January sets the strategy for your entire year of travel. The offers available right now include a massive launch from the new Alaska-Hawaiian merger and competitive responses from major issuers like American Express and Chase. We are currently in a period of “points inflation,” where 60,000 points is the new floor and 100,000 is the target.

This list cuts through the marketing noise to identify the 8 best credit card sign-up bonuses available in January 2026. These selections are based on mathematical return on spend, transfer flexibility, and long-term value.

The 8 Best Credit Card Sign-Up Bonuses

Here are our selections:

1. Atmos™ Rewards Summit Visa Infinite®

Following the historic merger of Alaska and Hawaiian Airlines, the new “Atmos Rewards” program has launched with a massive 100,000-point offer. This card replaces the legacy airline cards and allows you to book across the entire Oneworld alliance or for vacation packages to Hawaii.

Best For: Travelers based on the West Coast or those planning a major trip to Asia/Hawaii.

Pros:

- Massive 100,000-point welcome bonus.

- Annual “Companion Fare” (buy one ticket, get one for ~$99).

- Earns 3x points on all mobile wallet purchases.

Cons:

- High annual fee ($395).

- Reward availability can be tight on partner airlines like JAL.

2. American Express® Gold Card

While the standard public offer sits at 60,000 points, January 2026 sees a surge of targeted 90k and 100k offers available via referral links or “Incognito” browser modes. It remains the “Gold Standard” for daily spending, earning 4x on global dining and U.S. supermarkets.

Best For: “Foodies” and families with high grocery bills.

Pros:

- Highest earning rates for food (4x).

- Monthly dining and Uber credits offset the annual fee.

- Transferable points to partners like Air Canada Aeroplan and British Airways.

Cons:

- $325 annual fee is steep if you don’t use the credits.

- Amex is not accepted everywhere internationally.

3. Delta SkyMiles® Reserve American Express Card

Delta offers fluctuate wildly, but this current surge (valid through April 1, 2026) is near an all-time high at 100,000 miles. The card also features the enhanced “TakeOff 15” benefit, which gives cardholders a 15% discount on all award bookings, making those 100k miles stretch significantly further.

Best For: Dedicated Delta flyers chasing Medallion status.

Pros:

- Includes Delta Sky Club access (with limitations).

- Fast-tracks you toward elite status (MQD boost).

- Companion Certificate for First Class, Comfort+, or Main Cabin.

Cons:

- Expensive $650 annual fee.

- SkyMiles are often called “SkyPesos” due to variable value.

4. Chase Sapphire Preferred® Card

Chase has bumped the standard 60,000-point offer up to 75,000 for Q1 2026. This card remains the easiest recommendation for beginners because of its low cost and the ability to transfer points 1:1 to high-value partners like Hyatt and United.

Best For: People getting their very first travel rewards card.

Pros:

- Low $95 annual fee.

- Best-in-class travel insurance protections.

- Points are extremely flexible and easy to use.

Cons:

- Earning rates (2x on travel, 3x on dining) are lower than premium cards.

- Requires a “Good” to “Excellent” credit score.

5. Marriott Bonvoy Boundless® Credit Card

This offer surfaces occasionally and is arguably the best hotel card bonus in existence. Instead of points, you receive 5 Free Night Awards (each valued up to 50,000 points). If maximized at top-tier properties, this bonus can be worth over $2,000.

Best For: Travelers planning a 5-night luxury vacation in 2026.

Pros:

- Incredible potential value (up to 250,000 points total).

- Low $95 annual fee.

- Comes with automatic Silver Elite status.

Cons:

- Certificates expire after 1 year.

- Awards are capped at 50k points per night (though you can “top off” with up to 15k points).

6. Citi Strata Elite℠ Card

Launched in mid-2025 to compete with the Amex Platinum, the Strata Elite offers a solid 75,000-point bonus. The real draw is the 12x multiplier on hotels and car rentals booked through the Citi Travel portal, making it a powerhouse for earning points on paid travel.

Best For: Travelers looking for an alternative to the Chase/Amex ecosystem.

Pros:

- High earning rate (3x) on general travel and dining.

- $100 annual hotel credit.

- Points transfer to unique partners like Turkish Airlines and EVA Air.

Cons:

- $595 annual fee.

- No domestic airline transfer partners (like United or Delta).

7. Capital One Venture X Rewards Credit Card

This card effectively pays you to keep it. The $395 annual fee is offset by a $300 annual travel credit and 10,000 anniversary miles (worth $100+). The 75,000-mile bonus is consistent, easy to earn, and offers simple redemption options.

Best For: Travelers who want premium perks without the “coupon book” hassle.

Pros:

- Unlimited 2x miles on every purchase.

- Free access to Capital One Lounges and Priority Pass.

- Free authorized users (who also get lounge access).

Cons:

- Travel credit must be used in the Capital One portal.

- Approval algorithm can be unpredictable (even for high credit scores).

8. Chase Freedom Unlimited®

Chase is currently testing a “Double Cash Back” offer, where you earn an unlimited 3% cash back on everything (1.5% x 2) for the first year. Even if you get the standard offer ($200 bonus + 5% on gas/groceries), it is an excellent no-fee addition to your wallet.

Best For: Cash back lovers who don’t want to worry about points.

Pros:

- $0 annual fee.

- Can be combined with Sapphire cards to turn cash back into travel points.

- Introductory 0% APR period on purchases.

Cons:

- Charges foreign transaction fees (not for international use).

- Bonus is smaller compared to premium travel cards.

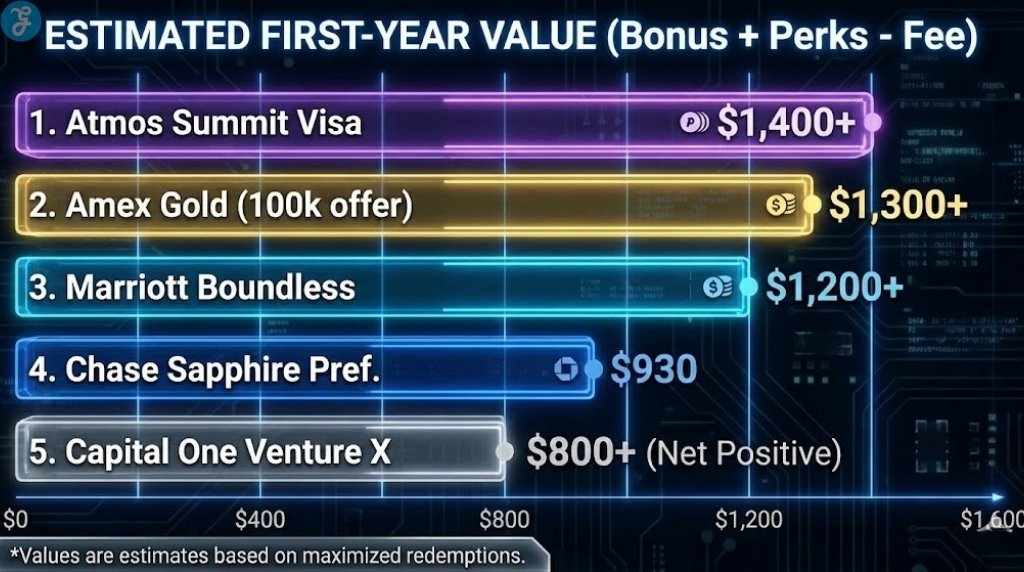

Just to recap:

| Card | Bonus Offer | Impact Level | Best For |

| Atmos™ Summit Visa | 100,000 Pts | High (New Launch) | West Coast Flyers |

| Amex Gold Card | 90k – 100k Pts | High (Targeted) | Foodies & Groceries |

| Delta Reserve Amex | 100,000 Miles | Medium (Limited Time) | Delta Loyalists |

| Chase Sapphire Pref. | 75,000 Pts | Medium (Standard+) | Beginners |

| Marriott Boundless | 5 Free Nights | High (Value) | Luxury Stays |

| Citi Strata Elite | 75,000 Pts | Medium (Competitor) | Flexible Travelers |

| Capital One Venture X | 75,000 Miles | High (Perks) | Lounge Access |

| Chase Freedom Unlimited | Double Cash Back | Medium (Cash) | Simplicity |

How to Choose the Right Card

Navigating these offers requires knowing your travel goals. Use this framework to decide:

The “5/24” Rule: If you have opened 5 or more credit cards in the last 24 months, you will be automatically rejected by Chase. If you are under this limit, prioritize the Sapphire Preferred or Freedom Unlimited first.

Annual Fee Comfort: Are you willing to pay $395+ upfront? If yes, the Atmos Summit or Venture X offer far more value than they cost. If not, stick to the Sapphire Preferred.

Liquidity: Can you comfortably meet the spend requirement (e.g., $6,000 for Amex Gold) without carrying a balance? Never pay interest just to earn a bonus.

This should help you make a decision.

Still unsure? Here you go:

Best Overall Value: Atmos™ Summit Visa Infinite. The 100k bonus combined with the annual companion fare offers unbeatable first-year value.

Best for Beginners: Chase Sapphire Preferred. The elevated 75k offer and $95 fee make it the safest entry point into travel rewards.

Best Return on Spend: Marriott Bonvoy Boundless. 5 Free Night Awards (worth up to 250k points) for just $3,000 spend is a mathematical outlier.

Wrap-Up

The credit card landscape in January 2026 is defined by aggressive competition. The new Atmos™ Summit Visa is the headline grabber, but the elevated offers from Chase and Amex ensure there is value for everyone. Whether you are looking for free hotel nights or a first-class flight to Tokyo, one of these 8 bonuses will get you there.