Many people with low credit see their card requests get turned down. They check a credit report and find red marks from credit bureaus. They feel stuck and worry about high annual fees and steep APRs.

One popular cashback card gives 1% cash back, has a $39 annual fee, and holds a 35.99% APR.

This post lists 10 top secured and unsecured products, from Visa to big-name Mastercard offers. We compare security deposits, annual fees, and credit limits. You will learn how to boost your score with on-time payments and simple credit line use.

Read on.

Key Takeaways

- In 2025, the Capital One Platinum Secured Credit Card holds a 4.69/5 WalletHub rating, charges a 29.74% APR, has no annual fee, and gives a $200 line for a $49 minimum deposit.

- The Avant Mastercard carries a 35.99% APR, a $39 annual fee, requires no security deposit, and pays 1% cash back on purchases.

- The First Progress Platinum Select Secured Card posts an 18.24% APR, a $39 annual fee, and needs a $200–$2,000 refundable deposit, while reporting to Equifax, Experian, and TransUnion.

- The ten cards span APRs from 18.24% to 35.99%, annual fees from $0 to $175, secured and unsecured Visa and Mastercards, instant-approval tools, and paths to unsecured upgrades.

- To rebuild credit, pay at least the minimum by each due date, keep your balance under 30% of your limit, limit hard pulls, use free credit monitoring, and review all three bureau reports yearly.

Capital One Platinum Secured Credit Card

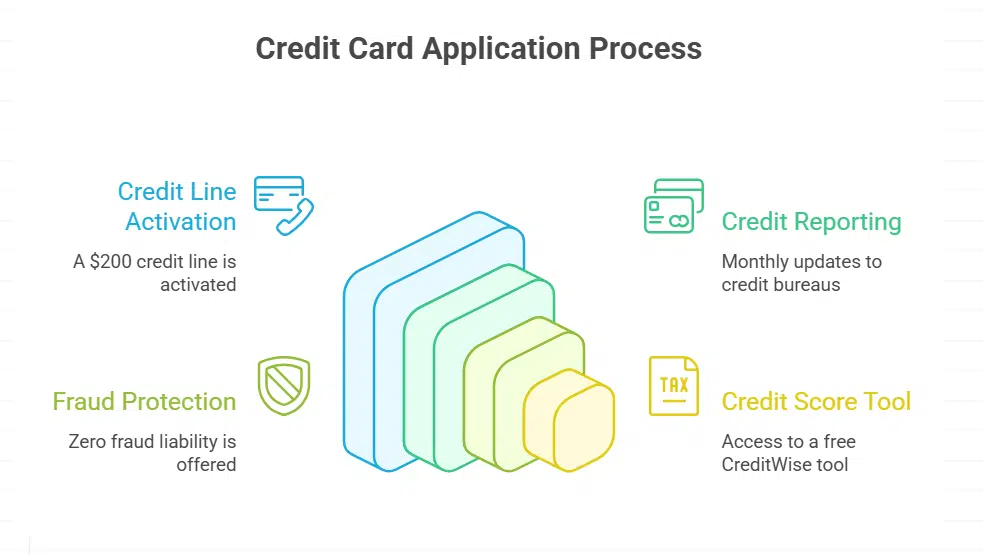

Capital One Platinum Secured Credit Card holds a 4.69 out of 5 WalletHub rating. It carries a variable APR of 29.74% and zero annual fees, with no hidden costs. Capital One issues this Visa secured credit card after a refundable deposit of at least $49, which unlocks a $200 credit line.

Account shows monthly updates to Equifax, Experian, and TransUnion for credit reporting. Card adds zero fraud liability and offers a free CreditWise score tool. This card suits bad or fair credit profiles.

Card avoids foreign transaction fees.

Credit One Bank® Secured Card

Credit One Bank Secured Visa credit card charges a 29.49% APR and waives any annual fee. You deposit $200 or more to set your credit limit via a refundable security deposit. It reports your payments to all three credit bureaus and rebuilds your credit history.

Cardholders earn 0 to 1 percent rewards on eligible purchases. It ranks among best credit cards for bad credit, with a 3.86 out of 5 rating from 584 user reviews.

Approval rates stay high even with low credit scores. It uses a soft credit check, so you can apply with little risk. Each account gets a monthly review for credit limit increases.

A related Visa offer picks a $75 to $99 fee with a $300 minimum limit. This option suits those who need a simple way to fix a poor credit score.

OpenSky® Secured Visa® Credit Card

This Visa secured credit card earns a 4.16 rating out of 5 and it carries a 24.64% annual percentage rate plus a $35 annual fee. It skips the credit check for approval, so folks with no credit history can apply.

A $200 refundable security deposit serves as the credit limit. The online form runs without a hard inquiry.

It sends monthly data to Experian, Equifax and TransUnion, so on-time payments boost your FICO score. Licensing rules vary, so approval may not happen everywhere. Cardholders can add more funds to raise their credit line.

You can track progress with credit monitoring and review credit reports. That strategy helps rebuild credit and cut your credit utilization ratio fast.

Avant® Mastercard®

Avant® Mastercard® features a 35.99% APR and a $39 annual fee while giving 1% cash back on purchases. It holds a 3.82 star score out of 5 from 95 user reviews. Users need no security deposit to access an unsecured credit card option for bad credit.

You can prequalify online without a hard pull. The issuer reports payment history to all three major credit bureaus every month to rebuild your credit fast.

Credit limits start small but can grow after making regular payments. You avoid high security deposits yet still build a strong credit history. A high credit utilization ratio can drag down your score, so watch your balance.

Fraud liability protection covers you if thieves swipe your account.

Surge® Platinum Mastercard®

Surge Platinum Mastercard meets the need for an unsecured card option. You pay no security deposit. It sets a 35.90% APR and charges an annual fee between $75 and $125. After year one, it tacks on a $12.50 monthly fee.

Approved applicants get up to $1,000 on their line of credit. You can prequalify online, and see approval odds without a hard inquiry on your credit report.

Company sends your payment history to Equifax, Experian, and TransUnion each month. This can help with credit bureaus and may raise your credit score if you pay on time. Watch how much credit you use, high credit utilization can hurt your score.

EMV chip and zero fraud liability guard against misuse. Credit limit won’t grow with extra payments. 1,219 reviewers gave it 1.8 out of five stars. They flag high fees and steep interest as deal breakers.

FIT™ Platinum Mastercard®

FIT™ Platinum Mastercard® has a 35.90% APR. It lists credit card fees, such as a $95 program fee. It gives a $400 credit limit. It reports to Equifax, Experian, and TransUnion. It suits folks with bad credit.

It works on the Mastercard network. Rating stands at 1.2 out of 5 based on 637 reviews.

New users pay a $99 annual fee the first year. Fees rise to $125 after that. A $12.50 monthly fee applies after year one. This unsecured option asks no security deposit. Approval hinges on credit score.

Many apply, some get approved.

Reflex® Platinum Mastercard®

Reflex Platinum Mastercard charges a 35.90% APR. It has an annual fee of $75 to $125. After the first year it adds a $12.50 monthly fee. You can pre qualify online without affecting your credit score.

It reports to Experian, TransUnion, Equifax. Cardholders get up to a $1,000 credit limit with no deposit.

It suits users with poor credit who need an unsecured card. It does not allow credit limit increases from extra payments. Six hundred twenty nine users gave it a 1.8 out of 5 star rating.

Many warn about steep fees and high APR. Pair it with on time payments to boost your credit score and build your borrowing record.

Destiny® Mastercard® with Instant Credit

This credit card for bad credit offers instant access. Destiny Mastercard grants a $700 credit limit right away. You get an instant card number once the issuer approves your application.

Applicants do not need a security deposit to start building credit. The issuer sends on-time payments to all three major credit bureaus. Denials do not ding your credit score. Score rebuilders face a $175 annual fee in year one, then a $49 fee after that with a $12.50 monthly fee.

Three hundred twelve users rated it 1.8 out of 5 stars on average.

First Progress Platinum Select Mastercard® Secured Credit Card

The First Progress Platinum Select Mastercard Secured Credit Card carries an 18.24% APR and a $39 annual fee. You fund it with a security deposit from $200 to $2,000. That deposit sets your credit limit.

The card pays 1% cash back on eligible purchases. You can link it to Apple Pay or a digital wallet for fast, safe checkout.

Your activity goes to all three major credit bureaus. You see credit history build with on-time payments. Bad credit or no score still qualifies. You need no hard credit check for preapproval.

It feels like training wheels, and you get a lower APR to rebuild credit.

Milestone® Mastercard® – $1,000 Credit Limit

Milestone Mastercard gives new cardholders a guaranteed $1,000 credit limit. It asks no security deposit. You apply online and get a fast decision. Denial costs no point off your credit score.

Milestone reports on-time payments to Equifax, Experian, and TransUnion. You build credit history with each statement. This unsecured credit card fits people with limited or bad credit.

It lets you track credit utilization ratio and plan for a mortgage or personal loan.

Features to Look for in a Credit Card for Bad Credit

Good cards for bad credit can open doors. Prioritize options that report to all three credit bureaus and minimize annual fees.

- Broad credit bureau reporting: Cards like Capital One Platinum Secured and Credit One Bank® Platinum Visa® report to Experian, Equifax, TransUnion. This boost to credit histories helps raise credit scores faster.

- Modest annual fees under $100: Choose cards with $0 to $99 yearly cost. Discover it® Secured Credit Card and Indigo Mastercard often charge low or no annual fee, easing budget strain.

- Solid refundable security deposit: Secured credit cards need a deposit of at least $200. OpenSky® Secured Visa® and Avant® Mastercard® turn that deposit into your credit limit and return it when you close or upgrade.

- Simple credit line increase policy: Issuers like Surge® Platinum Mastercard® raise your credit limit after six on time payments. Lower credit utilization ratio then lifts your credit score.

- Future unsecured upgrade option: Destiny® Mastercard® and First Progress Platinum Select Mastercard® Secured let you move to an unsecured card. You skip a new credit card application and keep your credit history intact.

- Practical cash back rewards: A 1 percent rewards program fits most budgets. The Capital One Quicksilver Secured Cash Rewards Credit Card earns real cash back rewards on every purchase when you pay in full.

- Transparent fee structure: Review monthly fees, cash advance fees, and interest rates before you apply. Clear fee details cut surprises and help you avoid debts from overdraft fees.

- Automatic on time payments aid: Set up an automated clearing house transfer or autopay from your checking account. This step ensures on time payments hit your credit report each month.

- Free credit monitoring tools: Pick cards with built-in credit monitoring and dark web monitoring. Those features shield you from fraud liability and track changes in credit scores.

- Reasonable interest rates: Seek lower APR options even on cards for bad credit. High credit card interest can turn a small balance into a big debt fast.

Tips for Improving Credit While Using a Credit Card

Building credit takes small but steady steps. Using a card smartly can boost your credit score.

- Always pay at least the minimum payment by the due date to avoid late fees and boost your FICO Score.

- Keep your credit utilization ratio under 30 percent of your credit limit to show lenders you handle debt well.

- Try Experian Boost to add on-time utility and phone payments into your FICO Score 8, and watch your credit jump.

- Open a credit-builder loan to add payment history and improve your credit mix, even if you use secured credit cards first.

- Review your credit report from each credit bureau at least once a year to spot errors and dispute any wrong entries.

- Limit credit card applications to one at a time to prevent hard inquiries that can drop your score.

- Use free credit monitoring tools from card issuers or sites like www.chime.com to track changes in your credit score.

- Weigh card closures carefully since closing a long-standing account can cut your average account age and hurt your credit history.

Takeaways

These ten cards give you a fresh start. This lineup fits your wallet like a glove. You can pick a secured credit card with a low security deposit and a clear refund path. Each issuer reports to major credit bureaus, so on time payments can lift your score.

Use credit monitoring and free credit reports to track progress. Aim to keep your credit utilization ratio under thirty percent. Apply with simple credit card applications that won’t need a high credit limit.

Earn cash back, rebuild credit, and gain more financial freedom.

FAQs on Best Credit Cards for Bad Credit

1. What credit cards can help rebuild bad credit in 2025?

You can pick secured credit cards like capital one platinum secured credit card or discover it® secured credit card, they need a refundable security deposit that sets your credit limit. You can also try an unsecured option like credit one bank® platinum visa® with no security deposit. Indigo mastercard and milestone mastercard pop up on many best credit cards for bad credit lists. All report to credit bureaus. This is not a debit card, it works like a credit card to rebuild credit.

2. How do secured credit cards work?

A secured credit card works like a locked box, your security deposit sits inside, and that sets your credit limit. You use it like a charge card, you pay each month in full or by the due date. The lender reports on-time payments to credit bureaus so you build credit history. After good payments, you can ask for a credit limit increase.

3. Can I earn cash back rewards with cards for bad credit?

Yes, some cards still pay you back. For example capital one quicksilver secured cash rewards credit card offers cash back rewards on every purchase, and credit one bank® platinum visa® can give cash-back, too. Just watch credit card fees and any annual fee.

4. How do these cards affect my credit scores?

Every on-time payment gets sent to credit bureaus, that helps your credit score and builds credit history. Keeping your credit utilization ratio low makes a big difference. You can also get credit monitoring or add dark web monitoring, and check your credit report often. Good habits move you toward a better score.

5. What fees should I watch on bad credit cards?

Fees can hide in small print. Look for annual fee, credit card fees, or no security deposit offers. Some cards need a refundable security deposit, some do not. Check if there is a no credit check policy or low fees listed. A clear fee sheet saves you money.

6. How can I get credit card approval with bad credit?

Getting credit card approval with bad credit is like knocking on a friendly bank door. You compare offers from credit card companies, you fill out a credit card application with ID and paycheck info. Some cards run no credit checks, others use soft credit checks. This is part of consumer lending, it works different than personal loans. You can pick a bank credit card from visa credit cards or american express. Once you get approval, you get a new credit line to help rebuild your credit.