You may feel stuck with a low credit score and sky-high interest rates. Payment history makes up 35% of your FICO score. This guide shows the Best Credit-Building Apps To Improve Your Score, from Experian Boost to apps that track payment history, credit utilization and credit monitoring.

Read on.

Key Takeaways

- Payment history makes up 35% of your FICO score. Self Credit Builder lets you take a 2-year loan at $25, $35, $48, or $150 per month. It reports on-time payments to Equifax, Experian, and TransUnion. Users average a 47-point gain in six months. Over 1 million people downloaded it, and 280,000 rated it 4.9 stars.

- Experian Boost links to your bank to add utility, phone, internet, rent, and subscription payments to your credit report—free. Many users see a 10–15 point rise in days. You stay in control of what it reports.

- Kikoff offers a $750 revolving line for $5 a month with zero interest or fees. It reports your payment history, and some users gain 58 points in months. Grow Credit uses a special Mastercard to report streaming and app fees to all three credit bureaus. The free plan covers $17 monthly; paid plans run $1.99–$7.99 for up to $150 credit.

- Sable issues a secured card with no credit check, no monthly fees, and 2% cash back on select buys. Extra reports your debit card use to Experian and Equifax. Credit Karma shows free scores from two bureaus, tracks on-time payments and utilization, and offers personalized credit product picks.

- SeedFi’s Borrow & Grow loans start at $10 with no interest. Credit Strong ties a savings CD plan to credit building with dues of $15–$110 over 6–24 months. Both apps report on-time payments monthly. Sesame Cash gives real-time score monitoring and a $100 bonus for a 100-point gain in 30 days. Ava offers goal tracking, visual charts, reminders, and real-time bureau updates.

Self: Build Credit and Savings Together

Self Credit Builder app lets you take a credit-building loan. The loan costs $25, $35, $48 or $150 per month. The term lasts two years. Find no admin fees or hard credit checks. Payments go to Equifax, Experian, TransUnion each on-time.

Many users gain 47 points in six months. Over one million people downloaded this app, and 280,000 rated it 4.9 stars.

Self locks your deposits in a monthly share certificate. This turns into a savings pool you can access later. You can set up autopay for on-time payments, to boost payment history, and keep credit utilization low.

A simple dashboard shows credit report changes. Members can also report up to five rent or subscription payments for $6.95 a month. This tool helps track FICO score gains and your savings goal.

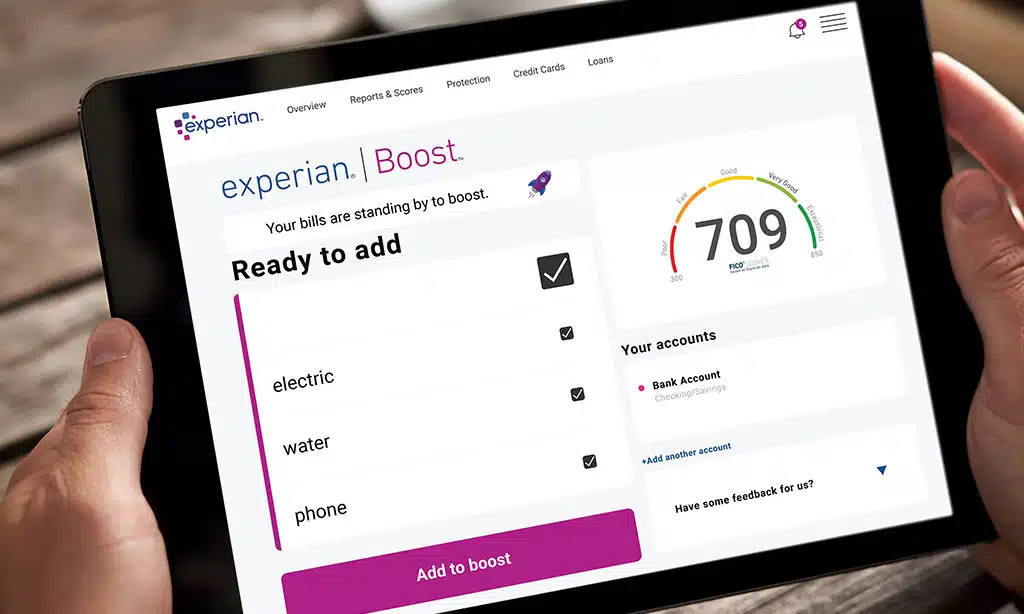

Experian Boost: Add Utility Payments to Your Credit Report

Experian Boost links bank accounts, to track utility, phone, and internet bills. It adds on-time payments, to your credit report. This credit builder app reports rent, subscription, and utility payments.

Many people see modest score increases, in days. That process helps, with credit building at the credit bureaus.

Link a checking account, to start. The app taps into payment data, to update your FICO score. You keep full control, of what it reports. No fees apply, so you can test it risk free.

Folks often cheer, at a quick bump. Some gain 10 or 15 points fast. That boost can unlock a higher credit line, or better loan terms.

Kikoff: Affordable Credit-Building Plans

Kikoff offers a $750 revolving credit line with no credit check. You pay just $5 a month, with zero interest or late fees. The platform sends reports to credit bureaus, boosting your payment history.

Some people see a 58-point jump in their FICO score within months. Kikoff tracks your credit utilization too, so you can spot spending spikes before they hurt your score.

A mobile tool gives credit monitoring in a clear control panel. It guards your data privacy, locking down personal details. This credit builder app feels like planting a seed that grows into a sturdy oak.

Grow Credit: Use Subscription Payments to Build Credit

A special Mastercard tracks your subscription charges and reports them to Experian, Equifax, and TransUnion. It adds your on-time payments to your credit file, boosting payment history.

You keep credit utilization low since you pay only your streaming and app fees.

The free plan holds up to $17 in monthly spend. Subscribers can raise their credit line to $50 or $150 for $1.99 to $7.99 per month. Major credit bureaus receive your data each billing cycle, helping you build credit and improve your credit score.

Credit Karma: Track and Improve Your Credit Score

Credit Karma shows your credit score and credit rating for free. You see updates from two main credit bureaus. A clear chart tracks on-time payments, credit utilization, and payment history.

It alerts you if any score change occurs.

The score tester tests how a new line of credit or an on-time payment might lift your rating. The app suggests credit cards, secured credit cards, and loans that match your needs. You tap one offer and apply right in the app.

Personalized credit product recommendations adapt to your profile.

Sable: A Secured Credit Card with No Credit Check

Sable grants readers a security-backed card with no credit check. It asks for an upfront deposit that becomes the credit line. You earn an upgrade to an unsecured card in four months with on-time payments.

Monthly fees cost zero. The system reports payment history to TransUnion, Experian and Equifax. Your credit utilization and on-time payment data can boost your FICO score.

Sable pays 2% cash back at select stores and 1% on other buys. The mobile app updates your credit report and credit monitoring in real time. Data privacy holds all personal details safe.

Friendly customer service reps answer card use questions in minutes.

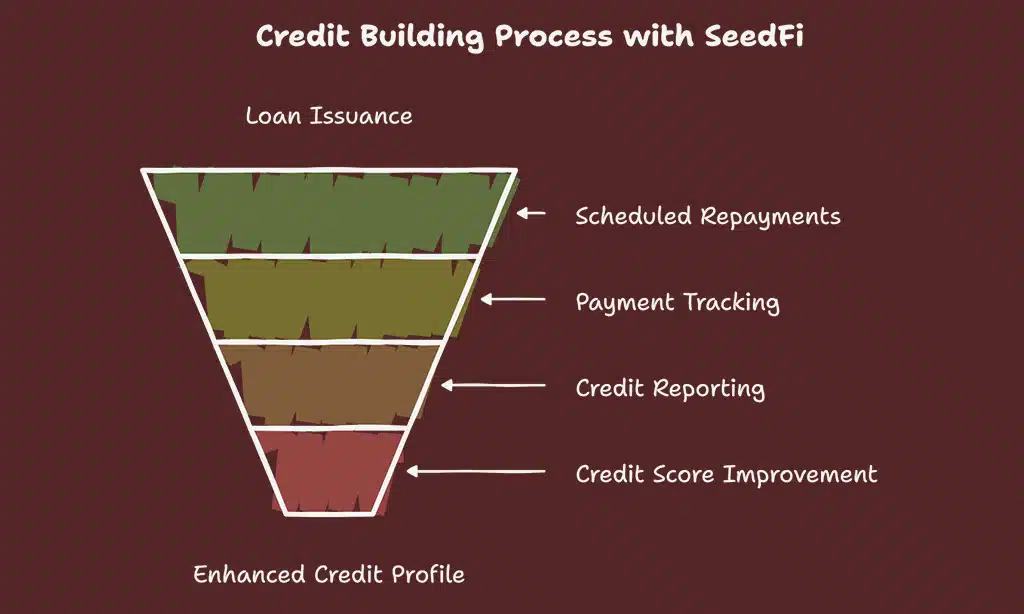

SeedFi: Credit Builder Loans for Faster Results

SeedFi’s Credit Builder Prime issues interest-free loans as low as $10. The service drops funds into a savings account under its Borrow & Grow program. Members pick a loan term and repay in easy, scheduled installments.

It tracks on-time payments and adds them to your payment history.

It reports activity to Equifax, Experian, and TransUnion each month. That steady credit reporting nudges your credit score upward. Users track progress on the SeedFi platform and watch credit utilization drop.

This tool builds credit smartly, with no hidden fees or annual percentage rate charges.

Credit Strong: Combine Savings and Credit Building

Credit Strong links a savings fund to a credit builder plan. It acts as a credit builder app to help you build credit. You pick a loan term from 6 to 24 months. The platform sends your on-time payments to Experian, Equifax, and TransUnion.

Monthly dues run from $15 to $110, and you get no loan funds up front. The plan holds your funds in a certificate of deposit as collateral. That move reports each payment to credit bureaus, builds payment history, and lowers credit utilization.

Later, your savings arrive at term end, minus interest and fees. You see steady credit score improvement and a stronger credit history.

Extra: A Debit Card That Builds Credit

This debit card sends transactions to Experian and Equifax, so you get credit reporting on every purchase. It uses your checking balance as a cap, so you never overspend. The card logs on-time payments to build a strong payment history and shows your credit utilization, so your FICO score can rise.

Users skip interest fees and security deposits common with a secured card. The app tracks credit bureau data in real time, and it alerts you about credit score changes. A gentle nudge on payment deadlines builds a positive payment history and improves your credit building efforts.

Sesame Cash: Real-Time Credit Score Monitoring

Sesame Cash shows score changes as they happen. The app links to all major credit bureaus and tracks on-time payments. A live feed updates your credit utilization ratio with each transaction.

Users spot FICO score trends in real time.

A virtual secured credit card lives inside the platform. Cardholders lock funds, then spend like usual. Credit Sesame grants $100 to users who boost scores by 100+ points within 30 days.

That perk turns credit repair into a fun challenge.

Ava: Simplify Credit Building with Goal Tracking

Ava sits on your phone. It works as a credit builder app to build credit steadily. It gives real-time updates and personalized tips after each payment. It tracks payment history, flags on-time payments, and spots credit utilization spikes.

Ava links to the three national credit bureaus. It shows FICO Score changes in a simple dashboard.

You set a credit score goal in minutes. Ava offers goal tracking and monthly saving targets. The app uses visual charts to show progress. It sends gentle reminders for due dates. It adds credit monitoring to your routine.

These decision-making tools make each step clear.

Takeaways

You now know ten top apps that push your credit score up. Self and SeedFi pair a savings tool with a loan to boost your payment history. Experian Boost adds your utility bills to your credit line.

Kikoff and Grow Credit let you build credit with tiny subscription plans. Credit Karma brings credit monitoring right to your phone. Sable and Extra give you a secured card or a debit card that reports to credit bureaus.

Sesame Cash shows your score in real time. Ava tracks your goals and sends gentle nudges. Pick one, make on-time payments, and watch your FICO score climb.

FAQs on Best Credit-Building Apps To Improve Your Score

1. What is a credit builder app?

A credit builder tool helps you build credit. It tracks on-time payments, rent reporting, credit utilization, and credit line changes. It sends data to credit bureaus.

2. How does an app boost my payment history?

It links your paycheck or rent account and reports on-time payments to credit bureaus. That flow lifts your payment history and raises your FICO score.

3. What if I have no credit or student loan debt?

Some tools work with no credit check. They log private student loans and defaults from an individual voluntary arrangement. They offer credit monitoring and guide you through credit repair.

4. How do these apps guard data privacy?

They lock your info with strong encryption. They block advertisers and cut targeted advertising. You can use them on macOS, iPod Touch, or other devices. You can also track subscriptions safely.

5. Can these tools work with secured credit cards?

Yes, many let you get a secured credit card and pay it on time. They report those payments to credit card companies. That cuts credit utilization and helps build your credit score.