Sustainable real estate is no longer just about solar panels on a roof; it is about entire cities redesigning themselves for survival and efficiency. In 2026, the “green premium” has shifted from a nice-to-have to a primary driver of property value. New regulations in cities like Vancouver and master plans in Singapore are forcing a market evolution, making non-compliant assets a liability.

This guide covers 6 global markets where eco-friendly mandates and climate resilience are driving massive real estate growth in 2026.

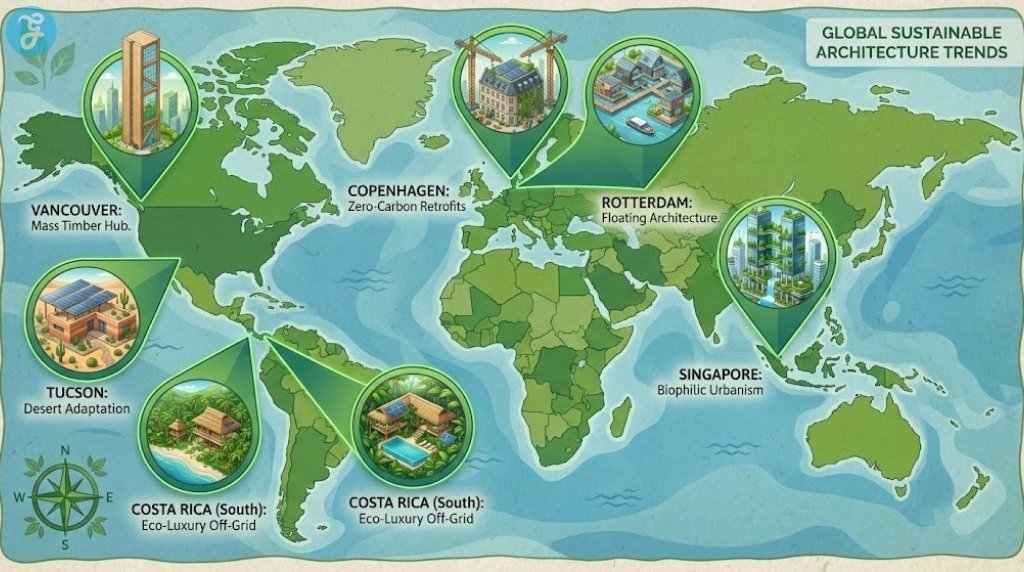

The 6 Green Real Estate Markets Exploding in 2026

Here are our top 6 picks for green real-estate markets that are set to boom in 2026:

1. Copenhagen, Denmark

The world’s poster child for carbon neutrality is doubling down. In 2026, the city enters a critical phase of its “Climate Plan 2035,” which shifts focus from just energy production to consumption-based emissions. This has triggered a massive market for high-efficiency retrofits. Investors are flocking to older building stock that can be upgraded to meet strict new energy ratings, unlocking significant value.

Best For: Institutional investors and those seeking stable, low-risk European assets.

Pros:

- Extremely stable political and economic environment.

- High demand for “green-rated” rental properties.

- World-class public infrastructure reduces car dependency.

Cons:

- High entry price and taxes.

- Strict regulations on foreign ownership (requires residency or business setup).

2. Singapore

Under the “Green Plan 2030,” 2026 is a pivotal year for mandatory green building standards. The city is transforming into a “City in a Nature,” with vertical forests and biophilic design becoming the standard for luxury condos. Developers are now competing not just on luxury finishes, but on “Green Mark” certifications, which translate directly to premium rental yields from multinational tenants.

Best For: High-net-worth individuals and family offices.

Pros:

- Strong capital appreciation driven by land scarcity.

- Government grants for green technologies are readily available.

- highly desirable location for global talent.

Cons:

- Additional Buyer’s Stamp Duty (ABSD) for foreigners is high.

- Market is highly sensitive to global economic shifts.

3. Vancouver, Canada

As of 2026, strict embodied carbon limits for new construction have reshaped the development landscape. This has spurred a boom in high-tech, sustainable timber construction (mass timber), making Vancouver a global hub for this architectural style. The “green” value here isn’t just operational efficiency; it’s about the building materials themselves. Properties built with low-carbon footprints are commanding higher rents from the city’s tech-heavy workforce.

Best For: Investors looking for “future-proof” assets in North America.

Pros:

- Global leader in sustainable building materials.

- Strong rental demand from a growing tech sector.

- High quality of life attracts long-term tenants.

Cons:

- Housing affordability crisis creates political risk.

- Slow permitting processes can delay projects.

4. Rotterdam, Netherlands

While other coastal cities fight rising seas with walls, Rotterdam embraces them. 2026 sees the expansion of floating neighborhoods like Spoorweghaven, turning climate adaptation into a unique real estate asset class. These aren’t houseboats; they are fully engineered, floating communities complete with parks and commercial spaces. For investors, this represents a chance to buy into flood-resilient infrastructure early.

Best For: Risk-tolerant investors and those fascinated by climate adaptation.

Pros:

- Properties are immune to rising sea levels.

- Unique asset class with high potential for tourism rental income.

- Strong innovative culture drives continuous improvement.

Cons:

- Financing and insurance for floating structures can be complex.

- Niche market with less historical data on resale values.

5. Tucson, Arizona, USA

A surprise entry driven by necessity. Tucson has become the US hub for “desert adaptation” architecture. With water scarcity a major 2026 theme, there is a surge in demand for water-neutral homes and heat-mitigating communities. Buyers are bypassing traditional lawns and pools for xeriscaping, greywater systems, and passive cooling designs. It is one of the few affordable green real estate markets left in the US.

Best For: First-time buyers and those seeking affordable, sustainable living.

Pros:

- Significantly lower entry price than coastal green markets.

- High solar potential reduces cost of living.

- Growing recognition as a “climate haven” relative to hotter peers like Phoenix.

Cons:

- Long-term water security remains a regional challenge.

- Slower capital appreciation compared to major metro

6. Costa Rica (Southern Zone)

2026 marks a strategic explosion for Costa Rica’s “Southern Zone” (areas like Uvita and Dominical). Unlike the over-developed north, this region is attracting eco-luxury buyers looking for large, biodiversity-rich estates that operate off-grid. The trend here is “regenerative real estate”—homes that actually improve the land they sit on. It is the top destination for “Plan B” lifestyle investors.

Best For: Lifestyle buyers and eco-tourism investors.

Pros:

- Incredible biodiversity and natural beauty.

- Strong property rights for foreigners.

- Booming market for high-end eco-rentals.

Cons:

- Infrastructure (roads, internet) can still be spotty in remote areas.

- Financing is difficult; mostly a cash market.

Here’s a quick comparison

| Market | Green Focus | Best For |

| Copenhagen, Denmark | Zero-Carbon Retrofits | Stable, Long-Term Investors |

| Singapore | Biophilic Urbanism | Luxury & Commercial Investors |

| Vancouver, Canada | Low-Carbon Materials | Tech & Eco-Conscious Renters |

| Rotterdam, Netherlands | Floating Architecture | Innovation-Focused Buyers |

| Tucson, USA | Desert Adaptation | Affordable Entry / Homeowners |

| Costa Rica (South) | Off-Grid Biodiversity | Lifestyle & Eco-Tourism |

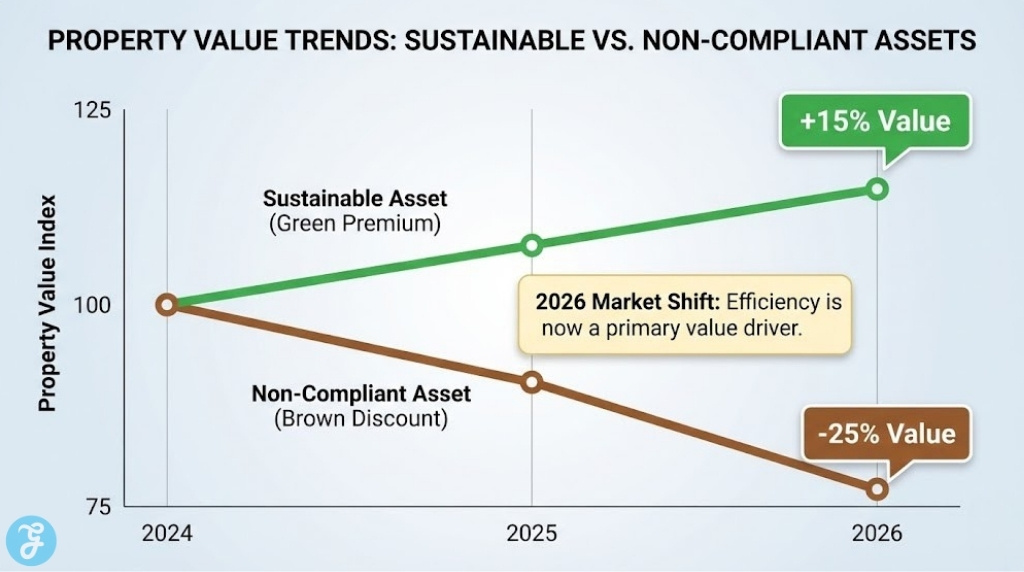

The ‘Green Premium’ vs. The ‘Brown Discount’

In 2026, the real estate market will have officially bifurcated. We are seeing a widening gap between the value of sustainable assets and traditional ones, driven by two powerful economic forces that every investor needs to understand.

The Green Premium: Certified sustainable buildings (LEED Platinum, BREEAM Outstanding, or local equivalents like Singapore’s Green Mark) are now commanding sales prices 10–15% higher than their non-green neighbors. Tenants, facing their own ESG reporting mandates, are willing to pay significantly higher rents for energy-efficient, low-carbon spaces.

The Brown Discount: Conversely, older properties that fail to meet new 2026 energy efficiency standards are seeing their values plummet. This “Brown Discount” reflects the future cost of mandatory retrofitting. In cities like Copenhagen and Vancouver, buying a non-compliant building is now considered a liability, with valuations dropping by up to 25% to account for the necessary upgrades

How to Choose the Right Green Market

Not all green real estate markets are created equal. You need to decide if you want regulatory safety or innovation upside.

Regulatory Stability: Choose Copenhagen or Vancouver. The rules are set, the path is clear, and the risk is low, even if the entry price

Innovation & Growth: Look at Rotterdam or Tucson. You are betting on new technologies (floating homes) or adaptations (desert living) that will likely become standard in the future.

Sustainability Checklist:

-

Energy Rating: Does the property meet the 2026/2030 standards for the region?

-

Climate Resilience: Is the location safe from flood/fire risks, or adapted to handle them (like Rotterdam)?

-

Materiality: particularly in Vancouver or Costa Rica, is the building made of sustainable, non-toxic materials?

Our quick picks:

Best for Stability: Copenhagen. Government-backed climate plans ensure your investment is future-proofed against regulation.

Best for Innovation: Rotterdam. The floating neighborhoods here are defining a completely new asset class.

Best for Lifestyle: Costa Rica (Southern Zone). A booming market for those who want luxury that sits in harmony with the rainforest

Wrap-Up

The data from 2026 is clear: sustainability is the new standard for value. Whether it is the high-tech timber towers of Vancouver or the floating docks of Rotterdam, the green real estate markets are outperforming the broader industry. Don’t just look for a view; look for a future-proof asset.