You sold the item. You shipped it on time. So why is the money gone from your account? Chargebacks feel like a critical system failure. You did everything right, yet the payment network reversed the transaction, leaving you without the product or the cash. It’s a logic error in modern commerce that costs business owners billions.

In 2026, the rules have changed. New updates from Visa and smarter prevention tools mean you don’t have to just accept these losses as the cost of doing business. I’m going to walk you through the exact steps of how to win chargebacks to debug this process and reclaim your revenue. Let’s fix this glitch together.

Understanding Chargebacks

Think of a chargeback as a “force undo” button for a credit card transaction. While it was designed to protect consumers from identity theft, it has morphed into a complex challenge for merchants.

What is a chargeback?

A chargeback occurs when a bank forcibly removes funds from your merchant account and returns them to the cardholder. Unlike a standard refund, which you control, this process is initiated by the bank. It comes with a non-refundable fee that typically ranges from $15 to $100 per instance.

According to 2025 industry data, for every $1 of direct fraud loss, merchants actually lose about $4.61 in total costs. This figure includes the lost goods, shipping fees, and the operational overhead of fighting the dispute.

A chargeback is not just a refund; it is a financial penalty that hits your bottom line four times harder than the original sale.

Common reasons for chargebacks

To win a dispute, you first need to identify the root cause. In 2026, most disputes fall into a few specific categories.

- Friendly Fraud (First-Party Misuse): This accounts for nearly 75% of all disputes. It happens when a legitimate customer makes a purchase but later claims they didn’t recognize it or “forgot” they subscribed.

- Goods Not Received: This flag is common in dropshipping. Customers claim the package never arrived, even if tracking says “Delivered.”

- Not as Described: A buyer claims the product is defective, counterfeit, or significantly different from the website photos.

- Authorization Issues: The bank flags the transaction because 3D Secure (3DS) data was missing or the CVV didn’t match.

- Duplicate Processing: A technical glitch causes the customer to be charged twice for a single order.

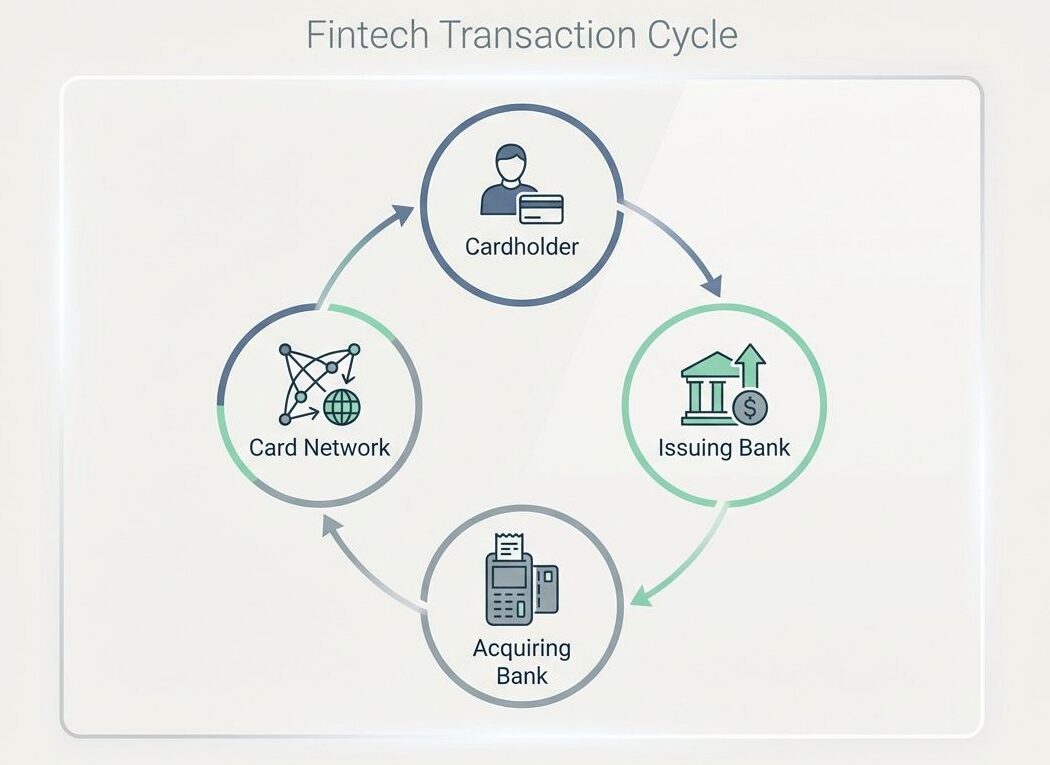

The Chargeback Process Explained

The dispute lifecycle follows a strict protocol, much like a server request and response cycle. Understanding the specific actors and their timeouts is critical for your defense.

How chargebacks are initiated

The process moves fast. Once a customer taps “Dispute Transaction” in their banking app, the clock starts ticking.

- The Dispute Filing: The cardholder contacts their Issuing Bank (like Chase or Wells Fargo) to contest the charge. They have up to 120 days from the transaction date to do this.

- Provisional Credit: The bank immediately refunds the customer using your money. This is why you see the funds disappear before you even know there is a problem.

- The Notification: Your Acquiring Bank (the bank that processes your payments) sends you an alert. If you use a dashboard like Stripe or Shopify, you will see a banner notification.

- The Evidence Phase: This is your only chance to respond. While card networks technically allow 20-30 days, most payment processors enforce a tighter internal deadline of 5 to 10 days.

- The Decision: The Issuing Bank reviews your evidence. If they rule in your favor, the funds are returned. If not, the chargeback stands, and you lose the dispute fee.

Key players involved in a chargeback dispute

It helps to know who is reviewing your case. It is rarely a human judge; it is often an automated system or a bank employee following a strict checklist.

| Player | Role | Goal |

|---|---|---|

| Cardholder | The customer | Wants their money back immediately. |

| Issuing Bank | Customer’s bank | Protects their client (the cardholder) to avoid churn. |

| Acquiring Bank | Your merchant bank | Facilitates the data transfer but remains neutral. |

| Card Network | Visa/Mastercard | Sets the rules (like Compelling Evidence 3.0). |

Key Strategies to Win Chargebacks

Winning requires precision. You cannot just say “they are lying.” You need to provide data that maps directly to the card network’s requirements.

Respond immediately within deadlines

Time is your enemy. If your processor gives you a deadline of January 15th, submit your response by January 14th. Late submissions are automatically rejected by the system logic of the card networks.

Analyze the reason code for the dispute

Every chargeback comes with a “Reason Code.” This is the error message that tells you exactly what to fix. You must look this up in your payment dashboard.

- Visa 10.4 / Mastercard 4837 (Fraud): The customer claims they didn’t authorize the purchase.

- Visa 13.1 / Mastercard 4853 (Merchandise Not Received): The customer claims the box never showed up.

- Visa 13.3 (Not as Described): The customer claims the product is wrong or broken.

Gather and submit compelling evidence

This is where the new Visa Compelling Evidence 3.0 (CE3.0) rules come into play. As of 2025/2026, this is the most powerful tool for merchants.

If you face a “Fraud” dispute (Code 10.4), you can now automatically win by proving the customer has a history with you. You need to show two prior undisputed transactions from the same customer that are between 120 and 365 days old. If the Device ID, IP address, or User ID matches, the liability shifts back to the issuer, and you win.

Types of Evidence Needed for Different Industries

Generic evidence fails. You need to supply the specific logs and documents that prove validity for your specific business model.

Card-present retail transactions

For physical stores, the “EMV Liability Shift” is the deciding factor. If you dipped the chip, you are generally safe from counterfeit fraud claims. Submit the authorization log showing that the chip read was successful. If you have a signed receipt, include it, but the digital chip log is the primary proof the bank wants to see.

E-commerce and physical goods

Online sellers face the hardest battle. You need to prove a link between the digital order and the physical delivery.

- AVS and CVV matches: Show that the billing address and security code entered at checkout matched the bank’s records.

- Proof of Delivery: A tracking number is not enough. You need a delivery confirmation that shows the full shipping address, not just “Delivered to City, State.”

- Social Media Proof: If the customer posted a photo of the item on Instagram or TikTok, take a screenshot. This is valid “Compelling Evidence” that proves possession.

Digital goods and subscriptions

When there is no shipping label, you must rely on digital footprints. You need to prove the customer actually used the product. Submit server logs showing the IP address of the download or the login timestamp. If it is a SaaS product, show the “Activity Log” that proves they logged in and performed actions after the purchase date. This contradicts the claim that they didn’t know about the charge.

Service-based businesses

For consultants or contractors, your contract is your firewall. Submit a copy of the signed agreement that outlines the scope of work. Include email threads where the client approved the work or asked for revisions. This proves they were actively engaged and that the service was delivered as requested.

Travel and hospitality industries

Disputes in travel have risen by over 800% in recent years due to cancellation confusion. Your defense relies on your Terms and Conditions. Show the digital audit trail where the customer clicked “I Agree” to your cancellation policy at checkout. If they were a “No Show,” provide the reservation log timestamped with when the room or seat was held for them.

Crafting a Strong Rebuttal Letter

Bank reviewers process hundreds of disputes a day. They scan documents using OCR (Optical Character Recognition). Your letter must be machine-readable and concise.

Structuring your argument

Do not write a story. Write a technical report. Start with the metadata: Case Number, Merchant ID, and Transaction Amount. State your case in one sentence: “The customer claims fraud (Code 10.4), but we have Compelling Evidence 3.0 showing two prior undisputed transactions from the same Device ID.” Then, list your attachments in order.

Including a summary of evidence

Create a “Table of Contents” for your evidence file. If you are uploading a PDF, the first page should be a summary list.

- Exhibit A: Checkout Log (AVS/CVV Match).

- Exhibit B: FedEx Proof of Delivery (Signed by Customer).

- Exhibit C: Copy of Refund Policy (Agreed to at Checkout).

This guides the reviewer’s eye and makes it easy for them to check the boxes required to rule in your favor.

Preventing Future Chargebacks

The best way to win a chargeback is to prevent it from entering the system in the first place. You can patch these vulnerabilities with better tools.

Using clear billing descriptors

Your “billing descriptor” is the text that appears on the customer’s bank statement. It is often limited to 20-25 characters. If your store is called “Sara’s Yoga” but your legal name is “SM Holdings LLC,” customers will get confused and dispute the charge. Update your descriptor to match your domain name, like “SARASYOGA.COM.” This simple fix can reduce “unrecognized transaction” disputes by up to 20%.

Implementing fraud prevention tools

Modern fraud tools are like firewalls for your payments. Tools like Kount, Signifyd, or Stripe Radar use machine learning to block risky transactions automatically.

Enable 3D Secure 2.0 (3DS2). This protocol asks the customer’s bank to verify their identity in the background. If you use 3DS, the liability for fraud disputes shifts from you to the bank. It is the single most effective “patch” for fraud liability.

Enhancing customer communication

Automate your communication to create a paper trail. Send an email immediately upon purchase, another when the item ships, and a third upon delivery. Include a clear “Reply-to” address. If a customer can easily email you to ask for a refund, they are less likely to call their bank. Banks prefer to see that the customer tried to resolve it with you first.

When Winning is Unlikely

Sometimes, the logic is hard-coded against you. It is more efficient to accept the loss and move on than to waste resources fighting a losing battle.

Cases of criminal fraud

If a criminal uses a stolen credit card and you did not use 3D Secure, you will likely lose. The bank is legally required to protect the true cardholder. In these cases, providing proof of delivery does not help because the real cardholder truly did not receive the item; the thief did. Accept the chargeback and focus on tightening your fraud filters for next time.

Duplicate refund scenarios

Always check your dashboard before issuing a manual refund. A common error is refunding a customer after they have already filed a dispute. If you do this, you lose the money twice: once for the refund and once for the chargeback. If a dispute is already open, submit evidence of the refund to the bank rather than processing a new one.

Wrapping Up

Winning chargebacks in 2026 isn’t about luck; it’s about system architecture. By understanding the reason codes, leveraging the new Visa Compelling Evidence 3.0 rules, and maintaining rigorous logs, you can protect your revenue.

Treat every transaction like a deployment, verify the inputs, monitor the process, and keep your documentation clean. With these protocols in place, you can turn a complex financial headache into a manageable background process.