The lanterns of the 2026 Lunar New Year are being lit tonight, yet the air in Beijing is already thick with a specific kind of manufactured optimism. This year, the festivities are set to stretch across a record nine days. It is a deliberate, state-sanctioned marathon of leisure designed to jumpstart the national heart. Central to this push is the China domestic market strategy 2026, a message from the leadership that is loud and clear: consume, spend, and travel. This is meant to be the grand debut of the Super Large Market, a domestic engine finally powerful enough to roar without the help of the outside world.

On the surface, the state’s projections look like a triumph. Tens of billions of yuan are expected to change hands as families flock to temple fairs and digital red envelopes flood the servers of WeChat. To the casual observer, this will be presented as the face of a rising superpower finally leaning into its own weight. It looks like confidence. It looks like a victory lap for a model that has successfully pivoted from the smog of the factory floor to the gloss of the shopping mall.

Yet, the data tells a far more haunting story. Even as Xi Jinping promotes this vast domestic market as the future of the Middle Kingdom, the trade ledgers reveal a staggering contradiction. In 2025, China’s trade surplus ballooned to a record 1.2 trillion dollars, a figure on a par with the GDP of Saudi Arabia. If the domestic market is truly the new engine of growth, one must ask why the nation is still forced to dump such a massive excess of goods onto a global market that is increasingly hostile to them. A country with a thriving, self-sustaining internal appetite does not need to export its way out of a slump with such desperation.

The Super Large Market is a mirage. It is not a sign of economic health but a frantic recalibration. The push inward is a high-stakes course correction forced by the sudden closing of the American and European shutters. With the geopolitical noose tightening and the old investment model of bridges to nowhere finally collapsing, Beijing is turning to its people not because it wants to, but because it has nowhere else to go. This is a story of structural stress disguised as a new dawn. It is a strategic retreat into a domestic fortress, built on the hope that the Chinese consumer can do what the rest of the world no longer will.

China Domestic Market Strategy 2026: The Redoubt Under Construction

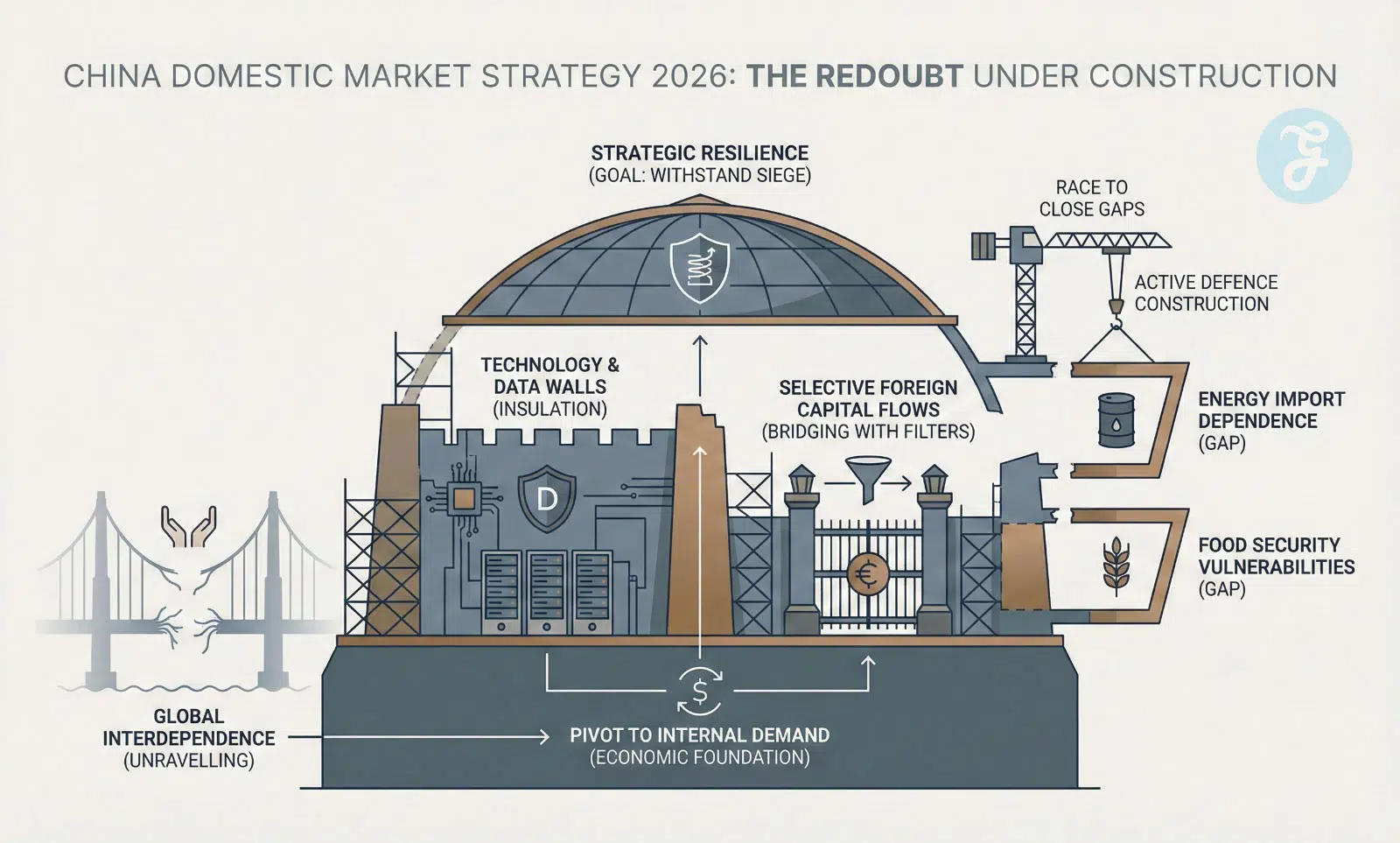

The Super Large Market is not a policy of choice; it is a strategic bunker under construction. For decades, Beijing’s survival rested on a grand bargain of global interdependence. That bargain is unravelling. What we are witnessing is the fortification of a financial redoubt. The state is selectively closing off vulnerabilities; while it seeks foreign capital, it is simultaneously building walls in technology and data to withstand a future siege. By pivoting the economy to rely more on internal demand, the leadership is attempting to insulate itself from a Western financial order it now views as an existential threat. This is the hardening of a nation-state. It is a cold recalibration designed to ensure that if the global slipknot finally tightens, the Chinese apparatus possesses the resilience to survive, even as it races to close the remaining gaps in its defence.

The Geopolitical Impetus: The End of the “Export Escape Hatch”

The world is no longer a boundless horizon for Chinese goods. For years, when domestic demand faltered, Beijing simply opened the export valves. Factories would hum, ships would sail, and global markets would absorb the excess. But by early 2026, that escape hatch has been slammed shut. The West has effectively moved from concern to active containment.

In the United States, a fresh wave of tariffs has pushed the effective rate on Chinese imports toward an eye-watering 37.7 per cent in late 2025, with legislated levies on specific sectors reaching far higher. This is no longer a trade skirmish; it is a blockade. In Europe, the sentiment is equally chilly. Brussels has moved beyond mere investigation to imposing heavy duties on electric vehicles and high-end semiconductors. The logic is simple: Europe refuses to see its industrial heartland hollowed out by a flood of subsidized Chinese technology. For Beijing, the realisation is stark: the global market can no longer be used as a dumping ground for overcapacity.

This external pressure has triggered a frantic internal cleanup. In 2025, the government launched a sweeping campaign against what it calls “involution” (nei juan). In the boardrooms of Shenzhen and Hangzhou, this term describes a toxic race to the bottom. Companies were slashing prices so aggressively that profits simply evaporated. Even leading brands were seeing profitability erode; only two of 18 listed EV firms earned more than 10,000 RMB (~$1,400) per vehicle in early 2025.

Beijing’s crackdown on these internal price wars is a defensive crouch. It is an attempt to prevent a systemic corporate collapse. By forcing firms to stop undercutting each other, the state is trying to salvage what remains of industrial profitability. It is an admission that the old model of growth at any cost is dead. If firms cannot make money abroad, they must at least remain solvent at home.

The grand strategy has shifted. The old Dual Circulation theory has evolved into something far more insular. It is the beginning of a Fortress China mentality. The leadership is now preparing for a future where the external cycle of global trade is broken or at least permanently unreliable. Autonomy is the new watchword. This is not the pivot of a confident globalist; it is the fortification of a nation that senses the gates are closing.

The Structural Staircase: Why Consumption is Stalling

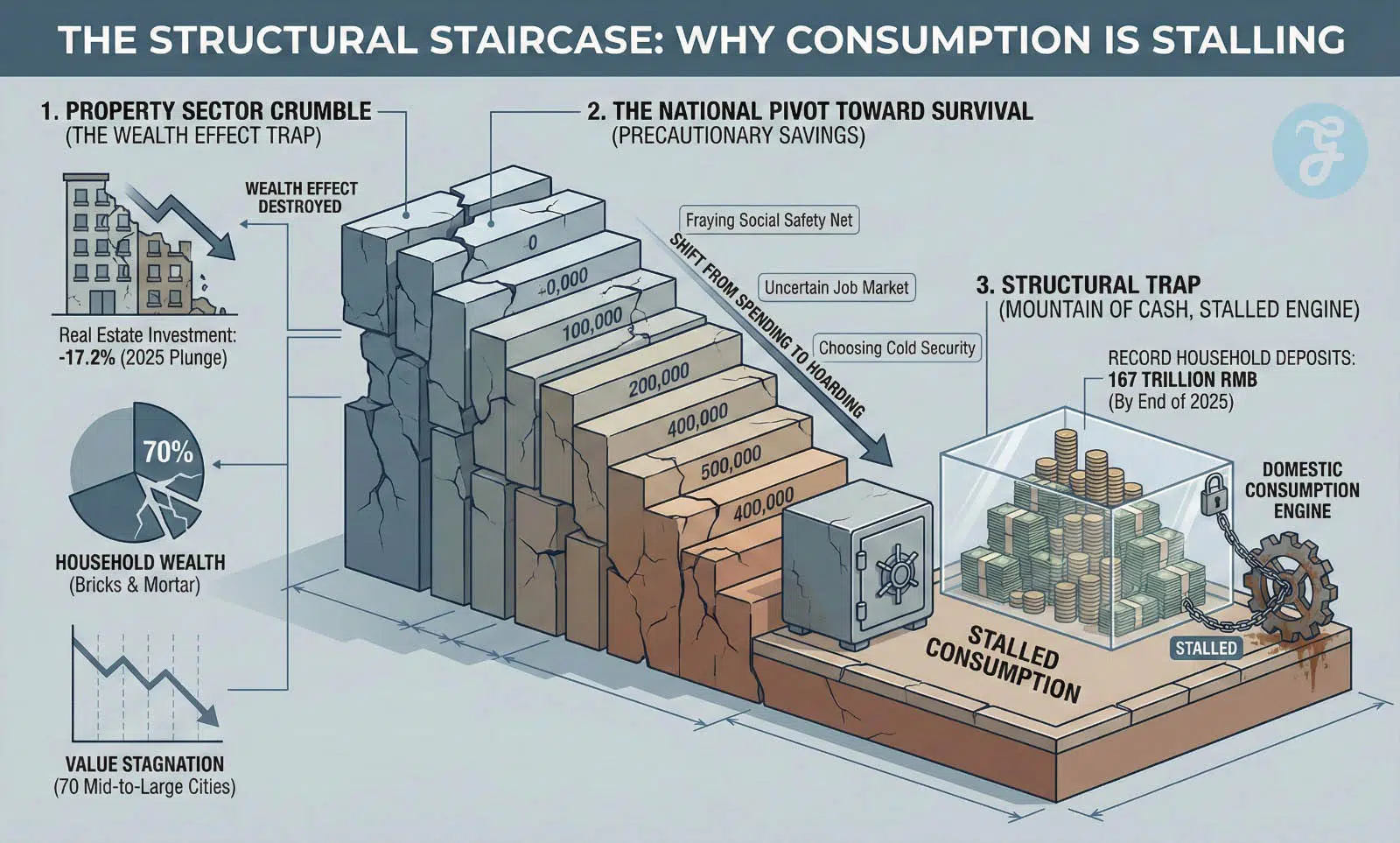

The dream of a domestic consumption engine hit a formidable wall in 2025. While the state speaks of a Super Large Market, the average Chinese household is currently in a state of quiet and disciplined retreat. The most visible symptom of this malaise is the property sector. For decades, the rising value of an apartment was the bedrock of middle-class confidence.

That bedrock is now crumbling. In 2025, real estate investment plunged by 17.2 per cent while sales continued their slide. This is not just a statistical dip; it is a fundamental destruction of the wealth effect. In China, roughly 70 per cent of household wealth is locked in bricks and mortar. When the value of the family home stagnates or falls, as it did in all 70 mid-to-large cities across 2025, the appetite for discretionary spending vanishes.

The result is a national pivot toward survival. By the end of 2025, household deposits in Chinese banks reached a record 167 trillion RMB. This represents a structural trap for the economy. On paper, there is a mountain of cash; in reality, this is precautionary savings. People are hoarding capital because they see a fraying social safety net and an uncertain job market. They choose the cold security of a bank balance over the fleeting joy of a luxury purchase.

The Power Matrix: 2026 Assessment

| Player | Front-Stage Narrative | Back-Stage Reality | Hidden Leverage |

| National Champions (EV/AI) | Global innovators dominating foreign markets. | Survival is dependent on state subsidies and new “anti-involution” pricing floors to stem losses. | Used as a tool for geopolitical bargaining and technology transfer. |

| Local Governments | Engines of local infrastructure and high-quality growth. | Paralysed by debt; land sale revenue fell 65% from its 2020 peak, forcing a reliance on central “refinancing” bonds. | Control over industrial output quotas and “New Productive Force” land grants. |

| Household Sector | The “Super Large Market” engine. | Precautionary saving mindset; record 167 trillion RMB in deposits trapped by a crumbling wealth effect. | Silent protest through “lying flat” (tang ping) and refusing to exit the savings trap. |

| State Banks | Pillars of financial stability and “Financial Power.” | Burdened by property defaults (down 17.2%) and the restructuring of 150 trillion RMB in total local debt. | Final arbiter of which “zombie” firms survive the 2026 industrial cleanup. |

This has created a starkly K-shaped reality. On one side, the New Economy is surging. The broad high-tech sector, spanning advanced manufacturing, green energy, and digital services, received massive support, with sales rising 13.9 per cent in 2025. But these industries are capital-intensive, not labour-intensive. They do not create the millions of service and retail jobs needed to sustain a consumer explosion. On the other side, the Old Economy of retail and property is struggling. Retail sales growth hit a three-year low of 0.9 per cent in December 2025. You cannot build a Super Large Market on industrial robots alone; you need a confident middle class.

The “Course Correction” vs. Confidence Debate

The frantic energy behind the Super Large Market often masks a deeper reluctance to change. In early 2026, the policy landscape remains a battlefield between short-term fixes and the structural surgery the economy requires. Beijing has leaned heavily on ‘trade-in’ subsidies for electronics and vehicles. While these attracted 350 million participants last year, they represent a mere sugar hit that pulls future spending into the present rather than creating new demand.

The real solution lies in structural reform: dismantling the hukou system, ensuring migrant workers have healthcare, and fixing a pension system nearing insolvency. These changes would unlock the 167 trillion RMB sitting in banks. If people knew the state had their back, they would stop hoarding. However, the leadership faces a political barrier. A true transition to a consumer economy requires a massive transfer of wealth from the State to households. For the CCP, this is a dangerous proposition; decentralising wealth is decentralising control.

3-Year Risk Forecast (2026-2029)

| Risk Domain | Intelligence Assessment | 2026 Outlook | 2029 Projection |

| Trade Friction | CRITICAL: US/EU tariffs and “exported deflation” trigger global retaliation. | Effective tariffs exceed 40% on key sectors. | Trade flows are permanently diverted to the Global South. |

| Social Safety | HIGH: Aging population and rural-urban healthcare gap fuel discontent. | Pension reforms remain stalled; rural spending low. | Social contract enters “active renegotiation” phase. |

| Financial Stability | MODERATE: Real estate decline managed through “slow-leak” bailouts. | Property investment down 10-14% YoY. | Consolidation of banking sector into 4-5 mega-state entities. |

| Tech Autonomy | STABLE: High-tech manufacturing remains the primary growth pillar. | Sales growth at 10-15%. | 80% self-sufficiency in legacy and mid-tier chips. |

Xi Jinping’s 2026 focus on ‘High-Quality Development’ serves to manage expectations for slower growth; projections currently sit between 4.0 and 4.8 per cent for the year. The goal is no longer to outrun the world, but to endure it. By framing slower growth as a choice for quality, the leadership is preparing the public for a future where double-digit expansion is a memory.

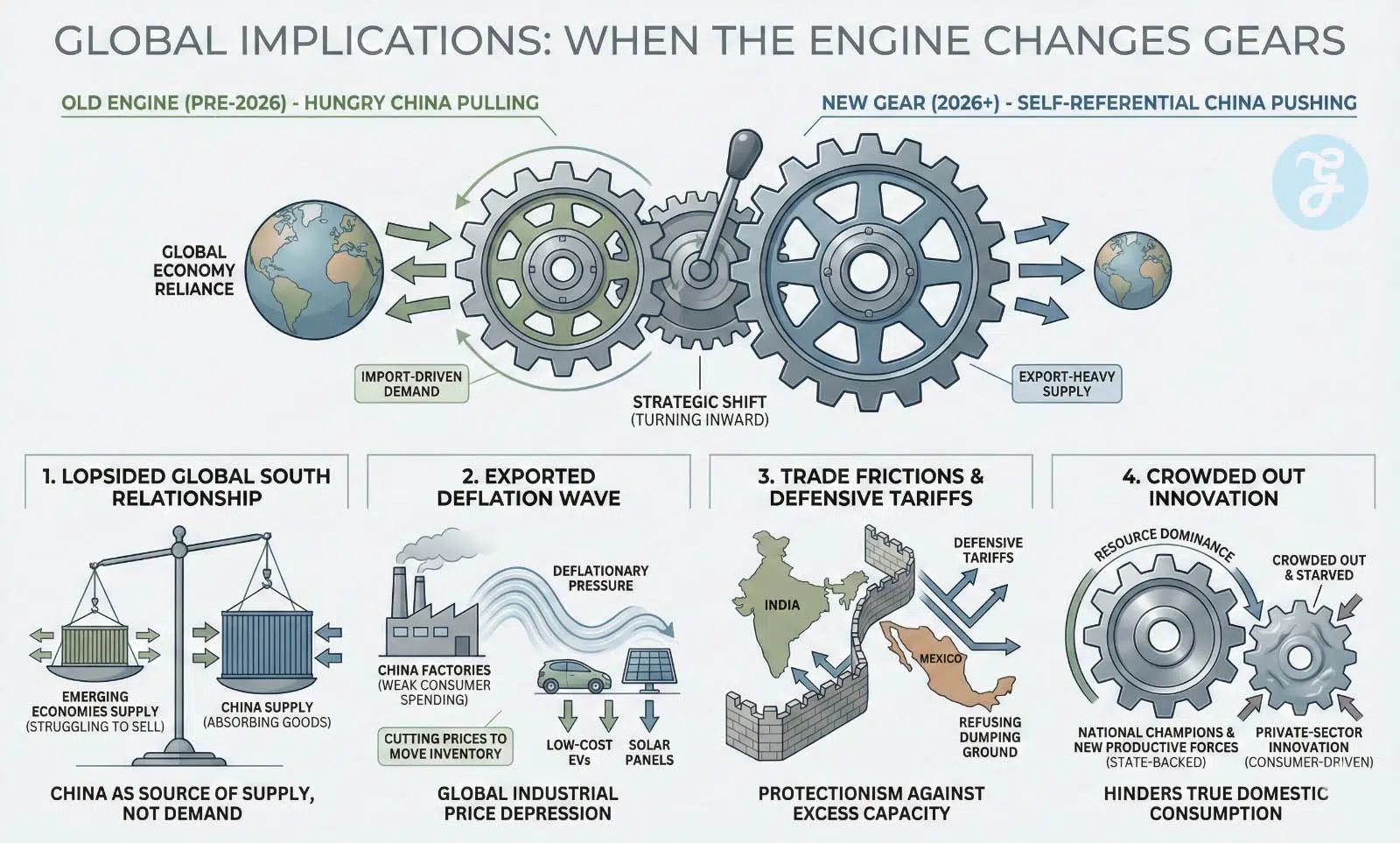

Global Implications: When the Engine Changes Gears

As China turns inward, the tremors are felt globally. For decades, the world relied on a hungry China to pull the global economy. Now, a self-referential China is altering the fortunes of its partners. In the Global South, the relationship is becoming lopsided; many emerging economies absorb Chinese goods while struggling to sell their own. China is increasingly a source of supply, not demand.

This internal weakness is exported as deflation. Because the Chinese consumer is not spending, factories cut prices to move inventory. This glut of low-cost EVs and solar panels depresses industrial prices worldwide. While this may help control inflation elsewhere temporarily, it triggers defensive tariffs in places like India and Mexico, which refuse to be the dumping ground for Beijing’s excess capacity. The focus on ‘National Champions’ and ‘New Productive Forces’ is crowding out the private-sector innovation needed to drive true domestic consumption.

The 2030 Horizon: A Fortress or a Foundation?

The rhetoric of the Super Large Market faces its ultimate test as the decade closes. It is essential to recognise that this vision is currently a policy goal rather than a lived reality. The state has successfully built the supply side of this architecture through high-speed rail and automated warehouses. But a market is more than just infrastructure. It is a psychological contract between a government and its people. Currently, that contract is under immense strain.

The metric for success is clear even if the timeline is not. For China to truly pivot away from its reliance on a cooling West, household consumption must move from its current stagnation. While global averages for consumption sit around 60 per cent of GDP, China has struggled to break past the 40 per cent mark. Success in 2030 would look like a country where the middle class no longer feels the need to hoard 167 trillion RMB in precautionary savings. It would look like a nation where the service sector and private innovation provide the broad-based employment that high-tech manufacturing simply cannot.

Central to navigating this transition is the China domestic market strategy 2026, which seeks to transform 1.4 billion citizens into a self-sustaining economic engine capable of offsetting external volatility. This shift is a matter of necessity rather than choice. China is not turning inward because it has found a superior economic path. It is being pushed there by a world that has grown weary of its exports and a domestic model that has run out of road. The leadership is betting the future of the Party on the idea that 1.4 billion people can sustain the world’s second-largest economy from within.

Whether the Chinese consumer can carry that weight is the most consequential question of our time. If the Super Large Market fails to materialise, the fortress will feel less like a sanctuary and more like a cage. The road to 2030 will determine if Beijing has successfully corrected its course or simply retreated into a beautiful yet hollow mirage. Can a state that refuses to relinquish financial control ever truly empower a consumer class to save it?

Foresight Assessment: The Next 18 Months

Within the next 18 months, expect a “Consumption Stagnation Crisis” as state subsidies fail to move the needle on household spending. This will likely force the central bank into more aggressive and unconventional monetary easing to prevent the redoubt from becoming a trap.