In an increasingly digitized world, the way we handle money has evolved dramatically. Gone are the days of waiting in long bank queues or struggling with cash. Peer-to-peer (P2P) payment apps have revolutionized how we send and receive money, offering convenience, security, and efficiency.

If you’re looking for the best peer-to-peer payment apps in 2026 that makes payments effortless, you’re in the right place. This guide explores the top five apps and highlights what sets them apart.

What Are Peer-to-Peer Payment Apps?

Peer-to-peer payment apps are digital platforms that allow users to transfer money directly to each other without needing an intermediary like a bank. These apps have become an essential part of everyday life, enabling seamless financial transactions for everything from splitting a dinner bill to paying freelancers.

Key Features of Peer-to-Peer Payment Apps:

- Security and Encryption: Advanced encryption ensures safe transactions.

- Instant Transfers: Money moves quickly, often in real-time.

- User-Friendly Interfaces: Designed to be intuitive, even for non-tech-savvy users.

- Multi-Platform Integration: Compatible with smartphones, tablets, and desktop devices.

Benefits of Using Peer-to-Peer Payment Apps:

- Cost-Effective: Lower fees compared to traditional banking systems.

- Time-Saving: Instant transfers reduce delays in financial transactions.

- Global Accessibility: Many apps support cross-border payments, making them ideal for international transactions.

With the right best peer-to-peer payment app, you can simplify your financial life while ensuring secure and hassle-free transactions.

5 Best Peer-to-Peer Payment Apps in 2026

Let’s dive into the five standout apps that redefine convenience and efficiency in 2026. Each offers unique features tailored to different user needs.

1. PayPal – The Most Secure Payment Platform

PayPal continues to dominate the P2P payment space with its robust security measures and global reach. Trusted by millions, PayPal offers an unmatched level of security and reliability for both personal and business transactions. Whether you’re sending money to a friend or paying for goods and services, PayPal ensures a seamless experience.

- Key Features:

- Industry-leading encryption and fraud detection.

- Integration with e-commerce platforms.

- Supports both personal and business transactions.

- Why It Stands Out: PayPal’s reputation for trust and reliability makes it the go-to app for millions worldwide.

Detailed Comparison Table:

| Feature | Details |

| Supported Countries | 200+ |

| Fees for Domestic Use | Free for personal accounts |

| Fees for International | 5% of the transaction |

| Payment Methods | Bank accounts, cards, etc. |

| Additional Features | Buyer and seller protection |

Real-Life Example:

Jane, a freelance graphic designer in the US, uses PayPal to receive payments from international clients. Its buyer protection and seamless invoicing tools help her manage her income efficiently.

2. Wise (formerly TransferWise) – Best for International Transfers

Wise is the best peer-to-peer payment app for global transactions, offering transparency and cost-effectiveness. It’s particularly useful for users who need to send money across borders without incurring hefty fees. Wise’s transparent pricing and mid-market exchange rates make it a favorite for international payments.

- Key Features:

- Real exchange rates with minimal fees.

- Multi-currency accounts supporting over 50 currencies.

- Fast transfers to 170+ countries.

- Why It Stands Out: Wise’s low-cost, transparent fee structure makes it ideal for cross-border payments.

Detailed Comparison Table:

| Feature | Details |

| Exchange Rates | Mid-market rates |

| Transfer Speed | 1-2 business days |

| Supported Currencies | 50+ |

| Average Fees | 0.4-1% |

| Account Types | Personal & Business |

Real-Life Example:

Michael, an expat working in Germany, uses Wise to send money back to his family in India. He saves up to 70% on transfer fees compared to traditional banks.

3. Venmo – Most User-Friendly Design

Venmo, a subsidiary of PayPal, is perfect for personal transactions and is particularly popular among younger users. Its unique social feed for transactions makes it an enjoyable and interactive experience. Whether you’re splitting bills, paying rent, or covering shared expenses, Venmo simplifies the process.

- Key Features:

- Social feed for payment interactions.

- Splitting bills and sending requests.

- Instant bank transfers (fees may apply).

- Why It Stands Out: Its fun, interactive design fosters engagement while simplifying transactions.

Detailed Comparison Table:

| Feature | Details |

| Supported Countries | U.S. only |

| Social Features | Transaction feed |

| Transfer Fees | 1.5% for instant transfers |

| Primary Use Case | Splitting bills, friends |

| Privacy Options | Customizable |

Real-Life Example:

Emma, a college student, uses Venmo to split dining bills with friends. She loves the social feed, which adds a fun twist to her transactions.

4. Square Cash App – Best for Business Payments

The Cash App by Square is more than just a P2P payment app; it’s a versatile financial tool. Businesses and freelancers can benefit from its quick deposit options and robust invoicing tools. With added features like stock and crypto trading, Cash App goes beyond just money transfers.

- Key Features:

- Crypto trading and stock purchasing.

- Instant deposit options for businesses.

- Free debit card linked to your account.

- Why It Stands Out: Ideal for small businesses and freelancers looking for quick and secure payment solutions.

Detailed Comparison Table:

| Feature | Details |

| Crypto Support | Yes |

| Free Debit Card | Included |

| Business Tools | Invoicing, deposits |

| Fees for Instant Deposit | 1.5% |

| Investment Features | Stocks and crypto trading |

Real-Life Example:

Lisa, a small business owner, uses Cash App to manage customer payments and invest in stocks. Its versatility allows her to handle multiple financial needs in one place.

5. Revolut – The All-in-One Payment Solution

Revolut combines P2P payments with a host of additional financial features, making it a top choice for versatility. From managing multi-currency accounts to budgeting and investing in stocks or cryptocurrencies, Revolut offers a one-stop solution for all your financial needs.

- Key Features:

- Multi-currency accounts with competitive exchange rates.

- Budgeting tools and financial analytics.

- Stock and crypto trading.

- Why It Stands Out: A comprehensive app that supports personal, business, and global transactions.

Detailed Comparison Table:

| Feature | Details |

| Multi-Currency Support | 30+ currencies |

| Stock Trading | Included |

| Crypto Options | Yes |

| Paid Plans | Starting at $9.99/month |

| Budgeting Tools | Advanced |

Real-Life Example:

David, a digital nomad, relies on Revolut for managing his finances across multiple currencies while investing in stocks and crypto on the go.

What Makes These Apps Stand Out?

The best peer-to-peer payment app is defined by its ability to offer seamless, secure, and user-friendly services. Here’s what differentiates these apps:

Cutting-Edge Security Features

- Advanced encryption and AI-driven fraud detection ensure user safety.

- Regular updates to counter evolving cyber threats.

User-Friendly Interfaces and Customization

- Apps like Venmo and Revolut prioritize intuitive designs, making financial management simple for everyone.

- Customizable settings allow users to tailor the app to their preferences.

Global Reach and Scalability

- Apps like Wise and Revolut enable international transfers with ease, supporting multiple currencies and regions.

How to Choose the Best Peer-to-Peer Payment App for You?

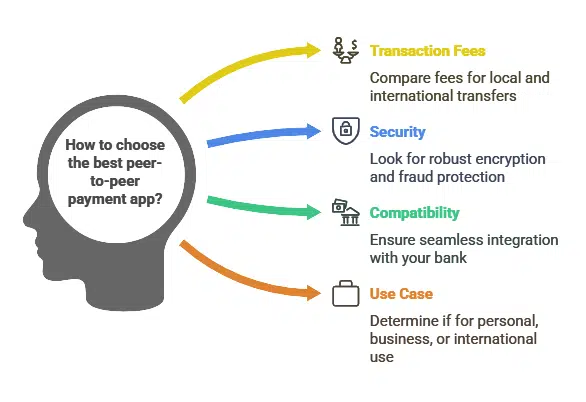

With so many options available, choosing the best peer-to-peer payment app can be overwhelming. Here are some tips:

Checklist to Help You Decide:

- Transaction Fees: Compare fees for local and international transfers.

- Security: Look for apps with robust encryption and fraud protection.

- Compatibility: Ensure the app works seamlessly with your bank.

- Use Case: Determine whether the app is for personal, business, or international use.

Takeaways

Peer-to-peer payment apps have transformed the way we handle money, making financial transactions faster, easier, and more secure.

Whether you prioritize security, user-friendliness, or global reach, there’s a best peer-to-peer payment app for everyone. From PayPal’s trusted platform to Revolut’s all-in-one solution, these apps cater to a variety of needs.

Which app will you choose to simplify your payments in 2026? Share your thoughts and experiences below!