As the fiscal year 2026 begins, the corporate tax landscape is undergoing its most significant technological transformation in decades. The conversation has shifted from the theoretical “hype” of Generative AI to the operational reality of Agentic AI in Tax Workflows.

For enterprise tax departments, 2026 marks the “Great Scaling”, the point where isolated pilot programs evolve into a silicon-based workforce capable of managing billions in transactions with minimal human intervention.

Key Takeaways: The Agentic Tax Era

-

Autonomy over Assistance: Agentic AI in Tax Workflows has evolved from answering questions to executing end-to-end workflows (e.g., pulling data, classifying, and filing) with minimal human oversight.

-

The “White Box” Standard: To satisfy regulators (IRS/HMRC), agents now generate “Reasoning Manifestos”, auditable logic trails for every tax decision.

-

Tiered Intelligence: Enterprises are optimizing costs by using Small Language Models (SLMs) for routine classification and reserving high-reasoning models for complex legal strategy.

-

Regulatory Survival: With global e-invoicing mandates and Pillar Two, autonomous agents are no longer optional; they are the only way to manage real-time compliance at scale.

-

New Human Roles: The tax professional is transitioning from a “data doer” to an “Agent Orchestrator,” focused on governing logic swarms and high-level strategy.

The Evolution: From Passive Assistants to Autonomous Agents

In the previous two years, tax professionals used AI as a “sophisticated intern”, a tool that required constant prompting to draft a memo or summarize a regulation. In 2026, the paradigm has shifted to Agency. Agentic systems do not just answer questions; they set goals, plan multi-step workflows, and execute them across multiple software environments.

According to research from Gartner, by the end of 2026, over 40% of enterprise applications will feature embedded task-specific AI agents. This is a dramatic leap from less than 5% in early 2025. This evolution is best understood through a maturity model that tax leaders are now using to audit their current capabilities.

Tax AI Maturity Model [2026]

| Level | Type of Agent | Primary Function | Example in Tax |

| Level 1 | Tasker | Data extraction and classification. | Extracting line items from 10,000 PDF invoices. |

| Level 2 | Automator | Multi-step workflow orchestration. | Pulling ERP data, applying VAT rules, and drafting a filing. |

| Level 3 | Strategist | Goal-oriented advisory and modeling. | Simulating the impact of global Pillar Two restructurings. |

The Tax AI Maturity Model (2026) is the framework enterprises use to transition from basic automation to a “silicon-based workforce.” In 2026, simply having AI is no longer a competitive advantage; the advantage lies in how much autonomy and reasoning you have delegated to that AI.

Below is a detailed breakdown of the three levels that define this maturity.

Level 1: The Tasker (The Foundation)

At this level, AI acts as a digital clerk. It is primarily used to eliminate the “drudge work” of data entry and initial categorization.

-

Primary Logic: Rule-based + basic Pattern Recognition.

-

Key Capabilities:

-

PDF/Data Extraction: Ingesting thousands of invoices and automatically extracting line items, tax IDs, and dates.

-

Initial Classification: Flagging a transaction as “Entertainment” vs. “Office Supply” based on historical patterns.

-

Regulatory Monitoring: Scanning government websites to alert the team when a new tax bulletin is published.

-

-

The Human Role: Heavy Oversight. Humans must review almost 100% of the output. The AI doesn’t “know” why it’s doing the task; it just follows a script.

Level 2: The Automator (The Orchestrator)

This is where the shift to Agentic AI in Tax Workflows begins. At Level 2, the AI isn’t just doing a task; it is managing a workflow across different software systems.

-

Primary Logic: Deterministic Workflows + Machine Learning.

-

Key Capabilities:

-

Cross-System Action: An agent might pull data from an ERP (like SAP), log into a tax engine (like Vertex or OneSource) to apply rules, and then draft a return in a filing software.

-

Exception Handling: Instead of breaking when it sees an error, the Automator can identify why it failed (e.g., a missing Tax ID) and send a specific request to the procurement team to fix it.

-

Audit Trail Generation: Creating the first version of “White Box” logs—showing exactly which data points were used for a specific tax position.

-

-

The Human Role: Exception Management. Humans only step in when the AI flags a high-risk anomaly or a logic break that it cannot resolve.

Level 3: The Strategist (The Autonomous Partner)

By 2026, Level 3 is the “North Star” for enterprise tax departments using Agentic AI in Tax Workflows. These agents are goal-oriented, meaning you give them an objective rather than a set of instructions.

-

Primary Logic: Goal-Oriented Reasoning + Generative Modeling.

-

Key Capabilities:

-

Impact Simulation: You can ask the agent: “What is the impact on our global effective tax rate if we move our IP from Ireland to Switzerland under the 2026 Pillar Two rules?” The agent builds the model, runs the numbers, and suggests the optimal path.

-

Predictive Compliance: The agent identifies potential audit risks before the filing happens by simulating how a government tax auditor’s AI might view the company’s data.

-

A2A Communication: Level 3 agents from the Tax department can talk directly to agents in Legal or Supply Chain to negotiate intercompany agreements that are tax-optimized from day one.

-

-

The Human Role: Strategic Orchestrator. The human professional sets the high-level policy, ethical guardrails, and final approval. They move from “doing tax” to “managing tax intelligence.”

Comparison: The Maturity Spectrum at a Glance

| Feature | Level 1: Tasker | Level 2: Automator | Level 3: Strategist |

| Focus | Speed & Accuracy | Efficiency & Integration | Value & Strategy |

| Scope | Single task | End-to-end process | Enterprise-wide impact |

| Connectivity | Siloed | Cross-platform | Cross-department (A2A) |

| AI Type | Generative AI / RPA | Agentic Workflow | Autonomous Agents |

Why the “Jump” to Level 3 is the 2026 Challenge

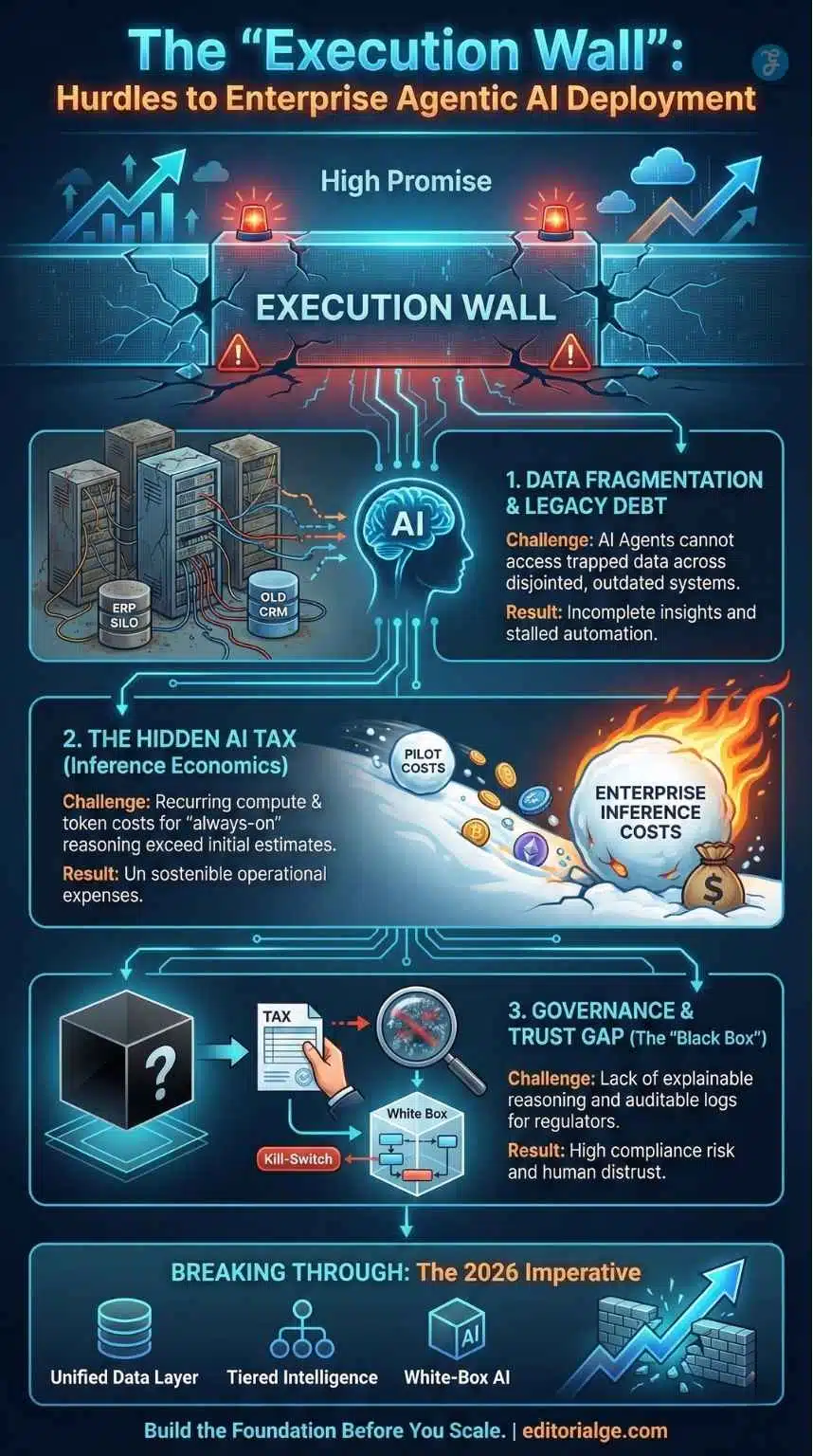

Most companies in 2026 are currently “stuck” at Level 2. Moving to Level 3 requires solving the “Execution Wall”:

-

Data Trust: You cannot have a Strategist agent if your underlying data in the ERP is messy.

-

The Reasoning Cost: Level 3 agents require “High-Reasoning” models, which are more expensive to run (Inference Economics).

-

Governance: Granting an agent the autonomy to “simulate and suggest” requires strict Agentic Identity Management to ensure it doesn’t make unauthorized commitments.

The Battle for Inter-Agent Protocols (The “A2A” Revolution)

As organizations move from one agent to “swarms” of hundreds, a new technical barrier has emerged: Agent Interoperability. In early 2026, the industry is witnessing a race to define the “TCP/IP of AI.”

-

The Contenders: Protocols such as Google’s A2A (Agent-to-Agent), Cisco’s AGNTCY, and Anthropic’s Model Context Protocol (MCP) are becoming the standards that allow a tax-filing agent to securely request data from a procurement agent without human intervention.

-

Why it matters for Tax: Without these protocols, tax departments remain trapped in “walled gardens” where their AI can only see data within one specific software suite. Deployment in 2026 now requires an “Agentic Service Bus” to manage these cross-vendor communications.

The High-Stakes Use Cases of 2026

Enterprise-wide deployment of Agentic AI in Tax Workflows is no longer a luxury; it is a necessity driven by a “perfect storm” of regulatory complexity. With the expansion of Pillar Two global minimum tax requirements and real-time e-invoicing mandates, human teams alone can no longer keep pace.

1. Autonomous Transaction Classification

The most immediate ROI for large enterprises has been in indirect tax. Advanced agents are now capable of ingesting millions of transactions directly from ERP systems (like SAP or Oracle), cross-referencing them against a dynamic database of global tax codes, and categorizing them with 98.5% accuracy. This has reduced the time for quarterly VAT reconciliations from weeks to hours.

2. Automated Notice and Audit Management

In 2026, the volume of digital tax notices from global authorities has spiked. Agentic systems act as a “first line of defense.” They ingest a notice from the IRS or HMRC, map it to the corresponding internal filing, identify the specific discrepancy, and prepare a response for a senior tax manager to review.

3. Real-Time Pillar Two Modeling

With the global tax floor now in full effect, enterprises are using “Strategic Agents” to monitor legislative changes across 100+ jurisdictions. These agents run continuous simulations, alerting the CFO if a change in a foreign subsidiary’s local tax law will trigger a top-up tax liability.

The “White Box” Requirement: Auditable Reasoning

In the early days of GenAI, the “hallucination” risk was a deal-breaker for tax. In 2026, the industry has solved this through Transparent Reasoning Logs.

-

Explainable Workflows: Modern tax agents now produce a “Reasoning Manifesto” for every decision. If an agent flags a transaction as “Tax Exempt,” it attaches a digital trail showing the specific section of the tax code it cited and the logical steps it took to reach that conclusion.

-

Audit-Ready AI: Tax authorities are beginning to accept these logs as primary documentation. In 2026, the goal is no longer just “getting the right number,” but “having an auditable, repeatable process” that can withstand a high-stakes government inquiry.

Real-Time Mandates: The “E-Invoicing” Catalyst

The urgency for Agentic AI in Tax Workflows is driven by the Global E-Invoicing Explosion. By early 2026, over 60 countries will have moved toward mandatory real-time digital reporting.

-

Instant Scrutiny: Governments now have “Tax-Authority-in-the-Loop” systems where they see your transaction data before you even file.

-

The Agentic Response: This has turned tax from a “periodic” function to a “continuous” one. Agents are now deployed as “Live Reconcilers” that verify e-invoices against local laws in milliseconds to prevent immediate digital penalties, a task that has become humanly impossible due to the sheer volume and speed required.

The “Execution Wall”: Challenges to Enterprise Deployment

Despite the momentum, the transition to enterprise-wide deployment is not without friction. Deloitte and McKinsey reports from early 2026 identify several critical hurdles that distinguish successful leaders from those stuck in the “pilot trap.”

-

The “Hidden AI Tax”: Approximately 96% of organizations have reported that the costs of scaling AI agents—driven by token consumption and the need for high-performance “inference” chips—have exceeded initial budgets by 20-30%.

-

Data Fragmentation: Agents are only as effective as the data they can reach. Many tax departments are struggling to connect modern AI layers to 20-year-old legacy ERP systems.

-

Governance and Kill-Switches: As agents gain more autonomy, the need for “Agentic Identity Management” has become paramount. Enterprises are now required to assign unique IDs and permission levels to AI agents to ensure they do not exceed their authority in financial systems.

Industry Insight: “Tax professionals hold AI to an exceptionally high standard. While 91% believe AI outputs should be more accurate than human work, nearly half will not trust an autonomous agent without a clear, auditable trail of its reasoning.” Thomson Reuters 2025 Future of Professionals Report.

The Fintech Regulatory Reset of 2026

By August 2026, the EU AI Act will become fully applicable. This has shifted Agentic AI from a “private corporate tool” to a “regulated financial product.”

-

The “High-Risk” Classification: Under 2026 regulations, AI agents used for credit scoring, insurance, and complex tax calculations are increasingly categorized as “High-Risk.” This mandates strict data lineage and “Safe Reasoning” protocols.

-

Operational Proof: Fintech regulators (including the SEC and ESMA) are no longer satisfied with “it works.” In 2026, they require Proof of Productivity and Logic. Tax agents must now be able to withstand a “Reverse Stress Test,” where they demonstrate how they would handle a systemic data failure or a sudden legislative change.

Inference Economics: The Cost of “Always-On” Compliance

The “2026 Infrastructure Reckoning” has forced tax departments to look beyond implementation costs and focus on Inference Economics.

-

The Shift: Unlike traditional software, every “thought” an agent has costs money in “tokens.” For a tax agent monitoring millions of transactions in real-time, these costs can snowball.

-

The 2026 Strategy: Enterprises are moving toward Small Language Models (SLMs) for routine classification to save costs, reserving expensive, high-reasoning models (like GPT-5 or equivalent) only for complex legal interpretations or audit defense. This “tiered intelligence” strategy is now a prerequisite for a sustainable enterprise-wide rollout.

The Rise of Sovereign AI & Data Residency

As global tax authorities, most notably in the EU, India, and Saudi Arabia, tighten data residency laws, the “Cloud-First” approach of 2024 is being replaced by Sovereign AI. For enterprise tax departments, this means deploying agents on local infrastructure to ensure that sensitive financial data, model weights, and “reasoning logs” never cross national boundaries.

-

The Compliance Conflict: Standard global LLMs often process data in centralized hubs. In 2026, a “Tax Agent” operating in Germany must often use a localized version of the model to comply with the EU’s evolving AI Act and specific German fiscal secrecy laws.

-

The Solution: Enterprises are adopting Multi-Cloud Agentic Meshes, where a central orchestration layer manages “Local Agents” that stay within regional silos, aggregating only anonymized, high-level reporting for the global CFO.

Journalistic Ethics in the Agentic Web

As we report on Agentic AI in Tax Workflows, the media landscape is also shifting.

-

The Ethics of “Agentic Journalism”: There is a growing debate in 2026 about “Agentic Journalism”—the practice of writing news specifically for machine compilers (bots) rather than humans. Ethical journalists now face a choice: write for the “lede” (human interest) or write for the “JSON” (machine readability).

-

Accountability for “Automated Harms”: If an AI-generated news analysis (like this one) provides an insight that leads to a financial error, who is responsible? Journalistic ethics in 2026 have evolved to include “Algorithmic Accuracy” as a core pillar, requiring a human editor to verify “Reasoning Logs” before publication.

The Human-in-the-Loop 2.0

The most significant shift in 2026 is not the replacement of tax professionals but the redefinition of their roles. The role of the “tax doer” is being replaced by the “agent orchestrator.”

Junior staff, who previously spent 60% of their time on tactical data entry, are being upskilled to manage “agent swarms.” This involves monitoring the logic loops of the AI, verifying edge cases where the law is ambiguous, and focusing on high-level tax strategy that requires human nuance and political context.

The New Talent War: From Tax “Doers” to “Agent Orchestrators”

The most significant bottleneck to “Enterprise-Wide Deployment” in 2026 isn’t the technology; it’s the talent. A new role has emerged at the intersection of tax law and prompt engineering: the Tax Agent Orchestrator.

-

The Skills Shift: Junior tax associates are no longer valued for their ability to find data in a spreadsheet, but for their ability to debug an agent’s logic. If an AI agent incorrectly classifies a R&D tax credit, the professional must be able to “audit the prompt” and adjust the agent’s goal parameters.

-

The “Agent Ops” Team: Leading firms like PwC and KPMG have established dedicated “Agent Ops” units. These teams don’t do tax work; they maintain the “health” of the silicon workforce, ensuring agents are updated with the latest 2026 legislative shifts (like the expiration of transitional reliefs in Pillar Two).

Media Policy and the “Transparency Mandate”

Governments are reacting to the flood of AI-generated financial information. By mid-2026, media policy has shifted to prioritize the “Source of Truth.”

Mandatory Labeling

In 2026, the EU and several U.S. states (via the GENIUS Act or similar state-level bills) require any AI-generated or AI-assisted financial report to be clearly and visibly labeled.

Media in AI (The Shift)

A major 2026 trend is moving from “AI in Media” to “Media in AI.” Instead of people going to a news site to read about tax changes, their personal agents “scrape” the media site. This has forced media outlets to adopt a policy of “Machine-Readable Integrity,” ensuring their articles are formatted correctly for AI agents to ingest without distorting the facts.

Final Thought: Architects of the Silicon Workforce

As we navigate 2026, the successful tax department will not be the one with the most advanced algorithms, but the one with the most visionary human leaders. While Agentic AI in Tax Workflows provides the “muscle” to process millions of transactions in seconds, it lacks the nuanced judgment required for high-stakes ethical and political tax decisions. The true competitive advantage lies in the human architect, the professional who can seamlessly weave autonomous agents into the corporate fabric while remaining the ultimate anchor of accountability.