In today’s digital world, shopping for car insurance has become simpler thanks to the best online tools to compare car insurance quotes. Whether you’re looking to save money on your premium or find the perfect coverage, these tools allow you to compare rates from multiple providers, all in one place.

Instead of spending hours on the phone or visiting numerous insurance websites, you can now quickly gather car insurance quotes that meet your specific needs. By using these tools, you can make informed decisions that will help protect both your car and your wallet.

In this article, we’ll dive into the best online tools to compare car insurance quotes, providing you with detailed insights, advantages, and actionable tips for using each platform.

These tools not only simplify the process but also ensure that you find the best possible deal for your car insurance needs.

Why It’s Important to Compare Car Insurance Quotes

When shopping for car insurance, it’s crucial to compare quotes from multiple providers. The best online tools to compare car insurance quotes help you do just that, making the process more efficient and less time-consuming.

Comparing quotes ensures that you’re not paying more than necessary and that you are choosing a policy that aligns with your coverage needs.

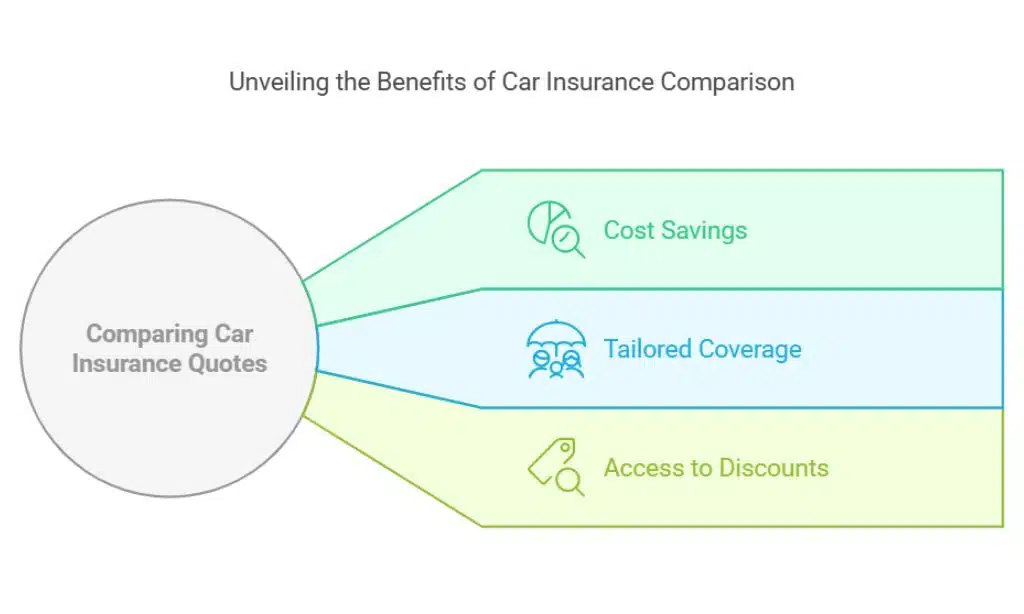

Here are some reasons why using these tools is essential:

- Cost Savings: Insurance premiums can vary significantly between providers. By using comparison tools, you can identify the most affordable option for the coverage you need.

- Tailored Coverage: Not all insurance policies are created equal. The best online tools to compare car insurance quotes allow you to customize your coverage and find the best fit for your situation.

- Access to Discounts: Many providers offer discounts for safe driving, bundling, or certain vehicle safety features. These tools can help you identify the discounts available to you.

8 Best Online Tools to Compare Car Insurance Quotes in the U.S.

When it comes to finding the best online tools to compare car insurance quotes, The Zebra is one of the top contenders in the market.

With a network of over 200 providers, this platform allows users to quickly compare rates and coverage options, ensuring they find the most competitive deal for their needs.

Whether you’re new to the insurance shopping process or simply looking for a better deal, The Zebra offers a seamless experience that helps make your decision easier.

1. The Zebra

The Zebra is one of the leading best online tools to compare car insurance quotes. This platform compares over 200 insurance companies, offering a wide range of quotes based on your personal details. With The Zebra, you can quickly see the best prices and coverage options for your needs.

Why It’s Great for Comparing Car Insurance Quotes: The Zebra’s vast network of insurers and its simple interface make it an excellent tool for quickly finding competitive rates. Whether you’re looking for the lowest premium or more comprehensive coverage, The Zebra helps you compare the best options in real time.

Pros and Cons:

| Pros | Cons |

| Compares quotes from over 200 providers | Limited to U.S. market only |

| Fast and easy to use | Doesn’t provide detailed policy explanations |

| No fees for using the tool | Not all insurers may be included |

Actionable Tips:

- Be sure to input accurate details for the best results. The more information you provide, the more tailored your quote will be.

- After receiving your quotes, visit individual insurers’ websites to verify the details of their policies.

2. Compare.com

Compare.com allows you to compare car insurance quotes from more than 60 providers. It’s a simple, step-by-step tool that lets you filter results based on the type of coverage you want, such as liability, collision, or full coverage.

Why It’s Great for Comparing Car Insurance Quotes: What sets Compare.com apart is its user-friendly design and the ability to filter quotes based on your specific needs. Whether you’re a high-mileage driver or someone who needs basic liability coverage, Compare.com makes it easy to find the best options for your profile.

Pros and Cons:

| Pros | Cons |

| Step-by-step process for customized results | Requires detailed personal information |

| Offers quotes from more than 60 providers | Limited to U.S. market |

| Simple and easy to navigate | Results may vary slightly from actual quotes |

Actionable Tips:

- Take your time to adjust the filters, as they allow you to tailor your results to your exact preferences.

- If you’re uncertain about a policy’s terms, consider reaching out to customer service for clarification.

3. Gabi

Gabi uses advanced technology to automatically compare your current car insurance policy with other available quotes. After linking your existing insurance, Gabi will analyze your coverage and suggest better deals based on your current policy.

Why It’s Great for Comparing Car Insurance Quotes: Gabi is one of the best online tools to compare car insurance quotes for people who already have a policy and are looking for potential savings. Its automatic process removes the need for manual data entry, saving you time and effort.

Pros and Cons:

| Pros | Cons |

| Automatically compares rates from multiple providers | Only available in select states |

| Personalized recommendations | Limited provider network |

| No need to manually input your information | May not show all available insurers |

Actionable Tips:

- If you’re already insured, Gabi is a great tool to quickly see if you could be saving money by switching providers.

- Always double-check your current policy’s coverage limits to ensure you’re comparing apples to apples.

4. Insurify

Insurify uses artificial intelligence to help users compare car insurance quotes from over 40 different providers. It provides real-time quotes and lets users filter results based on specific needs such as driving history or vehicle type.

Why It’s Great for Comparing Car Insurance Quotes: Insurify is one of the best online tools to compare car insurance quotes because it combines AI and real-time data to give you the most accurate and personalized results. The platform’s advanced filters help you narrow down your options and find the best deals based on your personal driving habits.

Pros and Cons:

| Pros | Cons |

| Uses AI to personalize your quote | Requires personal data entry for accurate results |

| Provides real-time, competitive quotes | Some providers may have additional fees |

| Offers multiple filtering options | Limited to the U.S. market |

Actionable Tips:

- Make sure to review the filtering options, as they allow you to find the best quotes based on factors like driving behavior and the make and model of your car.

- If you’re not ready to purchase, save your results for future reference.

5. Policygenius

Policygenius allows users to compare car insurance quotes from top insurers and gives detailed breakdowns of policy coverage and exclusions. It’s also a one-stop-shop for all types of insurance, including life and health coverage.

Why It’s Great for Comparing Car Insurance Quotes: The best online tools to compare car insurance quotes often include detailed coverage explanations, and Policygenius excels in this area.

The platform not only compares quotes but also educates users about what each policy includes and any exclusions that may apply.

Pros and Cons:

| Pros | Cons |

| Clear explanations of coverage options | Limited to certain states |

| Helps find the best rate while offering policy education | May not include every smaller insurer |

| Excellent customer support | Slightly slower than other tools in generating quotes |

Actionable Tips:

- Use Policygenius if you want to dive deeper into the specifics of each policy, especially if you’re unsure about certain coverage details.

- Be sure to inquire about discounts, as Policygenius often uncovers options that may not be immediately visible.

6. Lemonade

Lemonade offers a unique AI-driven experience for comparing car insurance quotes. It provides users with quick, transparent quotes and focuses on delivering an easy, digital-first experience.

Why It’s Great for Comparing Car Insurance Quotes: Lemonade’s simplicity and commitment to transparency make it a great choice for those who prefer a tech-driven, straightforward process.

The best online tools to compare car insurance quotes need to be fast and transparent, and Lemonade excels at both.

Pros and Cons:

| Pros | Cons |

| Simple, quick comparison process | Limited coverage options |

| Transparent pricing model | Available in select states |

| AI-powered claims process | Limited customer service options |

Actionable Tips:

- For tech-savvy users, Lemonade’s mobile-first experience is one of the easiest ways to compare car insurance quotes quickly.

- Make sure Lemonade is available in your state, as it’s currently limited to certain regions.

7. Esurance

Esurance, a subsidiary of Allstate, provides an easy-to-navigate platform for comparing car insurance quotes. With its customizable coverage options and fast quote generation, Esurance stands out for those looking for flexibility and speed.

Why It’s Great for Comparing Car Insurance Quotes: Esurance’s flexibility allows you to customize your coverage and adjust your deductible, making it one of the best online tools to compare car insurance quotes for those who need a personalized approach.

Pros and Cons:

| Pros | Cons |

| Customizable coverage options | Limited availability in some states |

| Easy-to-use mobile app | Some quotes may be inaccurate in certain regions |

| Quick, simple quote process | Doesn’t include every insurer |

Actionable Tips:

- Make sure to use the mobile app for quick quotes and manage your policy on the go.

- When customizing your coverage, check for any regional nuances that might affect the accuracy of your quote.

8. Root Insurance

Root Insurance offers personalized premiums based on your driving behavior. Through its app, Root tracks your driving habits and rewards safe drivers with lower rates, making it a great tool for those with a clean driving record.

Why It’s Great for Comparing Car Insurance Quotes: Root’s focus on safe driving sets it apart from other comparison tools.

By tracking your driving data, it offers personalized rates that reflect your actual driving behavior.

Pros and Cons:

| Pros | Cons |

| Personalized premiums based on driving behavior | Available only in select states |

| Simple, easy-to-use app | Limited customer support options |

| Easy-to-understand rates | Requires users to drive with the app for a while |

Actionable Tips:

- If you’re a safe driver, Root’s data-driven approach could lead to significant savings on your car insurance premiums.

- Be sure to download the app and start tracking your driving habits to take advantage of the personalized rates.

How to Choose the Right Tool for Comparing Car Insurance Quotes

With numerous tools available, choosing the right one depends on your personal preferences and needs. Here’s what to consider when selecting the best online tools to compare car insurance quotes:

- User-Friendliness: Choose tools that offer an easy-to-navigate platform with clear, actionable results.

- Customization: Look for platforms that allow you to filter quotes based on your driving history, vehicle type, and coverage preferences.

- Discounts: Make sure the platform highlights any available discounts, such as safe-driving or bundling discounts.

- Coverage Transparency: Opt for tools that provide detailed explanations of coverage and exclusions.

Takeaways

Comparing car insurance quotes is a crucial step in securing the right coverage at the best price. The best online tools to compare car insurance quotes make this process quick, easy, and transparent.

By using these tools, you can efficiently compare rates, uncover potential savings, and find the ideal policy for your needs.

Take advantage of these tools to ensure you’re getting the most comprehensive coverage at a price that works for you. Happy comparing!