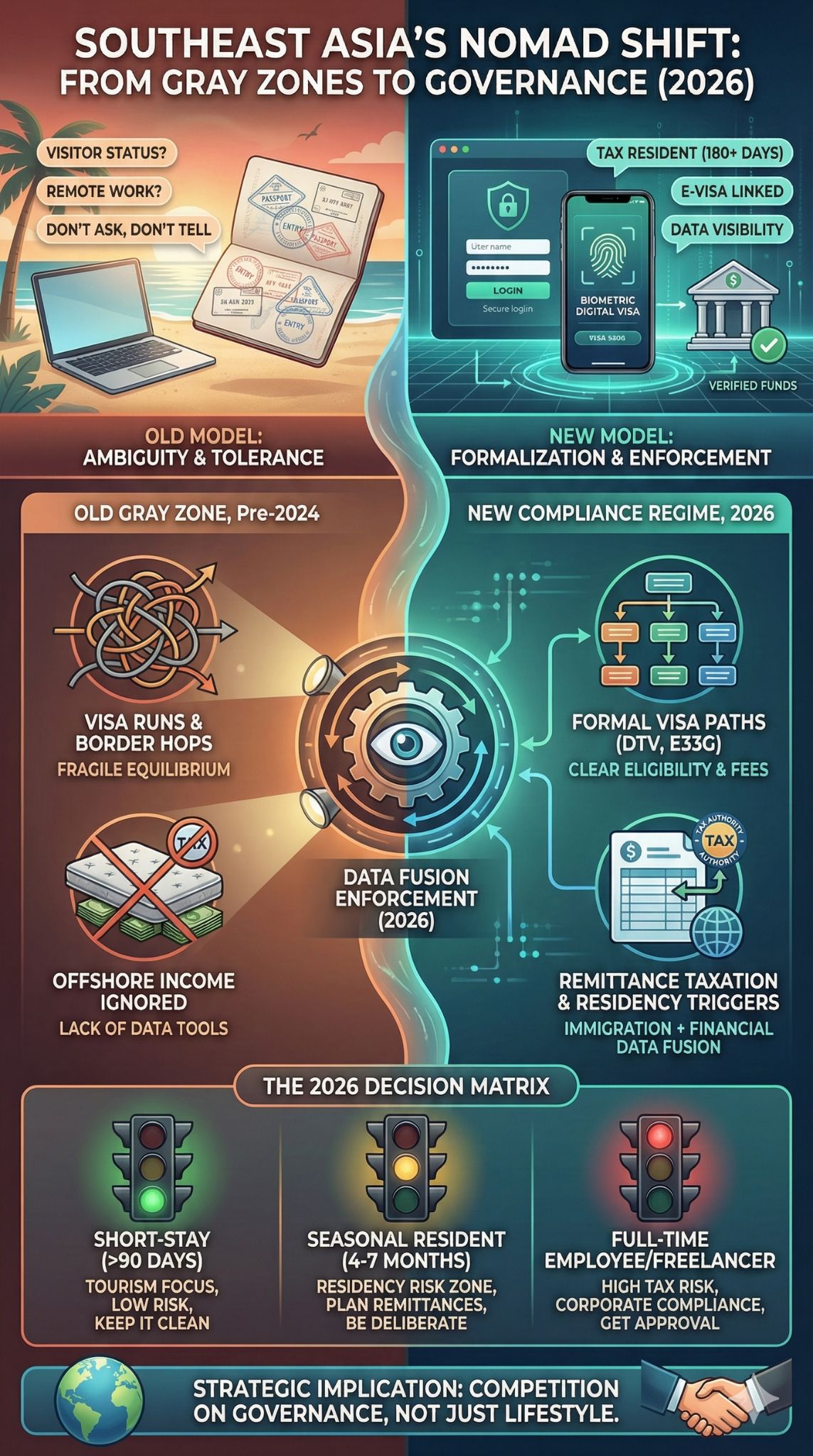

Thailand and Bali are shifting from quietly tolerating “work-from-paradise” gray zones to actively policing who counts as a resident taxpayer. That matters now because governments need revenue, locals are pushing back on overtourism and housing pressure, and tax authorities finally have the data tools to enforce rules that existed on paper for years.

How We Got Here

The pandemic made location-flexible work normal, then made it politically visible. For a few years, many destinations treated digital nomads like long-stay tourists: welcome for spending, tolerated for remote work, rarely scrutinized for tax residency unless they formally entered the labor market.

That “don’t ask, don’t tell” equilibrium did not last. Two things changed.

First, governments started formalizing pathways for long stays. Thailand rolled out new visa options aimed at remote workers and longer-term visitors, including the Destination Thailand Visa (DTV) reported in 2024. Indonesia added a specific remote worker visa classification (often referred to as E33G) with stated eligibility and fees on official immigration channels.

Second, the economic and political costs of letting a large, mobile population “live like residents but pay like tourists” became harder to ignore. Bali’s overtourism debate has become a governance issue, not just a travel story. Tourism remains a dominant pillar of Bali’s regional economy, but the strain from mass visitation has become a core policy driver.

The result for 2026 is not a single new law that “kills” digital nomad life. It is a tighter system where visas, tax residency tests, and enforcement capacity finally line up.

Key Statistics Shaping The 2026 Shift

- The digital nomad population is no longer niche. One major industry estimate put American digital nomads at 18.1 million in 2024, up sharply since 2019.

- Thailand’s tourism recovery remains central to economic planning, even as volatility returned in 2025. One widely reported snapshot showed year-on-year softness in arrivals through mid-2025 and a lowered full-year forecast compared to earlier expectations.

- Bali’s visitor volumes have rebounded strongly, with official statistics reporting hundreds of thousands of monthly foreign arrivals in peak months of 2025.

- Bali’s policy debate is increasingly framed around enforcement and “quality tourism,” reflecting both infrastructure strain and social friction.

A Timeline Of The Pivot From Promotion To Policing

| Period | Thailand | Bali / Indonesia | What It Signals |

| 2020–2022 | Remote work boom meets uneven rules | Bali becomes a global nomad hotspot | Mobility outpaces regulation |

| 2023–2024 | Thailand tightens interpretation of foreign-income remittance taxation from 2024 | Bali expands levies and “visitor conduct” messaging | The “tourist” category starts breaking |

| 2025 | Policy debate shifts to practical amendments and incentives | Bali increases enforcement posture and scrutiny | Enforcement capacity catches up |

| 2026 | Compliance becomes operational: audits, residency tests, cross-checking | Targeted crackdowns and clearer visa-tax alignment | “Gray zone” becomes expensive |

The Core Mechanism: Visa Status Is Not Tax Status

The biggest misconception in digital nomad culture is that immigration permission answers the tax question. It does not.

Tax systems typically care about where you live and center your life, not what stamp is in your passport. In both Thailand and Indonesia, day-count tests and “intent to reside” concepts matter. Indonesia’s tax authority has long described foreign citizens as domestic tax subjects if they meet residence-based thresholds (often framed around a 183-day test) or demonstrate an intention to reside.

This is why 2026 feels like a “crackdown.” Nomads are not being singled out as a new category. They are colliding with old tax logic that was built for immigrants, expats, and long-stay residents.

The Practical Rules That Matter Most In 2026

| Issue | Thailand | Bali / Indonesia |

| Typical tax residency trigger | Often tied to 180+ days within a tax year in common guidance discussions | 183+ days in a 12-month period, or intent to reside |

| The “hot” enforcement zone | Foreign income remitted into Thailand by residents, especially after 2024 changes | Tightening how days are counted and clarifying domestic tax subject status |

| Visa signal in 2026 | Long-stay and remote-worker pathways bring more people near residency thresholds | Remote worker visa pathways signal longer stays and clearer categorization |

| What triggers “surprise liability” | Assuming “foreign salary” is always outside the Thai net | Assuming “tourist-like living” avoids residency rules |

The real story is that governments are closing gaps between three systems that used to be loosely connected: immigration databases, financial flows, and tax residency determinations.

Thailand’s Foreign-Income Pivot: Why Remittances Became The Flashpoint

Thailand’s 2024 shift turned foreign-income remittances into a central compliance issue for residents, including foreigners who spend long periods in-country. In plain terms, the direction of policy has been: if you are tax resident and you bring foreign-sourced income into Thailand, the tax authority increasingly expects that flow to be within scope, subject to conditions, exemptions, treaty relief, and timing rules.

In practice, this matters because many long-stay foreigners and globally mobile earners used Thailand as a lifestyle base while keeping income offshore. A stricter remittance interpretation pressures that model in three ways:

- Cash-flow friction: People who previously remitted irregularly, or remitted older savings, face higher planning costs.

- Documentation burden: Proving when income was earned, where it was taxed, and whether treaty relief applies becomes necessary rather than optional.

- Behavioral change: Some residents reduce remittances, which can be bad for domestic consumption and investment.

That last point helps explain why Thailand’s policy conversation did not stop in 2024. By 2025, credible local reporting described plans to amend practical outcomes and clarified that foreign income earned before 2024 could be treated differently under prior handling. It’s the classic trade-off: enforce harder and you may collect more, but you may also discourage the kinds of inflows and longer-stay spending that the broader economy values.

So the “crackdown” framing is only half the truth. Thailand is also experimenting with how to enforce without scaring off capital inflows and longer-stay residents who support the service economy.

Bali’s Turn To Enforcement: The Politics Of Overtourism Meets Tax Reality

Bali is not a country, but it is a global brand with local political constraints. When the island becomes synonymous with “cheap paradise plus rules you can ignore,” enforcement becomes part of economic strategy.

Two Bali-specific dynamics make 2026 different.

First, overtourism has become an institutional problem. The discussion is no longer only about visitor numbers. It’s about congestion, waste, land use, cultural disruption, and fairness. Tourist levies, conduct campaigns, and stronger enforcement are governance tools aimed at restoring legitimacy.

Second, Indonesia is tightening the definition side of tax compliance, not only the policing side. Late-2025 implementation guidance from major tax advisory channels highlighted new detail on how day-counting is calculated when determining domestic tax subject status. This is a classic sign of an authority preparing for disputes. When a rule is enforced more, edge cases matter more.

Meanwhile, immigration categorization is becoming clearer. A remote worker visa pathway makes long-stay remote work more legible to the state. What is legible becomes taxable and enforceable.

Who Wins And Who Loses If Rules Tighten In 2026

| Likely Winners | Why | Likely Losers | Why |

| Local governments | More predictable revenue and political legitimacy | Visa runners and grey-market facilitators | Less demand for loopholes |

| Compliant long-stay residents | Clearer pathways reduce sudden shocks | “Permanent tourist” lifestyles | Higher compliance burden |

| Formal coworking and registered businesses | A shift toward licensed operators | Informal rentals and unlicensed services | More scrutiny, more penalties |

| Higher-spend, longer-stay visitors | Governments prefer “quality tourism” | Budget nomads relying on ambiguity | Costs rise, enforcement risk rises |

In other words, 2026 does not end digital nomadism. It changes who can do it cheaply.

The Housing And Infrastructure Backlash: Why Taxes Became A Proxy Fight

Tax rules are often the technocratic face of a deeper political argument: who belongs, who benefits, and who pays.

In Thailand, tourism remains economically crucial, yet 2025 volatility highlighted how exposed the sector is to shifts in regional demand, airline capacity, and traveler sentiment. If tourism is less reliable, the appeal of capturing revenue from long-stay residents rises.

In Bali, the backlash is more civic and environmental. When visitor numbers surge, the strain shows up in traffic, waste, water, land use, and rental inflation. Those pressures turn “digital nomads” from a cute subculture into a visible constituency with political cost.

This is why crackdowns often start with visas and levies, then spill into tax. It is easier to enforce paper rules than to directly regulate housing markets or rebuild infrastructure overnight.

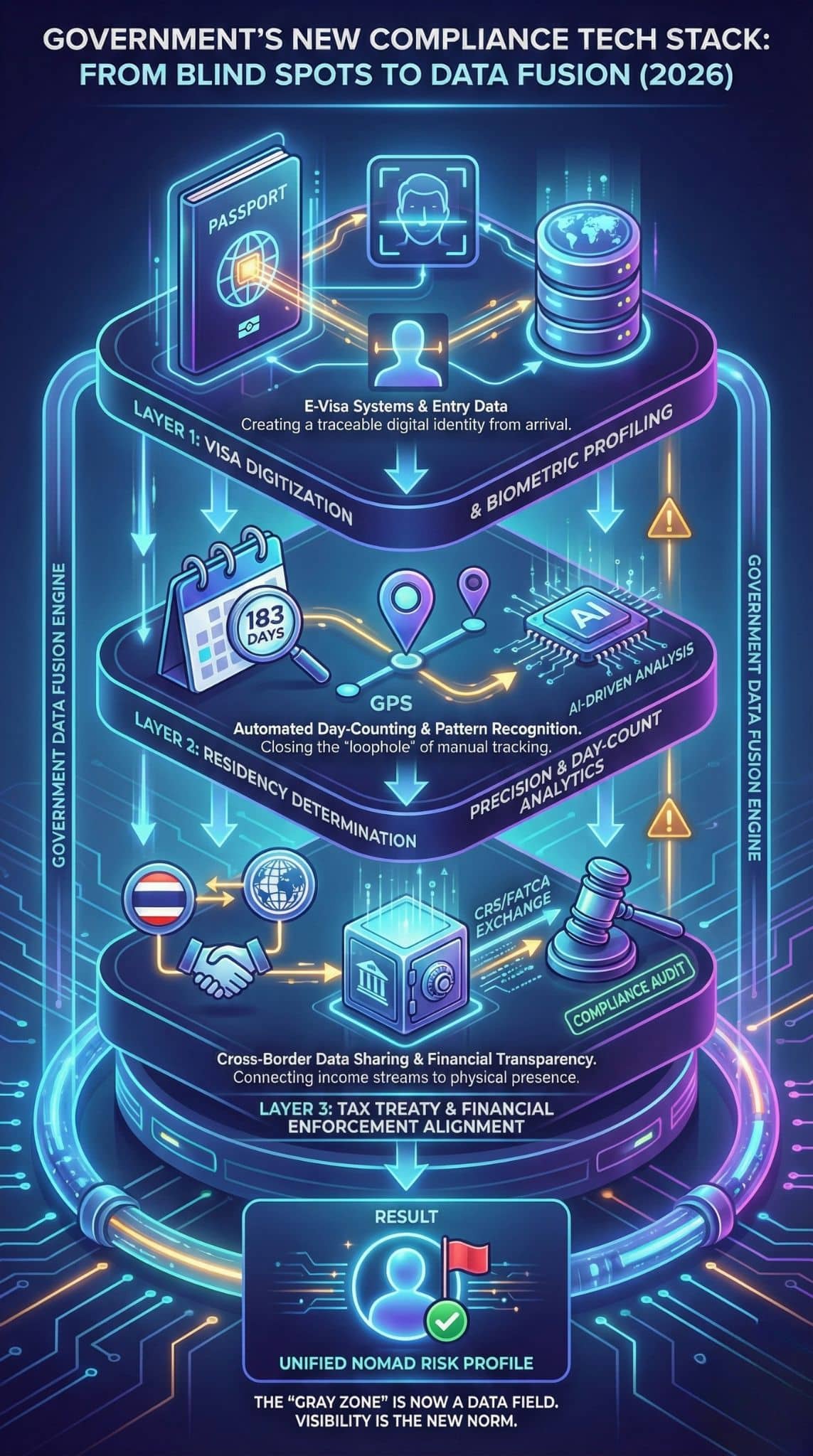

The Compliance Tech Stack: Governments Now Have The Tools They Used To Lack

The 2026 tightening is not only ideological. It is operational.

- Visa digitization: E-visa systems and specific visa classifications make it easier to profile long-stay cohorts and enforce conditions.

- Residency determination precision: Updating how day-count tests are calculated reduces loopholes and strengthens audit positions.

- Tax treaty and enforcement alignment: International tax frameworks are adapting to remote work, including discussions around permanent establishment risk and cross-border employee presence.

This matters because the old nomad playbook assumed authorities could not connect data across systems. That assumption is getting riskier each year.

The Employer Angle: Digital Nomads Are Becoming A Corporate Compliance Problem

A large share of modern nomads are not freelancers. They are employees. That shifts the stakes.

When employees work abroad for long periods, companies worry about payroll obligations, social security, and whether remote work creates a taxable presence for the employer. International tax commentary and corporate compliance practice have increasingly treated remote work as a risk-management topic, not just a lifestyle perk.

So Thailand and Bali’s tightening is part of a broader trend: remote work is being re-bureaucratized. Some firms respond by limiting where staff can work, using location controls, or requiring pre-approval for international remote arrangements.

For Southeast Asia, that creates a new competition: not just “who has the nicest beach,” but “who offers the cleanest compliance path.”

Expert Perspectives And The Neutral Case For Both Sides

A balanced reading of the 2026 crackdown story should hold two truths at once.

The case for tightening:

- Tax fairness improves when long-stay residents contribute similarly to locals, at least in principle.

- Enforcement can reduce illegal work, visa misuse, and predatory grey markets.

- Revenue helps fund infrastructure that visitors and long-stayers consume.

The case against over-tightening:

- If rules are complex, ambiguous, or inconsistently enforced, they scare off exactly the higher-spend, longer-stay visitors policymakers claim to want.

- Sudden shifts can create double-taxation anxiety and reduce inward remittances or spending.

- Aggressive policing can damage destination brand equity, especially in social-media-driven travel markets.

Thailand’s post-2024 debate about how to treat foreign-income remittances illustrates this tension. Too strict, and you discourage inflows. Too loose, and you create a visible fairness gap. Bali’s dilemma is similar but more civic: the island needs tourism, yet it also needs enforceable boundaries to remain livable and culturally intact.

A Practical 2026 Decision Matrix For Nomads

| If You Are… | Thailand Risk Profile | Bali / Indonesia Risk Profile | 2026 Smart Move |

| Short-stay remote worker (under ~90 days) | Lower tax residency likelihood, still immigration condition risk | Lower tax residency likelihood, still visa-condition risk | Treat it as tourism, keep documentation light but clean |

| Long-stay “seasonal” resident (4–7 months) | High chance of residency triggers and remittance scrutiny | Approaching or crossing 183-day tests, more day-count scrutiny | Decide deliberately where you are tax resident and plan remittances |

| Full-time employee abroad | Employer compliance questions if stays become regular | Employer compliance plus residency and treaty questions | Get employer approval and a written policy |

| Freelancer with mixed income streams | Harder to document source and timing | Residency rules plus local-client restrictions | Separate accounts and invoices by source country, maintain records |

This is not legal advice. It is the direction of travel: documentation and intentional residency planning are replacing casual “visa math.”

What To Watch In 2026 And Beyond

- Thailand’s next move on remittance taxation. Watch for finalized decrees and updated guidance, and how officials interpret timing and exemptions during the 2026 filing cycle.

- Indonesia’s application of updated residency guidance. If audits increase, the fight will move from “what is the rule” to “how do you count days and prove intent.”

- Bali’s enforcement intensity and consistency. The credibility of a crackdown depends on whether it becomes systematic compliance or remains sporadic headline enforcement.

- Corporate policy hardening. As firms tighten controls, destinations that offer clearer tax-safe frameworks will gain an edge.

Forward-Looking Prediction (Labeled)

Analysts suggest Southeast Asia is moving toward a two-tier nomad ecosystem by late 2026: a smaller, more compliant cohort on clear long-stay pathways, and a larger short-stay cohort rotating faster to avoid residency thresholds. That reshapes local economies. Coworking, premium rentals, and formal services benefit. Informal operators and “visa-run” micro-economies shrink.

The bigger implication is strategic. Countries are no longer competing only on lifestyle. They are competing on governance: who can host mobile professionals without losing tax integrity or social cohesion.