Bitcoin saw a sharp decline late Sunday into Monday morning, falling to around $95,000 as the cryptocurrency market responded negatively to new U.S. tariffs implemented by President Donald Trump’s administration. The decline also triggered a broader selloff in cryptocurrency-related stocks, as investors weighed the potential economic impact of escalating trade tensions.

Bitcoin’s latest drop marks its fourth consecutive day of losses, continuing a downward trend from its peak of over $109,000 last month ahead of President Trump’s inauguration. This decline comes as macroeconomic pressures—including concerns over inflation, Federal Reserve policies, and regulatory uncertainty—continue to weigh on risk assets like cryptocurrencies.

Crypto Stocks Decline Alongside Bitcoin

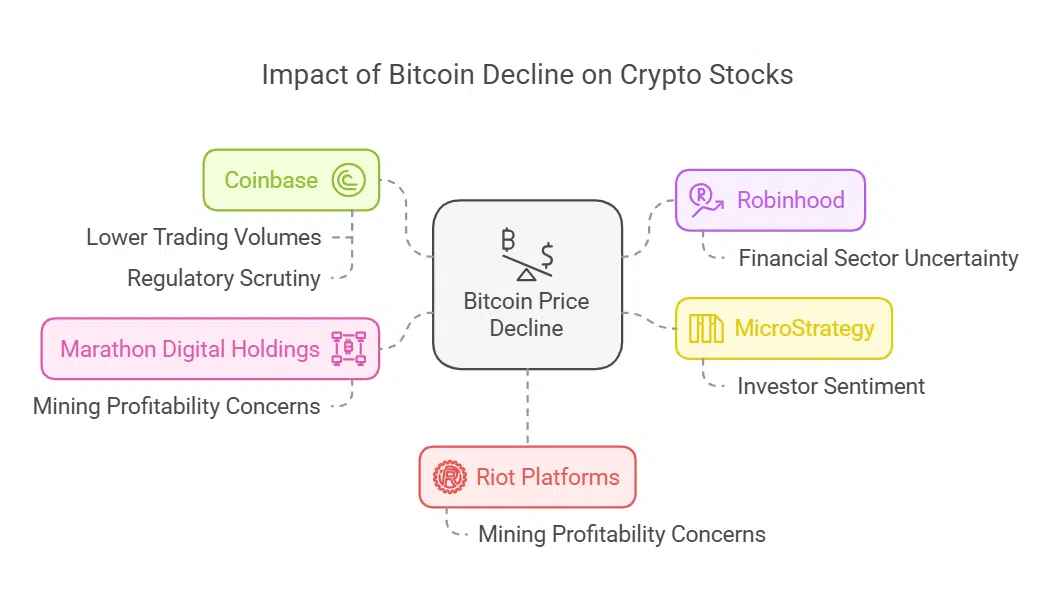

Several cryptocurrency-related stocks mirrored Bitcoin’s drop in premarket trading on Monday, experiencing losses of 5% or more:

- Coinbase (COIN): The major crypto exchange saw its shares decline by more than 5%, reflecting investors’ fears about lower trading volumes and heightened regulatory scrutiny.

- Robinhood (HOOD): The trading platform, which allows users to buy and sell cryptocurrencies, also saw a 5%+ drop as broader uncertainty loomed over the financial sector.

- MicroStrategy (MSTR): The company, which holds billions of dollars’ worth of Bitcoin on its balance sheet, saw its stock fall over 5%, as Bitcoin’s price slump directly impacted investor sentiment.

- Marathon Digital Holdings (MARA) & Riot Platforms (RIOT): Both crypto mining firms recorded losses exceeding 5%, reflecting broader market concerns about Bitcoin mining profitability if prices continue to decline.

Trump’s New Tariffs and Their Economic Ramifications

The crypto market turmoil is largely attributed to the latest tariffs announced by President Trump on Saturday. The U.S. government has imposed new 25% tariffs on all goods imported from Canada and Mexico, as well as an additional 10% tariff on all imports from China. These moves are part of Trump’s strategy to pressure trading partners and address concerns over illegal immigration and drug trafficking.

Key tariff details:

- 25% tariffs on all imported goods from Canada and Mexico

- 10% additional tariffs on all imports from China

- Set to take effect on February 4, 2025

The administration has justified these tariffs as necessary for boosting domestic manufacturing and protecting American jobs. However, many economists warn that tariffs could lead to higher consumer prices, potentially worsening inflation.

Market Reactions and Economic Concerns

The announcement of these tariffs has sparked strong reactions from international trade partners:

- Canada: Prime Minister Justin Trudeau has stated that Canada will impose retaliatory tariffs on American goods in response, arguing that the move could damage economic relations.

- Mexico: The Mexican government has similarly vowed to introduce countermeasures, particularly in industries such as agriculture and automotive exports.

- China: The Chinese government has condemned the tariffs and indicated plans to file a formal complaint with the World Trade Organization (WTO), while also considering retaliatory trade restrictions against the U.S.

Potential Inflation and Federal Reserve Policy Shifts

Economic analysts predict that these tariffs will likely lead to increased costs for businesses and consumers. As import prices rise, the risk of higher inflation grows, which could put pressure on the Federal Reserve to delay or cancel potential interest rate cuts planned for later this year.

Bitcoin and other cryptocurrencies, which are often seen as alternative assets in times of inflation, have reacted negatively to these developments. A high-inflation environment could make riskier assets like Bitcoin less attractive, particularly if the Federal Reserve decides to keep interest rates elevated.

Bitcoin’s Post-Election Rally and Current Downtrend

Bitcoin had seen a surge following Donald Trump’s election victory in November 2024, as many investors expected a more crypto-friendly regulatory approach under his administration. The cryptocurrency peaked at $109,000 in early January, shortly before Trump’s inauguration. However, recent economic and regulatory uncertainties have overshadowed initial optimism, causing a sharp pullback in its value.

Reasons for Bitcoin’s Decline:

- Macroeconomic Pressures: Rising inflation fears and potential delays in Fed rate cuts are weighing on investor sentiment.

- Regulatory Concerns: Despite optimism about a pro-crypto stance from Trump, uncertainty remains about how the administration will approach cryptocurrency regulations.

- Market Volatility: The broader financial market is experiencing heightened volatility due to geopolitical tensions and trade disputes.

What’s Next for Bitcoin and Crypto Markets?

Investors are now closely monitoring several key factors that could influence the next moves in Bitcoin and the crypto market:

- Federal Reserve’s Next Steps: Any signals from the Fed regarding future interest rate policies could have a direct impact on Bitcoin’s value.

- Global Trade Developments: Reactions from Canada, Mexico, and China could further escalate tensions, affecting overall market stability.

- Institutional Investor Behavior: Many large investors, including hedge funds and corporations, hold substantial Bitcoin reserves. Their trading decisions could further drive volatility.

As the situation unfolds, cryptocurrency traders and investors should brace for continued market fluctuations in the coming weeks. While some remain optimistic about Bitcoin’s long-term growth potential, the short-term outlook remains uncertain due to the complex economic landscape and ongoing trade disputes.