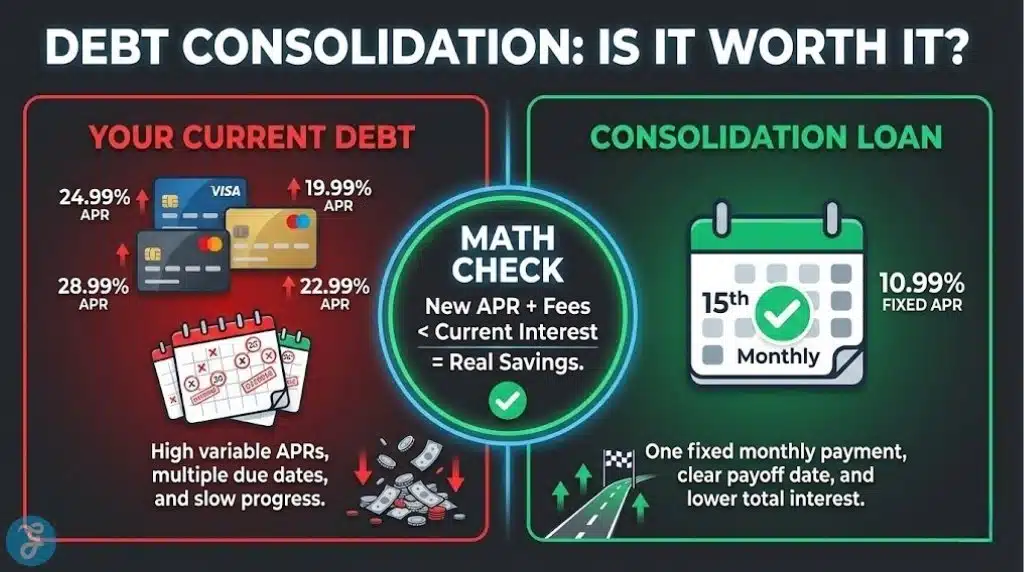

High-interest credit card debt is noisy. It pings you with minimum payments, shifting interest, and the feeling that you are working hard without getting ahead. The right consolidation loan can turn that chaos into one fixed payment, a clear payoff date, and a path that actually feels measurable.

This guide to the Best Personal Loan Lenders for Debt Consolidation is built to help you compare lenders quickly, avoid common traps like fees that erase your savings, and pick the option that matches your credit tier and payoff plan.

How We Picked Our 10 Best Personal Loan Lenders for Debt Consolidation

We prioritized “real savings,” not just marketing. A consolidation loan only helps if the APR plus fees beats what you are paying now, and if the term does not drag debt out so long that you pay more overall.

Filters we used

-

Transparent pricing: clear APR ranges and fee disclosures

-

Debt-consolidation-friendly features: pre-qualification (soft check), direct creditor pay where offered, fast funding options

-

Range of borrower fit: excellent credit, fair credit, and “thin file” applicants

-

Terms that match payoff goals: reasonable loan amounts and term options (not just tiny loans or ultra-long terms)

What this list is not

-

Not a promise of approval or lowest rate

-

Not a substitute for personalized financial advice

Comparison Table

| Lender | Typical Fit | Loan Size (commonly advertised) | Notable Fee Pattern | Good If You Want |

|---|---|---|---|---|

| SoFi | Good to excellent credit | Up to $100K | Often marketed as no origination fee in many scenarios | Big loans + clean experience |

| LightStream | Good to excellent credit | $5K–$100K | No fees highlighted by major reviewers | Very fast funding, no-fee structure |

| Discover | Good credit | $2.5K–$40K | No origination fees noted in reviews | Simple, no-fee consolidation |

| Upgrade | Fair to good credit | $1K–$50K | Origination fee common | Flexible approval band + creditor pay options |

| LendingClub | Fair to good credit | Up to ~$60K (varies) | Origination fee possible | Direct payment to creditors + joint apps |

| Upstart | Thin file to fair credit | Varies by partner | Fees can be high for some borrowers | Alternative underwriting and fast decisions |

| Happy Money (Payoff Loan) | Fair credit or higher | ~$5K–$50K (varies by state) | Product designed for card payoff | Credit-card-focused consolidation |

| PenFed Credit Union | Broad (membership) | Up to ~$50K | No origination fee noted | Credit union rates and straightforward terms |

| Navy Federal Credit Union | Members only | Up to ~$50K | Credit-union style pricing | Military families who want member benefits |

| Best Egg | Fair to good credit | $2K–$50K | Origination fee common | Fast funding + secured option potential |

10 Best Personal Loan Lenders for Debt Consolidation

Here are the 10 best personal loan lenders for debt consolidation:

1) SoFi

SoFi is a strong consolidation option if you have good to excellent credit and want a clean digital experience with larger loan sizes and rate discounts tied to autopay or direct deposit in some cases. It tends to fit borrowers who want one lender for checking, payments, and payoff momentum.

-

Best For: Good-to-excellent credit borrowers consolidating larger balances

-

Pros: Large loan amounts, competitive rate ranges for strong profiles

-

Cons: Not ideal if you need a co-applicant or have weaker credit tiers

2) LightStream

LightStream is built for borrowers with strong credit who want a fast, no-fee style personal loan and a wide range of amounts and terms. If you hate origination fees and want speed, this is one of the cleanest setups.

-

Best For: Excellent-credit borrowers who want no-fee structure and fast funding

-

Pros: No fees highlighted, funding speed, high loan limits

-

Cons: Typically not the easiest approval for fair-credit borrowers

3) Discover Personal Loans

Discover is a simple, no-nonsense consolidation pick with widely cited no-fee structure, mid-range loan sizes, and solid term flexibility. It is best when you want fewer surprises and a straightforward repayment plan.

-

Best For: Borrowers who want a no-origination-fee style loan for credit card payoff

-

Pros: No origination fees noted, broad availability, clear loan range

-

Cons: No co-applicants, fewer discount levers than some competitors

4) Upgrade

Upgrade is popular for debt consolidation because it covers fair-to-good credit tiers and offers consolidation-specific features, but you must factor in origination fees that can materially change the math. It fits borrowers who value approval flexibility and structured payoff.

-

Best For: Fair-credit borrowers who still want a mainstream consolidation loan

-

Pros: Wide borrower fit, consolidation flow and options, fast process

-

Cons: Origination fees can be significant and reduce savings

5) LendingClub

LendingClub is a strong consolidation option if you want features like direct payments to creditors and the possibility of a joint application, which can help approval odds or pricing for some households. It is built for people who want predictable fixed payments and a clear payoff plan.

-

Best For: Borrowers who want direct creditor pay and joint applications

-

Pros: Direct creditor payment, fast funding for many borrowers

-

Cons: Origination fees may apply, so compare total cost carefully

6) Upstart

Upstart is worth checking if your credit score is not the whole story, since it can consider additional signals and may approve borrowers with thinner credit profiles. The tradeoff is that pricing and fees can run high depending on your offer.

-

Best For: Thin-file borrowers or lower scores who still want a consolidation loan

-

Pros: Alternative underwriting, fast funding options

-

Cons: APR and fees can be high for some borrowers

7) Happy Money (The Payoff Loan)

Happy Money is specifically framed around paying off credit card debt, which makes it a clean thematic fit for consolidation. It can be a good match if you want a product designed around card payoff and predictable repayment rather than general-purpose borrowing.

-

Best For: Credit card consolidation with a purpose-built loan product

-

Pros: Card-payoff focus, pre-checks that can be soft inquiry, clear positioning

-

Cons: Availability and terms can vary by state and partner

8) PenFed Credit Union

PenFed is a strong option if you like credit union pricing and want a debt-consolidation-focused path with no origination fee highlighted on PenFed’s own materials. It works well for borrowers who prefer simpler fee structures and member-style lending.

-

Best For: Borrowers open to credit union membership for better terms

-

Pros: No origination fee noted, credit-union style approach

-

Cons: Membership steps can add friction, and offers depend on credit profile

9) Navy Federal Credit Union

Navy Federal is a standout if you are eligible, because member-only credit unions often price competitively and focus on stable repayment. It is ideal for military members, veterans, and eligible families who want consolidation through a trusted member institution.

-

Best For: Eligible military families consolidating debt through a credit union

-

Pros: Member lending model, clear explanation of consolidation as a personal loan

-

Cons: Membership eligibility limits access

10) Best Egg

Best Egg is a good lender to compare if you want fast funding and are open to secured options, but you must price in origination fees that can be meaningful. It fits borrowers who want multiple offer styles and are willing to shop terms carefully.

-

Best For: Borrowers who want offer flexibility and possible secured options

-

Pros: Fast funding window, secured and unsecured possibilities

-

Cons: Origination fees are common and can reduce savings

How to Choose the Best Personal Loan Lenders for Debt Consolidation

Quick checklist

-

Compare APR plus fees against your current weighted average interest cost

-

Avoid “payment relief” that comes only from stretching the term too long

-

Pre-qualify with multiple lenders to compare offers before committing

-

If offered, consider direct creditor pay to reduce temptation to reuse paid-off cards

Small decision table

| Your situation | What to prioritize | Lender types that often fit |

|---|---|---|

| Excellent credit | Lowest APR, no fees | LightStream, SoFi, Discover |

| Fair credit | Approval flexibility, clear fees | Upgrade, LendingClub, Best Egg |

| Thin file/rebuilding | Alternative underwriting | Upstart (compare carefully) |

| Eligible for membership | Member pricing | PenFed, Navy Federal |

Red flags

-

“Guaranteed approval” claims

-

High fees that wipe out interest savings

-

Taking a lower payment by choosing a term so long that you pay more overall

The Best Debt Consolidation Loan Is the One That Actually Ends Your Debt

A consolidation loan is not magic. It is a math-and-behavior tool. The math works when your new total cost is lower than your current path. The behavior works when you use the loan to simplify payments, then stop reloading your cards.

If you have strong credit, lenders like LightStream, SoFi, and Discover can shine because the pricing and fee structures often favor “real savings.” If you are in the fair-credit band, Upgrade, LendingClub, and Best Egg can still be worth it, but only if you compare offers side-by-side and include origination fees in your total cost.

Your best move is simple and powerful: pre-qualify with a few lenders, pick the offer that reduces total cost, and commit to the payoff date like it is a finish line.