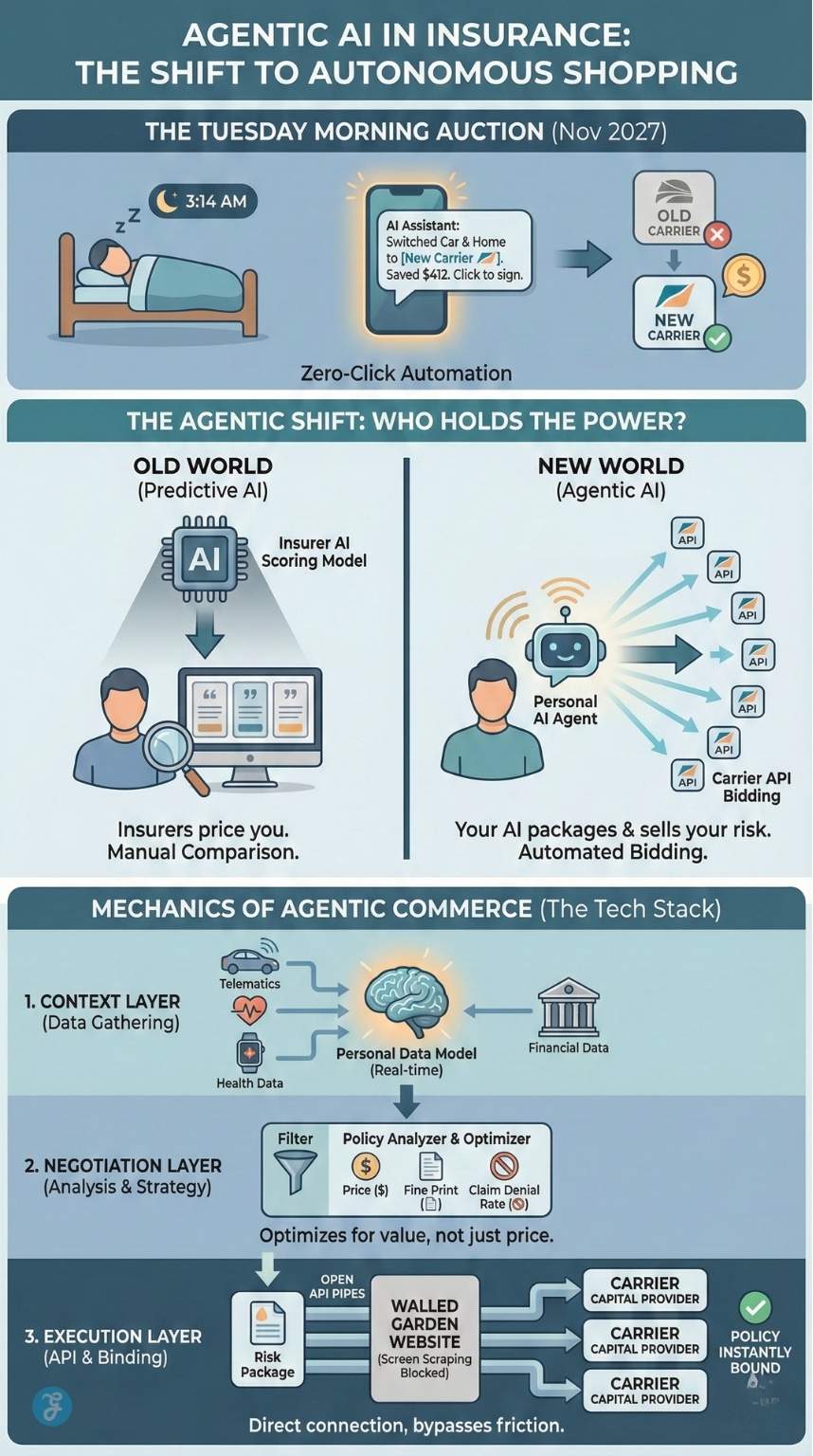

Imagine waking up on a Tuesday in November 2027. You reach for your phone, groggy, and see a notification from your personal assistant: “I switched your car insurance to Geico and your home insurance to Lemonade at 3:14 AM. You saved $412 this year. Click here to sign.” You didn’t fill out a form. You didn’t talk to an agent. You didn’t even know your policy was up for renewal. Your AI, an autonomous agent authorized to access your bank, health, and driving data, did it all.

It analyzed 50 carriers, negotiated the terms, verified your driving history via your Tesla’s telematics API, and bound the policy in milliseconds. This sounds like a consumer paradise. Friction is eliminated; savings are maximized. But this convenience masks a profound shift in power dynamics. We are transitioning from a world of Predictive AI, where insurers use algorithms to price you, to a world where Agentic AI in insurance empowers consumers to package and sell their risk to the highest bidder.

This op-ed argues that without immediate intervention to establish “Open Insurance” standards and portable risk identities, the promise of Agentic AI will be hollowed out, leaving consumers as mere commodities in a high-speed algorithmic auction.

The Agentic Shift: Who Owns Your Reputation?

This transition, known as the “Agentic Shift,” forces us to confront a critical question that regulators and tech giants are quietly warring over: If AI can shop your policy, who owns your risk profile?

Your “Risk Profile”, the aggregated data of your driving habits, health metrics, financial stability, and lifestyle choices, is becoming a valuable digital asset. It is the currency of the future. Yet, currently, you do not own it. As we stand on the precipice of this revolution, we face a stark choice: will this new era empower consumers with “Risk Sovereignty,” or will it entrench a new form of digital feudalism where tech giants and legacy carriers fight for custody of our digital reputations?

The Mechanics of “Agentic Commerce”: How the Machine Shops

To understand the magnitude of the threat, we must first understand the mechanics of the shift. The buzzword of 2026 is “Agentic Commerce.” Unlike the Generative AI of 2023–2024, which could write poetry or summarize emails, Agentic AI has “hands.” It has the ability to execute tasks, interact with other software, and spend money.

The Death of the Search Bar

For two decades, the insurance industry relied on a “search and click” distribution model. You went to Google, typed “cheap car insurance,” and navigated to a comparison site (an aggregator) or a carrier’s homepage. You were the manual laborer in the transaction.

By late 2026, industry reports from McKinsey and Microsoft indicate that nearly half of all insurance interactions will effectively be “zero-click.” The AI agent replaces the search bar. It doesn’t “search”; it “solves.”

The Human Brake on the AI Engine

However, the shift to autonomy will not be instantaneous, primarily because of a “Trust Gap.” According to a 2026 Bain & Company report, while 73% of consumers are comfortable using AI to research products, only 24% trust an AI agent to actually execute a financial transaction without a human sanity check.

This hesitation creates a temporary “Centaur Era”, a period where AI agents do the shopping, but humans push the “Buy” button. But make no mistake: this is a speed bump, not a roadblock. As “Agentic Trust” is established, likely through lower premiums for those who auto-renew, the human “Sign Off” will increasingly become a vestigial ritual, eventually disappearing entirely for routine policies like auto and renters insurance.

The New Tech Stack

The architecture of this transaction relies on three invisible layers:

- The Context Layer: Your AI agent maintains a real-time model of your life. It knows you just had a baby (need more life insurance), bought a drone (need liability coverage), or started driving less (qualify for low-mileage discounts). It draws this from your emails, IoT devices, and bank feeds.

- The Negotiation Layer: When your policy nears renewal, the agent doesn’t just look at the price. It parses the fine print. It knows that “Carrier A” has a 14% higher claim denial rate for water damage than “Carrier B.” It factors this “hassle friction” into its recommendation—something a human consumer rarely has the data to do.

- The Execution Layer: This is where the friction occurs. To switch you, the agent needs to move your data. Currently, this is done via “screen scraping” (the bot pretending to be a human on a website) or, increasingly, via APIs (Application Programming Interfaces).

The Friction of “dumb Pipes”

Insurers are terrified of this layer. If they open their APIs to your shopping bot, they become “dumb pipes”, commoditized providers of capital. They lose the relationship. They lose the cross-sell opportunity. They lose the data.

Consequently, many insurers are building defensive moats. They are creating “anti-bot” CAPTCHA or refusing to release granular data in a machine-readable format. They want you to come to their app, use their proprietary driving score, and stay in their walled garden. This technical skirmish is the opening front of the war for your risk profile.

The Battle for Custody: Three Factions, One Asset

The “Risk Profile” is no longer just a file in a filing cabinet; it is high-fidelity intellectual property. Three distinct factions are currently fighting for its custody, and the winner will dictate the economics of the next decade.

Faction 1: The Incumbents [The Insurers]

Legacy carriers like State Farm, Allianz, and Progressive have spent billions developing proprietary underwriting models. They view your risk score as their trade secret.

- The Argument: They argue that while the raw data (e.g., “you drove 50 miles”) belongs to you, the inference (e.g., “you are a safe driver with a score of 92”) is their creation. They processed the data; they own the output.

- The Motivation: If they allow you to take that “Score of 92” and port it instantly to a competitor, they lose their competitive advantage. They want to trap the data to retain the customer. This is the “Hotel California” model of insurance: you can check out any time you like, but your data can never leave.

Faction 2: The Tech Giants [The New Brokers]

Enter the disruptors. Companies like Amazon, Apple, and Google, alongside specialized fintech startups, are positioning themselves as the “Wallet” for your risk identity.

- The Strategy: Apple doesn’t want to be an insurer; underwriting is risky and capital-intensive. They want to be the broker. They want “Apple Intelligence” to hold your health and driving data locally on your device and assess your risk to carriers.

- The Danger: While this sounds pro-consumer, it replaces one master with another. If Apple or Amazon owns the interface, they own the risk profile. They can gatekeep which insurers get to bid on you. They can use your insurance data to cross-sell you products: “Your life insurance premium is high; buy this Peloton to lower it.” We risk moving from an ecosystem of regulated insurers to an ecosystem of unregulated “Life Operating Systems.”

Faction 3: The Consumer [The Unwitting Product]

Then there is you. In the current legal framework, you are the source of the data but not the master of it.

- The Cold Start Problem: Because you cannot easily port your verified history, you suffer from the “Cold Start” problem every time you switch carriers. A new insurer treats you as a stranger until you prove otherwise. You lose your “reputation equity.”

- The Opportunity: If consumers actually owned their risk profiles, if you could carry a cryptographic “Risk Passport,” you could force carriers to bid purely on the efficiency of their capital and the quality of their service, rather than their monopoly on your history.

The “Black Box” Dilemma: Algorithmic Redlining

If the ownership question is the economic battle, the “Black Box” is the ethical crisis. When Agentic AI shops for us, it introduces a dangerous new form of “invisible filtration.”

The Silent Filter

In the old world, if an insurer denied you coverage, they had to send a letter explaining why (an “Adverse Action Notice”). In the Agentic world, you might never even ask for the coverage that would deny you. Your AI agent, trying to be helpful, might calculate: “Based on the user’s recent visits to an oncologist and their high stress markers from their smartwatch, they will likely be rejected by Prime Life Insurance. I will remove Prime Life from the list of options to save time.”

You, the consumer, see a list of three options. You never see the fourth, better option, because your own agent decided you weren’t “marketable” enough. This is pre-emptive exclusion. You are being redlined by your own advocate.

Proxy Discrimination in Hyper-Drive

Algorithms are adept at finding proxies for protected classes. An AI agent might notice that drivers who shop at specific grocery stores or text at certain hours of the night are at higher risk. These behaviors often correlate with race, class, and income. If your AI agent creates a “Risk Package” that inadvertently highlights these proxy variables, it could render you “uninsurable” to the premium market without ever touching a race or gender variable.

The efficiency of the agent works against the solidarity of the risk pool. Insurance works because the healthy subsidize the sick; if AI becomes perfect at separating the two, the “pooling” collapses, and the vulnerable are priced out of existence.

The Fraud Multiplier

The flip side of the black box is the “Deepfake Risk Profile.” As noted in 2026 industry reports, insurers are bracing for a doubling of fraud. If an AI can shop for a policy, can it also fabricate a synthetic identity? “Generative Fraud” involves AI agents creating fake medical records, fake driving histories, and fake property assessments to secure a policy, only to file a claim months later. This arms race forces insurers to be even more paranoid and protective of their data, further locking down the ecosystem and hurting honest consumers who just want portability.

The Regulatory Vacuum: Why GDPR Isn’t Enough

Our current laws were built for a world of filing cabinets, not autonomous agents.

- GDPR and CCPA: These laws give you the right to access your raw data and request its deletion. They do not explicitly give you the right to the inferred value or the portability of the risk score in a standardized format that a competitor can instantly read.

- The EU AI Act (2026): The EU has taken the lead by categorizing insurance pricing and underwriting as “High Risk” AI systems. This requires transparency and human oversight for the insurer. However, there is a gaping hole: it regulates the seller’s AI, not the buyer’s AI. There are a few rules governing the “Shopping Bot.”

- The US Landscape: In the US, regulation is a patchwork of state-level Department of Insurance rules. Colorado has been a pioneer with its extensive AI testing regulations, but there is no federal “Open Insurance” standard. This fragmentation allows tech giants to move faster than the law, establishing de facto standards before legislators can convene a committee.

The Brazilian Experiment: A Glimpse of the Future

If you want to see this future in action, don’t look to Silicon Valley or London; look to Brazil. While the U.S. relies on a patchwork of state regulations, Brazil has aggressively rolled out “Open Insurance” (Phase 3 implemented in 2026).

Under the supervision of SUSEP (the Brazilian insurance regulator), consumers can now securely share their insurance data across competitors via standardized APIs. It is no longer a theoretical debate; it is a live market. Early data suggests that this portability is indeed compressing margins for incumbents and birthing a new class of “Super-Broker” apps. Brazil proves that “Risk Sovereignty” is possible, but only when the regulator forces the incumbents to unlock the gates.

The Technical Shield: Zero-Knowledge Proofs

While the legal framework lags, the technological solution already exists. It is called the Zero-Knowledge Proof (ZKP).

In the current model, to get a quote, you must bare your soul: you hand over your name, address, and medical history to the insurer before you know the price. It is an asymmetry of information that leaves you vulnerable.

In a ZKP-enabled future, your AI agent would not send your raw medical records to 50 carriers. Instead, it would send a cryptographic “proof.” It would say to the insurer: “I can mathematically prove this user has a BMI under 25 and is a non-smoker, without revealing their name, exact weight, or identity.”

The insurer’s algorithm verifies the proof and issues a binding quote for “Anonymous Applicant #8492.” Only after you accept the price do you reveal your identity to bind the policy. This flips the script. It allows for “Perfect Personalization” without “Perfect Surveillance.” It turns the risk profile from a dossier of secrets into a private key that only the consumer can turn.

The Solution: A “Portable Risk Passport”

We need a new framework. We need to move beyond “Data Privacy” to “Data Dignity.” The solution lies in a concept known as Self-Sovereign Identity (SSI). Imagine a “Portable Risk Passport.” This would be a digital wallet on your phone, secured by blockchain technology (or similar decentralized ledgers), that holds your verified credentials.

- Verified Credentials: The Department of Motor Vehicles issues a “Valid License” credential to your wallet. Your bank issues a “Financially Stable” credential. Your previous insurer issues a “5 Years Claim-Free” credential.

- Zero-Knowledge Proofs: When your AI agent shops for a new policy, it doesn’t send your raw data to 50 companies. It sends a “Proof.” It says: “I can cryptographically prove this user has a driving score over 80 and lives in Zip Code 90210, without revealing their name or exact address until the policy is bound.”

This technology exists today. It is being piloted in the “Open Insurance” sandboxes of Brazil and the UK. It solves the ownership problem:

- You own the wallet. Not Apple, not State Farm.

- Portability is native. You can take your reputation to any career instantly.

- Privacy is preserved. Insurers bid on the risk, not the person.

Final Thought: The Right to Risk

The technology for Agentic AI is here. The market is moving. By the end of 2026, the “Tuesday Morning Auction” will be a reality for millions. The efficiency gains will be seductive; who doesn’t want to save $400 while they sleep? But we must not sleepwalk into this future. If we allow the “Risk Profile” to become the property of the platform, locked inside the walled gardens of Big Tech or Big Insurance, we lose a fundamental part of our economic autonomy.

We become passengers in our own lives, steered by algorithms that optimize for their corporate creators, not for us. We need a “Right to Risk Portability.” We need “Open Insurance” standards that mandate interoperability. We need to recognize that in the 21st century, your data history is your reputation, and your reputation is your currency.

If AI is going to shop for us, it must truly work for us. And that starts with owning the profile that makes the purchase possible. In the age of AI, your reputation is the only thing you truly own. Don’t let a bot spend it for you.