Have you seen Bitcoin and Ethereum swing by double digits in a single day, and felt your stomach flip? Traders and savers face that wild ride every time they send or spend crypto, they need a stable digital currency to ease the pain.

Biitland.com Stablecoins run on a strong blockchain, they hold fiat currency and Ethereum in reserve, and they use smart contract tools to keep prices steady in digital finance. This post will show you how to tame volatility, speed up global transactions, and explore DeFi with confidence.

Keep reading.

Key Takeaways

- Biitland.com issues stablecoins that peg 1:1 to US dollars or euros and back each coin with fiat reserves or Ethereum.

- A smart contract adjusts supply when demand shifts to keep prices stable and volatility low.

- The platform uses multi-signature approvals, end-to-end encryption, KYC/AML checks, and monthly regulator audits to secure every transfer.

- Biitland.com stablecoins settle cross-border payments in under five seconds for just a few cents, instead of banks’ typical 5 % fees.

- Developers plug these coins into DeFi apps like Aave, Compound, and Uniswap for lending, borrowing, staking, and yield farming.

Key Features of Biitland. com Stablecoins

Biitland.com stablecoins run on a distributed ledger that logs every transfer in a public audit record, backed by strong encryption and smart contracts. They plug into DeFi protocols, work with digital wallets, and follow strict compliance steps like KYC and AML checks.

Price Stability and Low Volatility

People trade pegged tokens that hold a 1:1 link to fiat funds. Those tokens keep price stable, with low volatility for daily buys or savings. Biitland.com stablecoins back each unit with reserves like US dollars or Ethereum assets.

Smart contract algorithms adjust supply when demand shifts.

Companies adopt these coins for smooth digital transactions in the digital economy. Small price swings protect savings and income from sudden dips. Clients use the fixed exchange rate system to lock in value on every operation.

Such stability leads straight into security and transparency through blockchain.

Security and Transparency through Blockchain

Biitland.com issues stablecoins on a strong blockchain network. The ledger records each digital asset transfer in an unchangeable way. Regulators inspect reserves monthly, to confirm that each coin remains backed by reserves.

The platform meets all regulatory compliance requirements, including anti–money laundering rules. Security measures include multi-signature approvals that force multiple parties to sign off on transfers.

Encryption protocols lock the data end to end. Users track trades in real time through block explorer tools.

Automated protocols lock each transfer rule into code. Validator nodes screen transactions before adding them to the chain. Open API connect wallets, exchanges, and decentralized finance apps.

Auditors post findings on the immutable ledger, for everyone to check. Extra verification steps, like KYC and AML, add a layer of identity checks. Biitland.com stablecoins serve as a reliable bridge into the crypto ecosystem.

Integration with DeFi and Web3 Ecosystems

The same blockchain that guards transparency also powers integration with DeFi and Web3 ecosystems. Developers spin up decentralized applications on Ethereum and other smart contract platforms, and stablecoins from Biitland.com slide right into lending, borrowing, and liquidity pools.

Traders stake coins to earn yield, and users plug them into smart contracts with just a few clicks. Its integration dwarfs most stablecoins. It feels like a Swiss army knife for the crypto space.

Global banks eye this tech for future CBDCs. Large institutions may link fiat money with digital assets through Biitland.com stablecoins. That pairing can boost market liquidity in cross-border transactions and spark passive income for investors.

It also shows how stablecoins operate as a reliable digital asset for everyday transactions in the digital economy.

Types of Stablecoins Offered by Biitland. com

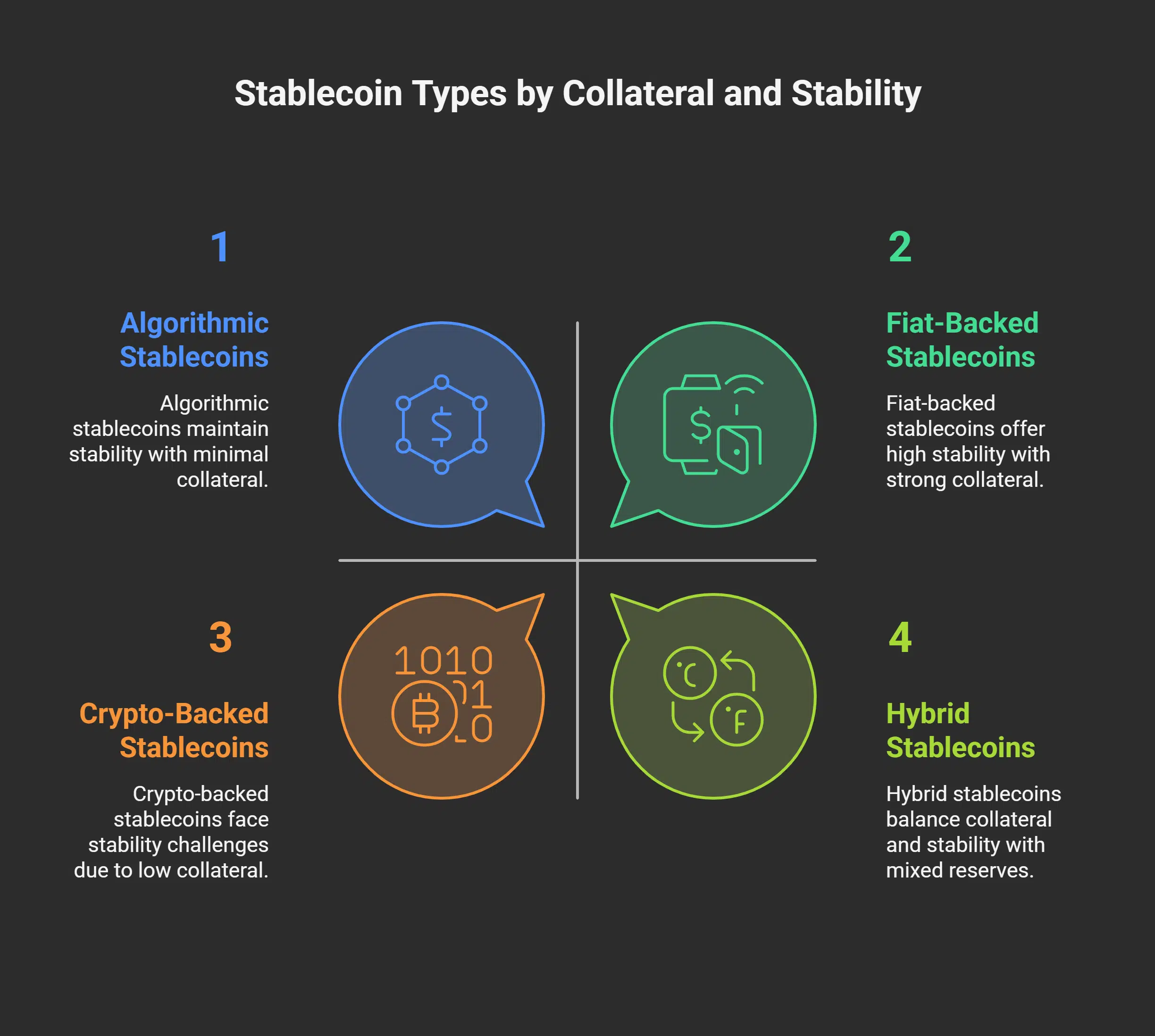

Biitland.com crafts stablecoins that blend traditional money, digital backing, and algorithmic tools to keep value firm. They rely on a distributed ledger, automated pact, and clear monetary rules, so you can fund fast payments from your digital vault.

Fiat-Backed Stablecoins

This token pegs one to one with a dollar, euro, or pound sterling. It draws its strength from real bank cash in a reserve. It holds price as stable as USDT or USDC or BUSD. A top auditor sends proof of reserves every month.

The smart contract runs on a leading public blockchain. Users move funds by wire transfer, then store them in a secure cryptocurrency wallet or use an electronic trading platform.

Small shops cut risk when they accept this coin for payments. It feels like a digital piggy bank that never rattles. Traders hedge against swings in bitcoin or ethereum. This model works as a bridge between traditional banking systems and DeFi apps.

Many spot the benefits of using biitland.com stablecoins for cross-border transfers.

Crypto-Backed Stablecoins

Shifting from fiat reserves, crypto-backed stablecoins hold digital assets such as Bitcoin or Ethereum. Biitland.com stablecoins operate on a public ledger secured by blockchain technology.

They use automation scripts to enforce collateral ratios. They mix crypto benefits with fiat style stability. The platform maintains stability through a diversified asset portfolio.

It faces market risks when reserve asset values fluctuate.

Biitland.com offers stablecoins that provide a reliable, low-volatility medium of exchange for trading and remittances. They enable access to decentralized finance through automation code platforms.

A ledger viewer shows transparent transactions in real time. Investors gain fast settlement and easy portfolio management. Price moves stay narrow because reserves back each coin.

Algorithmic and Hybrid Stablecoins

Biitland.com algorithmic stablecoins use smart contracts on a distributed ledger. A peer-to-peer oracle network feeds live price data. The contracts expand or shrink coin amounts to keep a stable value without direct collateral.

These coins stay firm, even when markets swing.

Biitland.com hybrid stablecoins mix code-driven supply rules with partial asset reserves. This blend boosts security and efficiency. The reserve funds back value, while contracts fine-tune supply.

Users get reliable coins for digital payments and DeFi.

Use Cases of Biitland. com Stablecoins

Biitland.com tokens pass through global rails, back lending apps with blockchain code pacts, and boost financial inclusion in its digital vault; read on to learn more.

Cross-Border Transactions

Traditional bank transfers can take days and charge as much as 5 percent in fees. Stablecoins from Biitland.com drop that cost to a few cents. Settlements finish in under five seconds.

The network uses blockchain and automated contracts to record each move. Users exchange stablecoins for US dollars at a fixed rate.

Anyone with an internet connection can tap a digital wallet and make cross-border transactions. Small businesses and gig workers gain new market reach. Stablecoins provide price stability, low volatility, and rapid settlement.

This model boosts financial inclusion for people in remote areas. We can now turn to decentralized finance applications.

Decentralized Finance Applications

Biitland.com stablecoins run on the Ethereum network using smart contracts. These coins support lending functions in loan protocols like Aave and Compound. They also power asset pools and let users stake tokens for yields.

Traders can swap stablecoins against fiat and crypto pairs on Uniswap. The design offers arbitrage routes and 24/7 access to contract networks.

Developers can integrate these coins via Web3 APIs and wallet tools. A secure digital wallet holds tokens with on-chain transparency. Participants in decentralized finance borrow funds at low rates, thanks to collateral adjustments.

Liquidity remains high, so traders face low slippage. Stablecoins facilitate smooth trading and lending, even in volatile markets.

Takeaways

Stablecoins from Biitland.com show how steady coins can power wallets and markets alike. They tie dollar tokens to code, so coins keep their worth even when markets swing. The coins run on a blockchain ledger, clear as day, and use smart contract scripts to tweak supply on demand.

Traders send funds abroad without fees, mobile wallets plug into DeFi apps, and investors see a safety net. A hybrid mix of fiat reserves, crypto collateral, and algorithmic logic keeps values steady.

You get fast transfers, lower risk, and open books in one wallet. Try these coins and watch cents stack up instead of doubts.

FAQs on Biitland.com Stablecoins

1. What are Biitland.com stablecoins?

They are digital coins. They are backed by assets like the United States dollar. They act as a bridge between traditional finance and the world of decentralized finance.

2. How do stablecoins work in the digital economy?

Biitland.com stablecoins adjust supply, based on market demand. They operate within the crypto market. They maintain a stable value in a changing digital economy.

3. Are Biitland stablecoins safe from fraud and volatility?

Biitland.com employs strong computer security, and it follows financial regulation and Know your customer rules. It offers high Transparency, and lower Volatility than traditional cryptocurrencies.

4. Can I use stablecoins for e commerce and everyday payments?

Yes, stablecoins from Biitland.com provide a choice for digital transactions. They work like fiat currencies with the advantages of blockchain. You can use them in e commerce or with a credit card in some apps.

5. What makes Biitland.com stablecoins stand out in a crowded crypto market?

Their asset backing and supply adjustment makes Biitland.com stablecoins act like a rock in rough seas. They offer a reliable and secure option for users seeking stability. They give a safe haven in a volatile landscape.

6. How do Biitland.com stablecoins fit into the future of digital finance?

They stand as a bridge between traditional finance and the world of decentralized finance. They fuel innovation and drive adoption. They can power e commerce, agriculture trade, and reshape monetary policy. These frequently asked questions show their growing role in the future of digital finance.