For the modern founder, the fundraising narrative has long followed a predictable arc: build a prototype, polish a pitch deck, and enter the venture capital rollercoaster. However, a shift is underway. With venture capital becoming more cautious and the bar for traction rising higher, a growing number of founders are opting for a different path. They are embracing a startup bootstrapped fundraising strategya hybrid model that prioritizes revenue and customer funding over institutional checks.

This approach isn’t about stubbornly refusing outside capital. It is about controlling your destiny. It means leveraging customer revenue, strategic pre-sales, and alternative financing to grow on your own terms. This article explores how to build a fundraising strategy that relies on your business fundamentals rather than investor sentiment.

What Does “Bootstrapped Fundraising” Really Mean?

At first glance, the term “bootstrapped fundraising” might seem like a contradiction. Fundraising typically implies asking for money, while bootstrapping implies self-sufficiency. In practice, a startup bootstrapped fundraising strategy bridges these two concepts.

It is the art of funding growth through non-dilutive means and strategic, customer-centric capital generation. You are still “raising” funds, but your investors are your customers, your partners, and your future revenue streams. This method forces a level of fiscal discipline that venture-backed startups often lack, building a foundation of sustainable growth rather than “growth at all costs.”

The Shift from Equity to Revenue

The traditional model trades equity for cash to fund customer acquisition. The bootstrapped model inverts this. It uses customer acquisition to generate cash, which then funds further growth. This creates a flywheel effect: happy customers pay for features, which attracts more customers.

Why Founders Are Choosing Control Over Cash

Opting for a bootstrapped approach isn’t always a matter of necessity; increasingly, it is a strategic choice. The benefits extend far beyond simply retaining a larger percentage of your company.

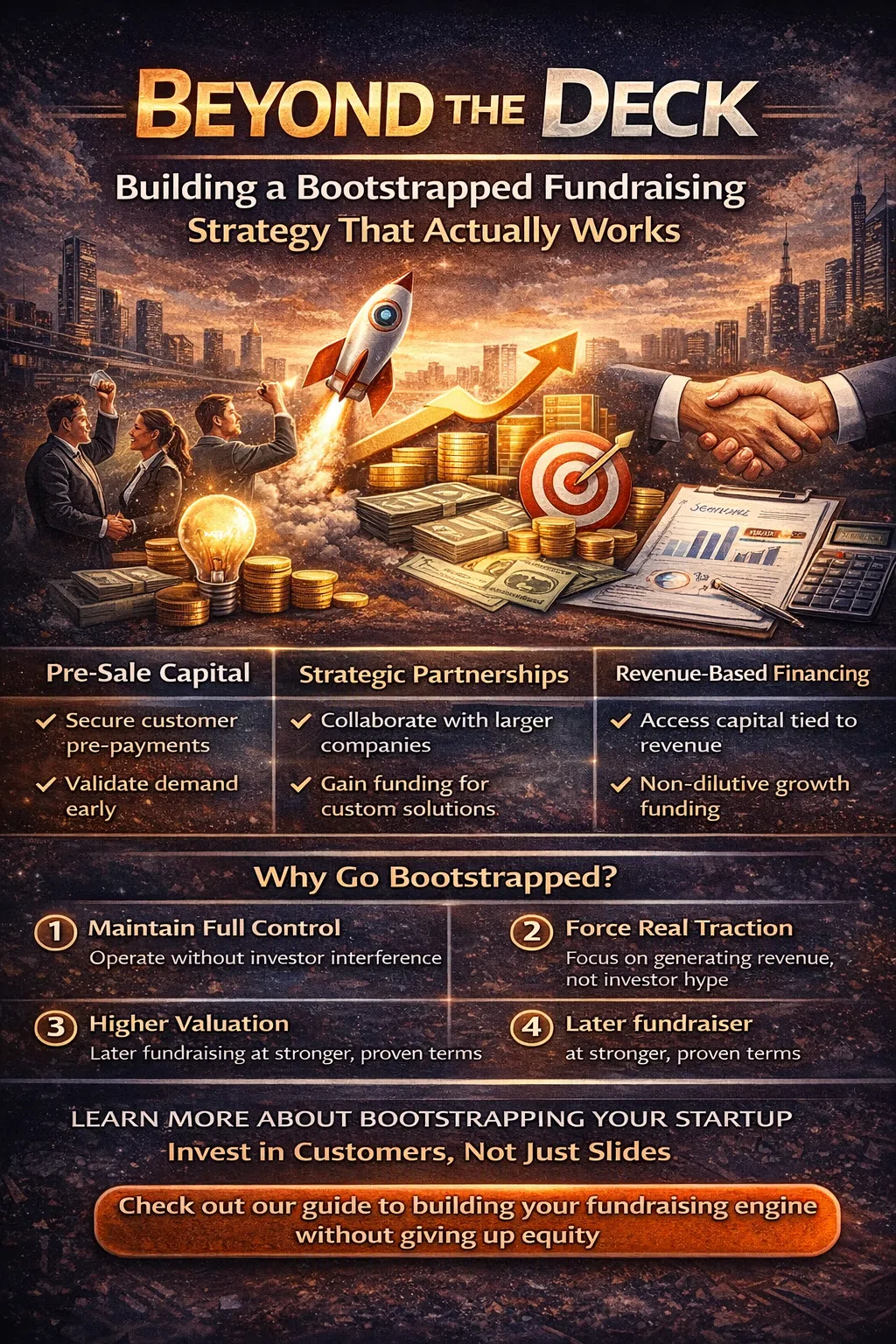

- Full Decision-Making Authority: Without a board of investors demanding specific exit timelines, you retain the freedom to pivot, experiment, or double down on niche markets that VCs might consider “unsexy.”

- Forced Product-Market Fit: You cannot fake traction with paid ads when you rely on revenue. Your product must solve a genuine pain point that people are willing to pay for now.

- Higher Valuation Later: If you eventually choose to raise venture capital, approaching the table with significant revenue, a proven unit economy, and no debt puts you in a position of strength. You are raising to scale a proven machine, not to test a hypothesis.

Building Your Bootstrapped Fundraising Engine

Transitioning from a grant-dependent or investor-dependent mindset to a bootstrapped one requires a fundamental shift in operations. You must view your business as a self-sustaining ecosystem. Here is how to build the core components of that engine.

1. Customer-First Capital: The Art of the Pre-Sale

The most effective tool in a startup bootstrapped fundraising strategy is the pre-sale. If you are building a SaaS product, a physical good, or a service, pre-selling validates demand while funding development.

- Identify Early Adopters: Look for businesses or individuals who are actively complaining about the problem you solve. They are your ideal pre-sale candidates.

- Offer Incentives: Provide a significant discount, lifetime pricing, or exclusive feature access in exchange for upfront payment.

- Deliver Religiously: The pressure is now on. You have a responsibility to deliver, which creates a healthy accountability loop.

2. Strategic Partnerships as a Funding Source

Large, established companies often have innovation budgets and are looking for agile startups to solve specific ecosystem gaps. Instead of paying them for distribution, structure partnerships where they pay you.

This could involve development fees for custom integrations, licensing your technology white-label, or co-marketing agreements where the larger partner funds the campaign in exchange for access to your solution.

3. Revenue-Based Financing (RBF)

As you generate consistent monthly recurring revenue (MRR), you unlock access to Revenue-Based Financing. RBF providers offer a capital injection in exchange for a fixed percentage of your future monthly revenue until a cap is paid back.

This is the modern alternative to a bank loan or a VC bridge round. It is non-dilutive and aligns with your cash flow; when revenue dips, your repayment dips.

The Psychological Shift: Sales Over Storytelling

Fundraising in the venture world is largely about storytelling. You are selling a vision of a massive future. Bootstrapped fundraising is about selling reality. It requires a founder to transition from “visionary” to “closer.”

You must become obsessed with the sales cycle. Every conversation is an opportunity to generate cash. This doesn’t mean you abandon the long-term vision; it means you anchor that vision in the tangible value you provide today. It is a grittier, more immediate way of building a business, but it fosters a resilience that pure venture funding rarely provides.

Frequently Asked Questions

To ensure this content performs well in voice search and AI-generated answers, here are clear, concise responses to common queries regarding bootstrapped fundraising.

Can you raise funds while bootstrapping?

Yes. Bootstrapping does not mean using zero capital; it means using non-dilutive capital. You can raise funds by securing customer pre-payments, obtaining revenue-based financing, winning small business grants, or negotiating strategic partnership advances. You are raising money without giving away equity.

What is the difference between bootstrapping and fundraising?

Bootstrapping relies on internal cash flow and revenue generated by the business to fuel growth. Traditional fundraising involves selling equity (shares) to external investors like angel investors or venture capitalists in exchange for a lump sum of cash. A bootstrapped fundraising strategy is the hybrid approach of aggressively seeking non-dilutive capital.

How do you fund a startup with no money?

If you have no personal capital, focus on “zero-capital” validation. Offer a service manually that you intend to automate, or build a Minimum Viable Product (MVP) using no-code tools. Use the revenue from your manual service to fund the automation. Your first paying customer is your first investor.

Is bootstrapping better than VC funding?

Neither is inherently better; they are suited for different goals. Bootstrapping is better for founders who want full control, sustainable growth, and the ability to build a business that aligns closely with customer needs. VC funding is better for founders targeting massive, rapid market domination in highly competitive spaces where speed is the primary advantage.

A Global Perspective on Funding

The concept of a startup bootstrapped fundraising strategy is not confined to Silicon Valley. It resonates globally because it relies on universal business principles: revenue, discipline, and customer value.

- In Europe and Asia: There is a strong cultural affinity for bootstrapping due to more conservative lending environments and a historical emphasis on “cash is king.” Founders here often view debt with caution but embrace revenue-based models as a natural progression of trade.

- In Emerging Markets: Bootstrapping is often the only option. This has led to incredible innovation in “lean” methodologies. Startups in these regions have perfected the art of doing more with less, proving that resource constraints often breed the most resilient business models.

- Language Nuance: When communicating this strategy internationally, avoid jargon like “burn rate” or “down round.” Instead, focus on universal terms like “profitability,” “customer-funded growth,” and “financial independence.” This ensures your message is clear whether you are speaking to a founder in Berlin, Singapore, or São Paulo.

Navigating the Challenges

Bootstrapping is not without its hurdles. It requires patience. Growth will likely be slower in the short term compared to a well-funded competitor who is buying market share.

- Cash Flow Management: You must become an expert in cash flow forecasting. Running out of money isn’t just a lost opportunity; it’s the end of the road.

- Resource Constraints: You will wear many hats. You might be the CEO in the morning and the customer support agent in the afternoon. This requires a high tolerance for ambiguity and hard work.

- Competitive Pressure: If you are in a space with venture-backed competitors, you cannot outspend them. You must outsmart them. Focus on customer service, niche markets, and product depth that they cannot replicate because they are too busy chasing broad metrics.

The Future is Funded by Value

The era of easy money in the startup world has receded, and in its place, a more robust, logical approach has emerged. Building a startup bootstrapped fundraising strategy is more than a financial necessity; it is a strategic advantage. It aligns your incentives perfectly with those of your customers, ensuring that every feature built and every market entered is driven by genuine demand, not just investor pressure.

By focusing on revenue as your primary fuel source, you build a business that is not only capital-efficient but inherently more valuable. You prove your worth in the market, not just on a pitch deck.