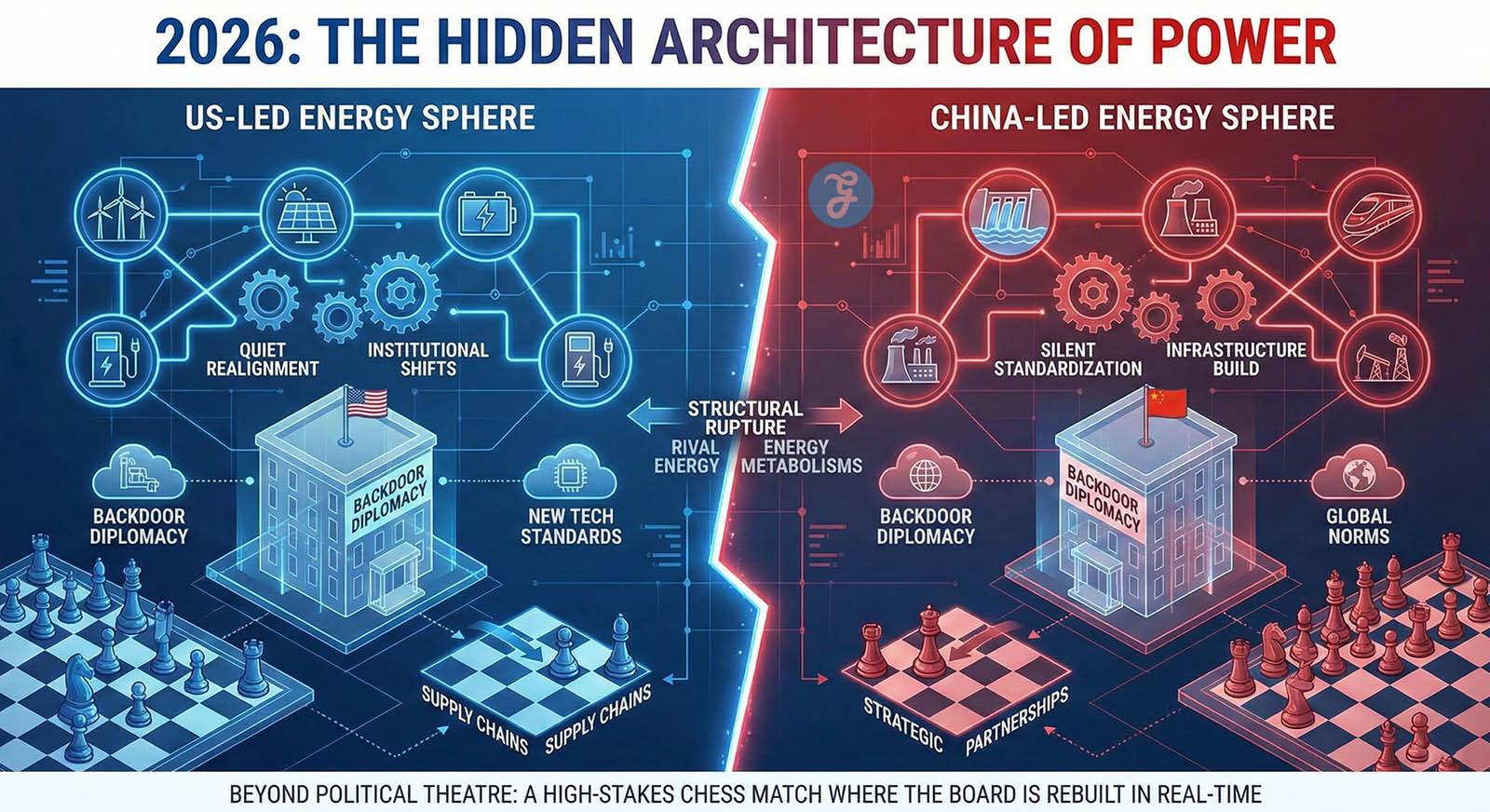

The global economy is fracturing in plain sight. This is no longer a passing trade dispute globally or a bout of diplomatic frost; it is a structural rupture. The world is hardening into two rival energy metabolisms, a phenomenon increasingly defined as the US-China energy competition. In this new era, the traditional rules of globalisation are being torched by a fierce brand of techno-nationalism that prizes strategic control over market efficiency and resilience over openness.

The divergence is visceral in the raw numbers of 2026. While the United States celebrates its return as an undisputed energy titan, pumping a record 13.6 million barrels of oil per day, China is cementing its grip on the circuitry of the future. Beijing now commands a staggering 70% share of global electric vehicle production. It is a tale of two clashing philosophies: one superpower is digging deep into the earth to secure its present, while the other is rewiring the very fabric of the global grid to own the century.

This is the birth of a systemic bifurcation. On one side stands the United States, the ultimate Petrostate, leveraging a vast abundance of oil and liquefied natural gas to tether allies and keep the global machinery humming. On the other stands China, the world’s first true Electrostate, having effectively monopolized the “electric stack”, from the rare earth minerals in the ground to the high-tech batteries and software that power modern life. One power seeks to control the molecules that fuel our world; the other seeks to own the electrons that will define it. The US-China energy competition has ceased to be about lower prices; it is now a battle for who sets the standards for the next hundred years of human movement and power.

The Hidden Architecture of Power: US-China Energy Competition

To truly grasp the seismic shift of 2026, one must apply a lens that peers through the fog of political theatre and performative summits to reveal the hidden mechanics of global power. This perspective exposes a world no longer defined by simple trade disputes, but by a structural rupture into two rival energy metabolisms. It is an analytical clarity that looks past the surface-level rhetoric of “decoupling” to find the backdoor diplomacy and institutional shifts that are actually moving the needle. By identifying the quiet realignment of supply chains and the silent standardization of new technologies, we see the true face of the US-China energy competition: a high-stakes chess match where the board itself is being rebuilt in real-time.

The Rise of the Electrostate

China’s current dominance is not merely a triumph of factory lines or cheap labour. It is the result of a decades-long, meticulous construction of a “vertical fortress.” Beijing has moved far beyond just assembling the world’s electric cars. It has effectively seized control of the entire process that makes modern life possible.

The sheer scale of this industrial machine is difficult to overstate. To power its transition into a global Electrostate, China now generates double the electricity of the United States. In 2025 alone, domestic investment in key energy projects surged past 3.5 trillion yuan ($500 billion), while the total economic value of its clean-energy sectors reached a staggering 15.4 trillion yuan ($2.1 trillion), nearly matching the world’s total clean-tech investment. This immense financial engine feeds a refining monopoly that acts as a global bottleneck. While China currently refines approximately 60% of the world’s lithium, its grip tightens further down the chain, where it commands a staggering 85% share of global battery component production, including anodes and electrolytes.

Even if a mineral is mined in Australia or Africa, the path to a finished battery almost inevitably runs through a Chinese factory.

This success is driven by a strategy of “Specialised Vertical Integration.” While Western firms spent decades outsourcing their supply chains to the lowest bidder, Chinese giants like BYD took the opposite path. BYD does not just build cars; it owns the lithium mines, manufactures its own semiconductors, and designs its own proprietary “Blade” batteries. This internal ecosystem insulates them from global supply shocks and allows for a pace of innovation that legacy automakers struggle to match.

The final stage of this strategy is the export of a new world order. China is no longer just selling hardware to the Global South; it is exporting the very “operating system” of the green economy. By installing the grids, the charging standards, and the software platforms in developing nations, Beijing is creating a technological lock-in. These nations are not just buying a Chinese car; they are plugging into a Chinese future. Once a country’s entire energy architecture is built on Chinese specifications, the cost of switching becomes almost impossible to bear.

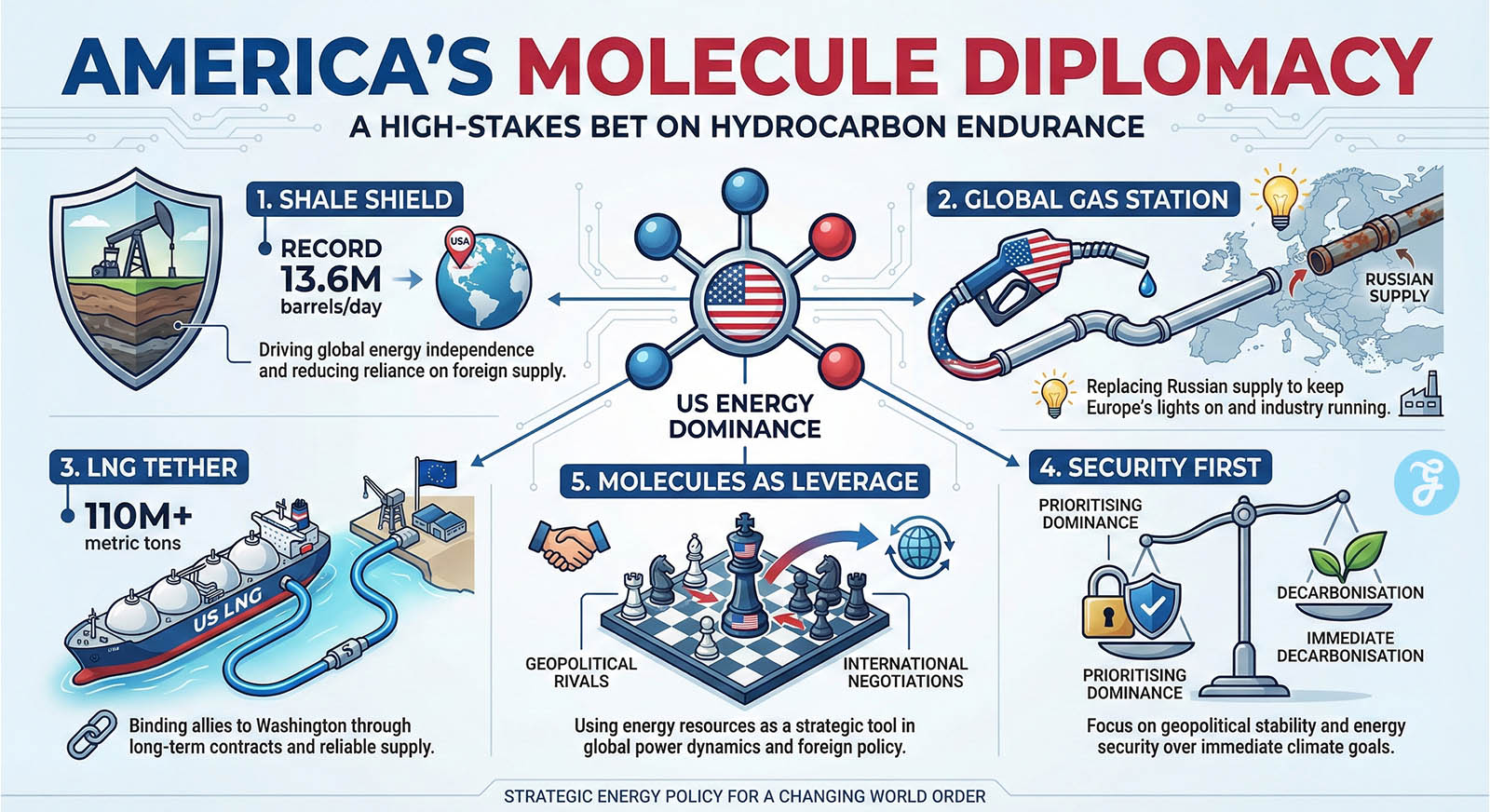

The Resurgence of the Petrostate: America’s Molecule Diplomacy

While China wires the future, the United States has made a conscious, strategic decision to double down on the power of the present. Washington is not merely ignoring the energy transition; it is betting that for the next two decades, the world will still run on molecules. This is the resurgence of the American Petrostate. It is a model built on the belief that extraction is the ultimate form of leverage.

The foundation of this power is the “Shale Shield.” Over the last decade, the Shale Revolution transformed the United States from a vulnerable importer into a global energy titan. By early 2026, American crude output remained near record highs of 13.6 million barrels per day. This surge did more than just fuel domestic SUVs; it allowed the United States to replace Russia as the primary gas station for the Western world. When the pipelines from the East went cold, American molecules kept the lights on in Berlin and Warsaw.

Today, American influence is exerted through “Diplomacy by Pipeline” or more accurately, by tanker. Liquefied Natural Gas (LNG) has become a primary geopolitical tether. In 2025, the U.S. exported over 110 million metric tons of LNG, cementing its status as the world’s leading exporter. These exports bind the security of Europe and East Asia directly to the American energy umbrella. Every long-term gas contract signed in Brussels or Tokyo is a vote for continued alignment with Washington.

The logic behind this move is clear and unsentimental. The U.S. is prioritising energy security and economic dominance over immediate, total decarbonisation. While “electrons” may be the future, the U.S. knows that “molecules” are the currency of national security today. By flooding the market with affordable gas, the U.S. ensures that allies remain dependent on its bounty rather than a rival’s grid. It is a high-stakes gamble on the endurance of the hydrocarbon age.

The Counter-Punch: Why “Drill, Baby, Drill” Isn’t Enough

Critics of the American Petrostate model argue that the U.S. is essentially building a bridge to nowhere. The opposing view, championed by Beijing, is that the age of molecules is ending far faster than Washington admits. In their eyes, the U.S. is doubling down on a 20th-century asset while the rest of the world adopts 21st-century infrastructure.

However, the “all-in on green” argument often fails to account for 2026’s gritty reality: energy density and portability still win in a crisis. While China owns the manufacturing of the “electric stack,” it remains the world’s largest importer of oil and gas. In a conflict, an Electrostate without a domestic fuel source is a giant with clay feet. The U.S. “Molecule Diplomacy” works because it addresses the immediate, existential fear of every world leader: what happens if the lights go out tonight?

Comparing the Two Energy Models

| Metric | The Petrostate (USA) | The Electrostate (China) |

| Primary Asset | Crude Oil & LNG | Batteries & Solar PV |

| Strategic Goal | Allied Energy Security | Supply Chain Dominance |

| Global Leverage | “Molecule Diplomacy” | “The Electric Stack” |

| Vulnerability | Long-term Decarbonisation | Resource Import Dependency |

The “Now vs. Future” Cost of Inaction

| Impact Area | Status Quo (2026) | Projected Inaction Cost (2030) |

| Consumer Prices | 100% Tariffs on Chinese EVs | $15,000 “Security Premium” per EV in the West |

| Grid Transition | Fragmented regional grids | 25% slowdown in global decarbonisation |

| Supply Chain | High redundancy (re-shoring) | $2.5 Trillion in duplicated industrial waste |

Winners vs. Losers in the Current Energy Divide

| Winners | Losers |

| U.S. Gulf Coast Hubs: Seeing record investment in LNG. | European Industrialists: Facing energy costs 3x higher than the U.S. |

| Chinese “New Three” Firms: BYD, CATL, and LONGi dominating markets. | Legacy Automakers: Struggling with 100% tariffs and high transition costs. |

| Swing States (India/Brazil): Leveraging both superpowers for deals. | Global Climate Goals: Stalled by supply chain duplication. |

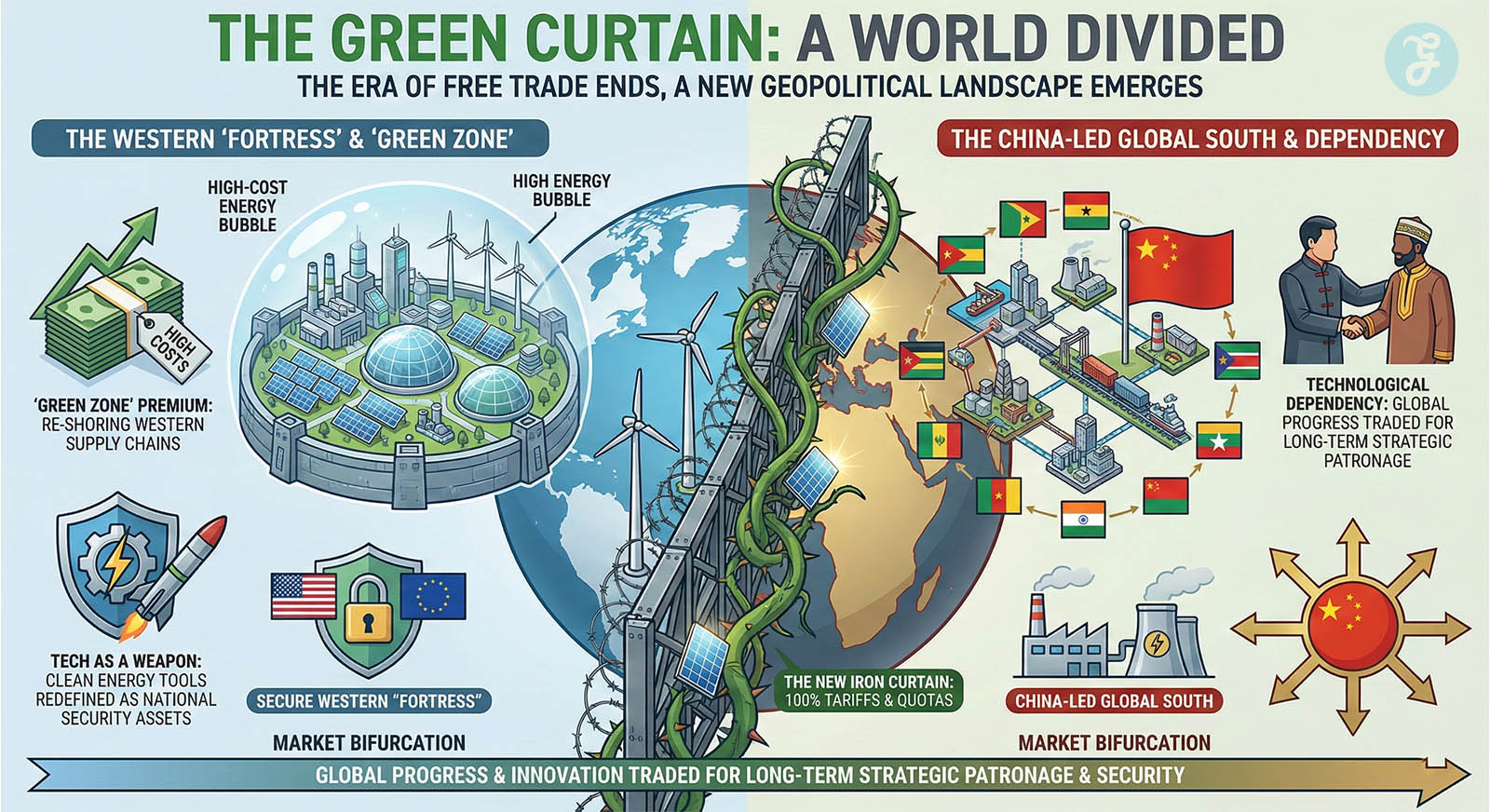

The Green Curtain: A World Divided by Trade Walls

A new kind of iron curtain is descending across the global economy. This time, it is not made of bricks or barbed wire, but of tariffs and trade quotas. We are witnessing the end of the era of frictionless global trade. In its place, a rigid system of techno-nationalism has emerged. This shift is most visible in the aggressive barriers being erected by the United States and the European Union. By slapping 100% tariffs on Chinese electric vehicles, the United States is effectively banning the world’s most advanced Electrostate from its shores. While Canada initially followed this protectionist path, its January 2026 pivot, slashing duties to 6.1% for a specific quota, highlights a growing fissure in the Western alliance.

The philosophy behind the American stance remains a radical departure from the past. For decades, the mantra was free trade at any cost. Efficiency was the only metric that mattered. Today, that has been replaced by the doctrine of secure trade. Clean technology is no longer viewed merely as an environmental good or a tool to fight climate change. Instead, it is being treated as a potent weapon of statecraft. Much like 5G networks or high-end semiconductors, batteries and solar panels are now seen through the cold lens of national security.

The consequence of this rift is a deeply bifurcated world. We are seeing the birth of a high-cost “Green Zone” in the West. Governments in Washington and Brussels are pouring billions into re-shoring supply chains that have lived in Asia for a generation. They are attempting to build a secure, domestic alternative to Chinese dominance, even if it means higher prices for consumers and a slower transition for the planet.

Meanwhile, the rest of the world is heading in a different direction. Blocked from Western markets, China is flooding the Global South with its surplus of cheap, high-tech energy infrastructure. While the West builds its fortress, the developing world is being wired with Chinese solar arrays and powered by Chinese lithium. This creates a lasting technological dependency. It is a world of two halves, where one side pays a premium for protection, and the other accepts a new kind of patronage in exchange for progress.

The Battle for the Global South

As the Great Divergence deepens, the most intense front of the US-China energy competition is not being fought in Washington or Beijing. It is unfolding across the bustling markets of Jakarta, the mineral-rich highlands of Brazil, and the fast-growing industrial hubs of India. These are the new “Swing States” of the energy age. They are being courted with a fervour not seen since the height of the Cold War. Each superpower is arriving with a distinct, tempting offer.

The United States offers the Petrostate model. It brings a promise of immediate energy security through LNG tankers and crude oil. This is often backed by a formidable security umbrella. For nations that fear regional instability or sudden power shortages, the American offer is one of reliability. It is the power of the “molecule”: dense, portable, and ready to use.

China, by contrast, presents the Electrostate model. Beijing does not just sell fuel; it sells the future of production. It offers the “fishing rod” rather than the “fish.” This includes low-cost solar arrays, high-capacity battery storage, and the ultra-high-voltage grids needed to tie them together. For a developing nation, this is a path to energy sovereignty and industrial modernisation. However, it comes with a catch. Installing Chinese hardware often means adopting Chinese software and standards, creating a digital and physical tether to Beijing.

The reality on the ground is far messier than a simple choice between two sides. Most developing nations are refusing to pick a team. They are pursuing a strategy of “active alignment.” India is a perfect example. New Delhi is aggressively installing Chinese-made solar panels to meet its ambitious green targets while simultaneously signing long-term gas deals with American firms to keep its factories running.

This creates a complex, overlapping world order. Nations are buying U.S. security while wiring their cities with Chinese electrons. They are using American molecules to bridge the gap until their Chinese-built grids are ready. It is a pragmatic, transactional landscape where the Global South leverages the rivalry to its own advantage. In this new era, influence is not won by forcing a choice, but by becoming an indispensable part of a nation’s energy survival.

2026 Fact Sheet: The State of Play

- U.S. Oil Production: 13.6M barrels/day (2025 record average maintained; weekly peaks reached 13.8M).

- U.S. LNG Exports: 111M metric tons/year (Global Leader; capacity expanding toward 115M by year-end).

- China EV Market Share: Over 70% of global production; 60% domestic sales penetration (up from 54% in 2025).

- China Mineral Refining: Control of 60% of global lithium processing (85% share applies to battery anodes/components).

- Global Energy Investment: $3.3 trillion (2025), with $2.2 trillion in clean tech (double the investment in fossil fuels).

- Tariffs: 100% duty on Chinese EVs in the U.S.; Canada reduced its rate to 6.1% for a 49,000-unit annual quota as of Jan 2026.

The Illusion of Sovereignty: A Call for Strategic Realism

The risks of this accelerating divergence are as profound as they are planetary. What we are witnessing is not “de-risking” but a catastrophic duplication of industrial effort. By severing the arteries of energy trade, the United States and China are forcing the world into an expensive and inefficient redundancy that we can ill afford. If the West insists on building a parallel supply chain from scratch while China sits on a mountain of overcapacity, the global climate transition will not just stall; it will collapse under the weight of its own ego. We simply do not have the luxury of time to rebuild the industrial wheel twice.

The cold reality is that neither model can succeed in a vacuum. The United States cannot cling to its Petrostate status indefinitely as the world’s economic engine shifts towards electrification. Conversely, China’s Electrostate is a house of cards if it remains locked out of the most innovative and affluent markets. The true winner of the twenty-first century will not be the nation that drills the last barrel of oil or assembles the most batteries. It will be the power that possesses the strategic foresight to bridge the divide between energy security and the energy transition.

We are at a tipping point where we must choose between the narrow dopamine hit of techno-nationalism and the gruelling necessity of planetary survival. The world does not need more trade barriers; it requires a “détente of electrons.” We must find the courage to insulate essential climate technology from the performative theatre of trade wars. Carbon molecules do not carry passports, and the warming of our atmosphere is entirely indifferent to national borders.

It is time to abandon the false binary of extraction versus manufacturing. True leadership in 2026 must be defined by the ability to integrate these two competing metabolisms into a single and resilient future. We cannot allow the US-China energy competition to become a suicide pact. For the sake of the next generation, the molecules of the past must yield to the electrons of the future, but that bridge cannot be built in isolation. It must be engineered together, or it will not be built at all.

What Happens Next?

As the “Green Curtain” hardens, expect the U.S. to fast-track small modular nuclear reactors (SMRs) to compete with China’s grid exports. Meanwhile, China will likely deepen its “minerals-for-infrastructure” deals across Africa to bypass Western trade walls. The million-dollar question: Will the high cost of energy independence in the West trigger a populist backlash against the transition, or will the “Electrostate” model simply become too cheap to ignore?