Apple ‘s original partnership contract—the foundational document that officially launched the technology giant on April 1, 1976—is returning to the auction block next year with Christie’s estimating its value between $2 million and $4 million. This three-page agreement, often referred to as Apple’s “birth certificate,” represents one of the most significant pieces of tech history ever to be offered for public sale, marking a moment when three individuals signed papers that would eventually reshape the entire technology industry.

The document will be featured at Christie’s prestigious auction titled “We the People: America at 250” scheduled for January 23, 2026, in New York. It will share the spotlight with other legendary American historical artifacts, including a draft of the U.S. Constitution with handwritten notes by founding father Rufus King.

The Three Founders and Original Ownership Structure

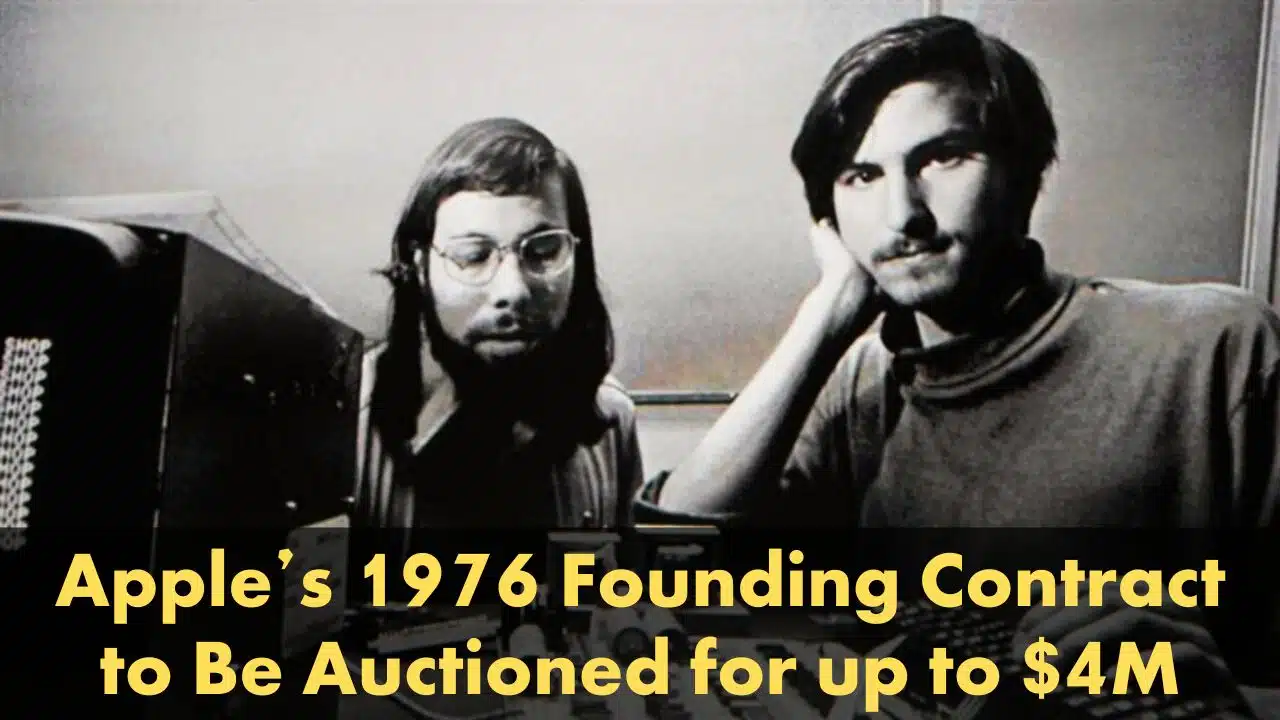

The partnership agreement was drafted and typed by Ron Wayne on his IBM typewriter and bears the signatures of the three co-founders: Steve Jobs, Steve Wozniak, and Ron Wayne. When the trio signed on that momentous April day in 1976, Jobs and Wozniak were remarkably young—Jobs was just 21 years old, while Wozniak was 25.

The contract established a clear ownership structure: Steve Jobs received 45 percent, Steve Wozniak received 45 percent, and Ron Wayne claimed 10 percent. These percentages would determine how the company’s early profits and decisions would be divided among the three—though as history would reveal, this distribution would prove remarkably short-lived for one of the founders.

Ron Wayne’s Fateful Decision: The $2,300 Gamble

Perhaps the most striking aspect of this historical document is what happened immediately after its signing—an event that has become one of the most discussed “what-if” moments in Silicon Valley history. Just 12 days after putting his signature on the founding agreement, Ron Wayne decided to withdraw from the partnership.

Wayne’s exit was prompted by concerns about personal financial liability in the fledgling venture. He reportedly described the business as destined to be a “roller coaster” and expressed reluctance to participate in such a high-stakes gamble. In exchange for relinquishing his 10 percent stake, Jobs and Wozniak paid Wayne $800 upfront, with an additional $1,500 to follow—totaling $2,300 for his share.

In today’s monetary terms, this initial payment of $800 would translate to approximately $4,500. By contrast, Wayne’s 10 percent stake in Apple today would be worth hundreds of billions of dollars, given the company’s current market capitalization approaching $4 trillion. This decision has since become a cautionary tale taught in business schools worldwide as one of the most consequential financial missteps in modern history.

The Historic Auction Lot and Additional Documentation

The lot being auctioned at Christie’s includes not only the original three-page partnership agreement but also the formal withdrawal documents that Ron Wayne signed just days later. These amendment papers serve as tangible proof of the rapid unraveling of the original three-way partnership and include the signatures of all parties involved in faded ink.

This is not the first time these documents have appeared on the auction block. The founding contract previously sold for $1.59 million in 2011, meaning collectors have shown significant appetite for owning a piece of Apple’s creation story. The new estimate of $2 million to $4 million suggests a substantial increase in value, reflecting growing recognition of the document’s historical significance.

The Birth of a Tech Dynasty

On April 1, 1976, when Jobs, Wozniak, and Wayne signed the Apple Computer Company Partnership Agreement, few could have imagined the trajectory the company would take. What began as a partnership typed on an IBM typewriter in a garage has evolved into one of the world’s most valuable technology corporations. The company that started with three founders and a handwritten partnership agreement now commands a global workforce, operates countless retail locations worldwide, and produces some of the most coveted consumer electronics on the market.