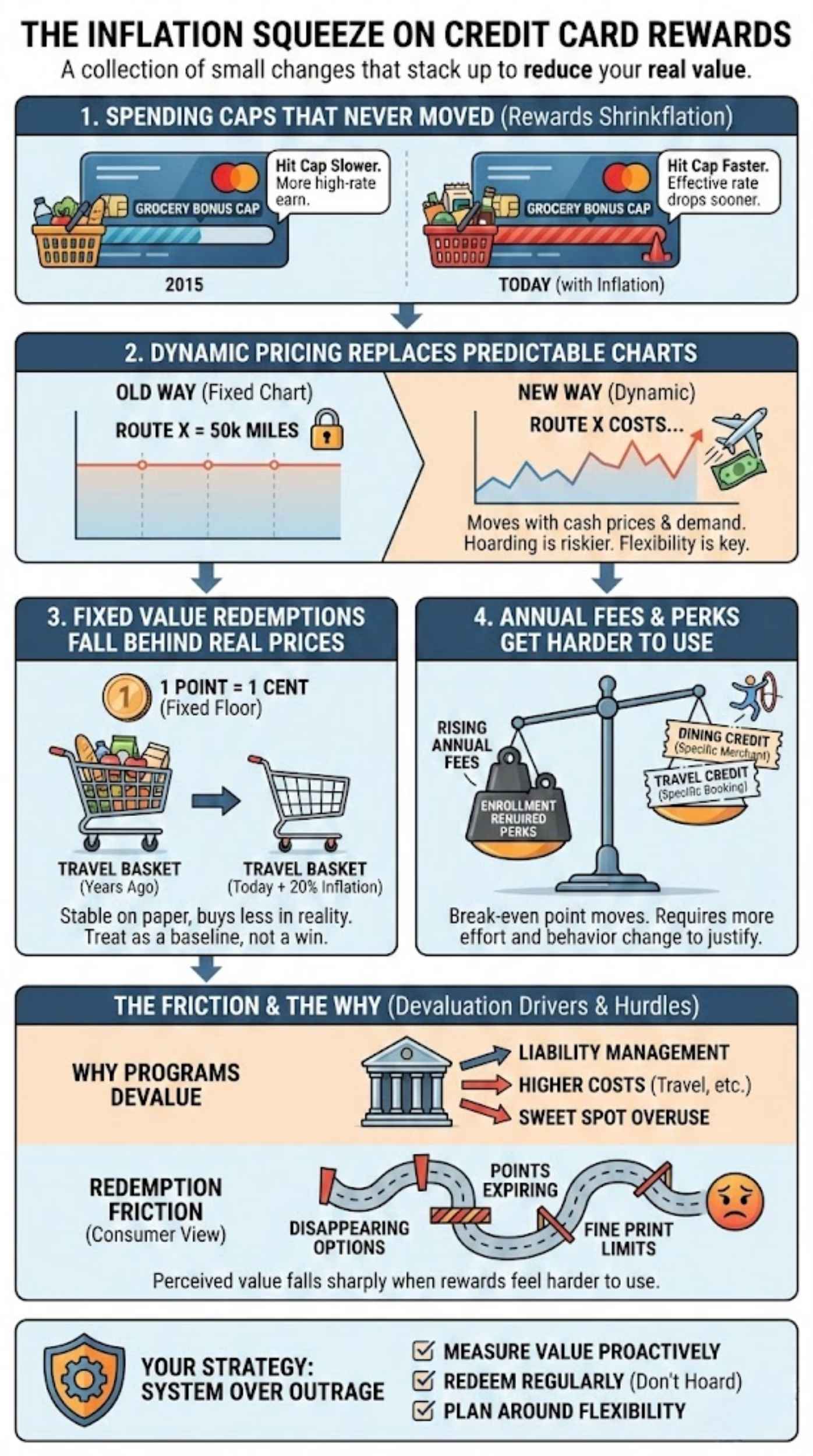

If your points feel weaker than they used to, you are not imagining it. Credit card rewards inflation is real, and it shows up in subtle ways that are easy to miss until you try to redeem. Prices rise, award prices shift, caps stay frozen, and “good value” becomes harder to find.

This article breaks down what is happening, why it is happening, and what you can do to protect yourself. You will also get a simple framework to measure value and avoid the most common traps.

Key Takeaways

- Inflation reduces the real-world buying power of points, even if redemption rates look unchanged.

- Program devaluation adds a second layer of value loss through higher award costs, dynamic pricing, and tighter terms.

- Category caps that do not rise with inflation reduce your effective rewards rate over time.

- Measure value with cents per point, and set a floor and a target to guide redemptions.

- Use an earn-and-burn mindset for planned goals, and avoid hoarding large balances indefinitely.

- Diversify with cash back plus flexible points to reduce dependence on any single program.

- Premium cards require regular audits because rising fees and harder-to-use credits can erase value.

- The best rewards strategy still starts with paying in full and avoiding interest.

What’s Happening And Why It Matters

Rewards were never a guaranteed currency. Banks and loyalty programs can change earn rates, caps, redemption values, and perks with relatively little friction. Inflation accelerates the pain because it hits both sides of the equation: what you earn and what you can buy.

The Silent Pay Cut For Your Points

When prices rise, every fixed-value redemption becomes less powerful. If you redeem points for a statement credit at 1 cent per point, that still equals one dollar per 100 points. But that same dollar now buys fewer groceries, fewer gallons of gas, and fewer travel upgrades than it did a few years ago.

Even if your points “hold” their nominal value, inflation erodes their purchasing power over time. That is the quiet part most people feel, even if they cannot name it.

Two Forces At Work: Price Inflation Vs Program Devaluation

Think of rewards pressure as two separate forces:

- Economic inflation: real-world prices rise, so redemptions buy less.

- Program devaluation: the program changes what it charges in points or changes the value of points.

Economic inflation is broad and obvious. Program devaluation is often subtle. It shows up as dynamic award pricing, fewer sweet spots, higher award prices for popular routes, reduced transfer value, tighter caps, or perks that look good on paper but are harder to use.

Credit Card Rewards Inflation Is Real

“Points inflation” is a useful shorthand, but it can mean two different things. You need to separate them, because the right strategy depends on which one is hurting you.

Economic Inflation: The Same Redemption Buys Less

If a hotel room that cost $200 now costs $260, a fixed-value redemption at 1 cent per point requires 26,000 points instead of 20,000 points. Nothing about your card changed. The world changed.

This is why many people feel like rewards are dying even when their earn rate stays the same. If your spending stays flat while prices rise, you may also earn fewer rewards in “real” terms because you buy fewer things or shift spend into categories that do not bonus as well.

Rewards Devaluation: Programs Change The Math

Devaluation happens when the program changes its terms so redemptions cost more points for the same travel, the same merchandise, or the same credits. It is common in airline and hotel programs because they have to manage inventory, demand, and financial liabilities tied to outstanding points.

Sometimes devaluation is direct, like removing an award chart or raising award rates. Sometimes it is indirect, like reducing availability for saver awards, shifting more inventory to higher-priced redemptions, or changing partner pricing.

Why Points Are Not Like Cash

Cash has a stable face value. Points do not. A point is closer to a coupon that the issuer can rewrite. That does not make points useless, but it changes how you should treat them.

If you approach points like a savings account, you are likely to lose. If you treat points like a tool for a specific goal, you are more likely to win.

How Inflation Shows Up In Credit Card Rewards

The squeeze is not one big change. It is a collection of small changes that stack up.

Spending Caps That Never Moved

Many category bonus caps were set years ago and never adjusted for inflation. A grocery cap that looked generous in 2015 can feel tight today. When your spending hits the cap faster, your effective rewards rate drops because the rest of your purchases earn a lower base rate.

This is rewards shrinkflation. The label stays the same, but the real capacity shrinks.

A simple way to see it: if a card offers a high rate on the first $X in a category, inflation pushes more of your annual spending above $X. That means a larger share of your spend earns a weaker return. Your card did not “change,” but your outcome did.

Dynamic Pricing Replacing Predictable Award Charts

Dynamic award pricing is one of the biggest reasons points feel less reliable. Instead of a fixed chart that says “this route costs X miles,” the number moves with cash prices, demand, and inventory. When fares spike, award costs often spike too.

Dynamic pricing can still offer great value, especially when cash prices rise faster than award costs on certain dates. But it also makes hoarding riskier because there is no stable target.

If you used to plan around a fixed award chart, you now need to plan around flexibility. Dates, routes, and airports matter more.

Fixed Value Redemptions That Fall Behind Real Prices

Many bank programs offer a “floor value” for redemptions such as statement credits, gift cards, or travel portal bookings. That floor can be useful, but it is also where inflation does the most damage.

A fixed 1 cent per point value is stable on paper. In real life, it steadily declines. If the average travel basket rises 20 percent over a few years, your fixed-value redemption effectively buys 20 percent less travel.

This is not a reason to avoid fixed-value redemptions entirely. It is a reason to treat them as a baseline, not a victory lap.

Annual Fees And Perks That Get Harder To Use

Inflation affects premium cards in a different way. Annual fees can rise, and the perks often shift toward “coupon book” credits that require more effort and more spending to realize full value.

A $300 travel credit only helps if you travel in ways that trigger it. A dining credit only helps if you already use that merchant or you are willing to change behavior. As prices rise, issuers may also tighten eligibility, add enrollment steps, or limit which purchases qualify.

The net effect is simple: your break-even point moves. You may need more spend, more redemptions, or more perk usage to justify the same card you loved before.

What The Market And Regulators Are Paying Attention To

Rewards are big business. Issuers market them aggressively because they drive spending, and spending generates fees. But regulators and consumer advocates have also paid more attention to how rewards can change, how they can be revoked, and how redemption can be inhibited.

Why Complaints Often Focus On Redemption Friction

From a consumer perspective, the most frustrating rewards changes usually share one trait: friction. That includes:

- Redemption options that disappear or become worse value

- Points that expire or get forfeited under certain account events

- Perks that require enrollment and do not apply automatically

- Fine print that narrows what qualifies for credits or multipliers

Inflation makes this feel worse because you are already paying more at checkout. When rewards also feel harder to use, the perceived value falls sharply.

Why Programs Devalue In The First Place

Rewards are a liability on someone’s balance sheet. When you earn points, a bank or loyalty program owes you something in the future. If the cost of fulfilling that promise rises, they look for ways to manage it.

Common drivers include higher travel costs, higher redemption demand, changes in interchange revenue, and competitive pressure. Sometimes programs devalue because too many people learned the same sweet spots, which increases redemption costs.

You do not need to love this logic. You just need to plan around it.

What “Transparency” Means For You

More scrutiny often pushes programs to communicate changes more clearly, but it rarely prevents changes. Your best defense is not outrage. It is a system.

That system starts with measuring value and making proactive redemption choices, especially when you have large balances.

A Simple Framework To Measure If Your Rewards Are Shrinking

If you do not measure, you guess. And when you guess, you usually redeem in the easiest way, not the best way.

The Cents Per Point Formula

Use this formula:

Cents per point = (Cash price you would have paid ÷ Points required) × 100

Example: If a $450 flight costs 30,000 points, your value is:

(450 ÷ 30,000) × 100 = 1.5 cents per point

This number is not a universal truth. It is a snapshot. But it helps you compare options quickly.

Use A Floor Value And A Target Value

Create two benchmarks:

- Floor value: the value you can always get, like a statement credit.

- Target value: the value you aim for when you put in effort, like well-timed travel redemptions or transfer partner sweet spots.

Once you have these, decisions get easier.

If you are redeeming below your floor, stop. If you are consistently hitting or exceeding your target, you are doing it right.

Redemption Types And Typical Value Ranges

Use this table as a decision guide. The exact value varies by program and redemption, but the pattern holds across most ecosystems.

| Redemption Type | Typical Value Range | Best For | Common Pitfall |

| Statement credit | Low to moderate | Simplicity, guaranteed floor | Inflation erosion over time |

| Gift cards | Low to moderate | Occasional targeted promos | Many options price poorly |

| Travel portal booking | Moderate | Easy travel redemption | Portal pricing can be higher than direct |

| Transfer to airlines | Moderate to high | Flexible travelers, deal hunters | Dynamic pricing and availability swings |

| Transfer to hotels | Moderate | Specific properties, peak cash prices | High point costs on popular dates |

| Merchandise | Low | Emergency use only | Usually the worst value |

The table is not telling you to chase maximum value at all costs. It is telling you to avoid consistently bad trades.

Portal Vs Transfer: A Practical Rule

Use portals when you want:

- Predictable booking

- Broad availability

- Easy cancellation rules

- A value that beats your floor with minimal effort

Use transfers when you want:

- A specific premium cabin or high cash-price route

- A high-value hotel stay where cash prices spike

- A redemption that clearly exceeds your target value

Transfers can be powerful, but they also come with friction, limited award availability, and stricter change policies. Measure the value and decide intentionally.

At this point in the article, it is worth repeating the main theme: credit card rewards inflation is not just about prices rising. It is also about how programs price redemptions, how they cap earnings, and how quickly the rules can shift.

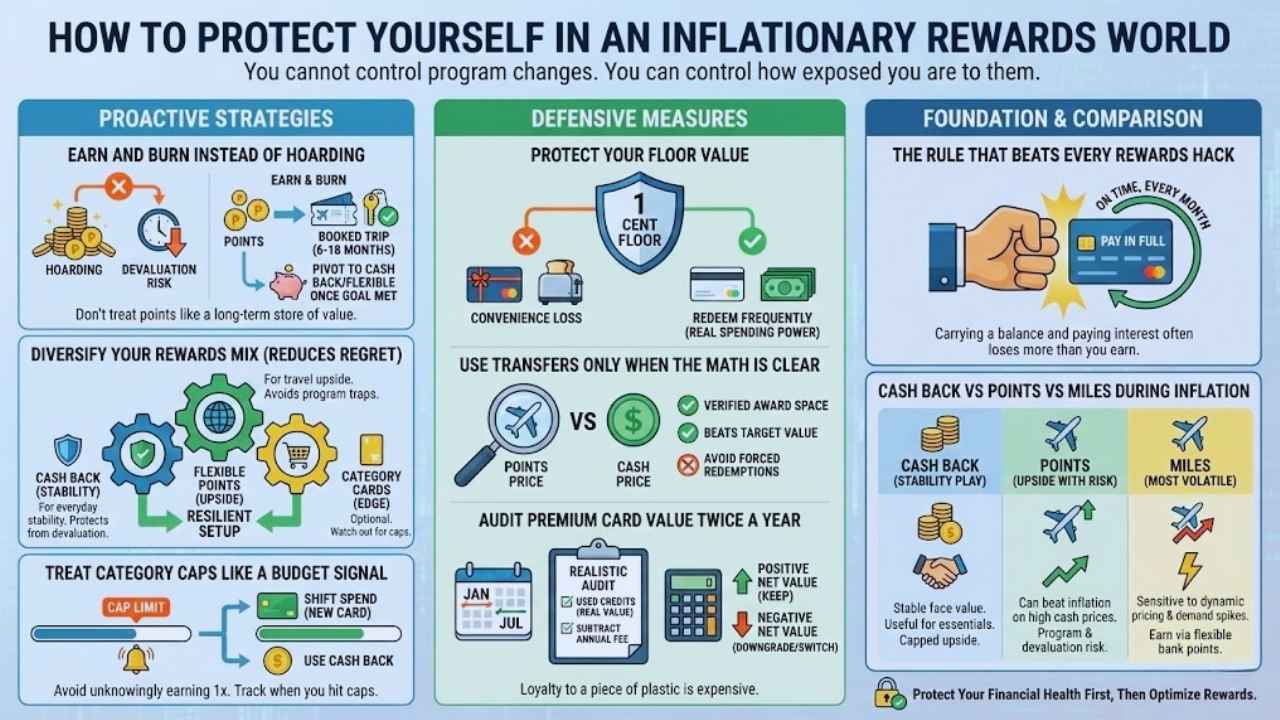

How To Protect Yourself In An Inflationary Rewards World

You cannot control program changes. You can control how exposed you are to them.

Earn And Burn Instead Of Hoarding

If you have a clear travel plan in the next 6 to 18 months, points can be a great tool. If you have no plan and you are stacking a massive balance “just in case,” you are taking devaluation risk for no reason.

A practical approach is to set a goal balance tied to a real trip. Once you have enough, pivot some spending to cash back or to another flexible currency until your plan is booked.

This does not mean you must redeem the moment points hit your account. It means you should not treat points like a long-term store of value.

Diversify Your Rewards Mix

Diversification reduces regret.

A resilient setup often includes:

- One strong cash back card for everyday stability

- One flexible points card for travel upside

- Optional category cards where the math clearly works for your budget

Cash back protects you from devaluation risk. Flexible points protect you from being trapped in a single airline or hotel program. Category cards can add edge, but only if you do not outgrow the caps.

Treat Category Caps Like A Budget Signal

Category caps are not just limits. They are signals that tell you where your strategy breaks.

Track when you hit caps, even roughly. If you consistently exceed them, consider:

- Adding a second card that rewards that category without a tight cap

- Shifting that spend to a different card after you hit the cap

- Using a cash back option once bonus rates drop

The goal is not perfection. The goal is to avoid unknowingly earning 1x on spending you assumed was earning 3x, 4x, or 5x.

Protect Your Floor Value

Know the worst-case value of your points. If your program offers a 1 cent per point statement credit, that is your floor.

Then guard it by avoiding redemptions that fall below it. Many people lose value through convenience redemptions, like low-value gift cards, merchandise, or random portal add-ons.

If you use points for cash-like redemptions, consider redeeming more frequently. That reduces inflation exposure because you convert points into real spending power sooner.

Use Transfers Only When The Math Is Clear

Transfer partners can unlock outsized value, but they can also create wasted time and costly mistakes.

Use transfers when:

- You verified award space first

- You compared cash price versus points price

- You understand change and cancellation rules

- Your cents-per-point calculation clearly beats your target

Avoid transfers when you are stressed, uncertain, or trying to “force” a high value. Forced redemptions often backfire.

Audit Premium Card Value Twice A Year

Premium cards are not “set and forget” in an inflationary environment. Benefits change, credits shift, and annual fees can rise.

Do a simple audit:

- List every credit and perk you actually used in the last 6 months

- Assign a realistic dollar value, not a marketing value

- Subtract the annual fee

- Decide if your net value is positive, neutral, or negative

If the card is negative, downgrade, switch, or replace it. Loyalty to a piece of plastic is expensive.

The Rule That Beats Every Rewards Hack

If you carry a balance and pay interest, you are likely losing more than you earn in rewards. Inflation can also push budgets tighter, which makes this trap more common.

The strongest rewards strategy is boring: pay in full, on time, every month. Then optimize.

Cash Back Vs Points Vs Miles During Inflation

Different reward types behave differently when prices rise and programs devalue.

Cash Back Is The Stability Play

Cash back has a stable face value. It does not depend on award charts, partner availability, or dynamic pricing. In inflationary times, that stability feels good.

Cash back also helps when your spending shifts toward essentials. Many people travel less during uncertain periods, and cash back stays useful regardless of lifestyle changes.

The downside is capped upside. You rarely get “amazing” value. You get consistent value.

Points Offer Upside With More Risk

Flexible points can beat inflation when used well because you can target high cash-price redemptions. If airfare spikes on the exact dates you need, a good points redemption can deliver strong value.

But points also carry program risk. Devaluation risk is real, and the programs control the game.

In a high-inflation environment, flexible points often outperform narrow points, especially if you redeem on a planned schedule and avoid hoarding.

Miles Are The Most Volatile

Airline miles can still deliver huge wins, especially for premium cabins. But miles are also the most sensitive to dynamic pricing and demand spikes.

If you primarily earn miles in a single airline program and you do not redeem frequently, you can get hit hardest when the program shifts pricing.

A practical way to reduce volatility is to earn via flexible bank points and transfer only when you are ready to book.

What To Watch Next

Inflation may cool or surge, but the structural trend is clear. Rewards are becoming more complex, more personalized, and more tied to behavior.

More Dynamic Pricing And Fewer Predictable Sweet Spots

Expect more redemptions to behave like cash pricing. That means you will need to shop around, compare dates, and treat points like a flexible tool, not a fixed promise.

Sweet spots will still exist. They will just move faster and require more awareness.

More Credits, More Enrollment Steps, More Fine Print

Perks will keep shifting toward credits tied to specific merchants and subscription-like benefits. For some people, that can be great. For others, it becomes breakage, meaning value you never actually capture.

Your defense is a simple one: value perks based on real usage, not potential usage.

More Pressure For Clearer Disclosures

As rewards become a bigger part of consumer finances, scrutiny increases. That can help with clearer communication and fewer surprise changes. But it will not remove the underlying incentive for programs to manage costs through pricing changes.

Treat transparency as helpful information, not protection.

Wrap-Up: Points Are Not Dead, But They Changed

The “death of points” is not a single moment. It is a slow shift. Inflation raises real prices, and loyalty ecosystems respond by changing how much value they deliver and how much effort it takes to unlock that value. If you do nothing, credit card rewards inflation will steadily shrink what your points and miles can do.

If you measure value, redeem with intention, and diversify your setup, rewards can still be powerful. The goal is not to chase every hack. The goal is to stop leaking value through caps, friction, and low-value redemptions, and to use points as a tool for real plans.