Turning your crypto into cash can feel tricky at first. Maybe you’ve got Bitcoin or Ethereum sitting in your wallet, but paying bills or making purchases with it isn’t always easy.

Many people ask: How do I turn my digital coins into dollars safely?

The good news is there are simple ways to cash out. From using cryptocurrency exchanges like Binance to trying a Bitcoin ATM, options exist for everyone. This guide will show you step-by-step how to pick the best method and avoid common mistakes.

Want to learn how? Keep reading!

Key Takeaways

- Use cryptocurrency exchanges like Binance or Coinbase to sell crypto for fiat money. Fees range from 0.1% to 4%.

- Bitcoin ATMs give fast cash but charge high fees up to 20%. Many have daily withdrawal limits.

- Peer-to-peer platforms, like Paxful, let you sell directly. Escrow systems keep trades safe.

- Crypto debit cards turn crypto into cash instantly during payments but may charge fees as high as 12%.

- Keep records of all transactions for taxes. In the U.S., short-term gains are taxed up to 37%, and long-term gains enjoy lower rates.

Choose the Right Cash-Out Method

Picking the best way to turn crypto into cash is key. Each method has its own perks, costs, and steps.

Cryptocurrency exchanges

Crypto exchanges like Coinbase, Binance, and Kraken help you trade digital assets for cash. First, create an account and pass identity verification. These platforms allow you to sell crypto such as Bitcoin or Litecoin for fiat currency like USD or EUR.

Transaction fees can range from 0.1% to 4%, depending on the platform. After selling, withdraw your funds through bank transfers linked to your account. State regulations may affect cash-out processes in some locations, so check rules before trading.

Always use two-factor authentication (2FA) for added security on these platforms.

Peer-to-peer (P2P) platforms

P2P platforms like Binance P2P and Paxful let you sell crypto directly to other users. Over 14 million people use Paxful, offering more than 400 payment options. Buyers pay through methods such as bank transfers or gift cards.

These platforms often use an escrow system to protect both sides of the deal. This means your bitcoin stays safe until the buyer sends money. Always check a buyer’s ratings and reviews before trading on these sites for safer transactions.

Bitcoin ATMs

Bitcoin ATMs let you turn Bitcoin into cash fast. These machines work like regular ATMs but handle digital currencies instead of debit cards. You scan your QR code from your crypto wallet, follow simple steps, and get physical currency on the spot.

They charge high transaction fees compared to other methods. Some have daily withdrawal limits too. Identity verification is often required before use. Sadly, these machines are not available in India yet.

Crypto debit or credit cards

Crypto debit and credit cards let you spend digital assets like cash. Services like RedotPay make it easy to convert crypto for direct use. These cards link to your bitcoin wallet or other crypto wallets, turning cryptocurrencies into fiat currency during payments.

Fees can be as high as 12% and require identity verification (KYC). Cards often work with Apple Pay or Google Pay, offering flexibility for everyday transactions. Prepaid Mastercards are common in this space, giving users quick access without waiting for traditional bank transfers.

Step-by-Step Guide for Cashing Out on an Exchange

Turning your crypto into cash on an exchange is simple, but each step matters—keep reading to get it right!

Create an account on the chosen exchange

Sign up on platforms like Coinbase, Binance, or Kraken. Provide your email and create a strong password. Use unique characters to make it secure.

Verify your identity through KYC steps. Upload an ID, such as a driver’s license or passport. Some exchanges may also ask for proof of address. This step ensures compliance with tax laws and prevents fraud.

Transfer your crypto to the platform

Move your crypto assets from your wallet to the exchange. Use secure hardware wallets like Ledger for storage before the transfer. Check that you know the platform’s specific deposit address for your digital assets.

For example, Bitcoin goes to a Bitcoin wallet address.

Copy and paste the provided QR code or address correctly into your sending wallet. Double-check details to avoid losing funds due to blockchain network errors or congestion. Keep an eye on transaction fees based on current rates in centralized exchanges.

Select the “Sell” option and choose your fiat currency

Click the “Sell” button on your chosen cryptocurrency exchange. Pick the fiat currency, like USD or EUR, you want in return. Check the current exchange rate to know how much you’ll get for your digital assets.

Review trading fees before finalizing the sale. Fees can vary but are often a small percentage of your transaction’s market value. Once confirmed, your funds will be ready to withdraw or transfer to a linked bank account.

Withdraw funds to your bank account

Transfer your fiat currency to your linked bank account. Most centralized exchanges, like Binance or Coinbase, need you to complete identity verification first. This process includes uploading a photo ID and confirming personal details.

Once verified, choose the withdrawal option on the platform. Enter your bank details carefully. Then confirm the amount you want to withdraw. Bank transfers usually take 1-5 business days but can vary based on location or network congestion.

Watch out for transaction fees during this step!

Using Peer-to-Peer (P2P) Platforms

Peer-to-peer platforms let you trade crypto directly with a buyer. They often use an escrow system to keep transactions safe and fair.

How P2P platforms work

P2P platforms let you trade your crypto directly with a buyer or seller. You set your price, and the platform connects you with someone who accepts it. Platforms like Binance P2P and Paxful use an escrow system to hold the crypto until both parties finish the deal.

These platforms often support many payment methods, including bank transfers, gift cards, and cash deposits. Both parties must complete identity verification for safety. Each trade comes with low transaction fees, making it budget-friendly compared to other options.

Tips for finding trustworthy buyers

Finding a trustworthy buyer is key to safe transactions. You need to be cautious and smart during the process.

- Use platforms with an escrow system. This holds funds until both parties complete the deal, lowering fraud risks.

- Check buyer reviews and ratings. Trusted users usually have positive feedback from past sellers.

- Verify identity of the buyer. Many platforms ask for identification to prevent scams.

- Communicate clearly through the platform’s chat feature. Avoid moving chats off-platform to keep records safe.

- Avoid deals that sound too good to be true. Suspiciously high offers could mean trouble.

- Confirm payment method before proceeding. Stick to secure methods like bank transfers or well-known systems like Cash App.

- Meet in public if selling locally. Busy, well-lit spaces add security when handling cash deals.

- Trust your gut during interactions online or in-person transactions as it helps spot red flags quickly!

Ensuring secure transactions

Use an escrow system on P2P platforms. It holds your crypto until the buyer pays. This protects both sides from scams or chargeback fraud. Meet in public, if trading cash, for safety.

Verify bills to avoid counterfeit money.

Stick to trusted sites like Binance P2P to avoid unsecure platforms. Check ratings and reviews of buyers before dealing with them. Watch out for unusually low prices too—it could be a trap!

Cashing Out via Bitcoin ATMs

Bitcoin ATMs make turning digital coins into cash super quick, but don’t skip the fine print on fees!

Locating a Bitcoin ATM

Check Coin ATM Radar to find Bitcoin ATMs near you. It’s a simple tool that shows locations by city or zip code. Many ATMs are in gas stations, malls, or convenience stores.

Bitcoin ATMs aren’t available in India right now. Keep this in mind before planning your trip to one. Always check hours of operation and fees beforehand to avoid surprises.

Steps for withdrawing cash

Turning crypto into cash can be easy. Follow these steps to withdraw money using Bitcoin ATMs:

- Find a Bitcoin ATM near you. Use online maps or locator apps to spot one close by.

- Go to the machine with your phone and wallet ready. Double-check that it supports cash withdrawals for digital assets like Bitcoin.

- Select the option to sell Bitcoin or exchange it for fiat currency, such as dollars.

- Scan the QR code from your Bitcoin wallet on the ATM screen using your phone.

- Enter how much crypto you want to convert into cash based on your liquidity needs.

- Confirm the transaction after reviewing ATM fees, which can be quite high—sometimes over 10%.

- Wait for blockchain network confirmation if needed, then collect your cash right away from the machine.

Understanding ATM fees and limits

Bitcoin ATMs charge high transaction fees. These fees can range from 7% to 20% of your total amount. Always check the fee on the machine before you confirm a transaction.

Most Bitcoin ATMs have withdrawal limits. Some only allow $1,000 per day, while others might let you withdraw more. Identity verification is often required for larger amounts. Keep your bitcoin wallet and QR code ready for smooth transactions.

Crypto-Backed Debit and Credit Cards

Crypto cards let you spend digital assets like regular money. They make crypto trading faster by skipping the cash-out steps.

How to use crypto cards for direct spending

Crypto cards, like RedotPay and Volet, let you shop using digital assets. They work like normal debit or credit cards but pull funds from your crypto wallet instead of a bank account.

Swipe the card at stores or use it online for payments. Some even convert cryptocurrencies to fiat currency instantly during transactions. Always check fees and limits before spending.

These cards make daily purchases with bitcoin and altcoins quick and easy.

Pros and cons of crypto cards

Crypto debit and credit cards can make spending digital assets easy. But, they come with both good and bad sides.

- They allow you to spend cryptocurrencies directly, like cash.

- Many cards work with major payment methods, such as Visa or MasterCard.

- You can avoid converting crypto to fiat currency yourself.

- Using these cards may include high transaction fees, often around 12%.

- Some require identity verification (KYC), slowing the process down for many users.

- Not all cards are accepted everywhere, limiting their use in some regions or stores.

- Crypto values change fast, which could affect your money during transactions.

- Certain companies offer rewards or cashback on crypto spending, which attracts frequent users.

- Cards linked to Bitcoin wallets provide ease but may also have hidden costs.

- Tax implications can be tricky since every card purchase might count as a sale of crypto.

Tax Implications of Cashing Out

Selling crypto can mean paying taxes, like income tax or capital gains. Keep records of every trade, sale, or transaction to avoid IRS trouble.

Reporting crypto sales on taxes

Paying taxes on crypto sales is required. The IRS views crypto as property, not currency. Profits are taxed as capital gains. For example, selling Bitcoin for a profit means paying taxes based on how long you held it.

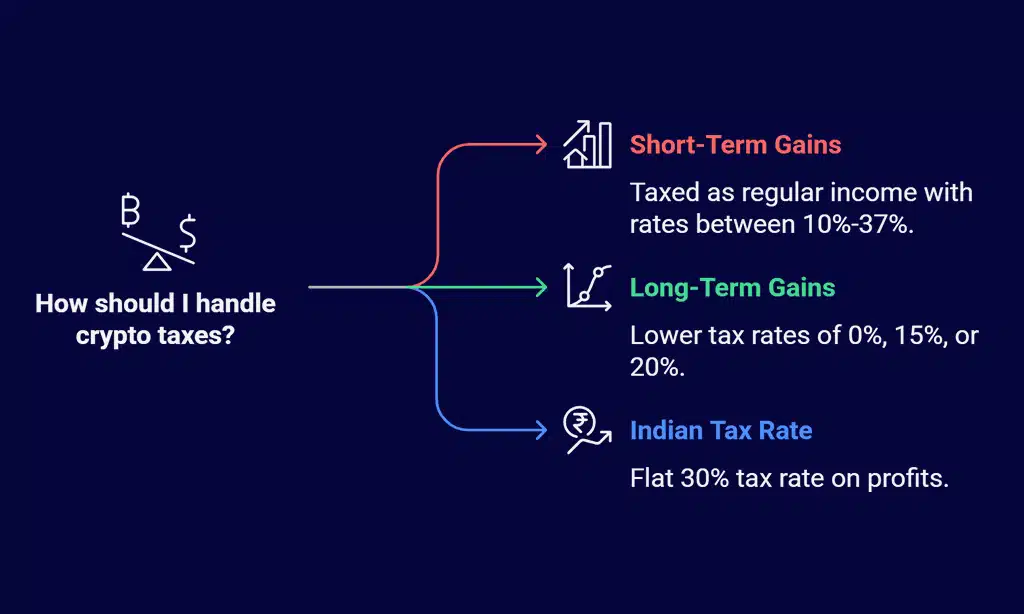

Short-term gains happen if you sell within one year. These are taxed like regular income with rates between 10%-37%, depending on your earnings. Long-term gains, from assets held over a year, get lower tax rates of 0%, 15%, or 20%.

In India, profits face a flat 30% tax rate.

Keep detailed records of all trades and transactions. Note dates of buying and selling, amounts involved, and related costs like transaction fees. Use tools to track data easily for filing Form 1040 during tax season.

Tracking your crypto transactions

Keep detailed records of your crypto trades and sales. Use tools on blockchain networks or apps to track each transaction. Note sale dates, amounts, and which digital assets you sold.

This helps calculate capital gains tax later.

Losing track could lead to costly tax errors. The IRS requires clear reports for crypto activity. Many platforms can export spreadsheets with all your history in seconds. Always double-check that data matches your wallet or exchange records before filing taxes!

Common Mistakes to Avoid When Cashing Out

Using shady platforms can cost you big time, both in money and safety. Watch out for hidden fees—they sneak up on your wallet like a thief in the night!

Using unsecure platforms

Unsecure platforms put your digital assets at risk. Hackers often target exchanges with weak security. Choose a platform with identity verification and encryption. Always check for reviews or complaints before using any service.

Use separate wallets for transactions, not your main bitcoin wallet. This keeps the rest of your funds safe in case of fraud. Skip platforms without escrow systems if you’re trading on Binance P2P or others.

Ignoring transaction fees

Transaction fees can eat into your cash-out amount. Bitcoin ATMs are a common example, often charging high fees of 7% to 20%. Using centralized exchanges like Binance may offer lower costs, but they still have charges for withdrawals and trades.

Skipping fee checks might leave you with less than expected in fiat currency. Network congestion during busy trading times can also increase costs. Always factor these fees into your decision to avoid unpleasant surprises when converting digital assets.

Takeaways

Turning crypto into cash doesn’t need to be hard. Choosing the right method depends on your needs, like speed or fees. Always stay safe by picking trusted platforms and securing your details.

Know the tax rules too—it can save you trouble later. With these steps, you’re ready to turn digital coins into real money easily!

FAQs

1. How can I convert my crypto to cash?

You can sell your digital assets on centralized exchanges, use a Bitcoin ATM, or trade through platforms like Binance P2P. Each method has its own steps and fees.

2. What is a Bitcoin ATM, and how does it work?

A Bitcoin ATM lets you exchange cryptocurrency for fiat currency. You scan your QR code from your bitcoin wallet, complete identity verification if required, and withdraw cash after paying transaction fees.

3. Are there tax implications when converting crypto to cash?

Yes, the Internal Revenue Service (IRS) treats cryptocurrencies as taxable property. Taxpayers must report gains or losses during their tax returns based on acquisition cost and sale price.

4. What payment methods are available for cashing out crypto?

You can choose bank transfers, gift cards, or direct withdrawals depending on the platform’s options and liquidity needs.

5. Can network congestion affect my cash-out process?

Yes, blockchain technology may experience delays due to high activity levels on the network during peak times.

6. Is using an escrow system safer for peer-to-peer transactions?

Yes! An escrow system protects both buyers and sellers in P2P trading by holding funds until all conditions are met securely.