Income protection insurance is a crucial financial safeguard for many Australians, providing essential support during unexpected periods of illness or injury.

As we look ahead to 2025, it’s more important than ever to understand the landscape of income protection insurance providers and make informed decisions about coverage.

This comprehensive guide explores the 12 best income protection insurance providers in Australia for 2025, offering detailed insights into their offerings, benefits, and features.

What is Income Protection Insurance

Income protection insurance, also known as salary continuance insurance, is designed to replace a portion of your income if you’re unable to work due to illness or injury. Typically, these policies cover up to 75% of your pre-tax income, allowing you to maintain your lifestyle and meet financial obligations during recovery.

Key Benefits of Income Protection Insurance

- Financial Security: Provides monthly payments to cover living expenses.

- Flexibility: Policies can be tailored to individual needs and budgets.

- Peace of Mind: Offers financial stability during challenging times.

- Tax Benefits: Premiums are often tax-deductible (when structured appropriately).

How Income Protection Works

When you take out an income protection policy, you choose:

- A waiting period (time before benefits start)

- A benefit period (duration of payments)

For example, you might select a 30-day waiting period and a benefit period of two years. If you become unable to work, you’ll receive monthly payments until you recover or until the benefit period ends.

| Feature | Description | Typical Options |

| Waiting Period | Time before payments begin | 14, 30, 60, 90 days |

| Benefit Period | Duration of payments | 2 years, 5 years, to age 65 |

| Coverage Amount | Percentage of income covered | Up to 75% of pre-tax income |

Factors to Consider When Choosing an Income Protection Insurance Provider

When it comes to securing your financial future, selecting the right income protection insurance provider is a decision that requires careful thought. With so many options available, it can be overwhelming to determine which provider best aligns with your needs and long-term goals.

From policy flexibility to claim processing efficiency, understanding what to prioritize ensures you’re making an informed choice. In this section, we’ll explore the key factors you should evaluate when choosing an income protection insurance provider, helping you safeguard your income with confidence and peace of mind.

1. Financial Stability and Reputation

Choose an insurer with a strong financial background. Look for ratings from agencies like S&P Global Ratings or APRA. A stable insurer is more likely to fulfill claims promptly and efficiently.

2. Policy Features and Flexibility

Key aspects to look for include:

- Partial Disability Benefits: Support if you’re able to work part-time

- Rehabilitation Support: Coverage for rehabilitation expenses

- Indexation Options: Automatic increases in benefits to keep pace with inflation

- Superannuation Contribution Option: Coverage for super contributions

3. Waiting Periods and Benefit Periods

Choose a waiting period that aligns with your savings and sick leave entitlements. Longer waiting periods generally result in lower premiums. Benefit periods can vary widely, from 2 years to up to age 65 or 70.

4. Premium Costs and Value for Money

While price is important, consider the overall value of the policy. Cheaper premiums might come with less coverage or fewer benefits.

Best Income Protection Insurance Providers in Australia for 2025

Here are the 12 best income protection insurance providers in Australia to secure your future. The lists are made for 2025.

1. AIA Australia

AIA Australia stands out for its comprehensive coverage options and innovative health programs.

| Feature | Details |

| Max Coverage | Up to 75% of income |

| Unique Features | AIA Vitality program offering health rewards |

| Customer Rating | 4.5/5 from over 1,000 reviews |

| Waiting Period Options | 14 days to 2 years |

| Benefit Period Options | Up to age 70 |

2. TAL

TAL offers tailored policies with flexible options catering to various needs.

| Feature | Details |

| Max Coverage | Up to 70% of income |

| Unique Features | TAL Health Sense program with premium discounts |

| Customer Rating | 4.3/5 from over 800 reviews |

| Waiting Period Options | 30 days to 2 years |

| Benefit Period Options | Up to age 65 |

3. Zurich

Zurich provides extensive income protection coverage with a focus on customer service.

| Feature | Details |

| Max Coverage | Up to 80% of income (including superannuation) |

| Unique Features | Zurich Active Living Program promoting wellness |

| Customer Rating | 4.4/5 from over 700 reviews |

| Waiting Period Options | 30 days to 2 years |

| Benefit Period Options | Up to age 65 |

4. MLC

MLC offers robust policies with many optional benefits tailored for individuals.

| Feature | Details |

| Max Coverage | Up to 75% of income |

| Unique Features | Child support benefit and business expense option |

| Customer Rating | 4.2/5 from over 600 reviews |

| Waiting Period Options | 14 days to 2 years |

| Benefit Period Options | Up to age 65 |

5. OnePath

OnePath’s policies are known for their flexibility and comprehensive coverage options.

| Feature | Details |

| Max Coverage | Up to 75% of income |

| Unique Features | Severity booster benefit for critical illnesses |

| Customer Rating | 4.3/5 from over 550 reviews |

| Waiting Period Options | 30 days to 2 years |

| Benefit Period Options | Up to age 65 |

6. Asteron Life

Asteron Life focuses on personalized service and flexible policies.

| Feature | Details |

| Max Coverage | Up to 75% of income |

| Unique Features | Needlestick benefit for healthcare professionals |

| Customer Rating | 4.1/5 from over 500 reviews |

| Waiting Period Options | 30 days to 2 years |

| Benefit Period Options | Up to age 65 |

7. BT Financial Group

BT offers comprehensive policies with various optional extras.

| Feature | Details |

| Max Coverage | Up to 80% of income (including superannuation) |

| Unique Features | Crisis benefit and family care option |

| Customer Rating | 4.2/5 from over 450 reviews |

| Waiting Period Options | 30 days to 2 years |

| Benefit Period Options | Up to age 65 |

8. ClearView

ClearView emphasizes transparency and customer-centric policies.

| Feature | Details |

| Max Coverage | Up to 75% of income |

| Unique Features | Future increase benefit without medical evidence required |

| Customer Rating | 4.3/5 from over 400 reviews |

| Waiting Period Options | 30 days to 2 years |

| Benefit Period Options | Up to age 65 |

9. MetLife

MetLife provides extensive support services alongside its policies.

| Feature | Details |

| Max Coverage | Up to 75% of income |

| Unique Features | Family care benefit and overseas assist option |

| Customer Rating | 4.0/5 from over 350 reviews |

| Waiting Period Options | 30 days to 2 years |

| Benefit Period Options | Up to age 65 |

10. NobleOak

NobleOak is recognized for its straightforward approach and competitive pricing.

| Feature | Details |

| Max Coverage | Up to $30,000 per month (for high earners) |

| Unique Features | No upfront commission fees; fully underwritten policies |

| Customer Rating | 4.4/5 from over 300 reviews |

| Waiting Period Options | 30 days or 90 days |

| Benefit Period Options | 2 years, 5 years, or to age 65 |

11. NEOS Life

NEOS Life focuses on innovative solutions and customer ease.

| Feature | Details |

| Max Coverage | Up to $20,000 per month (for high earners) |

| Unique Features | Streamlined application process; loyalty discounts available |

| Customer Rating | 4.5/5 from over 250 reviews |

| Waiting Period Options | 30 days to 2 years |

| Benefit Period Options | 2 years, 5 years, or to age 65 |

12. Integrity Life

Integrity Life prioritizes customer support and comprehensive coverage options.

| Feature | Details |

| Max Coverage | Up to $20,000 per month (for high earners) |

| Unique Features | Mental health coverage included in most plans; rehabilitation expense benefits available |

| Customer Rating | 4.2/5 from over 200 reviews |

| Waiting Period Options | 30 days to 2 years |

| Benefit Period Options | 2 years, 5 years, or to age 65 |

Industry Trends and Statistics

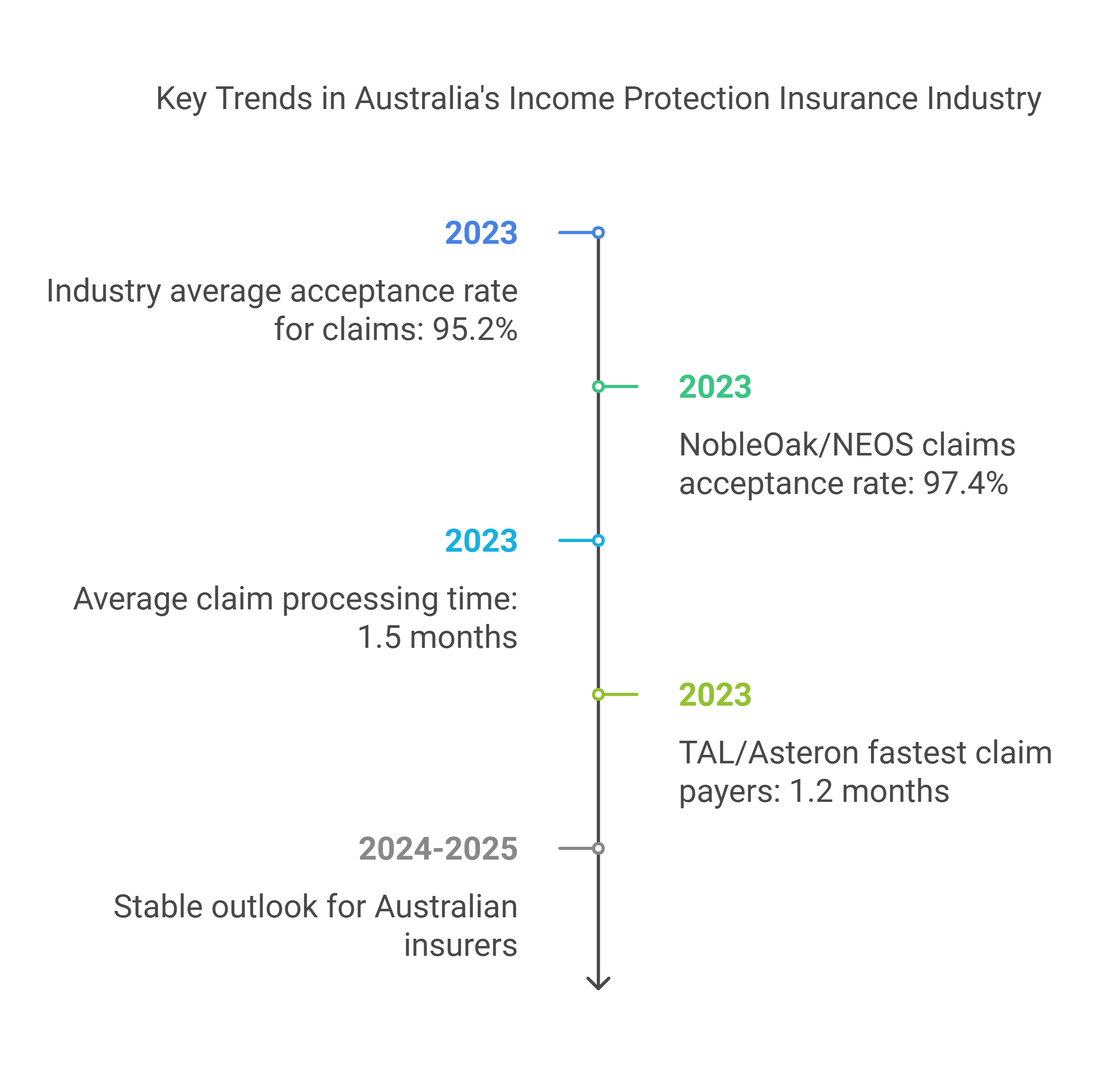

According to recent data from the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC), the income protection insurance industry in Australia has seen some significant trends:

- The industry average acceptance rate for income protection insurance claims in 2023 was 95.2%.

- NobleOak/NEOS had the highest income protection claims acceptance rate of 97.4% in 2023.

- The average time for an income protection insurance claim to be accepted was 1.5 months in 2023.

- TAL/Asteron were the fastest payers of income protection claims on average in 2023 at 1.2 months.

| Metric | Industry Average | Best Performer |

| Claims Acceptance Rate (2023) | 95.2% | NobleOak/NEOS (97.4%) |

| Average Claim Processing Time | 1.5 months | TAL/Asteron (1.2 months) |

It’s worth noting that the Australian insurance sector is expected to remain resilient in the coming years, with the creditworthiness of Australian insurers remaining stable over 2024 and 2025. About 79% of rated Australian insurers have stable rating outlooks.

How to Compare Income Protection Insurance Policies

When comparing different policies, consider these steps:

- Assess Your Needs: Determine how much coverage you need based on your income and expenses.

- Compare Benefits: Look at waiting periods, benefit periods, and additional features.

- Read Reviews: Check customer experiences regarding claims processing and support.

- Seek Professional Advice: Consult with an insurance broker or financial advisor if necessary.

Takeaways

Choosing the right income protection insurance provider is crucial for ensuring your financial security in case of unforeseen circumstances that prevent you from working. The top providers listed above offer various options tailored for different needs and budgets, making it easier for Australians in diverse situations to find suitable coverage.

As you navigate your choices, consider factors such as financial stability, policy features, premium costs, and customer service reputation when making your decision. Ensuring that you have adequate income protection can provide peace of mind as you focus on recovery during difficult times ahead in 2025 and beyond.

By investing time in understanding these options and comparing providers effectively, you’ll be better equipped to secure the right policy that protects not only your income but also your lifestyle during challenging periods.