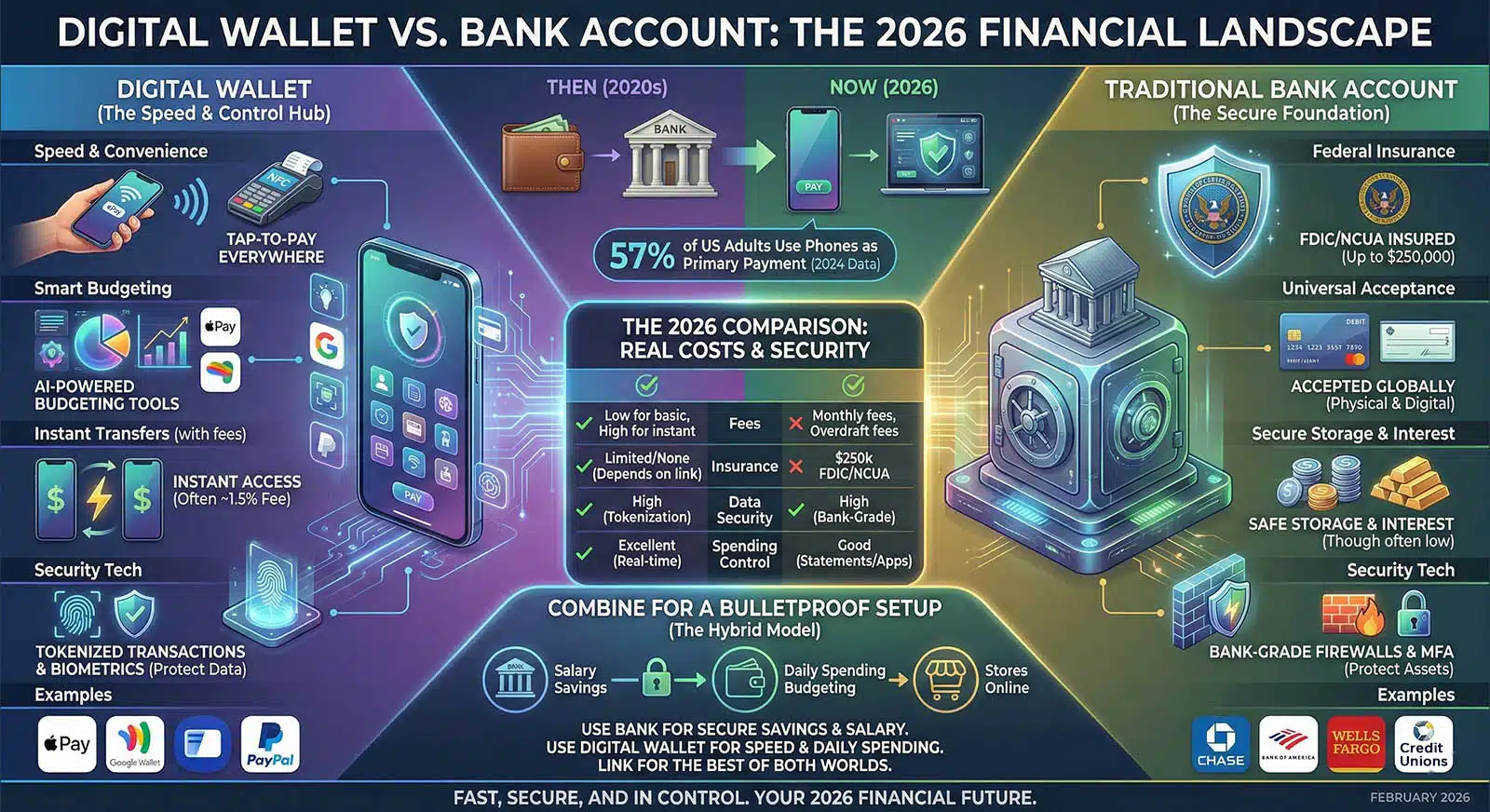

Deciding between a digital wallet and a bank account used to be simple. You had a physical leather wallet for cash and a bank for your paycheck. But the lines have blurred. You know how we used to think of our phones just for calls and texts? Now, for 57% of American adults as of 2024, that phone is also their primary way to pay. We are seeing a massive shift where tapping a screen feels more natural than swiping a card. Understanding the unique advantages of a Digital Wallet vs Bank Account is now essential for anyone looking to optimize their daily spending and long-term security.

From what we see in the financial sector, this isn’t just about cool technology. It is about a fundamental change in control. Digital wallets like Apple Pay offer speed and clever budgeting tools that traditional banks are racing to match. However, banks still hold the crown for one critical thing: federal insurance that guarantees your money is safe up to $250,000.

So, we are going to break down exactly how these two tools differ in 2026. We will look at the real costs of “instant” transfers, the specific security tech protecting your data, and how to combine both for a financial setup that is both fast and bulletproof.

What Is a Digital Wallet?

A digital wallet is a software-based system that securely stores your payment information and passwords. It lives on your smartphone or smartwatch and replaces the need to carry a physical wallet.

Think of apps like Apple Wallet, Google Wallet, or Samsung Wallet. These are not just storage folders; they are active transaction tools. When you tap your phone at a register, these wallets use Near Field Communication (NFC) to talk to the card reader wirelessly.

The Security Secret: Tokenization

The most important feature of a digital wallet is something called “tokenization.” When you pay with a physical card, your actual card number is shared with the merchant. That is risky.

Digital wallets do it differently. They replace your real card number with a unique, random string of numbers called a “token.” If a hacker steals that token from the store’s system, it is useless to them. They cannot use it to buy anything else. This makes digital wallets significantly safer than carrying plastic cards.

More Than Just Payments

These apps have evolved into all-in-one lifestyle tools. Beyond credit and debit cards, you can store:

- Boarding passes for flights (updating in real-time).

- Event tickets for concerts or sports.

- Loyalty cards for grocery stores and pharmacies.

- Digital keys for your car or home smart lock.

Apps like Venmo and Cash App take it a step further. They allow for peer-to-peer money transfer, letting you split a dinner bill or pay rent to a roommate in seconds. Some even hold crypto assets, turning your phone into a portable investment portfolio.

What Is a Bank Account?

A bank account is a financial arrangement with a licensed institution where you deposit funds for safekeeping. Unlike a digital wallet, which is often just a “pass-through” for money, a bank account is a regulated vault.

Banks are the foundation of the US financial system. When you deposit money into a standard checking or savings account, that money is protected by the Federal Deposit Insurance Corporation (FDIC). This means that even if the bank goes out of business, the government guarantees you will get your money back, up to $250,000 per depositor.

Types of Accounts for Different Needs

Most Americans use two main types of accounts:

- Checking Accounts: These are for daily flow. Money comes in from your paycheck and goes out for bills, groceries, and rent. You access it via a debit card, paper checks, or online transfers.

- High-Yield Savings Accounts (HYSA): These are for growth. Online banks like SoFi, Ally, or Varo offer these accounts with much higher interest rates than traditional brick-and-mortar banks. In early 2026, we are seeing top rates hover around 4.20% to 5.00% APY, compared to the national average of just 0.60%.

Banks also handle the “heavy lifting” of finance. They are where you go for auto loans, mortgages, and official cashier’s checks. While mobile banking apps have made them more digital, the core purpose remains stability and long-term security.

Opening a bank account unlocks tools that protect your cash while letting you pay your way every day.

Core Differences Between Digital Wallets and Bank Accounts

Digital wallets and bank accounts often look similar on a screen, but they work very differently under the hood. Understanding these differences can save you money on fees and keep your data safer.

Accessibility and Convenience

Digital wallets win on speed. If you are standing in line at a coffee shop, double-clicking your phone to pay with Apple Pay takes roughly two seconds. You do not need to dig for a card or sign a receipt. This convenience extends to online shopping too. Features like “Express Checkout” let you skip typing in your shipping address and card number entirely.

Bank accounts are catching up, but they are still slower. Logging into a mobile banking app often requires a password and two-factor authentication just to check a balance. Moving money between banks using the standard ACH system can take 1-3 business days. While services like Zelle have made bank-to-bank transfers faster, they still lack the “tap-and-go” ease of a digital wallet for in-store purchases.

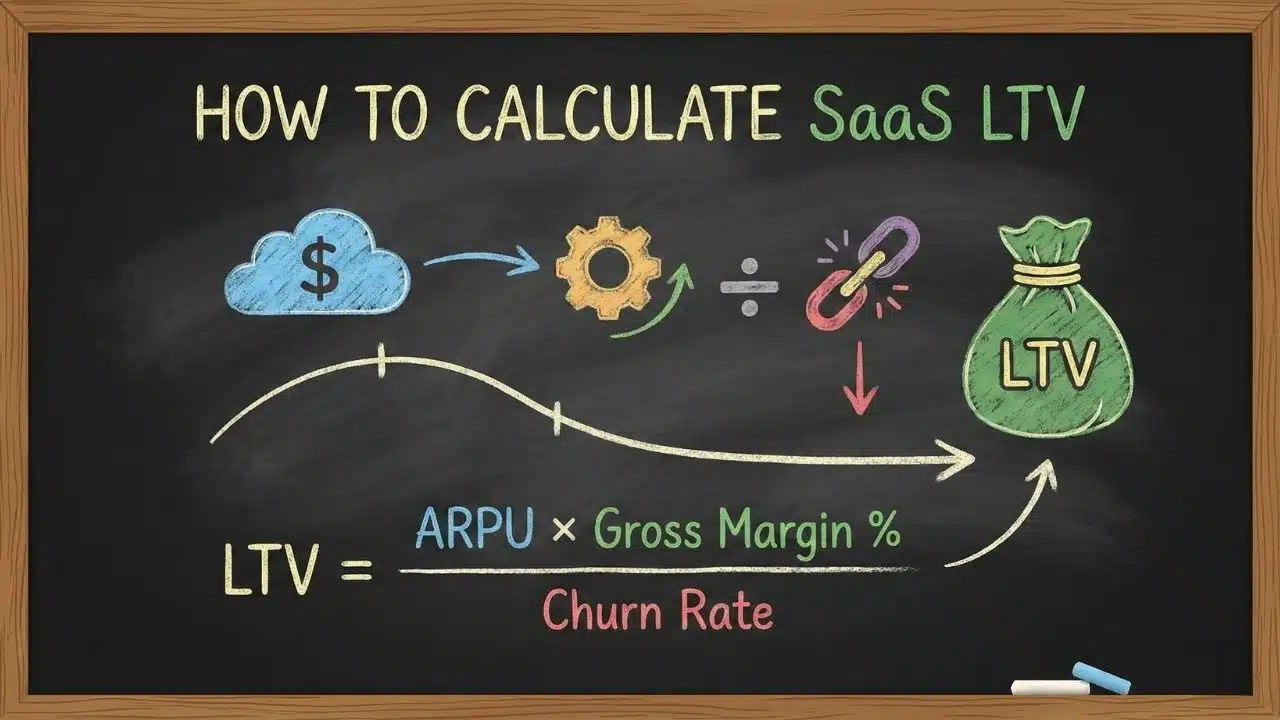

Costs and Fees (The Hidden Price Tags)

We need to talk about the fees because this is where users often get surprised. Digital wallets are generally free to use for purchases, but they charge for speed.

If you have a balance in Venmo or Cash App and want to transfer it to your bank instantly, you will pay a fee. As of 2025, this fee is typically around 1.75% of the transfer amount, with a minimum charge of $0.25. If you transfer $500 instantly, that costs you nearly $9. You can transfer it for free, but you have to wait 1-3 days.

Banks have their own fee structures. The most notorious is the overdraft fee. In 2025, the average overdraft fee in the US was approximately $26.77, with some large banks still charging up to $35. However, many online banks and “neobanks” like Chime have eliminated these fees entirely to compete with digital wallets.

| Feature | Digital Wallet (e.g., Venmo) | Bank Account (e.g., Chase) |

| Monthly Fee | Usually Free | $0 – $12 (often waivable) |

| Instant Transfer | ~1.75% Fee | Free (via Zelle) or Wire Fee |

| Overdraft Fee | N/A (Transaction declined) | Avg. $26.77 (unless opted out) |

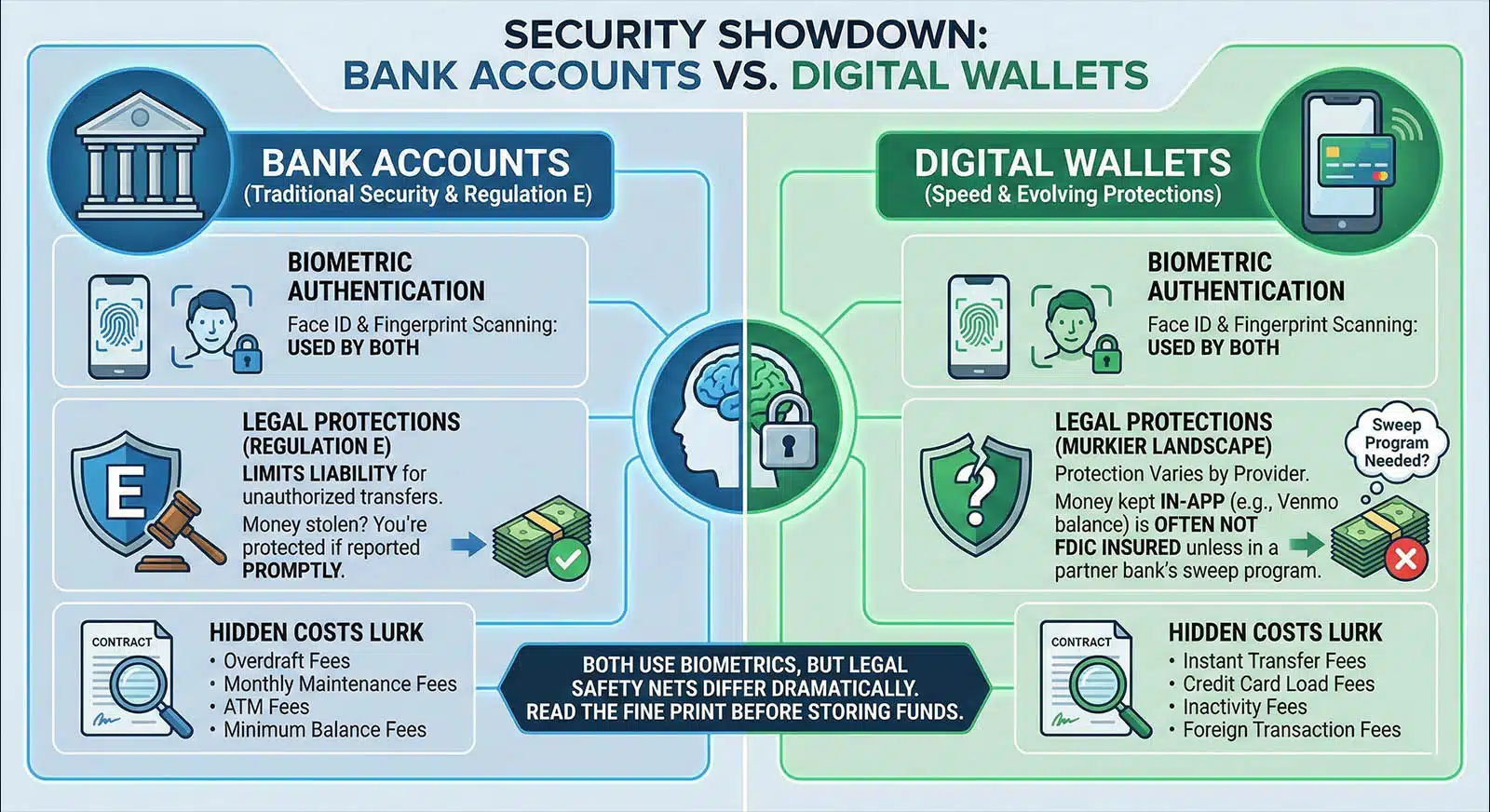

Security Features

Both tools use biometric authentication like Face ID or fingerprint scanning. But the legal protections differ.

Bank accounts are covered by Regulation E, which limits your liability if money is stolen from your account, provided you report it in time. Digital wallets offer some protection, but it can be murkier. If you keep money inside a wallet app (like a Venmo balance) rather than transferring it to a bank, that money may not be FDIC insured unless the app specifically places it in a partner bank’s sweep program.

Hidden costs lurk in both digital wallets and traditional bank accounts, so it pays to read the fine print before choosing where to keep your funds.

Digital Wallets: The Trade-offs of a Cashless Future

Pros

- Contactless Speed: Transaction times are often under 3 seconds, making smartphone payments significantly faster than using a traditional chip card.

- Enhanced Security: Your real card number is protected by tokenization, meaning it is never stored on a merchant’s server, which helps prevent data breaches.

- Organization: These apps clear pocket clutter by allowing you to store loyalty cards, gift cards, and event tickets all in one digital location.

- Peer-to-Peer Ease: You can split bills or reimburse friends instantaneously through apps like Cash App without needing to exchange bank account numbers.

Cons

- Transaction Limits: frustrating for large purchases, many wallets impose weekly or monthly limits on the amount of money you can send or receive.

- Battery Dependence: Unlike a physical card that never runs out of power, a dead phone battery means you lose immediate access to your funds.

- Privacy Trade-offs: Some providers track your purchasing habits specifically to target you with advertisements or offers within the app.

- Limited Acceptance: You can’t leave your physical wallet behind everywhere yet; many small businesses and “mom and pop” shops still require cash or physical cards.

- Regulatory Volatility: These apps may have less federal supervision than banks; for example, a major CFPB oversight rule was overturned by Congress in 2025.

- No Interest: Money held as a balance in a digital wallet usually earns 0% interest, causing it to lose value over time because of inflation.

Bank Accounts: Stability and Structure in a Digital World

Pros

- FDIC Insurance: Deposits are government-backed up to $250,000, providing a “gold standard” level of safety and peace of mind that digital wallets cannot match.

- Interest Earnings: High-yield savings accounts can earn between 4.00% and 5.00% APY, allowing your money to grow passively over time.

- Universal Acceptance: Bank-issued debit cards are accepted nearly everywhere, from online storefronts to rural gas stations that lack modern tech updates.

- Full Service: Banks provide a comprehensive suite of financial products, including mortgages, loans, and certificates of deposit (CDs), all within one institution.

- Paper Trails: Monthly statements and certified checks offer vital legal proof of payment for critical transactions like rent or taxes.

Cons

- Slow Transfers: Unlike the instant nature of digital wallets, standard bank-to-bank transfers can take several days to clear.

- Maintenance Fees: Traditional banks may charge monthly service fees (sometimes as high as $12/month) if your balance falls below a specific minimum.

- Overdraft Risks: Accidental spending beyond your balance can trigger expensive overdraft fees, which average nearly $27 per occurrence.

- Access Barriers: Opening a formal bank account often involves significant paperwork and identity verification compared to the ease of downloading an app.

- Foreign Fees: Using a standard debit card abroad often incurs a 3% foreign transaction fee, a cost that many digital wallets choose to waive.

When to Use a Digital Wallet

Digital wallets excel in specific scenarios where speed and convenience are the priority. We recommend using them for the “moving parts” of your financial life.

- Daily Commutes and Coffee: Use Apple Pay or Google Pay for transit turnstiles and morning coffee runs to speed up your routine.

- Online Subscriptions: Link your subscriptions to a digital wallet. If you lose your physical card and get a new one, many wallets automatically update the card details for you.

- Concerts and Flights: Always store your event tickets and boarding passes in your wallet app. The screen brightness automatically adjusts for scanners, and you won’t lose a paper ticket.

- Splitting Dinner Bills: Use Venmo or Cash App to instantly pay your share. It is polite, fast, and saves the server from running five different credit cards.

- Emergency Backup: If you leave your physical wallet at home, having a digital wallet set up on your phone ensures you are not stranded without buying power.

- Collecting Rewards: Use store-specific apps (like Starbucks or Target) stored in your wallet to automatically earn loyalty points with every scan.

- Buying from New Websites: When shopping on a new or unfamiliar site, use a digital wallet like PayPal or Apple Pay so you do not have to hand over your actual credit card number.

- International Travel: In many countries, contactless payment is the standard. A digital wallet often works better than US chip cards, which technically require a signature.

- Sending Small Gifts: Digital gift cards sent via wallet apps are instant and can’t be lost in the mail.

- Managing Crypto: For casual investors, buying small amounts of Bitcoin or Ethereum is often easiest directly through apps like PayPal or Cash App.

When to Use a Bank Account

Bank accounts are for the “foundation” of your finances. Use them for storing wealth and handling serious obligations.

- Receiving Your Paycheck: Always set up direct deposit into a checking account. This is often required to waive monthly maintenance fees.

- Building an Emergency Fund: Keep your 3-6 months of expenses in a High-Yield Savings Account (HYSA) to earn interest while keeping it safe.

- Paying Rent or Mortgage: Use your bank’s bill pay feature for large, recurring housing payments. It creates a solid legal record of on-time payments.

- Large Purchases: When buying a car or putting a down payment on a home, you will likely need a cashier’s check or a wire transfer, which only a bank can provide.

- Joint Finances: Shared checking accounts are still the best way for couples to manage household expenses and view total spending transparency.

- Cash Withdrawals: Using your bank’s own ATM network is the only way to get physical cash without paying third-party fees.

- Automated Savings: Banks allow you to set up automatic transfers from checking to savings, helping you build wealth without thinking about it.

- Applying for Loans: Having a long-standing relationship with a bank can sometimes help when applying for a personal loan or credit card with them.

- Tax Refunds: The IRS direct deposit system works most reliably with a standard bank routing and account number.

- Business Expenses: If you have a side hustle, open a separate business bank account to keep your finances clean for tax season.

Accessibility and Convenience: The Speed of Money

The gap in speed between these two options is closing, but it is still noticeable. Digital wallets like Apple Wallet and Google Pay offer near-instant gratification.

We can send money to a friend, pay a utility bill, or tap-to-pay at a grocery store in seconds. The integration of biometric authentication (Face ID or fingerprint) means security does not slow you down. It is faster than typing a PIN.

Bank accounts are evolving, but they have legacy hurdles. While mobile banking apps are better than ever, moving money between different institutions often relies on the ACH network, which batches transactions. This means a transfer you make on Friday night might not show up until Tuesday morning.

However, services like Zelle are the bank’s answer to this problem. Zelle is integrated into over 2,000 banking apps and allows for instant transfers between bank accounts with no fees. If your bank supports Zelle, you get the speed of a digital wallet with the security of a bank.

| Feature | Digital Wallet (e.g., Apple Pay, Google Pay) | Bank Account (Standard vs. Zelle) |

| Transaction Speed | Near-Instant. Tap-to-pay, bill pay, and P2P transfers happen in seconds. | Variable. Standard transfers can be slow; however, Zelle allows for instant transfers. |

| Authentication | Biometric. Uses Face ID or fingerprint; significantly faster than typing a PIN. | Login/PIN. Often requires passwords or PINs, though mobile apps are evolving. |

| Processing Time | Real-Time. Immediate gratification for users. | Standard: Uses ACH (Batched). A Friday transfer might not clear until Tuesday.

Zelle: Instant (No wait time). |

| Network | Built for modern, high-speed digital exchange. | Relies on legacy ACH Network (slow) or the Zelle Network (fast, integrated in 2,000+ apps). |

Wealth Building: Where Should Your Money Grow?

This is the most critical distinction for your financial future. Digital wallets are for spending; bank accounts are for growing.

If you leave $5,000 sitting in a standard Venmo or PayPal balance, it earns nothing. In fact, due to inflation, it effectively loses value every year. You are missing out on free money.

In contrast, High-Yield Savings Accounts (HYSAs) are powerful wealth-building tools. With rates around 4.50% APY in 2026, that same $5,000 could earn you over $225 in interest in just one year. That is a free nice dinner or a utility bill payment, just for keeping your money in the right place.

Our advice: Keep your checking account lean for monthly bills, keep your digital wallet empty until you need to pay, and funnel every extra dollar into a high-yield savings account.

The Future: Convergence and “Super Apps”

We are moving toward a world of “Super Apps.” Companies like PayPal and even X (formerly Twitter) have ambitions to become a single dashboard for your entire financial life.

We are already seeing this convergence. Apple Wallet now offers a savings account (via a partnership with Goldman Sachs) and a “Pay Later” installment loan feature. Apps like SoFi combine investing, banking, and loans in one place. The line between “tech company” and “bank” is getting thinner.

However, regulation is the wildcard. The Consumer Financial Protection Bureau (CFPB) has been trying to increase oversight on these digital giants. In late 2024, they finalized a rule to supervise large digital wallet providers, but political shifts and the Congressional Review Act in 2025 have challenged these regulations. This means that while features will grow faster, consumer protections might lag behind.

The Verdict: Performance vs. Protection

Ultimately, choosing between a digital wallet vs bank account is not about picking a winner but rather matching the tool to the task. If you prioritize velocity, meaning the ability to pay for a subway ride or split a lunch tab in seconds, the digital wallet is your primary tool. However, if you prioritize stability, meaning earning passive interest on your emergency fund or ensuring your rent payment is legally documented, the bank account remains indispensable. In 2026, the most successful consumers realize that a wallet is a spending engine while a bank is a wealth anchor. Relying solely on one creates a gap in either your security or your convenience. To get the best of both worlds, you do not have to choose because you simply have to integrate.

What Next: Do You Need Both? The short answer is yes. The best financial setup in 2026 uses a hybrid approach. Think of your bank account as your home base. It is secure, insured, and earns interest. It is where your paycheck lands and where your savings grow. Think of your digital wallet as your vehicle. It is the fast, efficient way to move that money into the world for daily spending. We recommend linking a credit card to your digital wallet rather than a debit card. This gives you the points and fraud protection of the credit card, combined with the security tokenization of the wallet. Then, use your bank account to pay off that credit card in full every month.

What Next: Do You Need Both?

The short answer is yes. The best financial setup in 2026 uses a “hybrid” approach.

Think of your bank account as your home base. It is secure, insured, and earns interest. It is where your paycheck lands and where your savings grow. Think of your digital wallet as your vehicle. It is the fast, efficient way to move that money into the world for daily spending.

We recommend linking a credit card to your digital wallet rather than a debit card. This gives you the “points” and fraud protection of the credit card, combined with the security tokenization of the wallet. Then, use your bank account to pay off that credit card in full every month.

Final Thoughts

We have explored how digital wallets like Apple Pay and Google Wallet prioritize speed and convenience, while traditional bank accounts offer the essential security of FDIC insurance and interest growth.

Both options have unique strengths. The smart move is to stop viewing them as competitors and start using them as partners. Use the wallet to protect your card data during transactions, and use the bank to protect your wealth for the long term.

Small changes, like setting up a high-yield savings account and linking it to your digital wallet, can significantly boost your financial health. By understanding the fees, the tech, and the risks, you can build a system that is both secure and effortless.

If you want to learn even more about making smart money choices, many trusted financial websites offer deep dives into the latest rates and tools. Choosing the right mix today sets up a stronger, wealthier tomorrow.

Read Part 1: Neobank vs Traditional Bank, 2026: The Ultimate Comparison Guide