Buying two-wheeler insurance can feel confusing. Many people make mistakes that cost them later. Picking the wrong policy or skipping important details may leave you with poor coverage or high costs.

One common mistake is not reading the terms and conditions carefully. This leads to misunderstandings about insurance benefits and exclusions. Avoiding such errors can save money, time, and stress.

This blog will guide you through seven common mistakes to avoid when buying two-wheeler insurance. It will also give tips on how to pick the best policy for your needs. Keep reading to protect yourself from costly errors!

Mistake 1: Lack of Research

Skipping research can lead to poor choices in a bike insurance policy. Many only focus on the insurance premium without checking coverage options. Some policies may be cheap but lack theft coverage or roadside assistance.

Compare multiple insurers and review their third-party liability insurance, comprehensive bike insurance, and own damage coverage.

Failing to explore features like no claim bonus (NCB) benefits can also cost you money during renewal. Each insurer offers different terms for NCB discounts, so it’s smart to check this beforehand.

“>“A well-informed buyer saves more.”.

Mistake 2: Choosing the Cheapest Policy Without Evaluating Coverage

Picking the cheapest bike insurance may seem smart, but it can backfire. Low-priced policies often skip critical benefits like theft coverage or own damage bike insurance. Without proper coverage, repair costs after accidents fall on you.

For example, a low-cost plan might only offer third-party liability insurance. This covers damages to others but leaves your bike uninsured during accidents or natural disasters.

Insurance companies set premiums based on coverage options and risks they handle. A cheap policy might include many exclusions hidden in the terms and conditions. Missing add-ons such as roadside assistance or personal accident cover could lead to high out-of-pocket expenses later.

Compare all two-wheeler insurance policies carefully before buying one. Ensure it offers financial protection for both minor repairs and major losses like total loss of your vehicle.

Mistake 3: Providing Incorrect or Incomplete Personal Information

Giving wrong or incomplete details can delay your bike insurance. Missing information like your name, address, or vehicle registration number may lead to errors in the policy. Insurance companies need correct data to process claims quickly.

An incorrect driving license or false details might cause claim rejection later. Always double-check personal and vehicle information before submitting forms. Ensure all details match official documents like your Regional Transport Office records.

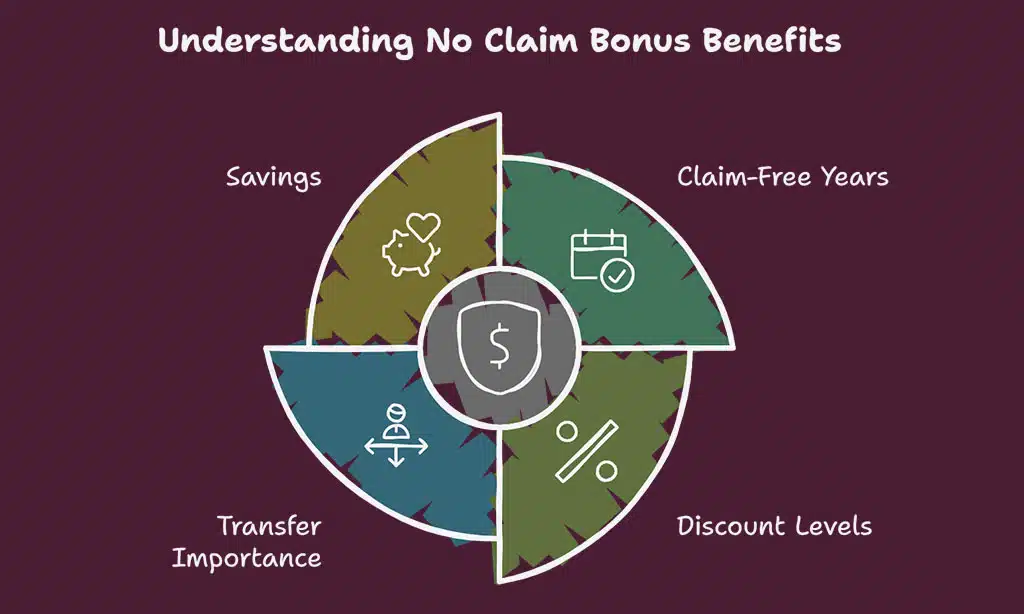

Mistake 4: Ignoring the No Claim Bonus (NCB) Benefits

Skipping the No Claim Bonus (NCB) can cost you savings. NCB rewards policyholders for claim-free years with discounts on insurance premiums. For instance, a 20% discount applies after one claim-free year, increasing to 50% after five years.

Ensure you transfer your NCB when switching insurance companies or buying a new two-wheeler insurance policy. Missing this step means losing out on significant savings and benefits during bike insurance renewal.

Mistake 5: Not Reading the Terms and Conditions Carefully

Policy terms and conditions hold key details about your two-wheeler insurance. These include coverage options, policy exclusions, claim processes, and more. Ignoring them can lead to unexpected claim rejection or financial risks later.

For example, theft coverage might have specific rules you must follow. Some insurers may not cover bike modifications or damages from certain situations. Always check for third-party liabilities and insured declared value (IDV) details.

Read carefully to avoid surprises during a bike insurance renewal or claims process.

Mistake 6: Failing to Transfer the Policy for a Second-Hand Vehicle

Buying a second-hand bike comes with risks. Not transferring the two-wheeler insurance policy is a big mistake. The law requires the transfer under the Motor Vehicles Act. If skipped, claims can get rejected during accidents or theft.

Notify the insurance company within 14 days of purchase to avoid lapses. Ensure both the coverage and Insured Declared Value (IDV) match your needs before updating details. Ignoring this step may lead to extra costs or denied claims later on.

Mistake 7: Selecting the Wrong Insured Declared Value (IDV)

Choosing the wrong IDV can cost you money during a claim. A higher IDV increases premiums but ensures better coverage. A lower IDV may save on premiums but leads to reduced payout after theft or an accident.

Always match the IDV to your bike’s market value. For example, if your bike’s current worth is $1,200 but you set an IDV of $800, it will leave you underinsured. Correctly setting the IDV protects against financial risks without overpaying for coverage.

How to Avoid Common Mistakes When Buying Two-Wheeler Insurance

Avoiding common pitfalls can save you money and trouble. Take simple steps to ensure your bike insurance fits your needs perfectly.

Compare policies from multiple insurers

Check prices and coverage options from different insurers. Some two-wheeler insurance policies may look cheap but have limited benefits. Compare third-party bike insurance, own damage bike insurance, and comprehensive bike insurance to find the right fit.

Look for features like no claim bonus (NCB) discounts or theft coverage. Review policy exclusions and inclusions closely. This can help avoid unexpected costs during a claim process.

Ensure accurate personal and vehicle details

Provide correct information about yourself and your bike while buying two-wheeler insurance. Small mistakes with your name, address, or vehicle details can lead to claim rejections later.

Double-check your bike’s registration number, engine details, and chassis number before submitting. Wrong data may result in delayed policy issuance or coverage issues. Accurate records help in smooth claim processing and avoid extra financial risks.

Review add-ons and exclusions

Check the add-ons offered in your bike insurance policy. Add-ons like roadside assistance or theft coverage can save you money during emergencies. Ensure these extras match your needs and travel habits.

Understand the exclusions too. Many policies do not cover damage from illegal activities or driving without a valid license. Avoid surprises by reading this section carefully before buying two-wheeler insurance.

Takeaways

Purchasing two-wheeler insurance is an essential measure. It safeguards you from financial risks and ensures compliance with the law.

John Carter, an insurance advisor with 15 years of experience in motor insurance, provides his expertise. He holds a degree in Business Risk Management and has assisted thousands in selecting the right coverage.

His professional advice has been featured in top industry journals.

John explains that avoiding common pitfalls such as skipping research or choosing an incorrect IDV helps save money and prevent issues later. Policies work best when customized to your needs by comparing options and reviewing inclusions.

He emphasizes that transparency is key. Honestly sharing personal details helps prevent claim rejections. Insurance providers adhere to strict regulations to promote safety and fairness for buyers.

To use bike insurance effectively, John recommends setting reminders for renewals and utilizing NCB benefits during renewal time. For second-hand bikes, always transfer the policy immediately.

According to John, thorough research yields better results, and balancing cost with coverage helps avoid drawbacks like low payouts or hidden exclusions. Some third-party options may appear inexpensive but fall short in critical situations like theft or damage cases.

His parting advice: Get informed before purchasing any plan—understand its terms, limits, and add-ons clearly—it’s time well spent!

FAQs

1. What are some common mistakes people make when buying two-wheeler insurance?

People often ignore policy terms and conditions, overlook policy exclusions, choose the wrong coverage options, or fail to understand the insured declared value (IDV). Missing bike insurance renewal deadlines or not considering no claim bonus (NCB) benefits are also common errors.

2. Why is it important to read the policy wording carefully?

Reading the policy wording helps you understand inclusions, exclusions, and your financial risks. It ensures you’re aware of what’s covered under comprehensive bike insurance or third-party liability insurance.

3. How can skipping a bike insurance renewal lead to problems?

If your two-wheeler insurance lapses, you lose coverage for theft or damages and might face higher premiums during renewal. A lapse could also result in legal penalties if caught without valid motor insurance.

4. What happens if I don’t disclose modifications made to my bike?

Failing to report modifications may lead to a rejected claim process later on. Insurance companies need accurate details about your vehicle for proper underwriting and setting fair premiums.

5. Is choosing only third-party bike insurance enough for full protection?

Third-party insurance covers liability for others but doesn’t protect against own damage like accidents or theft of your vehicle. Comprehensive bike insurance offers better protection by including both types of coverage.

6. How does understanding IDV help while buying two-wheeler insurance?

Knowing the insured declared value helps you select appropriate coverage based on your bike’s market worth—this affects both claims and premium costs directly!