Many people feel stress at tax time. They watch paychecks shrink, they worry about missing tax credits, they fear calls from IRS agents. They think about tax cheats who skip the rules.

This burden can lead to debt.

Did you know 17 percent of federal taxes go unpaid each year. We show 12 common tax loopholes you can use. They range from claiming depreciation on assets to using backdoor IRAs. We will note how the inflation reduction act can help.

We point to tools like the internal revenue service portal. We mention tax calculator apps, Form 1040 guides, health savings accounts info, and 529 plan rules. You will learn which moves are smart, and which could raise red flags.

Read on.

Key Takeaways

- Seventeen percent of federal taxes go unpaid each year. Small businesses lower taxable income by claiming depreciation on computers, machinery, and vans under Section 179 on Form 4562.

- Workers fund a health savings account (HSA) with a high-deductible plan and file Form 8889 to get pre-tax contributions that grow tax free. Parents use Section 529 plans for tuition, and many states let them deduct up to $5,000 on their state returns.

- Filers earn the Saver’s Credit on Form 8880 to cut their tax by up to half of $2,000 in retirement plan deposits if they earn under $34,000 single or $68,000 married filing jointly. High earners use a backdoor IRA (Form 8606) with a $6,500 cap plus $1,000 catch-up to fund a Roth IRA.

- Self-employed people deduct home office costs using the simplified method ($5 per ft², max $1,500) or by tracking actual expenses like rent, utilities, and repairs. Investors net up to $3,000 in carryforward losses each year to offset future gains and lower their tax bill.

Claim Depreciation on Assets

Small businesses cut expenses when they claim depreciation on assets such as computers, machinery, or delivery vans. Owners spread the cost using methods like straight-line or MACRS under Section 179.

You report the deduction on IRS Form 4562. These moves slash taxable income, boost cash flow, and work hand in glove with tax credits for extra relief.

The United States first taxed income in 1862, when President Abraham Lincoln signed a law to fund Civil War expenses. It set rates at 3 percent for incomes from $600 to $10,000 and 5 percent for higher amounts.

That levy now underwrites roads, schools, and bridges. Claiming depreciation today lets you save on your tax bill and reinvest in gear or guard your cash.

Utilize Health Savings Accounts (HSAs)

Open a health savings account when you sign up for a high deductible health plan. You make pre tax contributions, track them on Form 8889 with the IRS. Those funds grow tax free. You tap them for qualified medical bills anytime.

Using an HSA cuts your taxable income. It can build a big nest egg for health costs. You avoid extra tax on growth and withdrawals for those bills. Medicare got 16% of the federal budget in 2022.

Workers paid $603 in 2011, about 1.5% of their wages, toward it.

Benefit from 529 Plan Tax Breaks

Parents put money in a Section 529 plan, and funds grow free of federal taxes. The Internal Revenue Service lets families save for tuition, fees, and room without tax on growth.

States often let contributors deduct part of their deposits on state income tax filings. Some allow up to $5,000 in annual deductions.

Leverage the Saver’s Credit

A person earning $41,560 in 2011 paid about $5,153 in federal taxes, or 12.4% of earnings. The saver’s credit can cut that bite. It lets you claim up to half of your first $2,000 in retirement plan deposits.

A single filer with income under $34,000 can get the full credit. Couples filing jointly under $68,000 can claim it too. Most Americans who pay about 12% in federal tax qualify at least for a small break.

Use IRS Form 8880 on your 1040 to get the credit. Tax apps and pros will flag your eligibility. You plug in your retirement plan deposits and your filing status. The tool tallies your rate and cuts your tax due.

You can watch your refund grow or your balance drop.

Write Off Home Office Expenses

Self-employed workers can deduct part of their rent, mortgage, and utility bills for an office in their home. The IRS allows that under tax code section 280A. Filers fill out Schedule C or a dedicated tax form.

They pick a simplified route or track actual expenses. The simple route gives five dollars per square foot, up to 300 square feet. The max deduction is fifteen hundred dollars. The full-cost route lets them pro-rate mortgage interest, property tax, utilities, repairs, and even depreciation.

Rachel used a common tax program to claim one hundred fifty square feet last spring. She had a total of sixty thousand dollars in income. Her one thousand dollars deduction trimmed her tax bill by two hundred fifty.

She kept floor plans and bills in a binder, as IRS guidelines suggest. She also consulted IRS booklet 587 for more details. That record keeping keeps audits at bay, and it keeps her stress low.

Use Backdoor IRAs for Retirement Savings

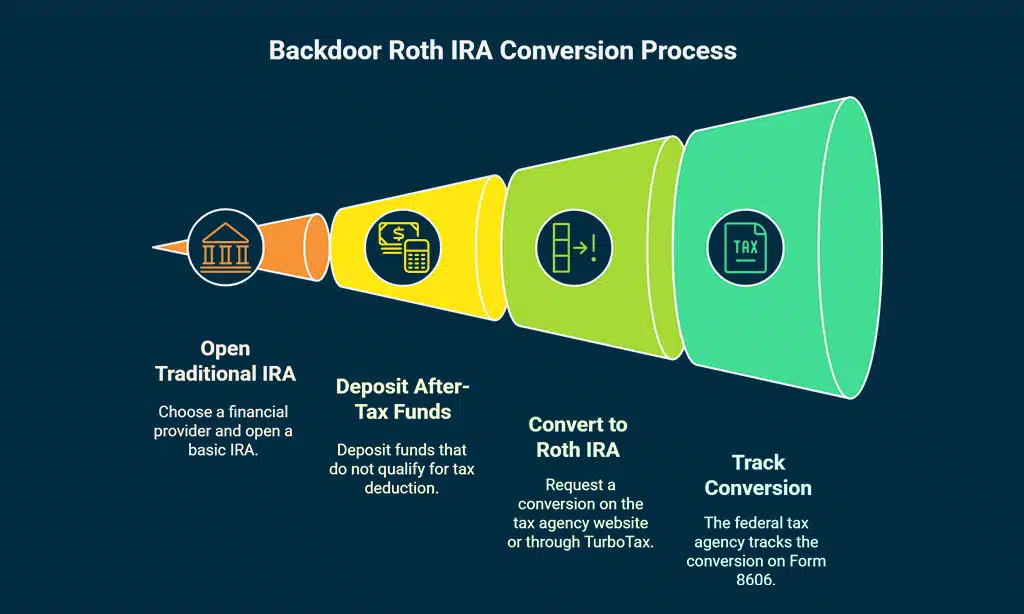

High earners face income limits for Roth IRAs, but they can use a backdoor route. They add money, after-tax, to a traditional IRA. They then convert the balance to a Roth. The federal tax agency tracks this on Form 8606.

The 2023 contribution cap is $6,500, plus $1,000 catch-up for those 50 or older. Jane, a 45-year-old graphic designer making $200,000, uses this trick to park funds in a Roth.

Choose a financial provider, such as Vanguard or Fidelity, and open a basic IRA. Deposit funds that do not qualify for tax deduction. Request a simple conversion on the national tax agency website or through TurboTax.

Watch out for pro-rata rules if you own other IRAs. You end up with a growing after-tax savings fund, shielded from future tax hikes.

Offset Gains with Carried Forward Losses

An investor tracks share trades in an accounting ledger, he notes gains or losses at year end. He lists $8,000 in losses and $5,000 in gains, then nets the figures on a summary form.

Excess losses create a carryforward loss that shields future gains. A $3,000 carryforward loss can cut tax liability year after year. That move can feel like turning lemons into lemonade for your wallet.

It keeps you ahead of bracket climbs too.

Tax form sheets show the net result, they make filing easier. Software programs or a spreadsheet tool can flag carryforward losses. Investment accounts report cost basis and sale dates, too.

The IRS notes that 17% of federal taxes go unpaid annually, errors and oversights add up. Claiming carryforward losses cuts errors and shrinks your bill. You gain peace of mind and leaner returns in future filings.

Takeaways

Smart use of these breaks feels like finding loose change in the sofa. Some options, such as health savings plans and education savings plans, help you shield gains. Open a tax return form guide, track your carryover losses too.

Claim depreciation, write off office costs, or fund a special retirement account. Talk with a tax professional before you hit the send key. Watch your small steps add up to big savings at tax time.

FAQs on Common Tax Loopholes in USA

1. What is a tax loophole, and is it legal to use in the USA?

A tax loophole is a gap in the tax code, it lets you pay less if you stick to the rules. Most are legal, but you must be fully compliant. If you push too hard, IRS agents can come knocking.

2. How does the home office deduction work, and will it invite IRS scrutiny?

You claim part of your rent and utilities as business expenses for your work spot. It is like splitting a restaurant check, you must keep detailed logs. If you guess or fudge the numbers, the IRS might ask for proof or launch an audit.

3. Can I use a medical savings plan to cut my tax bill?

You put money in before tax into a medical savings plan to pay health bills later. That trims your taxable income right away. You must spend the cash on approved medical costs or face tax plus a penalty. Keep every receipt, no excuses.

4. How do charitable donations and gift tax exclusions fit into tax strategies in the USA?

Giving to charity can score you an itemized deduction on your return, you just list each gift and keep proof. You can also give cash to a person up to a set limit each year with no gift tax thanks to the gift tax exclusion. These moves help plan your estate and can cut capital gains tax. Rules shift by year and by state, so read the fine print or ask a pro.