When people hear the phrase “tax loophole,” they often imagine shady offshore bank accounts or complex schemes used by billionaires to pay zero tax. While those exist, they are usually illegal tax evasion or highly aggressive tax avoidance that HMRC (His Majesty’s Revenue and Customs) fights tooth and nail. However, there is a different kind of loophole. These are legitimate reliefs, allowances, and incentives written directly into the UK tax code. These tax codes contain common and legal tax loopholes in UK, which are not accidents or mistakes.

They are government-approved methods designed to encourage saving, investing, or business growth. The problem is that the tax system is so complex that many average earners simply do not know these options exist.

Using these strategies is known as “tax planning.” It is completely legal and highly recommended. The key is knowing which ones apply to you and which ones are more trouble than they are worth. Continue reading as we discuss 12 common and legal tax loopholes in UK in 2026. But first,

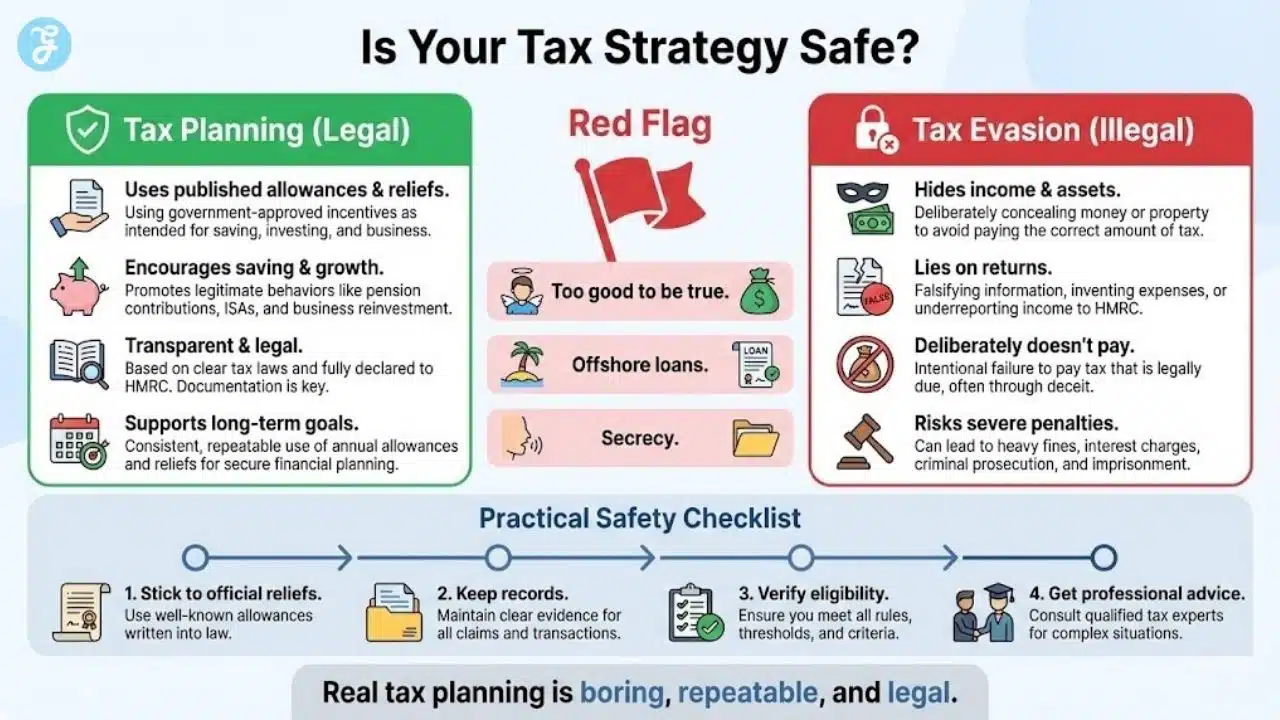

Are “Loopholes” Legal?

In the UK, the word “loophole” is often used loosely. For most people, the so-called loopholes are actually official tax reliefs, allowances, and incentives written into UK tax law—things like pension tax relief, ISAs, the Marriage Allowance, Rent-a-Room relief, and certain business exemptions.

These are not accidents in the system. They exist because the government wants to encourage certain behaviors (saving, investing, supporting families, and business growth).

The important thing is understanding the legal line:

- Tax planning (legal): Using published reliefs and allowances in the way they’re intended.

- Tax avoidance (sometimes legal, but risky): Arrangements designed mainly to reduce tax in ways HMRC may argue were not intended. These can be challenged and reversed.

- Tax evasion (illegal): Hiding income, lying on returns, inventing expenses, or deliberately not paying tax due.

Bottom line: The strategies in this article are legal when you qualify and follow the rules exactly. The real risk usually isn’t “normal tax planning”—it’s confusing legitimate reliefs with aggressive schemes marketed as loopholes.

12 of the Most Common and Legal Tax Loopholes in UK that are Legit

Here are 12 common and legal tax loopholes in UK for the 2025/2026 tax year and our verdict on whether you should use them.

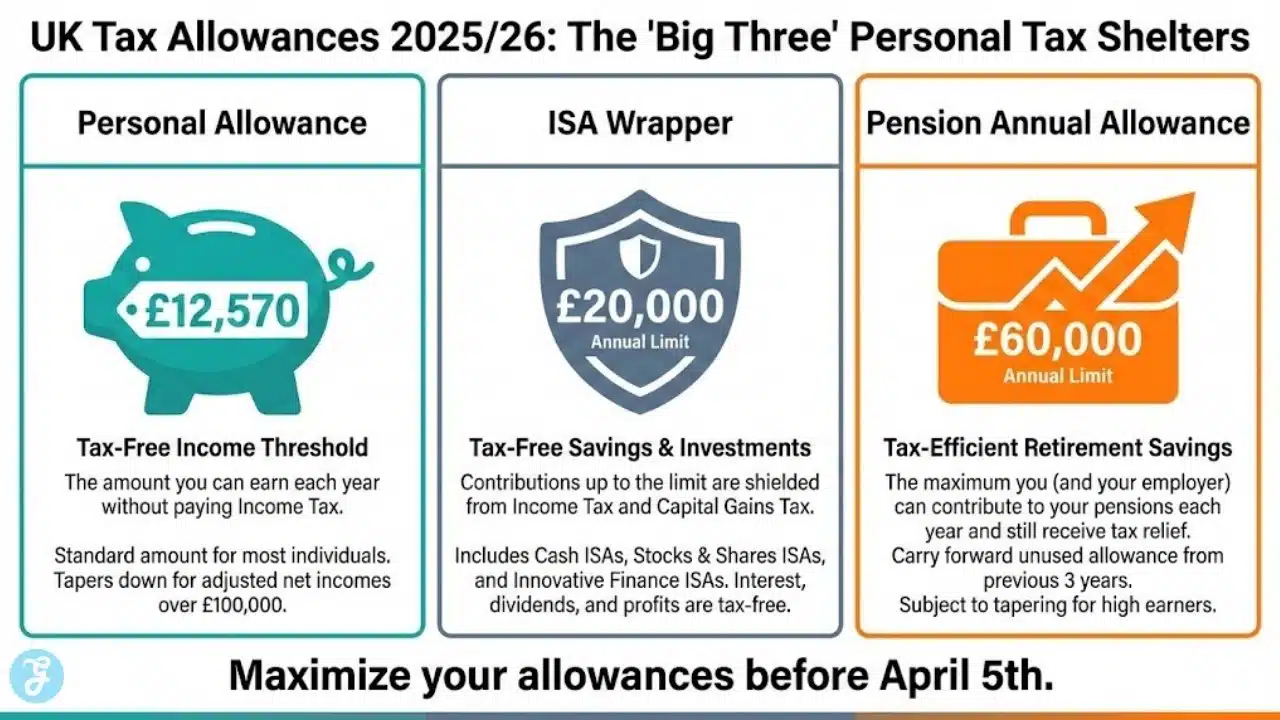

1. Salary Sacrifice for Pensions

This is arguably the most powerful “loophole” available to employees, yet millions fail to maximize it. When you pay into a pension via salary sacrifice, you agree to reduce your gross salary by a certain amount. In exchange, your employer pays that same amount directly into your pension pot.

How it works:

Because your official salary is lower, you pay less Income Tax and less National Insurance (NI). The tax relief is immediate. For higher-rate taxpayers, this is incredibly efficient. You are effectively getting an immediate 40% or 45% boost on your savings, plus the 2% or 8% saving on National Insurance. It also lowers your “adjusted net income,” which can help you reclaim things like the Child Benefit.

Should You Use It?

Yes. This is a no-brainer for almost everyone. The only downside is that your take-home pay is lower today, meaning you cannot access that money until retirement age. If you can afford the monthly reduction, the long-term tax efficiency is unbeatable.

2. The Marriage Allowance Transfer

This is a relief designed for couples where one partner works and the other either does not work or earns below the Personal Allowance threshold (usually £12,570).

How it works:

The lower-earning partner can “transfer” £1,260 of their unused Personal Allowance to their higher-earning spouse or civil partner. This reduces the higher earner’s tax bill by up to £252 for the year. It is a small amount, but you can also backdate the claim for up to four years, potentially resulting in a refund of over £1,000.

Should You Use It?

Yes. If you meet the criteria, this is free money. It takes about ten minutes to apply online. Note that the higher earner must be a basic rate taxpayer. If they pay tax at the higher or additional rate, you are not eligible.

3. Spousal Asset Transfers (Capital Gains)

Capital Gains Tax (CGT) is charged on the profit you make when selling assets like shares or a second home. Everyone has an annual tax-free allowance, but in recent years, this allowance has been slashed significantly (sitting at just £3,000 for the 2025/26 tax year).

How it works:

Transfers of assets between spouses or civil partners are tax-free. If you own shares that have made a large profit, you can transfer half (or all) of them to your spouse before you sell.

This allows you to use two annual allowances instead of one, effectively doubling your tax-free limit to £6,000. It also helps if your spouse pays tax at a lower rate than you, as they might pay 10% CGT on the excess rather than 20%.

Should You Use It?

Yes. This is a fundamental part of family tax planning. It requires some paperwork to transfer ownership legally before the sale, but the tax savings can be substantial.

4. The “Rent-a-Room” Scheme

If you have a spare bedroom, the government offers a generous tax break to encourage you to take in a lodger.

How it works:

You can earn up to £7,500 per year tax-free from letting out furnished accommodation in your main home. This is automatic. If you earn less than this, you do not even need to tell HMRC. If you earn more, you only pay tax on the amount above £7,500. This is much better than standard rental income, which would be taxed at your highest marginal rate from the first penny.

Should You Use It?

Maybe. The tax benefit is excellent, but the reality involves living with a stranger. If you value privacy over profit, the £7,500 might not be enough compensation. However, from a purely financial perspective, it is one of the few ways to earn tax-free income.

5. The Trading Allowance

This is a “micro-loophole” for the gig economy. The government allows you to earn up to £1,000 of trading income each tax year without paying a penny in tax.

How it works:

This applies to casual income like selling items on eBay, doing a bit of gardening, or freelance writing. If your total revenue is under £1,000, you do not need to declare it. If you earn more than £1,000, you can choose to deduct this £1,000 allowance from your income instead of calculating your actual expenses.

Should You Use It?

Yes. If you have a small side hustle, this simplifies your life immensely. It saves you from having to keep receipts for tiny expenses like stationery or petrol.

6. Trivial Benefits for Directors

If you run your own Limited Company, this is a small but satisfying perk.

How it works:

A company can provide “trivial benefits” to employees or directors. To be tax-exempt, the gift must cost £50 or less, not be cash (gift cards are fine), and not be a reward for performance. Directors can receive up to £300 worth of these trivial benefits per year.

Should You Use It?

Yes. It is essentially £300 of tax-free shopping vouchers a year. Many directors use this to buy Christmas gifts or treat themselves to a monthly meal. As long as you stick strictly to the rules (never a penny over £50 per receipt), it is a legitimate business expense that is tax-free for you.

7. Electric Vehicles (Salary Sacrifice)

The government is desperate to get people into green cars, and they have rigged the tax system to make it happen.

How it works:

Similar to the pension scheme, you sacrifice salary for a car. Usually, a company car is a taxable perk (Benefit in Kind). However, for electric vehicles (EVs), the taxable value is incredibly low (currently rising by 1% each year, but still a fraction of petrol cars). This means you can drive a brand-new Tesla or Polestar for a net cost that is often 30-40% cheaper than leasing it personally.

Should You Use It?

Yes. If you are in the market for a new car, this is the cheapest way to drive one. It covers insurance, maintenance, and tires. Just be aware that it ties you to your employer, and early exit fees can be steep if you leave your job.

8. The ISA “Wrapper”

It seems obvious, but millions of people still keep savings in standard bank accounts where interest is taxable. The Individual Savings Account (ISA) is a permanent shelter from the taxman.

How it works:

You can put up to £20,000 per year into ISAs. Any interest, dividends, or capital gains generated inside this wrapper are 100% tax-free forever. You do not even declare them on your tax return.

Should You Use It?

Yes. Always fill your ISA before using general investment accounts. It is the simplest and most effective tax loophole in existence.

9. Relevant Life Policies

Life insurance is usually paid from your net income (after tax). If you own a business, you can flip this.

How it works:

A “Relevant Life Policy” allows a limited company to pay for life insurance for its directors or employees. The premiums are a tax-deductible business expense for the company, and they are not treated as a taxable benefit for the individual.

Should You Use It?

Yes. If you are a business owner paying for life insurance personally, you are paying too much. Switching to a Relevant Life Policy can save you nearly 50% in costs once Corporation Tax and Dividend Tax savings are factored in.

10. Inheritance Tax Gifts (The 7-Year Rule)

Inheritance Tax (IHT) is often called a “voluntary tax” because there are so many ways to avoid it legally if you plan early enough.

How it works:

You can give away as much money as you like to anyone you like. As long as you survive for seven years after making the gift, that money falls completely outside your estate for IHT purposes. If you die within 7 years, the tax is reduced on a sliding scale (known as Taper Relief). You also have a £3,000 annual exemption that is immediately IHT-free.

Should You Use It?

Yes. If you can afford to give money away while you are alive, it is far more tax-efficient than hoarding it until death. It allows you to see your beneficiaries enjoy the money, rather than the taxman taking 40% of it later.

11. Child Benefit High Income Charge Avoidance

If one parent earns over £60,000 (thresholds are subject to change, but this is the typical danger zone), the government starts clawing back Child Benefit via a tax charge. However, it’s worth clarifying that the charge is fully payable only at £80,000 now (previously £60,000). The advice to use pensions to lower adjusted net income remains 100% valid and is excellent advice.

How it works:

This isn’t a specific loophole but a combination of others. The charge is based on your “Adjusted Net Income.” By increasing your pension contributions (using loophole #1) or donating to charity using Gift Aid, you can lower your adjusted income below the threshold.

Should You Use It?

Yes. We see scenarios where people earning £62,000 pay a massive effective tax rate because they lose their Child Benefit. By putting that extra £2,000 into a pension, they keep the benefit, save for retirement, and avoid the tax charge entirely.

12. Offshore Tax Schemes

Finally, we address the “loophole” often sold by aggressive promoters. These schemes usually involve getting paid via a loan from an offshore trust that you theoretically “never have to pay back,” claiming it is not income.

How it works:

Promoters claim this avoids UK Income Tax. They will show you legal opinions and promise that it is fully compliant.

Should You Use It?

NO. Absolutely not. HMRC has cracked down ruthlessly on these Disguised Remuneration schemes. They will pursue you for the unpaid tax years later, add massive interest, and impose penalties. The “loan charge” legislation means you will eventually have to pay. If a tax strategy sounds too good to be true (like paying 5% tax on your salary), it is not a loophole. It is a trap.

Will I Get Into Trouble for Using Common and Legal Tax Loopholes in UK?

Usually, no—if you’re using mainstream reliefs properly and you genuinely qualify. HMRC expects people to claim allowances and reliefs they’re entitled to.

Most problems happen in these situations:

1) You claim something you don’t qualify for (or apply the rules incorrectly)

If a claim is wrong, HMRC can deny it and recalculate your tax. Depending on the situation, you may also owe interest and penalties, especially if HMRC believes the mistake was careless or deliberate.

2) Poor record-keeping

Even if you’re entitled to a relief, you should be able to show basic evidence—especially for things like pension contributions, spousal asset transfers, director benefits, and business expenses.

3) You get pulled into a marketed “scheme”

If a promoter claims you can pay an unrealistically low rate of tax, or the strategy relies on complicated offshore steps, “loans,” secrecy, or urgency—treat it as a red flag. These are the arrangements most likely to be challenged years later.

4) The arrangement doesn’t reflect reality

Some strategies are legal only if they are genuine. For example, employing a spouse can be valid, but only if they actually work and are paid a reasonable market rate for real duties.

Practical safety checklist

- Stick to well-known, clearly defined reliefs and allowances

- Follow the rules exactly (thresholds, limits, timing, eligibility)

- Keep reasonable records

- Avoid anything that sounds “too good to be true”

- Get professional advice if the situation is complex (inheritance planning, company structures, large capital gains, anything offshore)

In short, using legitimate tax reliefs correctly is not something that typically causes trouble. The risk usually comes from incorrect claims, weak documentation, or aggressive schemes disguised as “loopholes.”

Why You Should Take Advantage of Tax Loopholes

Using legitimate tax breaks isn’t “cheating.” It’s simply using the UK tax system the way it was designed to be used. The tax code includes incentives, and if you ignore them, you may end up paying more tax than necessary.

Here’s why it makes sense to use legal tax reliefs and allowances:

1) You keep more of your money—legally

Allowances and reliefs exist to reduce tax for people who meet the conditions. If you qualify, claiming them is sensible, not shady.

2) Many of the best tax breaks are meant for normal earners

Some of the most powerful options—like salary sacrifice pensions, ISAs, and spousal transfers—are not “rich-person tricks.” They’re mainstream tools.

3) You reduce the risk of accidentally overpaying tax

Many people miss reliefs simply because they don’t know they exist or assume they don’t apply. Proper tax planning often prevents unnecessary overpayment.

4) You can avoid “cliff edges” and hidden high effective tax rates

Certain rules can create situations where a small income increase causes a large loss of benefits or triggers extra charges. Using legitimate tools (like pension contributions or Gift Aid) can help manage this legally.

5) It supports better long-term financial planning

Pensions and ISAs aren’t only about paying less tax today. They also help you build wealth more efficiently over time.

6) The safest strategies are usually boring and repeatable

The best tax planning is rarely a one-off hack. It’s the consistent use of annual allowances, correct paperwork, and good timing before the tax-year deadline.

The Verdict?

The UK tax system is a patchwork of rules, but it rewards those who pay attention. Using things like Pension contributions, ISAs, and Spousal transfers is not “cheating the system.” It is using the system exactly as it was intended.

The real secret to paying less tax isn’t finding a magical grey area. It is about boring, consistent administrative tidiness. It is ensuring your tax code is correct, claiming your expenses, and utilizing your annual allowances before the clock strikes midnight on April 5th.