Blockchain has moved far beyond a niche technology for cryptocurrency fans. It now underpins payments, lending, supply chains, identity, and even experiments with national digital currencies. As the market matures, understanding key blockchain trends is essential for anyone making business, policy, or investment decisions.

Analysts now estimate that the global blockchain technology market is in the tens of billions of dollars and could grow to several hundred billion, or even over a trillion dollars, within the next decade. While figures vary, the direction is clear: rapid expansion across finance, logistics, healthcare, government, and consumer apps.

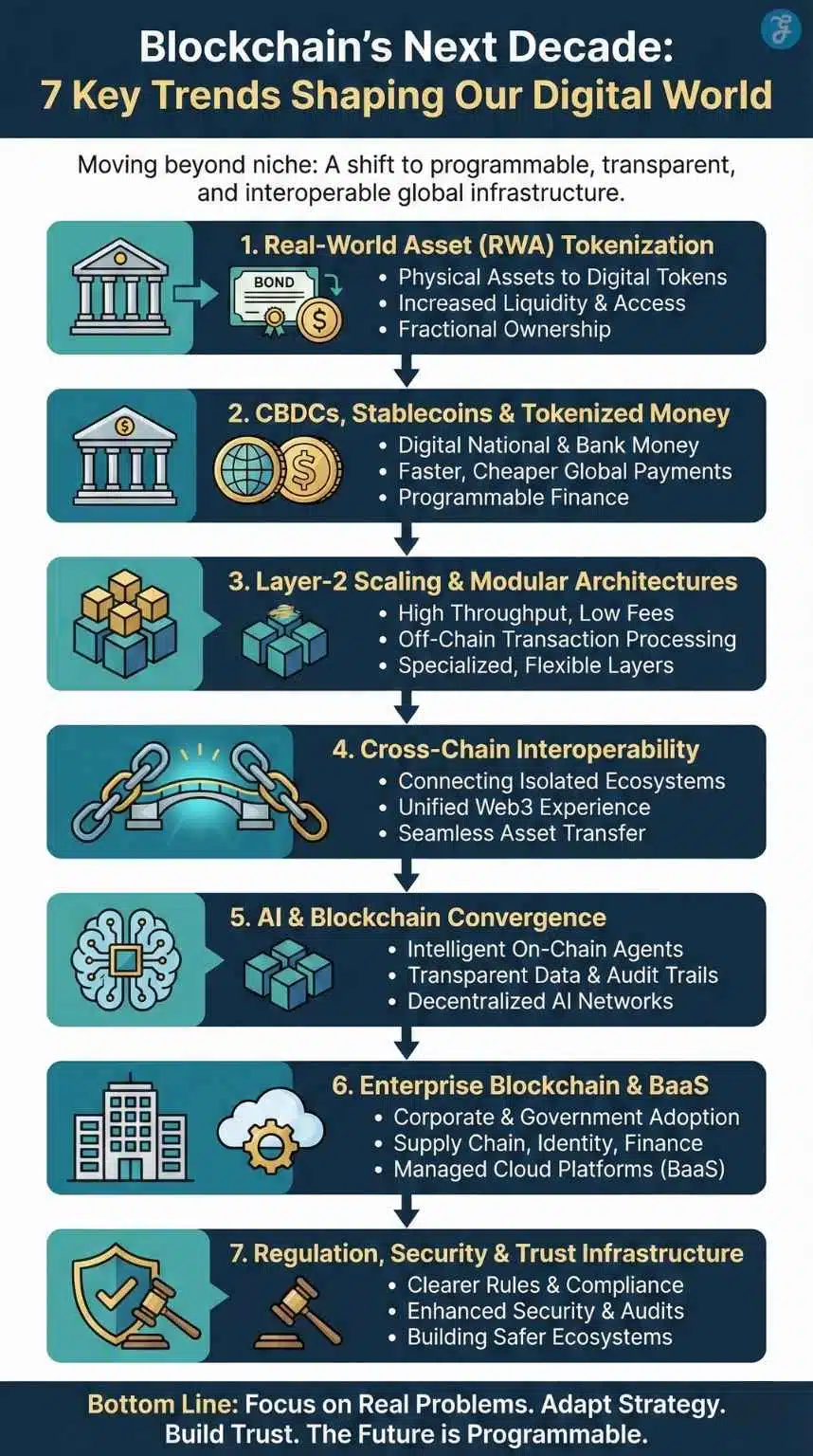

In this guide, we break down the most important blockchain trends to watch in the coming years. You will see how tokenized real-world assets, digital money, scaling solutions, interoperability, AI integration, enterprise platforms, and regulation are reshaping how value moves and how trust is built online.

Key blockchain trends shaping the next decade

Before diving into each area, it helps to step back and see how they fit together. These trends are not separate islands. Tokenized assets need digital money rails. Scalable Layer-2 networks depend on interoperability. AI agents rely on secure data and clear rules.

At a high level, these blockchain trends are driven by four forces:

- The need for faster and cheaper financial infrastructure.

- The search for more transparent and auditable data.

- The pressure to comply with evolving regulations.

- The desire to embed automation and intelligence into transactions.

If you are a business leader, policymaker, or developer, these forces will influence your strategy. They will affect how you design products, manage risk, and choose partners or platforms.

Overview of the 7 trends

| Trend | Trend name | Core theme |

| 1 | Real-world asset tokenization | Turning physical/financial assets into tokens |

| 2 | CBDCs, stablecoins, and tokenized money | Digital cash and bank money |

| 3 | Layer-2 scaling and modular architectures | Faster, cheaper transactions |

| 4 | Cross-chain interoperability | Connecting many chains and ecosystems |

| 5 | AI and blockchain convergence | Intelligent, automated on-chain agents |

| 6 | Enterprise blockchain and BaaS | Corporate and government adoption |

| 7 | Regulation, security, and trust infrastructure | Making the ecosystem safer and compliant |

Trend 1: Real-world asset tokenization goes mainstream

Real-world asset (RWA) tokenization means representing assets like government bonds, real estate, private credit, invoices, or commodities as digital tokens on a blockchain. These tokens can then be traded, used as collateral, or embedded into smart contracts.

Recent reports show this segment has moved well beyond pilots. Estimates suggest that tokenized real-world assets (excluding stablecoins) grew to tens of billions of dollars by mid-2025, with strong double-digit or even high double-digit annual growth rates. At the same time, broader “asset tokenization” forecasts run into the trillion-dollar range over the next decade, depending on definitions and scenarios.

The big attraction is liquidity. Tokenization can slice large, illiquid holdings into smaller units. That makes it easier for investors to buy or sell pieces of assets that were previously hard to trade, such as commercial buildings, private funds, or long-dated bonds. Tokens can also carry built-in rules for who can hold them, how they can be traded, and when payouts occur.

Use cases now include tokenized treasury bills and money-market-style funds, tokenized real estate and infrastructure, and tokenized private credit or revenue shares. Large financial institutions and exchanges are acquiring tokenization platforms, launching regulated products, or partnering with specialized providers.

Challenges remain. Laws differ by country, and many regulators still treat most tokenized assets as securities, with strict rules for investor protection, disclosures, and KYC/AML. Technical issues such as reliable price oracles, custody, and interoperability between chains must also be solved at scale.

RWA tokenization summary table

| Aspect | Key facts/ideas | Implication |

| Market size | RWA tokens are already in tens of billions of USD | The trend has moved beyond early experiments |

| Use cases | Treasuries, real estate, private credit, commodities | Broad impact across finance and real assets |

| Benefits | Liquidity, fractional ownership, programmable compliance | More investors can access more types of assets |

| Key risks | Legal clarity, KYC/AML, oracle risk, tech fragmentation | Need strong regulation and infrastructure |

Trend 2: CBDCs, stablecoins, and tokenized money

Central bank digital currencies (CBDCs) and regulated stablecoins are changing what money looks like on blockchain rails. A CBDC is a digital form of a national currency issued by a central bank. Stablecoins are digital tokens, often backed one-to-one by safe assets like cash and government bonds. Tokenized deposits represent regular bank deposits recorded as tokens instead of entries in traditional databases.

According to public trackers, well over a hundred countries and currency unions are exploring CBDCs, with many now in advanced stages, such as development, pilot, or launch. Some jurisdictions are testing retail CBDCs for everyday payments, while others focus on wholesale CBDCs for interbank settlement.

In parallel, stablecoins have become one of the largest real-world blockchain applications. The leading dollar-pegged stablecoins have market capitalizations in the tens or even hundreds of billions of dollars and support hundreds of billions of dollars in monthly transaction volume. New laws in major markets are introducing stricter reserve, audit, and licensing rules for issuers, which could further legitimize this sector.

Tokenized deposits, often run by banks themselves, offer another path. They let banks keep their traditional role while using tokens for instant, programmable transfers, settlement, and collateral. Some projects aim to create “financial internet”-style infrastructures where CBDCs, tokenized deposits, and tokenized securities operate on shared ledgers.

The benefits are clear: faster cross-border payments, cheaper remittances, instant settlement of securities and invoices, and transparent audit trails. The risks are also serious: system-wide cyberattacks, operational failures, privacy concerns, and the possibility of changing the balance between central banks and commercial banks.

Digital money summary table

| Aspect | Key facts/ideas | Implication |

| CBDC adoption | 100+ jurisdictions exploring CBDCs | Digital public money is likely to be in many economies |

| Stablecoins | Large caps and growing transaction volumes | Blockchain-based payments are already at scale |

| Tokenized deposits | Bank deposits issued as tokens | Bridges traditional banking and Web3 |

| Main risks | Privacy, cybersecurity, and impact on banks | Careful design and regulation are essential |

Trend 3: Layer-2 scaling and modular architectures

Blockchains like Ethereum face a fundamental trade-off between decentralization, security, and throughput. Base layers process a limited number of transactions per second. When demand spikes, users face higher fees and slower confirmations.

Layer-2 networks aim to solve this by moving most activity off the base chain. Rollups bundle large batches of transactions, process them off-chain, and periodically post compressed proofs back to the main network. This approach can dramatically increase throughput and reduce fees while benefiting from the security of the underlying chain.

By 2025, combined daily transactions across major Ethereum Layer-2 networks had already reached tens of millions per day at peak, far exceeding base-layer volumes. These networks host DeFi protocols, gaming platforms, NFT marketplaces, social apps, and experiments with on-chain identity and reputation.

At the same time, the industry is moving toward modular architectures, where execution, consensus, and data availability can be handled by different layers or specialized chains. This makes it easier to tailor infrastructure for specific needs, such as low-latency trading, enterprise workflows, or high-volume micro-payments.

For businesses and developers, Layer-2 solutions open the door to new use cases that were previously impossible because of cost. Examples include pay-per-use APIs, streaming payments by the second, in-game economies with tiny transactions, and machine-to-machine payments for IoT devices.

Layer-2 and modular summary table

| Aspect | Key facts/ideas | Implication |

| Problem solved | Base layers are slow and expensive | Limits mainstream adoption without scaling |

| Layer-2 impact | Tens of millions of daily transactions | Enables smaller, more frequent on-chain actions |

| Modular design | Separate layers for execution, consensus, and data | Flexible infrastructure for different use cases |

| Key challenges | Fragmented liquidity, complex UX, bridge risk | UX and security must improve for mass adoption |

Trend 4: Cross-chain interoperability and unified Web3 experiences

The blockchain ecosystem is now multi-chain by default. There are many public networks, permissioned enterprise chains, and Layer-2 rollups. Each has its own tokens, smart-contract standards, and user communities. Without good interoperability, value and data become siloed.

Interoperability solutions aim to connect these networks. They include cross-chain bridges, messaging protocols, shared security models, and frameworks such as inter-blockchain communication (IBC) that allow different chains to send data and value to each other.

In recent years, several large bridge hacks have exposed the risks of moving assets between chains. This has pushed the industry toward more robust designs, including light-client-based bridges, audited multi-sig schemes, and native interoperability features baked directly into protocols.

For users, the ideal outcome is “chain-abstracted” experiences. Instead of manually bridging assets, selecting networks, and worrying about gas tokens, they simply state intent: swap one asset for another, send money to a friend, or buy an in-game item. Wallets and infrastructure handle the cross-chain complexity in the background.

Interoperability summary table

| Aspect | Key facts/ideas | Implication |

| Current landscape | Dozens of public, private, and Layer-2 chains | Value and users are scattered across ecosystems |

| Interop solutions | Bridges, messaging, shared security, IBC | Enable cross-chain transfers and data sharing |

| User goal | Chain-abstracted, intent-based UX | Less friction and confusion for everyday users |

| Main risks | Bridge exploits, governance, complexity | Requires strong security and standards |

Trend 5: AI and blockchain convergence

Artificial intelligence and blockchain are often discussed separately, but their convergence is becoming a significant theme. AI systems need high-quality, trusted data and clear audit trails. Blockchains offer tamper-evident records and programmable logic.

One emerging idea is on-chain AI agents. These are software agents that can hold digital assets, interact with smart contracts, execute trading or governance strategies, and follow pre-defined rules coded into their logic. Over time, such agents could handle tasks ranging from portfolio rebalancing to automated compliance checks.

Another area is decentralized AI. Instead of one company owning all the data and models, networks allow many participants to contribute data, compute, or models. Blockchain can help coordinate rewards, track contributions, and ensure transparent governance. This is attractive for industries where data privacy and auditability are critical, such as healthcare, finance, and supply chains.

Blockchain can also support AI accountability. Logs stored on a blockchain can prove which data sets trained a model, which version was used, and how outputs were generated. This can help regulators and courts understand decisions that affect credit scores, hiring, or access to services.

However, combining these technologies raises new questions. Who is responsible if an autonomous agent causes losses? How do we prevent biased models from making unfair decisions at scale? Which parts of AI pipelines should be on-chain versus off-chain to balance cost, privacy, and transparency?

AI–blockchain convergence summary table

| Aspect | Key facts/ideas | Implication |

| On-chain agents | AI systems that hold assets and call contracts | New forms of automation and financial services |

| Decentralized AI | Shared data, compute, and models | Fairer access and community-governed ecosystems |

| Accountability | On-chain logs and provenance for AI decisions | Better auditability and regulatory compliance |

| Key concerns | Liability, bias, privacy, scalability | Governance and design choices are critical |

Trend 6: Enterprise blockchain and BaaS

Enterprise blockchain focuses on business and government use cases where participants are known, and permissions are controlled. Instead of letting anyone participate, these networks require identity checks and formal onboarding.

Estimates suggest the enterprise blockchain market was under USD 10 billion in 2023 but could grow to well over USD 100 billion by 2030, with high double-digit compound annual growth rates. When you add related infrastructure, consulting, and cloud services, some analyses put the broader enterprise-related blockchain ecosystem in the hundreds of billions over the next decade.

Use cases include:

- Supply chain traceability for food, pharmaceuticals, and luxury goods.

- Trade finance, syndicated loans, and corporate payments.

- Document and certificate verification for education, licensing, and public services.

- Identity and access management for enterprise systems.

Blockchain-as-a-Service (BaaS) platforms from major cloud providers and specialized firms lower the barrier to entry. They offer managed nodes, smart-contract templates, integration tools, and dashboards. Businesses can focus on process design while the provider handles infrastructure, security patches, and uptime.

Real deployments are growing. For example, logistics networks trace shipments across many countries and companies. Banks run permissioned networks for faster settlement and better KYC data sharing. Governments experiment with land registries, grant management, and digital identities.

Yet there are hurdles. Integrating blockchain with legacy systems is complex. Skills are scarce. Governance can be slow when many stakeholders must agree. Data privacy laws such as GDPR require careful design so that personal data is not permanently stored on public ledgers.

Enterprise blockchain summary table

| Aspect | Key facts/ideas | Implication |

| Market growth | Fast-growing, heading toward a large multi-billion-dollar | Significant long-term enterprise investment |

| Core sectors | Finance, logistics, healthcare, public sector | Broad range of mission-critical applications |

| BaaS role | Cloud providers offer managed blockchain stacks | Easier adoption for firms without deep expertise |

| Main challenges | Integration, skills, privacy, governance | Need strong partners and realistic roadmaps |

Trend 7: Regulation, security, and “trust layer” infrastructure

The last few years have seen major hacks, protocol failures, and high-profile collapses of exchanges and platforms. At the same time, regulators around the world have started to define clearer rules for digital assets, stablecoins, and service providers.

This is pushing blockchain toward a more mature “trust layer” role in the digital economy. Regulators focus on disclosures, reserve quality, segregation of customer assets, risk management, and anti-money-laundering checks. New laws specify how issuers must handle stablecoins, what counts as a security token, and how custodians and exchanges must operate.

On the technical side, security practices are improving. Smart-contract audits, bug-bounty programs, formal verification, and real-time on-chain monitoring are becoming standard for serious projects. Insurance-like products and backstops are emerging, though still early.

Identity and compliance layers are also evolving. Some products offer permissioned pools where only KYC-verified addresses can participate. Others use zero-knowledge proofs to show compliance (for example, that a user is from an allowed region and not on a sanctions list) without revealing full personal data.

Regulation and trust infrastructure summary table

| Aspect | Key facts/ideas | Implication |

| Regulatory trend | Clearer rules for assets and intermediaries | Reduces uncertainty, encourages institutions |

| Security focus | Audits, monitoring, and better engineering | Fewer catastrophic failures over time |

| Compliance tech | KYC layers, ZK proofs, permissioned DeFi | Balances regulation with privacy where possible |

| Trade-offs | More safety but more friction | Users and projects must adapt to new norms |

How businesses and builders can act on these blockchain trends

Blockchain trends are interesting, but what should you actually do with them? The answer depends on your role, but some common steps apply across organizations.

Define real problems before picking technology. Many failed projects started with “we need a blockchain” rather than “we need to solve this pain point.” Focus on use cases where decentralization, shared data, or programmable money truly add value.

Start small. Pilot projects in one product line, geography, or workflow are a safer way to learn. You can test tokenized invoices with a select group of suppliers, experiment with a CBDC or stablecoin for internal treasury flows, or integrate a Layer-2 payment option in a single app feature.

Invest in literacy. Non-technical leaders need enough understanding to ask good questions about risk, compliance, and ROI. Technical teams need skills in smart-contract security, key management, cross-chain integration, and data modeling.

Think about partnerships. Most organizations will not run their own blockchains from scratch. They will join existing networks, use BaaS platforms, or integrate with specialized providers for tokenization, custody, analytics, or compliance.

Finally, keep your strategy flexible. This field changes fast. The most resilient organizations treat blockchain as a capability, not a single project. They monitor regulatory changes, market signals, and technical breakthroughs, and they adjust their roadmaps accordingly.

Action plan summary table

| Role | Practical next steps | Key questions to ask |

| Business leaders | Identify use cases, sponsor pilots, and build teams | What problems does this solve? What is the ROI? |

| Developers | Learn smart contracts, security, and cross-chain | How do we minimize risk and complexity? |

| Risk/compliance | Map rules, align with regulators, choose vendors | How do we stay compliant without blocking innovation? |

| Investors | Diversify, focus on fundamentals, and watch regulation | Which trends have real users and revenue? |

FAQs about blockchain trends

What industries will be most affected by blockchain trends?

Finance and payments are still at the center, especially with tokenized assets, CBDCs, and stablecoins. But supply chain, logistics, healthcare, energy, and public services are also likely to be heavily affected as identity, traceability, and smart-contract automation spread.

Is blockchain still relevant if I am not in crypto or finance?

Yes. Many use cases do not involve speculative tokens. For example, tracking components in manufacturing, verifying academic or professional credentials, or running tamper-evident audit logs can all use blockchain without any trading element.

How can small and medium-sized businesses start exploring blockchain?

SMBs can start with simple steps, such as accepting stablecoin payments through a trusted payment processor, using blockchain-based tools for document verification, or joining supply chain platforms that already integrate blockchain under the hood. They do not need to build infrastructure themselves.

Are blockchains bad for the environment?

The environmental impact varies by design. Energy-hungry proof-of-work systems have drawn criticism. Many newer networks, including major smart-contract platforms after upgrades, use proof-of-stake or similar mechanisms that greatly reduce energy use. Environmental impact is now a core design concern for most new projects.

How do blockchain trends relate to Web3 and the “metaverse”?

Web3 is a broad term for user-owned internet services built on tokens, smart contracts, and decentralized governance. Blockchain trends such as tokenization, interoperability, and Layer-2 scaling underpin Web3 applications. In virtual worlds and gaming, they enable verifiable ownership of digital items and open marketplaces for in-game assets.

Can blockchain make AI safer and more transparent?

Blockchain can help by recording data sources, model versions, and important decision steps in tamper-evident logs. This does not solve every problem of AI, but it can improve traceability, accountability, and evidence for audits or investigations.

Bottom Line: Making sense of blockchain trends

Blockchain is no longer an experimental technology searching for a purpose. It is becoming a core part of financial infrastructure, supply chains, digital identity systems, and even AI governance.

Focus on real problems. Follow the data, not the hype. Understand the trade-offs between openness and control, speed and security, innovation and compliance. Pick partners and platforms that can evolve as the landscape changes.

If you treat these blockchain trends as a guide rather than a rigid prediction, they can help you design strategies that survive regulatory shifts, technological breakthroughs, and market cycles. The details will change, but the shift toward programmable, transparent, and interoperable digital infrastructure is likely to shape the next decade of the internet and the global economy.