There are many important financial decisions in life. One of these is applying for a loan. There are essential financial basics to know before you take out a loan. These range from knowing your credit score and gathering documents like proof of identity, income verification, returns, and address verification, to understanding your debt-to-income ratio. All these factors can make a big difference when qualifying for a loan.

It’s easy to apply or prequalify for a loan online. Many people look to use a personal loan as a financing tool for education, home improvements, debt consolidation, or bridging the gap in an emergency. Therefore, it’s important to do your research to figure out the best loan options for you. Also, remember that all loans require documents, and processes can vary between lenders.

Learn the top 4 essential things to know before applying for a loan.

1. Your Credit Score and Credit History

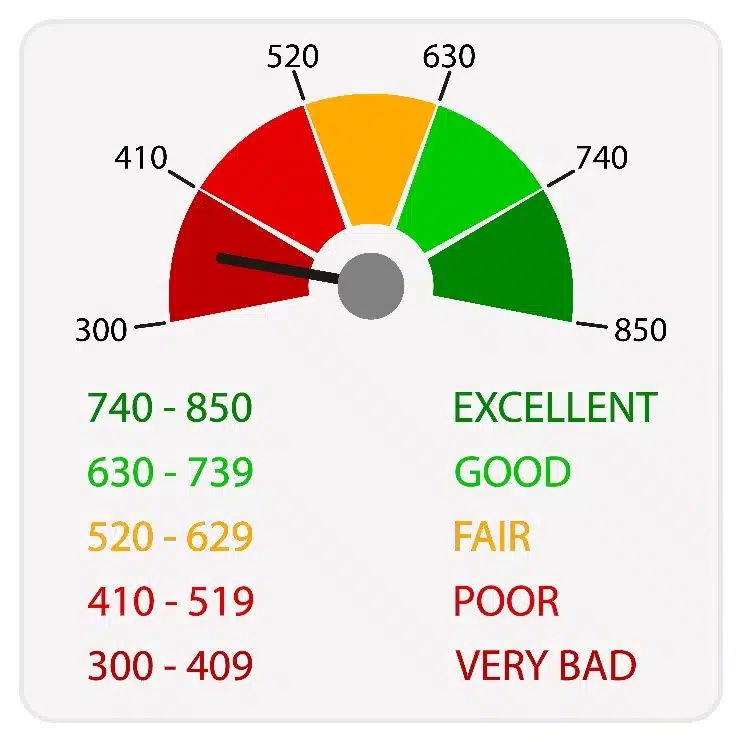

The first thing to do before applying for a loan is to check your credit score. Most lenders who offer personal loans run your credit score, review your credit history, and check your income level and debt-to-income ratio (DTI) to determine if you’re eligible for a loan.

While requirements can vary from lender to lender, a minimum credit score of 670 is a good rule of thumb. If you still need to get there, work to boost your credit score by paying off credit cards each month or scoring a perfect run of on-time payments for a few months. Any changes usually take 30 days or less to update your credit bureau report.

If you’re trying to secure more favorable loan terms, NerdWallet suggests having a minimum credit score of 720.

Here’s why a good credit score is one of the most critical factors in securing a personal loan.

A good credit score can help you pre-qualify and give you various loan options. Most importantly, securing favorable loan terms can save you thousands in loan interest payments.

For example, a person with bad credit might secure fair loan terms at 30% APR. But this is a high-interest rate, which means that your annual interest rate will be about 30% of the total balance of your loan.

Having poor credit can cost you extra over the life of the loan. Here’s how that works. For example, if you take out a $10,000 loan at 30% APR, you will pay a total of $1,168 in interest over the life of the loan. In comparison, securing a $10,000 loan at a 6% interest rate would only cost you $328 in interest over the life of the loan.

The bigger the loan and the longer you take to repay the loan can exponentially increase these numbers.

If you’re unsure about your credit score or want to check your credit report for any negative credit reporting errors, such as settled debts, that are still showing up, you can do this at AnnualCreditReport.com.

If your credit report falls below 670 or you have a lot of debt, such as credit card debt, car loans, mortgages, or student loans, it’s a good idea to hold off on applying for a personal loan until your credit history is in better shape.

At the same time, there are lenders such as SimpleFastLoans who will allow you to qualify even with bad credit or no credit history if you need an emergency loan.

2. Your Debt-to-Income Ratio

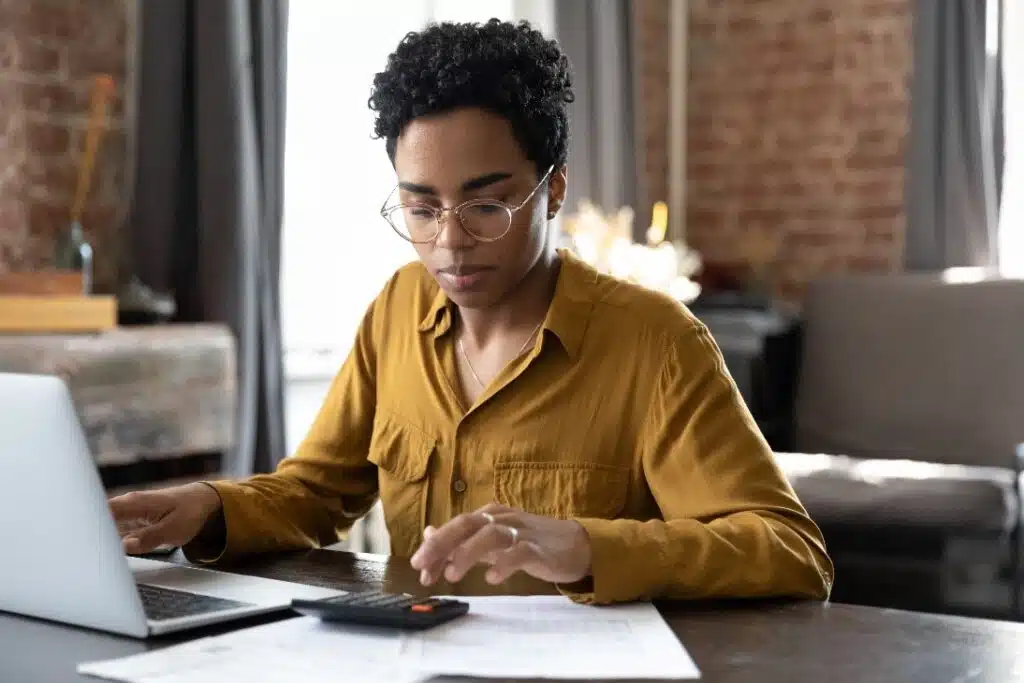

How much you take home in pay factors into whether you can pay off a loan. When applying for a loan, you must provide proof of income.

Lenders require certain income levels to ensure that borrowers can afford to repay the loan. These baseline income requirements can vary depending on the lender. For instance, SoFi requires borrowers to have a $45,000 minimum salary per year. Avant, meanwhile, only requires $20,000 in annual income to qualify.

Bear in mind that many lenders won’t disclose their income threshold requirements. So if you’re turned down for a loan and have a good credit history and score, an income level requirement may be the cause.

If you’re employed, gather pay stubs, W-2 or 1099 forms, or a letter confirming your salary from your employer. Most lenders want to see at least two years’ worth of tax returns and bank statements that show how much you make if you are self-employed or work for yourself.

When you apply for a loan, you don’t need to know if your income is down to the last dollar, but you will need to figure out your take-home pay each month to know if you can make loan repayments.

It’s essential to consider every income source you may have in addition to your day job. For example, your total income may include your spouse’s paycheck, child support, a side hustle, or a second job.

When reviewing a loan application, lenders also review a borrower’s debt-to-income ratio to determine loan eligibility. Your DTI is how much of your gross monthly income pay off existing debt. If your DTI is high, you may not qualify for some loans.

For example, most lenders look for a DTI that is under 36%. But sometimes, a lender will give a loan to someone with good qualifications but a DTI of up to 50%.

Before applying for a loan, remember that lenders seek evidence that you have a steady and regular monthly income source. So, if your pay stubs or bank statements show that your income is inconsistent or varies, lenders may need to be sure you can always meet loan repayment requirements.

That’s why it’s in your best interests to try prequalifying when you can to ensure that you’re meeting lenders’ requirements and only applying for loans you can repay.

3. Any Monthly Payments and Origination Fees

Your debt-to-income ratio is just part of what it takes to qualify for a loan. First, list any personal loans, credit card debt, mortgage payments, or student loans you already must pay each month.

On top of that, figure out how much you plan to borrow from a new loan. Then, if you know the interest rate you’ll receive, you can calculate your monthly payment with any interest at Bankrate, Quicken Loans, or Experion.

It’s always a good idea to factor in any loan origination fees the lender might charge. While this isn’t part of the application process, you may still need to pay a fee that covers application processing, credit score runs, and loan closing costs.

Most origination fees vary from 1% to 8% of the loan amount. This percentage can vary based on your credit score and how large a loan you take out.

Depending on the lender, you may pay in cash when you close the loan, see the fee included in your overall loan amount, or subtract any fees from the disbursed loan when you close.

4. Your Assets and Collateral

The good news is that most personal loans are unsecured. This means you won’t need to put up your car or house as collateral to prove that you will repay the loan.

It’s best to choose an unsecured loan if you have the option since if you miss payments or default on an unsecured loan, you can lose any assets you put up for collateral.

If you’re considering applying for a secured loan or acting as a co-signer for a loan, it’s best to do your research first. Consider if you need the loan enough to place physical assets such as your vehicle or home, real estate, bank accounts, and investment accounts at risk to provide a loan guarantee.

One big advantage to collateralizing a secured loan is that you may receive a lower interest rate. Gather information if you are a co-signer or joint applicant since you will need to give your co-applicants Social Security Number and proof of income.

Applying for a loan with another person with good credit can help boost your chances of qualifying for a personal loan with better rates. However, remember that if you’re a co-signer or joint applicant on a loan, you are just as responsible for making payments as the other person.

The Takeaway

You can save yourself a lot of time and only apply for loans that fit your financial situation by knowing your credit score, identifying your debt-to-income ratio, figuring out fees and monthly payments, gathering required documents, and assessing any collateral for secured loans upfront.