For decades, the “wallet” has been a physical object—a leather fold containing cash, cards, and identification. In the last ten years, it migrated to our smartphones. Now, in 2026, the wallet is disappearing entirely. It is becoming you. The shift toward biometric payments at the register—where a palm hover or a quick smile settles the bill—is no longer science fiction. It is a rapidly expanding reality deployed by retail giants like Amazon, Mastercard, and JP Morgan, fundamentally changing the checkout experience from “contactless” to “device-less.”

The Rise of Biometric Checkout in Retail

The concept of paying with a body part has graduated from pilot programs to full-scale rollouts. In 2025, retailers began aggressively integrating biometric payments at the register to reduce friction and increase throughput. The primary driver is speed; a biometric scan takes less than a second, significantly faster than digging for a card or unlocking a phone for Apple Pay.

Amazon One and the Palm Revolution

Amazon has been the bellwether for this technology with its Amazon One service. By late 2025, the “wave-to-pay” terminals were operational in over 500 Whole Foods locations and had expanded into third-party venues like Panera Bread and airports. The technology uses infrared light to map the unique vein patterns in a user’s palm, linking it to a credit card. Unlike facial recognition, which can feel intrusive, palm scanning is viewed as more “opt-in” and private, as users must intentionally hover their hand over a sensor.

Facial Recognition: PopID and Mastercard

While Amazon bets on palms, others bet on faces. PopID, a facial recognition payment company, solidified partnerships with Visa and JP Morgan in 2025 to bring “smile-to-pay” to US restaurant chains like Steak ‘n Shake. Simultaneously, Mastercard’s “Biometric Checkout” program has been pushing standards to allow consumers to smile or wave at terminals globally. Mastercard has set a bold goal: to phase out manual card entry and achieve 100% tokenization in key markets like Europe and Asia by 2030.

Comparison of Leading Biometric Modalities

| Feature | Palm Scanning (e.g., Amazon One) | Facial Recognition (e.g., PopID) | Biometric Cards (e.g., Mastercard) |

| Primary Interaction | Hover hand over sensor | Look at a camera/tablet | Thumb on card sensor |

| Privacy Perception | High (Intentional gesture) | Low (Passive scanning) | Medium (Data on card) |

| Hygiene | Contactless | Contactless | Contact (User’s own card) |

| Speed | < 1 Second | < 1 Second | Standard Chip Speed |

| Hardware Cost | High (Specialized scanner) | Medium (Standard tablet/camera) | Low (Merchant uses existing POS) |

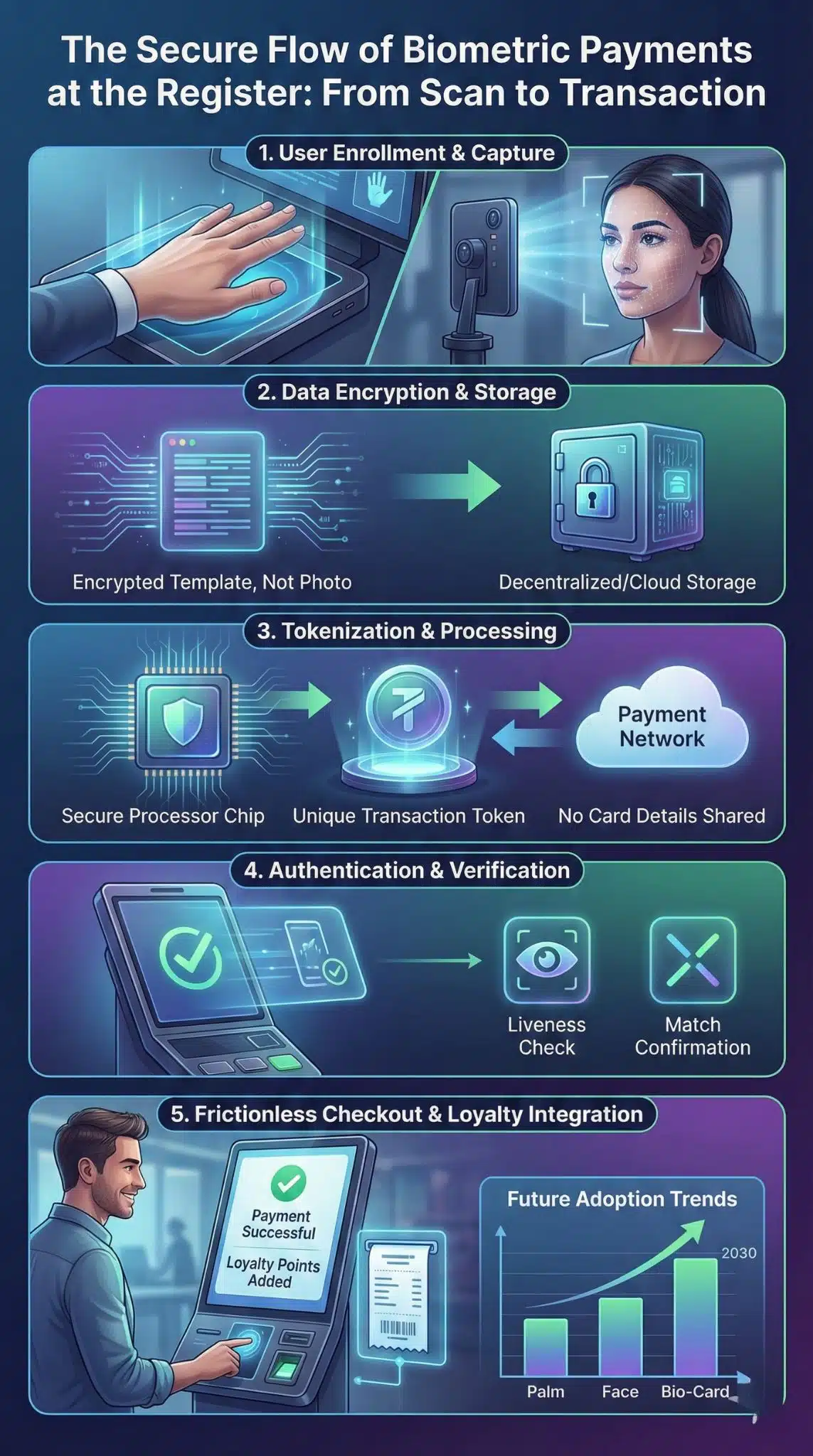

How It Works: The Tech Behind the Scan

To understand the security of biometric payments at the register, it is crucial to separate the image from the data. When a user enrolls, their biometric image is not stored as a simple photo. It is converted into an encrypted mathematical string known as a “template.” This template is useless to a hacker without the proprietary algorithm to decode it.

Tokenization and Encryption

The industry standard in 2026 relies on tokenization. When a palm or face is scanned, the system generates a unique, one-time token that represents the user’s payment credentials. The actual credit card number is never transmitted during the transaction. This mirrors the security protocol of mobile wallets but removes the device from the equation. Recent updates to the US “Bulk Data Rule” in 2025 have further tightened how this sensitive data is handled, forcing companies to implement decentralized storage models where possible.

Liveness Detection

A common fear is that a thief could use a high-resolution photo or a 3D mask to trick the system. To combat this, modern terminals use “liveness detection.” This technology analyzes micro-movements, depth, and skin texture to ensure the biometric source is a living, breathing human present at the kiosk. For example, Amazon One’s infrared sensors detect the blood flow in palm veins, making it nearly impossible to spoof with a silicone hand replica.

Security Features vs. Risks

| Security Layer | Function | Potential Risk |

| Liveness Detection | Verifies the subject is real and present. | Deepfake technology (advancing rapidly). |

| Tokenization | Replaces card numbers with unique codes. | Token theft (though useless without bio-key). |

| Template Storage | Stores math data, not images. | Database breaches (irreversible if compromised). |

| Multi-Factor Auth | Requires phone confirmation for high-value buys. | Friction (slows down the “seamless” promise). |

Privacy Wars: Convenience vs. Surveillance

While the technology is sound, the cultural reception of biometric payments at the register varies drastically by region. In China, facial payment is ubiquitous. In the West, however, privacy advocates raise valid concerns about corporate surveillance and data ownership.

The Data Storage Debate

The central tension lies in where the data lives. “Centralized” biometrics (storing templates in the cloud, like Amazon One) allows for a true device-less experience—you can walk into a store naked and still pay. However, this creates a “honeypot” for hackers. “Decentralized” biometrics (storing the template on the user’s own device or card) is safer but less convenient, as the user must carry their phone or card to verify the scan. Privacy regulations like GDPR in Europe and BIPA in Illinois are pushing companies toward decentralized models or strict consent frameworks.

The “Creepiness” Factor

Adoption statistics from 2025 show a generational divide. Gen Z and Alphas are largely comfortable trading biometric data for speed, viewing it as a natural evolution of unlocking their phones. Older demographics remain skeptical. Retailers are countering this by linking biometrics to loyalty programs—offering instant discounts to customers who pay with their face is a powerful incentive that often overrides privacy hesitation.

Consumer Privacy Concerns

| Concern | Description | Industry Response |

| Surveillance | Fear of being tracked across different stores. | specific “payment-only” consent clauses. |

| Data Permanence | You can change a password, but not your face. | Advanced encryption and “cancelable biometrics.” |

| Data Sharing | Fear of selling data to advertisers. | Explicit “no-sell” policies (e.g., Amazon One). |

| Consent | Unknowingly being scanned. | Active triggers (hovering, looking at specific zone). |

Global Adoption Landscape

The rollout of biometric payments at the register is uneven globally. Asia leads the charge, while North America and Europe are in a “catch-up” phase, driven by specific high-tech retailers and transit systems.

Asia: The Global Leader

In China, facial recognition payments are standard in convenience stores and subway stations. The infrastructure was built early by giants like Alipay and WeChat Pay. The normalization of this technology in Asia provides a roadmap for Western adoption, suggesting that convenience eventually wins out over privacy concerns for the mass market.

North America and Europe

In the US, adoption is fragmented. Amazon’s purchase of One Medical and the deployment of palm scanning in healthcare (like NYU Langone in 2025) signaled that this tech is not just for buying groceries; it is for proving identity. In Europe, Mastercard’s push for biometric standards is creating a unified framework, but strict GDPR enforcement means rollouts are slower and more scrutinized. The UK and Nordics are expected to be the fastest adopters in the region due to their high existing usage of cashless payments.

Regional Adoption Rates (Projected 2026)

| Region | Adoption Level | Primary Driver | Top Barrier |

| Asia-Pacific | High (Mainstream) | Super-apps (Alipay, WeChat) | None (High saturation) |

| North America | Medium (Growing) | Retail Efficiency (Amazon, Walmart) | Privacy/Trust |

| Europe | Low-Medium | Regulatory Standards (Mastercard) | GDPR/Privacy Laws |

| Middle East | High (Rapid Growth) | Government Initiatives (UAE) | Infrastructure Cost |

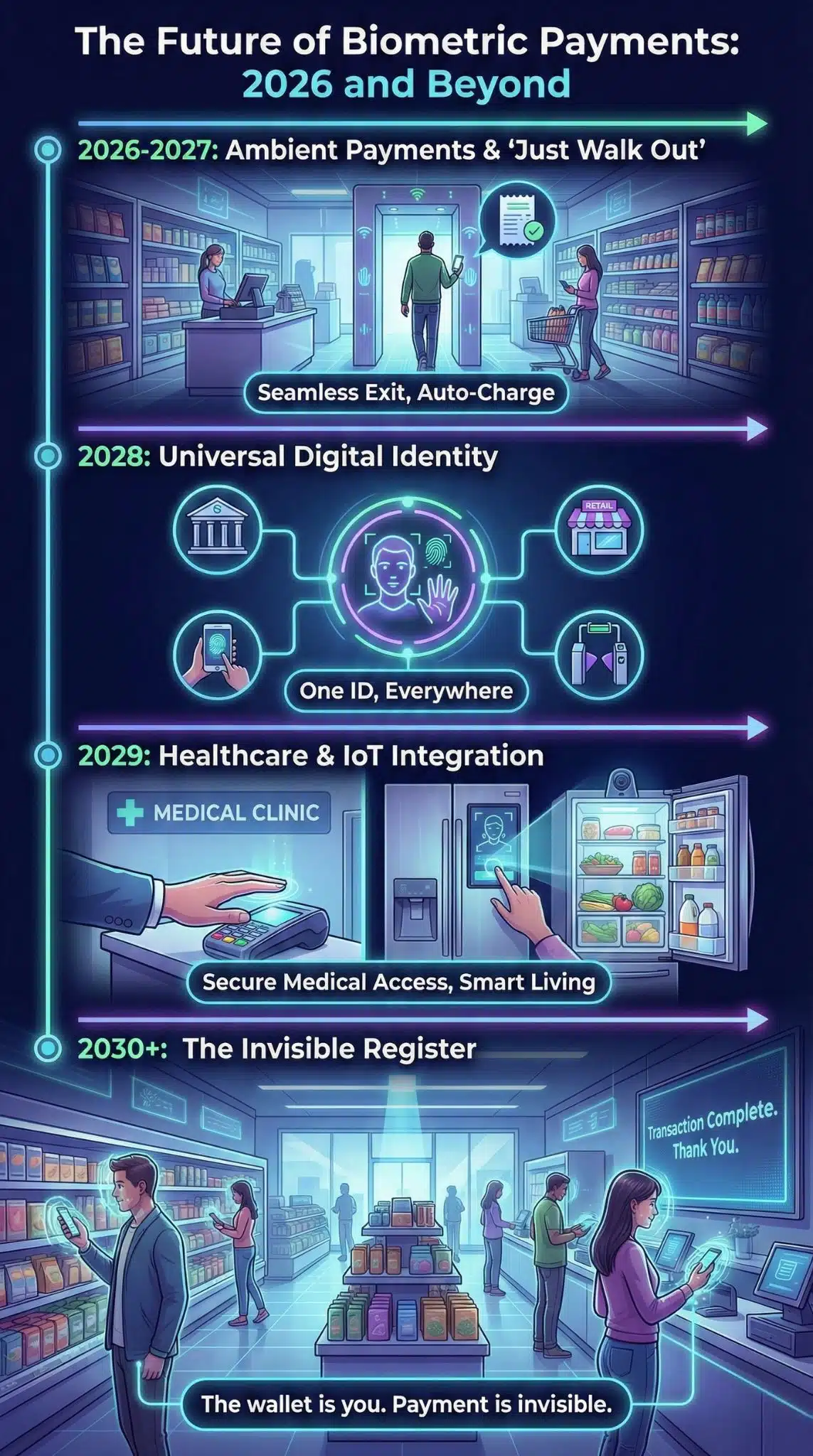

The Road Ahead: 2026 and Beyond

As we look toward 2030, biometric payments at the register will likely become the default for high-frequency transactions like transit, fast food, and grocery. The friction of pulling out a wallet—or even a phone—will eventually feel archaic.

Integration with Loyalty Programs

The “killer app” for biometric payments is not just speed; it is personalization. In the near future, a terminal will not just charge you; it will recognize you. A coffee shop screen could greet you by name and ask, “The usual oat latte?” while automatically applying your loyalty points. This seamless integration of payment and loyalty is what will ultimately drive mass consumer adoption.

The End of the Checkout Line?

Biometrics are also the key to “Just Walk Out” technology. While early versions used cameras to track items, the future is hybrid. You tap your palm to enter, grab your items, and walk out. The biometric entry acts as the signature for the entire session. By 2030, the concept of a “register” itself may dissolve, replaced by ambient biometric authentication that settles the tab as you leave the door.

Future Predictions (2026-2030)

| Trend | Prediction | Impact on Consumers |

| Ambient Payments | No stopping at a kiosk; cameras charge you as you leave. | Zero wait times; invisible payments. |

| Universal ID | One biometric ID works across all retailers/banks. | No need to re-enroll at every new store. |

| Healthcare Mergers | Payment biometrics used for medical check-ins. | unified identity for health and finance. |

| Biometric ATMs | Cash withdrawal via face/palm scan. | End of physical bank cards. |

Final Thoughts

The transition to biometric payments at the register represents the final step in the digitization of commerce. It promises a world where you are your own bank card, offering unparalleled speed and convenience. However, this convenience comes at the cost of giving up our most intimate data—our physical identity. As the technology matures in 2026, the success of biometric payments will depend less on the hardware and more on the trust retailers can build with their customers. If privacy is guaranteed, the wallet of the future will be nothing more than the palm of your hand.