Neobanks—those slick, digital-only apps that live on your phone—have completely changed how we handle money. They promise zero fees, early paydays, and interfaces that actually make sense. But for all the shiny features, there is a lingering problem that keeps most Americans from going “all in.” You might love the app, but do you trust the bank behind it?

Recent data backs this up. While customer satisfaction with digital banks is often higher than with traditional ones, trust scores tell a different story. In fact, a 2025 report from Alterna CX found that traditional banks still hold a trust score of 87, compared to just 74 for neobank trust. It is the “trust deficit,” and it is the single biggest hurdle standing between a neobank being your “spending money” app and your primary bank.

In this analysis, we are going to look at why that gap exists—especially after the 2024 Synapse collapse that shook the US fintech market—and the specific steps top players like SoFi and Chime are taking to fix it.

Inside the Trust Deficit in Banking

Trust in banking isn’t just about a friendly logo; it is about knowing your money is safe when things go wrong. For neobanks, the challenge is proving they have the infrastructure to weather storms, not just the code to make transfers fast.

Traditional Banks vs. Neobanks: A Trust Comparison

Neobanks are shaking up the sector, but skepticism lingers. The data shows a clear divide: users prefer the digital experience of neobanks but rely on the stability of traditional banks. Here is how they stack up in the current US market.

| Category | Traditional Banks (Chase, BofA, etc.) | Neobanks (Chime, Varo, SoFi) |

|---|---|---|

| Consumer Trust Score | High (87/100) – Seen as “too big to fail” and secure. | Moderate (74/100) – Users worry about stability during crises. |

| Primary Bank Usage | Dominant (82%) – Most Americans keep their main paycheck here. | Niche (~13%) – Often used as a secondary or “spending” account. |

| Fee Structure | Complex; often criticized for overdraft and maintenance fees. | Transparent; famous for “no hidden fees” and early direct deposit. |

| Regulatory Status | Directly chartered and heavily regulated. | Often rely on “partner banks” (BaaS), though some like SoFi now have charters. |

| Customer Satisfaction | Lower; often dragged down by slow service and legacy tech. | Significantly higher; apps are faster and more intuitive. |

Key Factors Contributing to the Trust Gap

Why do so many people treat neobanks as a side wallet rather than a main vault? The answer lies in structural reliance.

Many neobanks are not actually banks; they are technology companies that partner with smaller regional banks to hold your money. The 2024 collapse of Synapse, a “middleman” company that connected these apps to banks, froze funds for thousands of US customers. This event highlighted the risks of the “partner bank model” and made consumers wary.

Beyond structural risks, simple familiarity plays a role. 79% of consumers still say they trust traditional banks more with sensitive financial data. While a user might love the interface of a neobank for buying coffee, they often prefer the brick-and-mortar stability of a Chase or Wells Fargo for their mortgage or life savings.

How Neobanks Are Rebuilding Reputation

Smart neobanks know that cool features aren’t enough anymore. To win the “primary account” status, they are aggressively rebuilding their foundations to look, act, and protect like mature financial institutions.

Transparency and Clear Communication

The strongest weapon neobanks have is radical honesty about fees. Traditional banks have a reputation for “gotcha” charges, like surprise overdraft fees. Neobanks have turned this into a trust-building feature.

- No-Fee Overdrafts: Features like Chime’s “SpotMe” allow trusted users to overdraft small amounts without penalty. This signals that the bank is on the customer’s side, not trying to profit from their mistake.

- Upfront Pricing: Apps like Current and Varo display all costs clearly. There are no monthly maintenance fees hidden in fine print.

- Plain English Policies: Instead of dense legal jargon, top fintechs explain terms in simple language. This clarity helps close the trust gap, as users feel they understand exactly what they are signing up for.

Customer-Centric Digital Experiences

Neobanks focus on solving specific user pain points that traditional banks ignore. It is about more than just a pretty app; it is about speed and access.

For example, “early direct deposit”—getting your paycheck two days early—was a feature pioneered by neobanks that built immense goodwill. It showed that these companies understood the cash-flow reality of the average American worker. By processing payments as soon as the notification hits rather than holding them for interest, they proved they value the customer’s financial health.

Top platforms now integrate 24/7 chat support directly in the app, often with shorter wait times than traditional phone lines. This responsiveness counters the fear that “there is no branch to visit if something goes wrong.”

Enhanced Security Measures and Fraud Prevention

Security is the baseline for trust. With cyber threats rising, neobanks are often faster to adopt new defensive tech than legacy institutions.

“For many consumers, the turning point for trust is ‘control.’ The ability to instantly freeze a lost card from your phone is a neobank native feature that makes users feel safer than calling a 1-800 number.”

Leading US neobanks have rolled out heavy-hitting security features:

- Biometric Enforcement: Mandatory FaceID or fingerprint scanning for every login, not just for setup.

- Transaction Control: The ability to turn off online transactions or international spending with a single tap.

- Direct Charters: Companies like SoFi and Varo have obtained their own national bank charters. This means they are regulated directly by the OCC and FDIC, removing the “middleman” risk and offering the same government-backed security as the biggest banks.

Leveraging Technology to Bridge the Gap

Technology isn’t just the product; it is the trust-builder. Neobanks use data and code to offer a level of personalization that makes customers feel “seen” rather than just processed.

AI-Driven Personalization

Artificial Intelligence allows neobanks to act like a proactive financial advisor. Instead of just showing a balance, AI tools analyze spending to find problems before they hurt the user.

For instance, an app might alert you that a subscription price just went up or that you are on track to overspend on dining out this month. By shifting from “recording history” to “predicting the future,” tools like the AI-powered insights in Cleo or similar integrations prove their value daily. This creates a functional reliance that deepens the relationship beyond just holding money.

Embedded Finance and Ecosystem Integration

The most successful fintechs are embedding themselves into the apps you already use. It is the concept of “banking where you are.”

Think about the Apple Card or savings integrations. By living inside the phone’s operating system, the financial tool feels like a utility, not a separate entity. Retailers and gig-economy platforms (like Uber or DoorDash) now offer instant payouts to specific debit cards. This integration makes the neobank account the “hub” of a user’s digital life, increasing stickiness and trust through utility.

ESG and Values-Based Banking

A growing segment of US consumers, particularly Gen Z, chooses banks based on values. They want to know their deposits aren’t funding oil pipelines or private prisons.

Neobanks have been quick to launch “green” accounts. Some platforms offer carbon footprint tracking on every purchase or commit a percentage of interchange fees to reforestation projects. By aligning with the personal values of their users, these banks build an emotional connection that traditional institutions—often tied to legacy industrial investments—struggle to match.

Challenges Neobanks Face in Rebuilding Trust

Despite the progress, the road ahead is steep. Neobanks face specific structural hurdles that legacy banks simply don’t have to worry about.

Regulatory Compliance and the “Partner” Problem

The biggest challenge in 2026 is regulatory pressure. After the Synapse and Silicon Valley Bank crises, regulators like the FDIC and CFPB are watching fintechs like hawks.

For neobanks without a charter, ensuring their partner banks are stable is a survival task. If a partner bank fails, the neobank’s customers could lose access to their funds temporarily. Navigating this “third-party risk” is the top priority for compliance teams. US regulators are currently rewriting the rules on “pass-through” insurance, and neobanks must adapt quickly to ensure they never face a frozen-funds situation again.

Profitability and Sustainability

Trust is also about financial health. You don’t want to bank with a company that might go out of business. For years, neobanks burned cash to grow.

Now, the focus has shifted to profitability. Leaders like SoFi have reached GAAP profitability, proving their model works. However, many smaller players are still losing money on every customer. To build long-term trust, these companies must show they can survive without constant venture capital funding. This often means introducing fair, transparent subscription models for premium features.

Cybersecurity Threats

As digital-first entities, neobanks are prime targets for cyberattacks. The rise of “synthetic identity fraud”—where criminals combine real and fake data to create new personas—is a major threat.

A single data breach can destroy a neobank’s reputation overnight. Unlike a physical bank where you can walk in and talk to a manager, a hacked app feels like a complete dead end. Maintaining military-grade security while keeping the app easy to use is a constant, expensive balancing act.

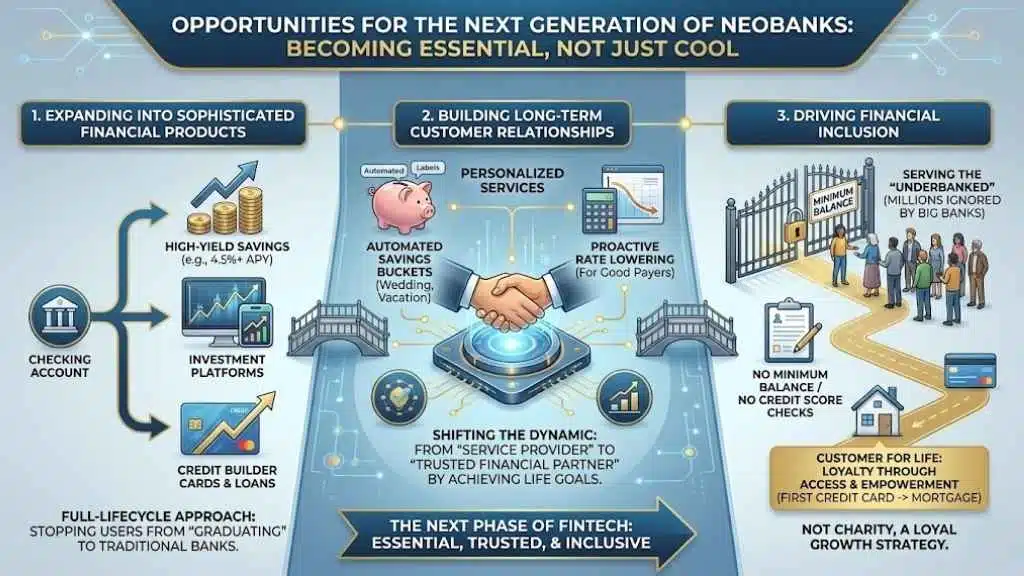

Opportunities for the Next Generation of Neobanks

The “trust deficit” is shrinking for the companies that are willing to grow up. The next phase of fintech isn’t about being cool; it is about being essential.

Expanding into Sophisticated Financial Products

The era of “just a checking account” is over. To become primary banks, fintechs are launching products that build wealth.

We are seeing neobanks add high-yield savings accounts (giving 4.5% APY or more), investment platforms, and even credit builder cards. By offering a full suite of services, they stop users from “graduating” to a traditional bank when they need a loan or an IRA. This full-lifecycle approach proves they are serious financial partners.

Building Long-Term Customer Relationships

Winning a customer is easy; keeping them requires a relationship. Top performers are using their data advantage to offer genuine help.

This means proactively lowering interest rates for good payers or offering automated savings buckets for specific goals like a wedding or vacation. When a bank helps a user achieve a life goal, trust is cemented. It shifts the dynamic from “service provider” to “financial partner.”

Driving Financial Inclusion

Finally, neobanks have a massive opportunity to serve the “underbanked”—the millions of Americans ignored by big banks due to low balances.

By removing minimum balance requirements and credit score checks for basic accounts, neobanks bring people into the system. This isn’t just charity; it is a loyal growth strategy. A customer who gets their first credit card and mortgage from a neobank because Chase wouldn’t talk to them becomes a customer for life.

Final Thoughts

Trust in digital banking is still a work in progress, but the gap is closing. By securing bank charters, adopting transparent fees, and offering real financial guidance, top neobanks are proving they can be just as safe as they are simple.

If you are on the fence, look at the infrastructure behind the app. Does it have its own charter? Is it profitable? Does it offer 24/7 support?

The future of banking belongs to the companies that can combine the speed of Silicon Valley with the safety of Fort Knox. For you, the consumer, that means more choice, lower fees, and finally, a bank that works as hard as you do.