Indian weddings are grand, lavish, and deeply rooted in cultural traditions. However, with large-scale events come unforeseen risks, from vendor mishaps to last-minute cancellations. This is where wedding insurance becomes a game-changer. Understanding the benefits of wedding insurance for Indian couples can help protect your financial investment and ensure peace of mind as you prepare for your big day.

Wedding insurance acts as a safety net against unpredictable circumstances like vendor failures, property damage, extreme weather, and even medical emergencies. Given the significant expenses involved in an Indian wedding, having a financial safeguard in place is not just wise but essential.

In this article, we explore the top 7 benefits of wedding insurance for Indian couples, why it is a must-have, and how to choose the right policy to secure your dream wedding.

What is Wedding Insurance and Why Do Indian Couples Need It?

Wedding insurance is a specialized policy designed to cover financial losses due to unforeseen disruptions before or during a wedding. It typically includes coverage for:

- Event cancellation or postponement

- Vendor-related issues (no-shows, bankruptcy, etc.)

- Weather-related damages or delays

- Accidental property damage

- Medical emergencies

- Jewelry theft or loss

- Personal liability coverage for guests and hosts

Why Wedding Insurance is Essential for Indian Weddings

Indian weddings involve multiple events, extensive bookings, and high-value expenses. With such a significant financial commitment, securing a wedding insurance policy ensures protection against unexpected disruptions. Here’s why wedding insurance is particularly important for Indian couples:

- High Costs: From venue bookings to catering, Indian weddings involve huge investments. Insurance helps recover financial losses if anything goes wrong.

- Multi-Vendor Dependencies: Indian weddings require multiple service providers (decorators, caterers, photographers, etc.). A vendor’s failure can lead to chaos.

- Unpredictable Weather Conditions: Monsoons, floods, and extreme heat can disrupt an outdoor wedding.

- Family and Guest Risks: With large guest lists, medical emergencies or accidental injuries are more likely to occur.

- Destination Weddings: Travel cancellations, hotel issues, or local disruptions can impact weddings planned outside India.

- Unforeseen National Events: Political unrest, government restrictions, or public emergencies can result in abrupt changes to wedding plans.

Top 7 Benefits of Wedding Insurance for Indian Couples

Indian weddings come with extensive planning and high financial stakes, making wedding insurance an essential safeguard against unexpected mishaps.

1. Financial Protection Against Unexpected Cancellations

Wedding plans can be disrupted due to unavoidable circumstances like illness, accidents, or sudden family emergencies. Wedding insurance ensures that deposits for venues, catering, and other bookings are reimbursed in case of last-minute cancellations or postponements.

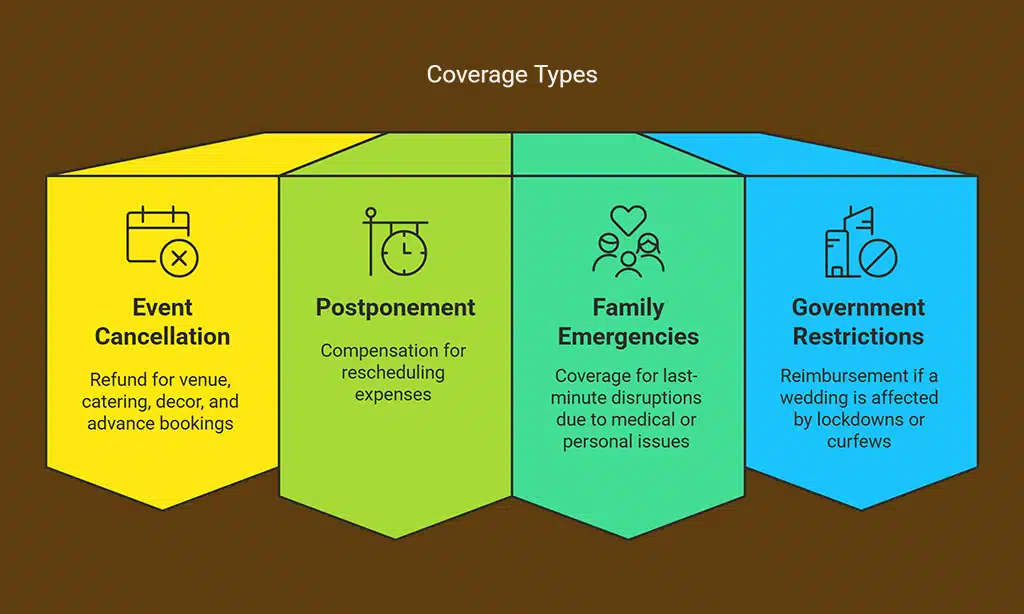

Key Coverage Areas:

| Factor | Coverage Provided |

| Event Cancellation | Refund for venue, catering, decor, and advance bookings |

| Postponement | Compensation for rescheduling expenses |

| Family Emergencies | Coverage for last-minute disruptions due to medical or personal issues |

| Government Restrictions | Reimbursement if a wedding is affected by lockdowns or curfews |

2. Coverage for Vendor No-Shows and Service Failures

Imagine your decorator failing to turn up on the wedding day or the caterer providing subpar service. Wedding insurance helps cover the financial loss due to vendor failures, ensuring you don’t bear the entire burden.

Common Vendor-Related Issues Covered:

- Photographer or videographer not delivering promised services

- DJ or live band failing to appear

- Catering service issues

- Florist or decorator failing to meet agreed standards

- Wedding planner abandoning responsibilities

Compensation Breakdown:

| Vendor Type | Coverage Provided |

| Photographer/Videographer | Compensation for rebooking new services or refunds |

| Catering | Refund for subpar or missed services |

| Decorator | Coverage for redesign or replacement |

| Wedding Planner | Compensation for incomplete or failed execution |

3. Protection Against Weather-Related Disruptions

Outdoor and destination weddings are vulnerable to weather conditions. Sudden rains, storms, or extreme heat can force event cancellations or shifts. Wedding insurance compensates for losses due to weather-related disruptions, ensuring your wedding remains stress-free.

| Weather Event | Impact | Insurance Coverage |

| Rainstorm | Outdoor wedding disruption | Compensation for rescheduling or shifting venues |

| Extreme Heat | Guest health risks | Coverage for medical emergencies |

| Flooding | Travel disruptions | Refund for cancellations and alternative arrangements |

| Cyclone/Typhoon | Severe damage to venue | Compensation for full event rescheduling |

4. Safeguarding Against Accidental Property Damage

With extravagant décor and venue arrangements, accidental damage to property is not uncommon. Wedding insurance covers:

- Damage to the wedding venue

- Accidental breakage of rented furniture or décor

- Fire or electrical damage due to lighting or fireworks

- Damage to sound systems, stages, and seating arrangements

5. Medical Emergencies and Liability Coverage

Large-scale weddings involve risks of accidents, injuries, or health emergencies. Wedding insurance provides coverage for:

- Medical treatment costs for guests or family members

- Accidental injuries during ceremonies

- Liability protection if a guest causes damage to property

- Legal costs if a dispute arises from injuries at the event

| Coverage Type | Benefits Provided |

| Medical Coverage | Covers hospitalization costs |

| Guest Liability | Protection for injuries due to accidents |

| Venue Damage | Reimbursement for accidental damages |

| Legal Assistance | Compensation for lawsuits arising from incidents |

6. Jewelry and Valuable Assets Protection

Indian weddings are incomplete without heavy gold and diamond jewelry. Wedding insurance ensures protection against:

- Theft or misplacement of jewelry

- Loss of expensive gifts

- Damage to precious wedding attire

- Loss of heirloom jewelry passed down through generations

7. Honeymoon Protection and Travel Insurance Add-ons

Many insurers offer honeymoon protection as an add-on to wedding insurance. If you face travel cancellations, visa issues, or baggage loss, your policy will help cover the additional costs, ensuring a smooth honeymoon experience.

| Risk | Coverage Provided |

| Flight Cancellations | Refund for non-refundable tickets |

| Lost Baggage | Compensation for missing items |

| Visa Issues | Coverage for unexpected visa denials |

| Hotel Cancellations | Reimbursement for non-refundable bookings |

How to Choose the Right Wedding Insurance Policy in India

Factors to Consider When Selecting a Plan

When choosing a wedding insurance policy, keep these factors in mind:

- Coverage Scope: Ensure the policy covers all critical risks (vendor failures, cancellations, jewelry loss, etc.).

- Exclusions: Read the fine print to know what’s not covered.

- Policy Cost: Compare plans to find an affordable option with maximum benefits.

- Claim Process: Choose an insurer with a quick and hassle-free claim process.

Comparison of Leading Wedding Insurance Providers in India

| Provider | Coverage Offered | Premium Cost | Customer Ratings |

| XYZ Insurance | Vendor & Cancellation Coverage | ₹10,000 – ₹50,000 | ⭐⭐⭐⭐⭐ |

| ABC Insurance | Jewelry & Travel Protection | ₹15,000 – ₹70,000 | ⭐⭐⭐⭐ |

| PQR Insurance | Comprehensive Wedding Policy | ₹20,000 – ₹80,000 | ⭐⭐⭐⭐⭐ |

Takeaways

Indian weddings are once-in-a-lifetime events, but they come with significant financial and logistical risks.

The benefits of wedding insurance for Indian couples go beyond just monetary compensation; they provide peace of mind and allow couples to enjoy their celebrations stress-free.