If you are looking at your portfolio in February 2026, things look very different than they did just two years ago. The wild speculation of the post-halving cycle has settled. The “memecoin supercycle” has cooled off. In its place, we are seeing the rise of the Utility Era.

No longer just guessing which dog coin handles transactions faster. Watching trillion-dollar asset managers like BlackRock tokenize real estate on Ethereum. Seeing AI agents—not humans—executing on-chain trades.

The market has matured. The “easy money” phase of blind guessing is over. To win in Q1 2026, you need to follow the narratives—the specific sectors where institutional capital and developer activity are concentrating right now.

This guide breaks down the top 6 crypto narratives for Q1 2026. Search intent, the technology, and the tokens leading the charge, giving you a clear roadmap for the year ahead.

The State of Crypto in Early 2026

Let’s set the scene. It is Q1 2026. The dust from the 2025 bull run has settled, and we have entered a phase of “high-conviction accumulation.”

Why is this period different?

- Institutional Integration is Deep: It’s not just ETFs anymore. Banks are using public blockchains for settlement.

- The AI Merger: Blockchain is becoming the payment rail for Artificial Intelligence.

- Regulation is Clearer: Frameworks in the EU and parts of Asia have given big money the green light to enter DeFi.

If you are searching for “Crypto narratives Q1 2026”, you likely aren’t looking for a gamble. You want to know: Where is the smart money going?

The answer lies in six specific sectors. Let’s dive in.

1. The Rise of AI Agents (The “Autonomous Economy”)

- Trend Status: Exploding

- Risk Level: High

- Investor Type: Growth / Tech-Focused

Two years ago, “AI Crypto” meant buying a token with “GPT” in the name and hoping for the best. In 2026, the narrative has shifted completely. We are now in the era of AI Agents.

What Are AI Agents?

An AI Agent is a bot that can perform tasks on its own. It doesn’t just chat with you; it works for you.

- It manages your wallet.

- It finds the best yield in DeFi.

- It executes trades while you sleep.

This is the Autonomous Economy. In Q1 2026, AI agents are becoming the biggest users of blockchains. They don’t have bank accounts; they have crypto wallets. They need to pay for data, compute, and storage instantly. Crypto is the native currency of AI.

Why It’s Winning Q1 2026

The demand for “decentralized intelligence” is skyrocketing. Big tech companies have walled off their AI models. In response, crypto protocols are building open networks where anyone can contribute computing power or data and get paid.

Key Insight: If 2024 was about Chatbots, 2026 is about Action-bots. The tokens that power these agents are seeing the highest volume in Q1.

Top AI Crypto Coins 2026 (Watchlist)

- Bittensor (TAO): Still the king of decentralized machine learning. It acts as a marketplace where AI models compete to provide the best answers.

- Fetch.ai / ASI Alliance (FET): The infrastructure layer that allows these AI agents to talk to each other and negotiate tasks.

- NEAR Protocol: Has successfully pivoted to become the “User-Owned AI” chain, focusing on letting users own their data.

2. RWA 2.0 – Institutional Tokenization

- Trend Status: Maturing

- Risk Level: Low / Moderate

- Investor Type: Conservative / Yield-Seeker

This is the “grown-up” table of crypto. Real World Assets (RWAs) have evolved from a niche idea into a multi-billion dollar sector.

The Shift to RWA 2.0

In the past, RWA mostly meant tokenized US Treasuries (putting government bonds on the blockchain). That was RWA 1.0.

RWA 2.0 in 2026 is about diverse, hard assets:

- Private Credit: Lending money to real-world businesses via DeFi.

- Real Estate: Buying fractional shares of commercial properties on-chain.

- Commodities: Tokenized gold and silver that can be used as collateral in DeFi.

Why Banks Are Here

Traditional finance (TradFi) loves this because it settles instantly. Instead of waiting 3 days for a wire transfer to clear, they can move millions of dollars in tokenized assets in seconds on Ethereum or specialized Layer 2s.

Top RWA Tokenization Projects

- Ondo Finance (ONDO): A leader in bridging institutional-grade yield to on-chain users.

- Chainlink (LINK): The glue holding it all together. Its CCIP (Cross-Chain Interoperability Protocol) is the standard banking swift replacement for crypto.

- Centrifuge (CFG): Focuses on financing real-world trade receivables (invoices) on the blockchain.

3. DePIN (Decentralized Physical Infrastructure Networks)

- Trend Status: High Growth

- Risk Level: Moderate

- Investor Type: Utility-Focused

DePIN stands for Decentralized Physical Infrastructure Networks. It sounds complex, but the concept is simple: Airbnb for hardware.

How It Works

Big tech companies like Amazon (AWS) and Google spend billions building server farms. Telecom companies spend billions building cell towers.

DePIN projects say: “Why don’t we let regular people build the network and pay them?”

- You buy a specialized WiFi hotspot → You get paid in tokens.

- You connect your gaming PC’s GPU to the network → You get paid for renting out your computing power.

- You put a sensor on your car to map roads → You get paid.

The 2026 Catalyst: The GPU Shortage

The AI boom (mentioned in Narrative #1) is hungry for power. There aren’t enough chips to go around. DePIN networks that aggregate GPU power from gamers and idle computers are solving this crisis right now.

DePIN Crypto List for Q1 2026

- Render (RENDER): Often called the “Nvidia of Crypto.” It connects artists needing 3D rendering power with people who have idle GPUs.

- Helium (HNT): The OG. Now focusing heavily on Helium Mobile, a decentralized 5G network that is actually cheaper than traditional carriers.

- IoTeX: The blockchain built specifically to handle the data from billions of Internet of Things (IoT) devices.

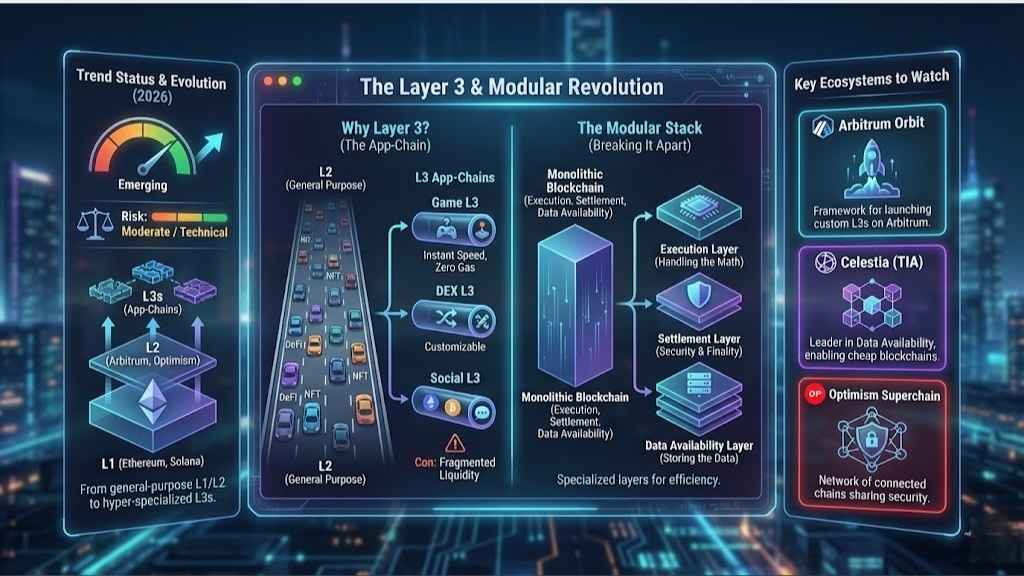

4. The Layer 3 & Modular Revolution

- Trend Status: Emerging

- Risk Level: Moderate / Technical

- Investor Type: Infrastructure / Narrative Trader

If you’ve been in crypto for a while, you know about Layer 1s (Ethereum, Solana) and Layer 2s (Arbitrum, Optimism).

In 2026, the market is obsessed with Layer 3s and Modular Blockchains.

Why Do We Need Layer 3?

Layer 2s made Ethereum cheaper, but they are still general-purpose. You are competing for space with everyone else.

Layer 3s are “App-Chains.” Imagine a blockchain built specifically for a single game or a single decentralized exchange.

- Pros: Instant speed, zero gas fees (subsidized by the app), and customizability.

- Cons: Fragmented liquidity (assets are stuck on different chains).

The Modular Stack

Instead of one blockchain doing everything (Execution, Settlement, Data Availability), we are breaking it apart. One chain handles the math, another stores the data, and another handles the security. This is the Modular thesis.

Key Ecosystems to Watch

- Arbitrum Orbit: A framework letting anyone launch their own L3 on top of Arbitrum.

- Celestia (TIA): The leader in “Data Availability.” It makes launching new blockchains incredibly cheap.

- Optimism Superchain: A network of connected chains sharing the same security.

5. The “Prediction Economy” (Truth Markets)

- Trend Status: Viral / Mainstream

- Risk Level: High

- Investor Type: Active Trader / News Junkie

This narrative exploded in 2024/2025 around the US Elections and has stayed relevant. Prediction markets allow users to bet on the outcome of future events.

Why It’s a “Truth Layer”

In an era of AI deepfakes and biased media, people don’t know who to trust. Prediction markets put money on the line. As the saying goes: “Money talks, BS walks.”

If there is a rumor about a CEO stepping down, the prediction market odds often react faster and more accurately than the news headlines.

Growth in Q1 2026

We are seeing prediction markets expand beyond politics into:

- Crypto Prices: “Will BTC hit $150k by March?”

- Pop Culture: Awards shows, viral events.

- Climate Data: Betting on weather patterns (used by farmers for hedging).

Key Projects

- Gnosis (GNO): Provides the underlying infrastructure and liquidity for many prediction markets.

- Polymarket: (Note: While primarily a platform, its success drives volume to the underlying chains like Polygon or its own potential L3).

6. Sustainable GameFi (Play-to-Own)

- Trend Status: Rebounding

- Risk Level: High

- Investor Type: Gamer / Speculator

GameFi is back, but it looks nothing like the “click-to-earn” Ponzi schemes of 2021. The narrative for 2026 is Play-to-Own.

The Quality Shift

In the past, crypto games were boring but profitable… until they collapsed. Now, we have AA and AAA studios releasing games that are actually fun.

The blockchain element is invisible. You don’t “connect wallet” to start. You just play. But if you find a rare sword, you actually own it as an NFT and can sell it for real money if you choose.

The “Gamer Revolt” is Over

Gamers used to hate crypto. But now that the integration is seamless and adds value (ownership), the resistance is fading. Q1 2026 is seeing record player numbers in web3 games.

Top Gaming Ecosystems

- Immutable (IMX): The go-to platform for high-quality web3 games. Zero gas fees for players is a huge selling point.

- Ronin (RON): Proved its resilience. It is a dedicated gaming sidechain with a massive, loyal user base.

- Illuvium / Pixels: Leading examples of the “gameplay first” mentality.

Which Narrative Fits Your Portfolio?

Not all narratives are created equal. Use this table to match your investment style with the 2026 market trends.

| Narrative | Risk Level | Time Horizon | Best For… |

| AI Agents | High | Long-term (5+ yrs) | Aggressive investors betting on the tech singularity. |

| RWA 2.0 | Low/Med | Medium-term | Conservative investors seeking stable, real-world yields. |

| DePIN | Medium | Medium-term | Investors who want to back tangible infrastructure. |

| Layer 3s | Medium | Short-term | Tech-savvy traders following developer activity. |

| Prediction | High | Event-based | Active traders who follow news cycles closely. |

| GameFi | High | Cycle-based | Investors looking for viral consumer adoption. |

Final Thoughts

Navigate through Q1 2026, the signal in the crypto market has never been clearer. The era of blind speculation is fading, replaced by a landscape defined by convergence and tangible utility. No longer just trading digital collectibles; we are investing in the backbone of a new autonomous economy.

The narratives driving this cycle—from AI Agents executing complex tasks to RWAs unlocking trillions in institutional capital—share a common thread: they solve real-world inefficiencies. The “silos” are breaking down. AI needs DePIN for decentralized compute, gaming needs Layer 3s for infinite scalability, and global finance needs the transparency of public ledgers.

For investors, success in 2026 requires discipline over FOMO. The winning strategy isn’t to chase every pumping coin, but to build high-conviction positions in the sectors that are actively building the future. Whether you lean toward the explosive growth of the Autonomous Economy or the stability of Tokenized Assets, the tools are now in your hands. The infrastructure is built, the institutions have arrived, and the Utility Era is officially here.