Freelancing in Ireland offers flexibility, independence, and the ability to control your income. However, one challenge freelancers face is managing taxes effectively. Understanding tax deductions can significantly reduce your taxable income and help you save money.

Many freelancers miss out on potential savings simply because they are unaware of what they can claim. This guide explores 10 common tax deductions for freelancers in Ireland, ensuring you claim every possible expense to maximize your tax savings while staying compliant with tax laws.

By taking advantage of these tax deductions, freelancers can reinvest in their business, improve financial stability, and gain better control over their earnings.

Whether you’re a graphic designer, writer, consultant, or developer, understanding these deductions is essential to optimizng your financial health.

Understanding Tax Deductions for Freelancers in Ireland

Tax deductions reduce your taxable income by allowing you to subtract legitimate business expenses from your earnings. As a freelancer, the more deductions you claim, the lower your tax liability. These deductions can include office expenses, travel costs, marketing expenses, and even bad debts. Understanding what qualifies as a deductible expense ensures compliance with tax laws while maximizing savings.

Why Freelancers in Ireland Should Maximize Deductions

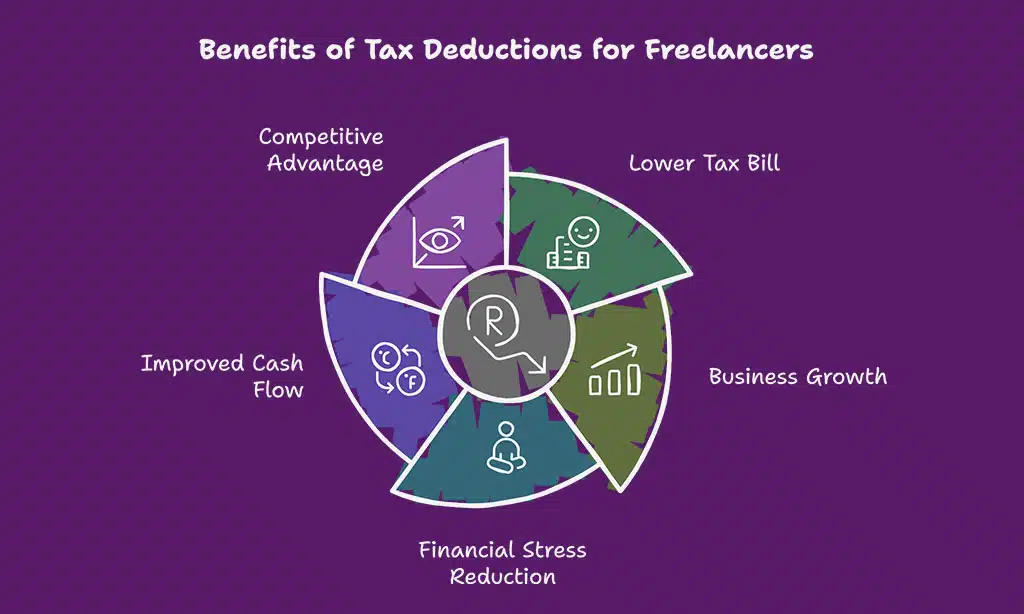

Freelancers often bear multiple business costs that employees don’t. By identifying and deducting allowable expenses, you can:

- Lower your annual tax bill significantly

- Free up more funds for business growth and reinvestment

- Reduce financial stress during tax season and avoid overpaying

- Improve cash flow, ensuring sustainability in the long run

- Compete more effectively with larger businesses that have tax advantages

How to Claim Tax Deductions Effectively

To claim tax deductions, freelancers in Ireland must:

- Keep detailed records of all expenses to ensure accurate reporting.

- Maintain receipts and invoices as proof to present in case of an audit.

- Separate personal and business expenses to avoid confusion.

- Use digital tools or accounting software to streamline tax calculations.

- File tax returns accurately and on time through Revenue Online Service (ROS) to avoid penalties.

- Consult with a tax professional to identify additional deductions and ensure compliance.

Top 10 Tax Deductions for Freelancers in Ireland

Freelancing in Ireland comes with numerous advantages, including flexibility and independence. However, managing taxes efficiently is crucial to ensuring profitability and financial stability.

Understanding the tax deductions available to freelancers can significantly reduce tax burdens, allowing for reinvestment in business growth.

This section covers the most common deductions available to freelancers in Ireland, helping them maximize their savings and maintain compliance with tax regulations.

1. Home Office Expenses

Freelancers working from home can claim deductions for a portion of their rent, mortgage, electricity, heating, and other utilities, provided that they have a dedicated workspace used exclusively for business activities.

This deduction can significantly reduce taxable income, making it essential for freelancers to track their expenses meticulously. To qualify, freelancers must ensure their home office is a clearly defined area used regularly for work, and they should maintain accurate records of relevant expenses to substantiate their claims during tax assessments.

What Qualifies as a Home Office?

- A dedicated workspace used exclusively for business.

- A portion of your home that is regularly used for freelancing.

- Expenses that are necessary for business operations, such as furniture, lighting, and security.

How to Calculate Your Deduction

- If you use one room in a five-room house for work, you can deduct 20% of your rent and utilities.

- Keep utility bills and mortgage statements as proof of expenses.

Home Office Deduction Table:

| Expense Type | Percentage Deductible |

| Rent/Mortgage | Up to 20% |

| Electricity | Up to 20% |

| Heating | Up to 20% |

| Internet | Business usage % |

| Office Furniture | 100% (if exclusively for business) |

2. Internet and Phone Bills

Reliable internet and phone services are the backbone of modern freelancing, enabling seamless communication with clients, participation in virtual meetings, and efficient online collaboration.

As a freelancer, your work may depend on high-speed internet for file transfers, video conferencing, and cloud-based applications. Similarly, business-related phone calls, VoIP services, and mobile data usage contribute to operational costs. These expenses are fully or partially deductible, depending on the proportion of business use. Keeping an accurate log of internet and phone usage for work can help justify these deductions during tax filings.

Percentage of Usage for Business vs. Personal

- If 70% of your phone and internet usage is work-related, you can deduct 70% of the cost.

Best Practices for Keeping Records

- Maintain detailed usage logs or obtain separate business accounts to track expenses accurately.

- Consider using a VoIP service to track business-related calls separately.

Internet & Phone Deduction Table:

| Expense Type | Deductible % |

| Internet | Business usage % |

| Mobile Bills | Business usage % |

| Landline | Business use only |

3. Professional Equipment and Software

Freelancers often invest in tools that support their work, ensuring efficiency, productivity, and quality in their deliverables. These tools can range from essential hardware, such as laptops and printers, to industry-specific software like Adobe Creative Suite, AutoCAD, or accounting applications.

Investing in high-performance equipment not only improves workflow but also enhances output quality, leading to better client satisfaction and potential revenue growth. By claiming these purchases as tax-deductible expenses, freelancers can reduce their taxable income while maintaining the tools necessary for professional success.

Eligible Purchases

- Laptops, monitors, keyboards, external drives, printers

- Software like Adobe Suite, Microsoft Office, cloud storage

Depreciation vs. Full Deduction

- Equipment above a certain price threshold must be depreciated over several years, while smaller items may be deducted in full in the purchase year.

Example Depreciation Schedule:

| Equipment | Cost | Depreciation Years |

| Laptop | €1,500 | 3 |

| Office Chair | €300 | 1 |

| External Hard Drive | €150 | 1 |

4. Business-Related Travel Costs

If you travel for meetings, conferences, or client work, these expenses are deductible, provided they are directly related to generating income for your business. This includes costs for flights, train fares, bus tickets, taxi services, accommodation, and even meals if they are incurred during an overnight business trip.

Freelancers who use their personal vehicle for business travel can also claim mileage allowances, making it crucial to maintain detailed records of travel dates, destinations, purposes, and associated costs. Keeping digital copies of receipts and using expense tracking apps can streamline the deduction process and ensure compliance with tax regulations.

Public Transport and Accommodation Deductions

- Flights, train fares, taxis, and hotel stays can be deducted if directly related to business.

- Keep receipts and record business purposes for each trip.

Travel Deduction Table:

| Expense Type | Deductible? |

| Flights | Yes (business-related) |

| Hotels | Yes (if traveling for business) |

| Taxi/Uber | Yes (with receipt) |

| Rental Car | Yes (if for business use) |

5. Marketing and Advertising Expenses

To grow your business, marketing and promotions are essential for building brand awareness, attracting new clients, and maintaining a competitive edge in the industry. Freelancers must invest in various marketing channels, including digital advertising, content marketing, and social media campaigns, to ensure a steady flow of work. Strategic marketing efforts not only help in acquiring clients but also position freelancers as authorities in their field. By leveraging tax-deductible marketing expenses, freelancers can scale their business effectively without incurring unnecessary financial burdens.

Eligible Expenses

- Website design, hosting, and domain renewal

- Social media advertising, Google Ads, business cards

- SEO tools and content marketing services

How to Optimize Marketing Costs for Maximum Deductions

- Track your ROI on marketing spend to allocate funds efficiently.

- Focus on high-impact digital marketing strategies to maximize business growth.

| Marketing Expense Category | Eligible Expenses |

| Website Costs | Design, hosting, domain renewal |

| Digital Advertising | Google Ads, Facebook Ads, Instagram promotions |

| Print Marketing | Business cards, brochures, flyers |

| SEO & Content Marketing | SEO tools, blog writing services, keyword research tools |

| Email Marketing | Newsletter software, automation tools |

| Influencer & PR | Sponsored content, influencer collaborations |

| Video & Media Production | Promotional videos, stock images, editing software |

6. Training and Educational Courses

In an ever-evolving market, staying updated with industry trends and learning new skills is crucial for freelancers. Training, workshops, and online courses help enhance knowledge, improve service offerings, and keep freelancers competitive. Many professional courses are tax-deductible if they are directly related to your freelancing work.

Whether you are a graphic designer learning new software, a writer improving SEO skills, or a developer upgrading coding knowledge, investing in education can be a smart way to reduce taxable income while improving your business potential.

Eligible Training Costs

| Training Type | Deductible? | Example Expenses |

| Online courses | Yes | Udemy, Coursera, LinkedIn Learning |

| Workshops and bootcamps | Yes | SEO workshops, coding bootcamps |

| Industry conferences | Yes | Tickets, travel, accommodation |

| Certification programs | Yes | Google Ads, Adobe, PMI Certifications |

| Professional development | Yes | Leadership and communication training |

How to Claim Training Deductions

- The course must be directly related to your business or field.

- Keep receipts, invoices, and proof of course completion.

- Maintain a record of how the course benefits your freelance work.

7. Business Insurance

Business insurance is a crucial safety net for freelancers, protecting them from unforeseen liabilities, equipment damage, or legal disputes. Unlike salaried employees, freelancers are responsible for their own risk management, making insurance a necessary expense. Having proper coverage ensures that freelancers can focus on their work without worrying about financial risks.

Fortunately, business insurance costs are fully deductible, helping freelancers safeguard their businesses while reducing their tax burdens.

Types of Deductible Business Insurance

| Insurance Type | Deductible? | Coverage Details |

| Professional Indemnity Insurance | Yes | Covers legal costs in case of client disputes |

| Public Liability Insurance | Yes | Protects against third-party injury claims |

| Equipment Insurance | Yes | Covers damage or theft of business tools |

| Cyber Liability Insurance | Yes | Protects against data breaches and hacking |

| Health Insurance (Self-Employed) | Partial | May be deductible depending on circumstances |

How to Claim Insurance Deductions

- Ensure the policy is in your business name.

- Keep copies of premium payment receipts.

- Consult a tax professional to confirm eligibility.

8. Banking and Payment Processing Fees

Freelancers often deal with multiple financial transactions, including receiving payments from international clients, using online payment gateways, and maintaining business bank accounts.

These transactions often come with fees that can add up over time. Luckily, many of these banking and processing fees are deductible, helping freelancers lower their taxable income while managing business finances more efficiently.

Common Banking and Payment Expenses

| Expense Type | Deductible? | Example Costs |

| Business bank account fees | Yes | Monthly maintenance fees |

| Payment processing fees | Yes | PayPal, Stripe, Revolut transaction fees |

| Foreign currency conversion | Yes | Fees from receiving international payments |

| Wire transfer charges | Yes | Bank transfer fees for business transactions |

| Loan interest (business only) | Yes | Interest on business-related loans |

Best Practices for Record-Keeping

- Use a dedicated business account to separate expenses.

- Download monthly statements and categorize fees.

- Keep digital records of all banking transactions.

9. Subcontractor and Outsourcing Costs

Freelancers often collaborate with other professionals to complete projects more efficiently. Whether outsourcing tasks like content writing, design work, or administrative support, these costs are deductible as legitimate business expenses.

Hiring subcontractors allows freelancers to scale their businesses while optimizing productivity, and claiming these expenses ensures freelancers only pay tax on their net earnings.

Deductible Outsourcing Expenses

| Expense Type | Deductible? | Example Costs |

| Payments to freelancers | Yes | Upwork, Fiverr, PeoplePerHour contracts |

| Virtual assistants | Yes | Admin support, email management |

| Web development | Yes | Website redesign or maintenance |

| Graphic design | Yes | Logos, branding, social media visuals |

| Copywriting services | Yes | Blog posts, sales copy, product descriptions |

Tips for Proper Documentation

- Keep invoices and contracts from subcontractors.

- Use payment platforms that provide transaction records.

- Ensure services are directly related to your freelance work.

10. Business Memberships and Subscriptions

Freelancers often rely on industry-specific tools, memberships, and subscriptions to stay informed, network with peers, and improve their workflows. Whether subscribing to professional associations, research tools, or software applications, these costs are essential for business growth.

Since these expenses contribute directly to the success of a freelance business, they are fully deductible under tax laws in Ireland.

Deductible Memberships and Subscriptions

| Expense Type | Deductible? | Example Costs |

| Professional associations | Yes | Writers’ Guild, Chamber of Commerce membership |

| Industry publications | Yes | Research journals, business magazines |

| Software subscriptions | Yes | Adobe, Canva, Grammarly, QuickBooks |

| Cloud storage services | Yes | Google Drive, Dropbox, OneDrive |

| SEO and marketing tools | Yes | Ahrefs, SEMrush, social media schedulers |

How to Maximize Deductions

- Review subscription services annually to ensure relevance.

- Keep digital receipts for all membership payments.

- Ensure subscriptions are directly related to freelance work.

Final Thoughts: Maximize Your Tax Savings as a Freelancer

Freelancers in Ireland can significantly reduce their tax burdens by strategically utilizing deductions. By applying these insights, freelancers in Ireland can optimize tax savings and improve financial stability. Start preparing today and take control of your taxes!

By implementing these tax-saving strategies, freelancers in Ireland can reduce costs, stay compliant, and focus on growing their business sustainably.