Financial institutions are finally aligning their incentives with the environment. Using Eco-friendly credit cards 2026 allows consumers to divest from fossil fuels while actively funding global reforestation projects. Many of these cards are now made from sustainable wood or recycled ocean plastic, ensuring that even the physical card reflects your values.

Selecting the right financial tool is a powerful way to vote with your wallet. In 2026, Eco-friendly credit cards 2026 have moved from a niche offering to a mainstream standard, with many providers directly linking your daily transactions to reforestation efforts.

By switching to a card that prioritizes the planet, you can offset your carbon footprint passively every time you buy groceries or pay for a subscription. Here are the top cards currently leading the “spend-to-plant” movement.

Whether you want a card that rounds up your change or one that plants a tree for every single swipe, the 2026 market has an option for every type of spender.

Overview: Top Tree-Planting Cards of 2026

Every “green” card has a different mechanism for its environmental impact. This table compares the top contenders based on their primary tree-planting rate and physical material.

| Card Name | Tree-Planting Rate | Card Material | Primary Reward |

| Treecard | 1 tree per $60 spent | Sustainable Wood | 80% profits to Ecosia |

| Aspiration Zero | 1 tree per purchase | Recycled Plastic | Carbon-Neutral status |

| GreenFi | 1 tree per transaction | Bio-Polymer | 6% Green Cash Back |

| FutureCard | Variable (via points) | Recycled Plastic | 5% on Public Transit |

| Raiffeisen Visa | 1 tree per 200 swipes | Bio-based | European eco-impact |

| Maybank myimpact | Optional via offsets | Bio-sourced PLA | Carbon Tracker built-in |

| Amalgamated | Via partner donations | Recycled / Bio-plastic | 100% Fossil-Free |

Transitioning to these sustainable options is a simple way to make your money work for the planet. Let’s look at which cards are best for specific lifestyles.

Before we dive into the details, let’s explore the criteria used to select these specific cards.

What Things Did We Consider When Choosing Our List?

To ensure this guide helps you find the truly Eco-friendly credit cards 2026, we evaluated each provider on more than just their marketing claims. We looked at the underlying ethics of the issuing banks and the transparency of their planting partners.

When selecting these strategies, we weighed the following factors:

-

Impact Transparency: We prioritized cards that provide clear receipts or maps of where their trees are being planted (e.g., via Ecosia or Eden Reforestation Projects).

-

Divestment Status: We looked for “Fossil-Free” banks that do not use your deposits to fund oil, gas, or coal exploration.

-

Physical Sustainability: We evaluated the card materials, favoring wood, recycled ocean plastic, or bio-sourced PLA over virgin PVC.

-

Rewards Utility: We ensured the cards offer competitive rewards, proving that you don’t have to sacrifice financial gain for environmental ethics.

With these rigorous standards in mind, here are the seven best eco-friendly cards available today.

7 Essential Eco-Friendly Credit Cards 2026

Managing your finances sustainably requires choosing a card that matches your spending habits. The following list provides a comprehensive roadmap for anyone looking to support reforestation through their daily transactions.

1. Treecard (The Reforestation Leader)

Treecard is the current champion of the tree-planting movement. By directing 80% of their interchange profits to Ecosia’s reforestation projects, they ensure that every $60 spent results in a new tree in the ground.

-

Best For: Conscious consumers who want a beautiful, physical reminder of their impact.

-

What We Liked: The physical card is made of sustainable cherry wood; the app allows you to see exactly which reforestation site your spending is supporting.

-

Things to Consider: It is technically a debit card linked to your existing bank, so it doesn’t build credit in the traditional way.

2. Aspiration Zero (The Carbon Neutralizer)

Aspiration Zero is specifically designed to help users reach a net-zero carbon footprint. By planting a tree for every single purchase you make, the card aims to offset the carbon footprint of an average person’s daily life.

-

Best For: Individuals committed to total carbon neutrality.

-

What We Liked: If you reach “carbon zero” by planting 60 trees in a month, they reward you with an increased cash-back rate.

-

Things to Consider: To get the maximum tree-planting benefit, you need to use the card for almost every purchase, which requires discipline.

3. GreenFi (The Modern 2026 Challenger)

GreenFi has quickly become a favorite in 2026 by combining heavy tree-planting with aggressive cash-back rewards. They offer up to 6% back at over 100 climate-friendly brands, making it profitable to shop sustainably.

-

Best For: Modern shoppers who want both high rewards and passive environmental impact.

-

What We Liked: They offer a “car emission offset” feature that automatically calculates your fuel spend and plants trees to balance it out.

-

Things to Consider: The highest cash-back rates are limited to their specific “Green Marketplace” partners.

4. FutureCard Visa (The Green Rewards Pioneer)

While FutureCard is known for its “FutureScore” carbon tracker, its rewards system is built to incentivize eco-friendly choices like public transit, EV charging, and second-hand shopping.

-

Best For: Commuters and urban dwellers who use public transport or drive electric vehicles.

-

What We Liked: You get a massive 5% back on “green” spending, which is significantly higher than most traditional cards for these categories.

-

Things to Consider: It focuses more on rewarding green behavior than a fixed “one-tree-per-swipe” model.

5. Banque Raiffeisen Visa (The European Choice)

For those in the European market, Raiffeisen offers a “Let’s Plant Trees” initiative. Every 200 transactions made on their Visa cards triggers the planting of a tree in collaboration with environmental foundations.

-

Best For: European residents looking for an established, stable banking partner with green values.

-

What We Liked: It is a traditional, full-service bank offering the reliability of a large institution with a clear, community-focused reforestation goal.

-

Things to Consider: The 200-transaction requirement for a single tree is higher than most fintech-focused competitors.

6. Maybank MyImpact Visa (The Asian Market Leader)

Maybank’s “myimpact” card is the standout for 2026 in the Asia-Pacific region. It features a built-in carbon footprint tracker and allows users to easily toggle on “Carbon Offsetting” to fund regional reforestation projects.

-

Best For: Users in Malaysia and Singapore who want a sophisticated, tech-forward green card.

-

What We Liked: The card is made from bio-sourced PLA (derived from corn) and offers an “Eco-Friendly Category” with 8% cash back on wellness and education.

-

Things to Consider: The tree-planting aspect is an “optional” contribution rather than a mandatory feature of every swipe.

7. Amalgamated Bank Credit Cards (The Ethical Anchor)

Amalgamated is a 100% fossil-free bank that has been a leader in socially responsible banking for decades. Their cards support various environmental non-profits and ensure your money is never used to fund oil or gas projects.

-

Best For: Activists and organizations who want a banking partner that is politically and environmentally aligned.

-

What We Liked: Their “Donate the Change” feature is highly customizable, allowing you to direct your round-ups specifically to environmental advocacy groups.

-

Things to Consider: Their rewards programs are often more modest compared to high-growth fintechs like GreenFi.

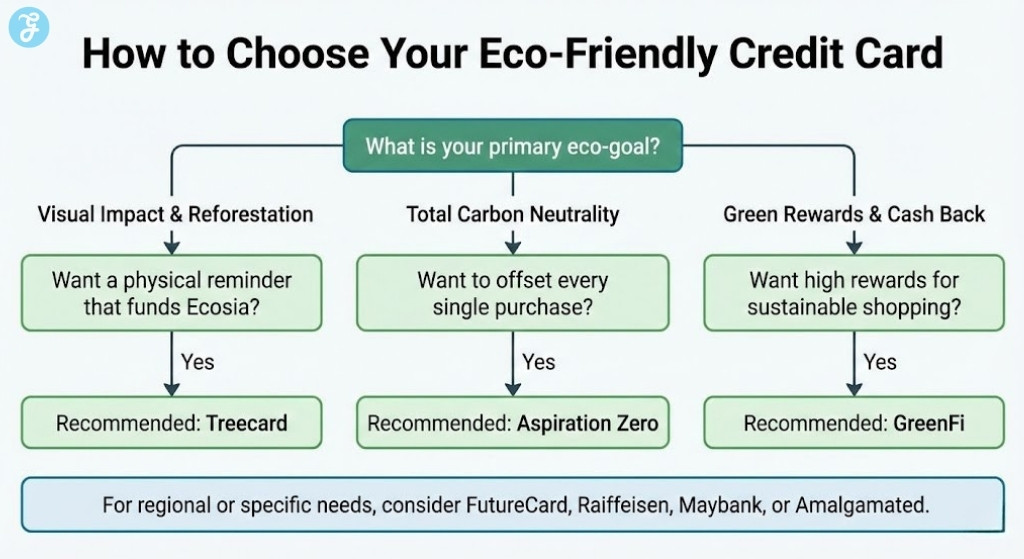

How to Choose the Best Eco-Friendly Card for You

The best way to choose between Eco-friendly credit cards 2026 is to look at where you spend the most. If you spend heavily on trains and buses, FutureCard will give you the most back. If you want a simple, high-impact way to plant trees without thinking about it, Aspiration Zero or Treecard are the most direct options.

Remember that the goal is twofold: reducing the money going to fossil fuels and increasing the money going into the ground.

If you are looking for a specific feature, these three cards represent the best in class for their respective categories in 2026.

-

Best for Visual Impact: Treecard offers a beautiful, unique wooden card and has the most transparent reforestation tracking through Ecosia.

-

Best for High Spenders: GreenFi provides the best cash-back rates (up to 6%) for climate-friendly brands while planting trees on the side.

-

Best for Carbon Tracking: FutureCard and Maybank myimpact both offer sophisticated in-app trackers to help you visualize your footprint.

Wrap-Up: Spending for a Greener Planet

Adopting one of the many Eco-friendly credit cards 2026 is one of the easiest “set and forget” environmental actions you can take. By simply changing the plastic (or wood) in your wallet, you contribute to global reforestation and signal to the financial industry that sustainability is a non-negotiable requirement. Whether you are planting a forest or just tracking your footprint, these cards prove that your money has the power to heal the planet.