You work hard for your savings, but have you considered the two forces that quietly shape their future value – compound interest and inflation? While compound interest can amplify your wealth over time, inflation works in the opposite direction, slowly eroding your purchasing power. Without the right strategy, your savings might not keep up with rising expenses and long-term goals.

Keep reading to understand how these two powerful forces impact your wealth and how to navigate them effectively to protect and grow your money over time.

Inflation: A silent wealth eroder

Inflation refers to the rise in prices of goods and services over time. For example, if inflation is 6% annually, what costs ₹100 today will cost ₹106 next year. If your savings only grow at 3% (as is often the case with many savings accounts), you are effectively losing purchasing power.

Inflation can result from factors such as economic growth, supply chain issues, and global market conditions.

Compound interest: The wealth multiplier

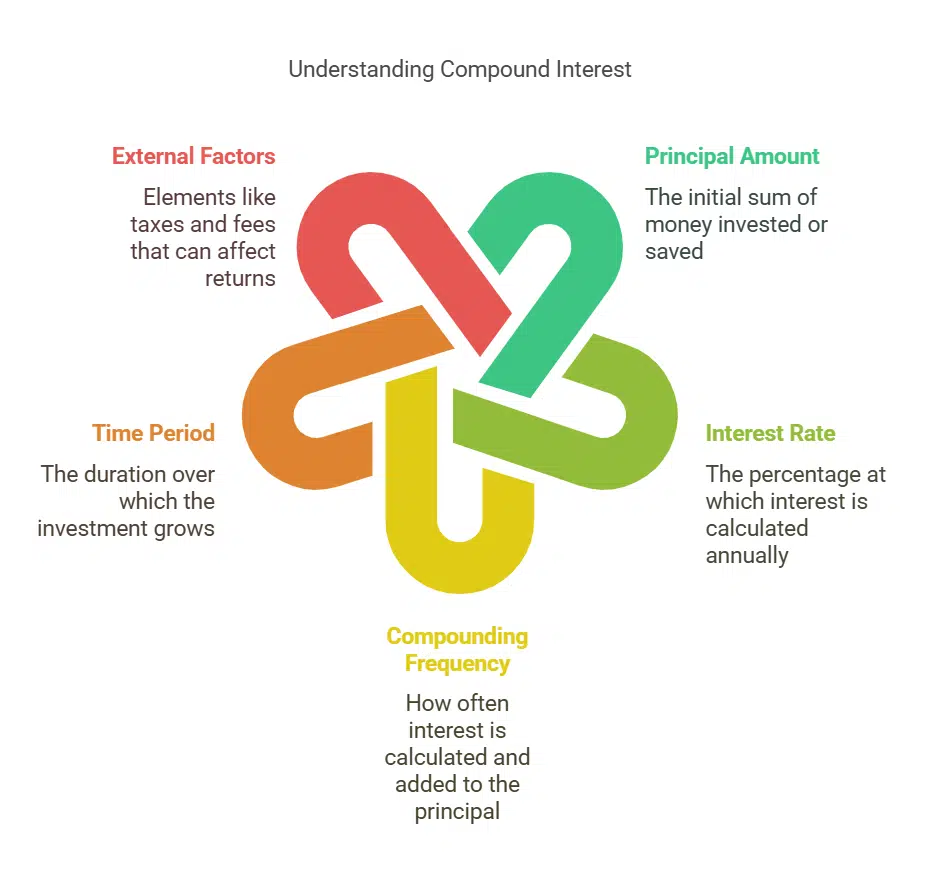

Compound interest is often described as the “eighth wonder of the world” because of its ability to grow wealth over time. It is the process where interest is added to the principal, and subsequent interest is calculated on this new total. This compounding effect accelerates the growth of your savings or investments over time.

Say you invest ₹1 lakh in a mutual fund scheme at an annual interest rate of 10%, compounded annually. At the end of the first year, you will earn ₹10,000 as interest (10% of ₹1 lakh), making your total ₹1.10 lakh.

In the second year, interest is calculated on ₹1.10 lakh, which means you earn ₹11,000, and the total becomes ₹1.21 lakh. If this process continues for 10 years, your investment may amount to ₹2,59,374.

This is the power of compounding at work. However, it’s important to remember that this is a simplified calculation. Real-world returns may be affected by taxes, fees, and market volatility.

You can use online tools like a power of compounding calculator to visualise the growth of your investments or savings. Simply enter the principal amount, interest rate, duration, and compounding interval (e.g., monthly, quarterly, etc) to estimate your future wealth.

Finding the balance

Building lasting wealth depends on finding a balance between the compounding growth of your savings and the gradual erosion caused by inflation. Here are some strategies to help you stay ahead:

Invest early: The earlier you start, the longer you allow compounding to work in your favour. For example, starting at age 25 instead of 35 can significantly increase your wealth due to the additional compounding years.

Opt for growth-oriented investments: Consider high-growth options like equity mutual funds to generate inflation-beating returns over time. A common guideline is the “100 minus your age” rule, which suggests allocating a percentage of your portfolio to equities based on your age. For example, if you are 30, you can consider investing 70% in equities.

Diversify your portfolio: Avoid concentrating your investments in a single asset class. Diversify across equities, bonds, real estate, gold, and other options to mitigate risk and maximise returns. For example, during periods of high inflation, assets like gold and real estate often perform well.

Stay consistent: Regular investments through a Systematic Investment Plan (SIP) help you benefit from compounding steadily, regardless of market fluctuations. Consistency and discipline are key to long-term wealth creation.

Leverage tools: Use an online compound interest calculator to visualise the growth of your investments. Seeing the potential growth can motivate you to stay disciplined. Additionally, consult a financial advisor to tailor your investment strategy to your unique needs and goals.

Key takeaways

Inflation and compound interest are two sides of the financial coin that must be understood to protect your hard-earned savings. While inflation silently erodes your wealth, compound interest, when used effectively, can offset its effects and help your investments grow.

To ensure your savings do not lose value over time, it’s crucial to adopt a smart approach. Start investing early, diversify your portfolio, and focus on high-growth options like equity mutual funds that offer inflation-beating returns. Consistency and discipline, combined with the power of compounding, are powerful tools to grow wealth and stay ahead of inflation.