Car insurance is a necessary expense for drivers in the U.S., but the cost can vary significantly based on numerous factors.

Understanding these “car insurance premium factors” can help you make informed decisions to save money while ensuring you have the right coverage.

Whether you’re a new driver or an experienced one, these factors provide a roadmap to reducing your expenses while optimizing your protection.

Let’s explore the seven key factors that influence your car insurance premium and actionable tips to keep your costs under control.

What Is a Car Insurance Premium?

A car insurance premium is the amount you pay to your insurance provider to maintain coverage for a specified period, typically six months or a year.

This payment ensures financial protection in case of accidents, theft, or other covered incidents.

But why do some drivers pay significantly more than others for the same type of coverage? It all comes down to how insurance companies assess risk.

Factors like your driving habits, location, and financial history play a crucial role in determining these costs.

Key Insight: The average annual car insurance premium in the U.S. is approximately $1,600, but this figure can vary widely depending on personal and external factors. Learning about “car insurance premium factors” can help you identify ways to minimize costs.

Why Do Insurance Premiums Vary Across Drivers?

Insurance companies use a range of factors to determine your premium, including personal details, driving habits, and external influences.

By analyzing these variables, insurers assess the likelihood of you filing a claim. The higher the perceived risk, the higher your premium.

Understanding these “car insurance premium factors” can help you strategize and potentially reduce your insurance costs.

Here are the seven primary factors that determine car insurance premium rates:

1. Driver’s Age and Experience

Young and inexperienced drivers are statistically more likely to be involved in accidents, making them a higher risk for insurers.

Drivers aged 16-25 often face the highest premiums due to their limited driving history and propensity for risky behavior.

Research shows that accident rates drop significantly after age 25, leading to lower premiums.

The Role of Driving Experience

As you gain more driving experience and maintain a clean record, your premiums typically decrease.

For example, a 30-year-old with 10 years of experience and a spotless record will likely pay less than a 20-year-old new driver.

Experienced drivers also benefit from programs like accident forgiveness, which further stabilizes premiums.

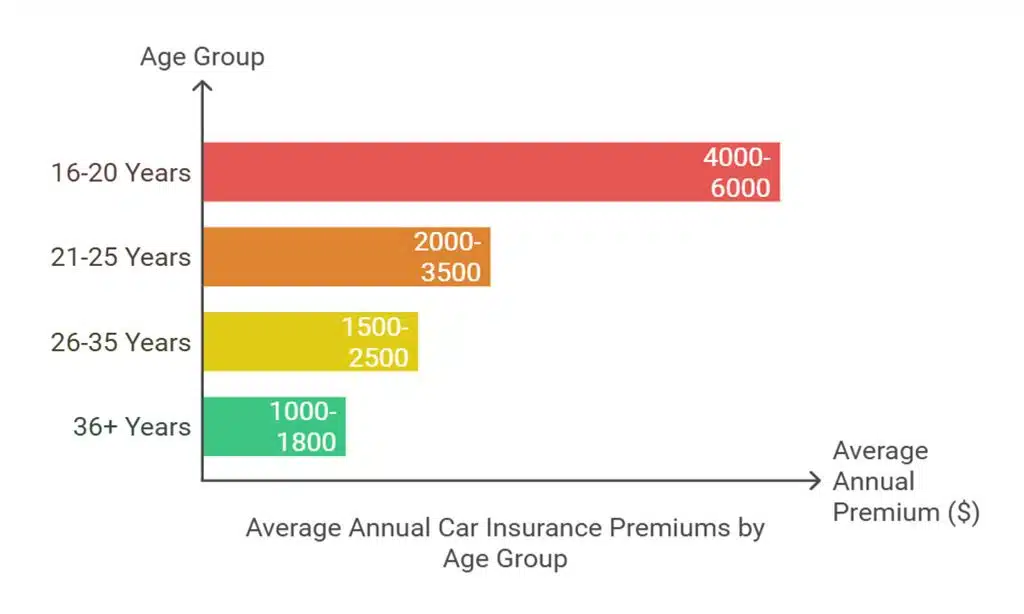

Average Annual Premium by Age Group

| Age Group | Average Annual Premium |

| 16-20 Years | $4,000 – $6,000 |

| 21-25 Years | $2,000 – $3,500 |

| 26-35 Years | $1,500 – $2,500 |

| 36+ Years | $1,000 – $1,800 |

Real-Life Example: A 22-year-old driver in Texas with two years of driving experience and a speeding ticket on record could pay up to $4,500 annually for full coverage.

By maintaining a clean record for three years and completing a defensive driving course, they could reduce this amount by nearly $1,000.

Participating in insurer-provided safe driving programs can also help lower premiums significantly.

2. Driving Record and Claims History

Your driving record is one of the most critical car insurance premium factors. Speeding tickets, DUI offenses, and reckless driving violations can lead to significant premium hikes, sometimes as much as 30-50%.

A single DUI offense, for instance, can raise your premium by up to 75%. Even minor violations like failing to signal can contribute to a higher risk profile.

The Effect of Accident Claims on Premiums

If you’ve filed multiple claims in the past, insurers may view you as a higher risk. Claim-free drivers often qualify for “safe driver discounts,” reducing their premiums.

Even minor claims can affect your premium, especially if they occur within a short time frame.

Common Violations and Their Impact on Premiums

| Violation Type | Average Premium Increase |

| Speeding Ticket | 20% – 30% |

| DUI | 50% – 75% |

| At-Fault Accident | 40% – 60% |

Actionable Tip: Many insurers offer accident forgiveness programs. Enroll in these if available, as they can help prevent a single claim from drastically increasing your premium.

Consider defensive driving courses, which can often result in a 5-15% discount on your premium.

3. Location and ZIP Code

Where you live significantly impacts your premium. Urban areas typically have higher premiums due to increased traffic, higher accident rates, and greater risk of theft.

Conversely, rural areas often have lower rates. For example, drivers in New York City can pay up to three times more than those in rural Kansas.

Crime and Accident Rates in Your Area

Insurers analyze crime statistics, including vehicle theft and vandalism rates, in your ZIP code. High-risk areas lead to higher premiums, even if you personally have a clean driving record. For this reason, moving to a safer neighborhood can sometimes lower your premium.

Average Premium by Location Type

| Location Type | Average Annual Premium |

| Urban Areas | $1,800 – $3,000 |

| Suburban Areas | $1,200 – $2,000 |

| Rural Areas | $800 – $1,500 |

Current Data: According to a 2025 study by the Insurance Information Institute, Florida and Michigan have the highest average premiums due to dense populations and no-fault insurance laws, while Maine has the lowest rates.

By understanding your location’s impact, you can better negotiate coverage and rates.

4. Type of Vehicle You Drive

Vehicles with advanced safety features, such as automatic braking and lane-keeping assist, often qualify for lower premiums.

Safer vehicles reduce the likelihood of severe accidents, which benefits both you and your insurer.

Models like the Subaru Outback and Honda CR-V are known for offering excellent safety ratings and lower insurance costs.

Why Luxury and Sports Cars Cost More

High-performance and luxury vehicles typically have higher premiums due to increased repair costs and a higher likelihood of theft.

For instance, insuring a sports car can cost twice as much as a standard sedan. Cars like the Dodge Charger and Tesla Model S often rank high on insurers’ lists of expensive vehicles to cover.

Premiums by Vehicle Type

| Vehicle Type | Average Annual Premium |

| Standard Sedan | $1,200 – $1,800 |

| SUV | $1,500 – $2,200 |

| Luxury Car | $2,500 – $4,000 |

| Sports Car | $3,000 – $5,000 |

Example: A driver insuring a Toyota Corolla with a high safety rating might pay $1,200 annually, while a luxury vehicle like a BMW X5 could cost upwards of $3,500.

Choosing cars with strong safety features can reduce premiums.

Pro Tip: Before purchasing a vehicle, check its insurance cost to avoid unexpected expenses.

5. Annual Mileage and Usage

The more you drive, the higher your risk of accidents. Insurers often offer discounts for low-mileage drivers who drive less than 7,500 miles annually.

Drivers with commutes over 15,000 miles annually typically pay higher premiums.

How Work Commutes Affect Your Premium

If you use your car primarily for commuting, you might face higher premiums compared to someone who uses their vehicle for leisure.

Many insurers now offer telematics programs that monitor mileage and reward low usage.

Annual Mileage and Average Premiums

| Annual Mileage | Average Annual Premium |

| Less than 7,500 | $1,000 – $1,500 |

| 7,500 – 15,000 | $1,500 – $2,000 |

| Over 15,000 | $2,000 – $3,000 |

Actionable Insight: Signing up for a usage-based insurance program like Progressive’s Snapshot can result in discounts of up to 20% for low-mileage drivers.

Additionally, carpooling or using public transportation part-time can help reduce premiums.

6. Coverage Levels and Deductibles

Comprehensive coverage provides extensive protection but comes with a higher premium. Liability-only coverage is more affordable but offers limited protection.

Comprehensive plans are ideal for newer or high-value vehicles, while liability is often sufficient for older cars.

The Impact of Higher Deductibles on Premiums

Opting for a higher deductible can lower your premium, but it means paying more out of pocket in case of a claim.

For example, increasing your deductible from $500 to $1,000 could save you 10-20% annually.

Deductibles and Their Impact on Premiums

| Deductible Amount | Average Premium Reduction |

| $500 | Standard |

| $1,000 | 10% – 20% Savings |

| $2,000 | 20% – 30% Savings |

FAQ: What’s the ideal deductible amount?

Answer: It depends on your financial situation. A $500 deductible balances affordability and risk for many drivers.

7. Credit Score and Financial History

In most states, insurance companies use credit-based insurance scores to predict the likelihood of a claim.

Drivers with good credit scores often enjoy lower premiums. States like California, Hawaii, and Massachusetts prohibit this practice.

How to Improve Your Credit to Lower Premiums

- Pay bills on time.

- Reduce outstanding debt.

- Monitor your credit report for errors. Correcting errors can immediately improve your score.

Quick Tip: Regularly check your credit score and dispute inaccuracies to maintain favorable insurance rates. A small increase in credit score can result in noticeable premium reductions.

Additional Tips to Reduce Your Car Insurance Premium

- Bundle Policies for Discounts: Combine auto and home insurance for multi-policy savings.

- Take Advantage of Safe Driver Discounts: Install telematics devices or enroll in safe driving programs offered by your insurer.

- Shop Around: Compare quotes from multiple providers to find the best deal.

- Review Coverage Needs Annually: Ensure you’re not over-insured and adjust coverage levels as needed.

- Improve Vehicle Security: Installing anti-theft devices can lower premiums significantly.

Takeaway

Car insurance premiums depend on various factors, including age, driving history, location, and vehicle type.

By understanding these car insurance premium factors, you can make informed decisions to lower your costs without compromising coverage.

Take proactive steps, like improving your credit score, maintaining a clean driving record, and comparing rates regularly, to ensure you’re getting the best value.

Prioritizing the “car insurance premium factors” that apply most to your situation can lead to significant savings over time.