Non-Fungible Tokens (NFTs) have captured the world’s attention over the last few years. From digital art to gaming and virtual real estate, NFTs have unlocked new ways of owning and exchanging assets in the digital world. However, as with any rapidly growing industry, the NFT market has faced its fair share of pitfalls.

While some NFT projects have flourished, others have quickly fallen into disarray, suffering from hype-driven crashes, security breaches, and market saturation.

As the NFT space continues to evolve, it’s important to examine the biggest NFT fails to learn from these mistakes and build a more sustainable and responsible market moving forward.

This article will provide an in-depth analysis of the 7 biggest NFT fails and lessons learned, including well-researched case studies and practical takeaways for creators, investors, and enthusiasts.

NFT Fail #1: Overhyped Projects Without Substance

Hype is one of the driving forces behind the rapid rise of NFT projects, but it’s also one of the most significant contributors to their downfall. Many NFT projects are launched with an overwhelming amount of publicity, often fueled by social media influencers or celebrity endorsements, promising exclusive experiences or instant financial rewards.

However, these projects frequently lack a tangible or long-term value proposition, which ultimately results in disappointment for investors and creators alike.

When there’s a rush to capitalize on the NFT trend, many projects are rushed to market without adequate preparation or substance, leading to unsustainable valuations and a volatile market.

Case Study: The Fall of High-Profile NFT Projects

One of the prime examples of overhyped projects without substance is CryptoKitties, one of the first mainstream NFT projects. Initially, the idea of digital collectible cats was exciting, but when the market became saturated with similar projects, their value plummeted. CryptoKitties became a cautionary tale of how NFT projects driven solely by hype can lose relevance once the novelty fades.

Another high-profile example is the Bored Ape Yacht Club (BAYC). While BAYC initially sold for high prices, the value of derivative projects began to diminish over time. Many of these derivative NFTs were launched with no meaningful additions to the ecosystem and eventually faced significant price corrections.

What We Can Learn: The Importance of Substance Over Hype

| Lesson | Explanation |

| Build Meaningful Value | Projects should focus on offering genuine utility, community engagement, or exclusive content to ensure long-term success. |

| Avoid Relying on Hype | Relying solely on celebrity endorsements or social media buzz can create inflated expectations and lead to market crashes. |

| Focus on Sustainability | The focus should be on creating a sustainable ecosystem that thrives beyond the initial hype cycle. |

The lesson here is that creating substance-driven projects with real value is key to maintaining longevity in the NFT space. Creators should prioritize utility, innovation, and community building, as opposed to chasing short-term, hype-driven success.

NFT Fail #2: Lack of Proper Regulation and Security Risks

NFT platforms, like any other online marketplace, are vulnerable to cyberattacks, phishing scams, and other types of fraudulent activity. In an industry with little regulation, bad actors are able to exploit security weaknesses, leading to significant financial losses. Some NFT creators and marketplaces may not follow best practices in securing their platforms, leaving users at risk of losing their assets or funds.

Security breaches, in particular, have made headlines as more high-value NFTs are being stolen through flaws in smart contract code or compromised accounts.

Case Study: High-Profile Hacks and Scams in the NFT Space

In 2022, the OpenSea hack shook the NFT community, where attackers exploited vulnerabilities in the platform’s smart contract, leading to the theft of millions of dollars worth of NFTs. Similarly, scams involving fake NFT platforms, like Fyre Festival NFTs, targeted unsuspecting buyers who were lured by promises of exclusive content and high returns, only to find the platforms were non-existent.

What We Can Learn: The Need for Better Security Protocols and Regulations

| Lesson | Explanation |

| Implement Stronger Security Measures | NFT platforms need to prioritize security by using advanced encryption, multi-factor authentication, and regular audits to detect vulnerabilities. |

| Require Regulation | Clear, industry-wide regulations are necessary to ensure transparency and protect users from fraud and theft. |

| Protect Consumers | Consumers should be educated about the risks involved in NFTs and how to protect their investments through secure platforms and wallets. |

The lesson here is that the NFT space requires more robust security measures and regulatory oversight to prevent hacks and fraud. Investors should always conduct thorough research and use trusted platforms to avoid falling victim to these scams.

NFT Fail #3: Unsustainable Environmental Impact

The environmental impact of NFTs has been a major point of contention. Most NFTs are built on Ethereum, which until its recent upgrade to Ethereum 2.0, relied on a proof-of-work consensus mechanism. This process consumes significant amounts of electricity, contributing to carbon emissions and raising concerns among environmentalists.

As NFTs continue to gain popularity, their carbon footprint has become an important issue for investors and creators who are concerned about the ethics of contributing to such environmental harm.

Case Study: NFTs and Their Carbon Footprint

According to a 2021 report from Digiconomist, each Ethereum transaction (including NFTs) consumed as much energy as an average household in the U.S. uses in a week. The environmental cost of minting NFTs became a concern, especially as high-profile NFT sales were being linked to substantial carbon emissions.

What We Can Learn: Sustainable Practices for NFT Creation

| Lesson | Explanation |

| Choose Eco-Friendly Blockchains | Blockchain networks like Tezos or Flow use much less energy and can significantly reduce the carbon footprint of NFTs. |

| Transition to Proof of Stake | The Ethereum upgrade to proof-of-stake (ETH 2.0) has drastically reduced energy consumption. This is a step forward for NFTs’ environmental sustainability. |

| Embrace Carbon Offsetting | NFT creators and buyers can offset their environmental impact by supporting green initiatives or purchasing carbon credits. |

The key takeaway is that creators and platforms need to adopt more sustainable practices, such as using energy-efficient blockchains, to reduce the environmental cost associated with NFTs. As sustainability becomes more of a priority for consumers, environmentally conscious NFTs will have an advantage.

NFT Fail #4: Pump-and-Dump Schemes

NFTs, like many digital assets, are susceptible to speculative trading. Pump-and-dump schemes are common in markets where hype and volatility reign. In these schemes, the price of an NFT is artificially inflated (pumped) by a small group of people or platforms, then sold off quickly at a profit (dumped). This leaves late investors with worthless assets once the price crashes.

These schemes not only damage the reputation of the NFT market but also create distrust among investors, especially those who are new to the space.

Case Study: Major NFT Scams and Their Impact on Investors

One of the most notorious pump-and-dump cases involved the Eminem NFT drop, which was promoted by a group of influencers and then rapidly sold off, leaving many buyers with assets that had no value.

What We Can Learn: Protecting Against Pump-and-Dump Scams

| Lesson | Explanation |

| Conduct Thorough Research | Always research a project’s credibility, team, and roadmap before investing. Projects with transparency and verifiable plans are more likely to succeed. |

| Look for Red Flags | Be cautious of projects that promise unrealistically high returns or have unclear ownership structures. |

| Educate Investors | Investors must understand that the NFT market is volatile and risks are inherent in speculative trading. |

By understanding the mechanisms behind pump-and-dump schemes, both creators and buyers can avoid getting caught up in short-term volatility. Protecting oneself from scams starts with education, vigilance, and avoiding overly speculative behavior.

NFT Fail #5: Intellectual Property Issues

The line between owning an NFT and owning the rights to the underlying content is often blurred. Many buyers mistakenly assume that purchasing an NFT grants them the full intellectual property rights to the associated digital artwork. In reality, the purchase of an NFT usually only grants the buyer ownership of the token itself, not the underlying copyright.

This misunderstanding has led to numerous legal battles, where creators and buyers have found themselves at odds over ownership and usage rights.

Case Study: Legal Battles Over NFT Ownership

Artists like Mad Dog Jones and Rhett Branson have faced issues with unauthorized use of their artwork being sold as NFTs without their consent. These legal disputes highlight the need for clarity regarding intellectual property rights in the NFT space.

What We Can Learn: The Need for Clear Licensing Agreements

| Lesson | Explanation |

| Clarify Ownership Rights | NFT creators and buyers need to fully understand and communicate the ownership rights tied to each NFT. |

| Use Legal Frameworks | NFT platforms should implement clear licensing agreements for every NFT to avoid potential legal disputes. |

| Educate Consumers | Buyers should know exactly what they are purchasing — whether it’s the artwork, the rights to use it, or just the digital token itself. |

Clear licensing agreements are essential to prevent confusion and ensure that creators and buyers alike understand the full scope of their rights and responsibilities.

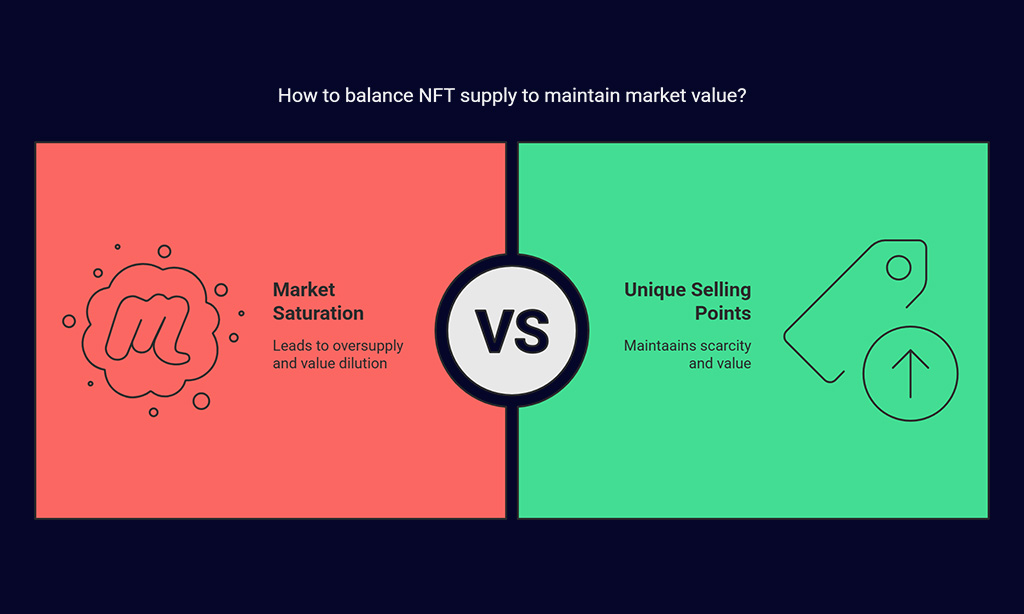

NFT Fail #6: Market Saturation and Loss of Value

As the NFT market continues to grow, the supply of NFTs has surged, leading to market saturation. While having more projects can be a good thing, an oversupply of low-quality or redundant projects can dilute the market and reduce the overall value of NFTs. Without scarcity or a unique selling point, NFTs can struggle to maintain their value.

Case Study: The Decline of Certain NFT Marketplaces

Several NFT marketplaces, including SuperRare and Foundation, have faced issues with oversupply, as many NFT projects flood the platform, reducing the demand for high-quality content. When the market becomes oversaturated, it results in lower prices and decreased demand.

What We Can Learn: How to Avoid Market Saturation and Maintain Value

| Lesson | Explanation |

| Focus on Quality | Quality projects with real value and utility will always outperform a saturated market of low-effort NFTs. |

| Prioritize Scarcity | Ensure that projects are scarce and exclusive, encouraging demand and maintaining long-term value. |

| Foster Community Engagement | Building a loyal community around your NFT project helps maintain demand and value. |

The key takeaway is that in an oversaturated market, quality over quantity wins. NFT creators should focus on uniqueness, utility, and creating lasting relationships with their audiences.

NFT Fail #7: The Overvaluation of Digital Art

NFTs have disrupted the art world by allowing digital art to be bought, sold, and traded as unique assets. However, the rise in the price of digital art NFTs has raised questions about whether these prices are sustainable or artificially inflated. Many high-profile NFTs have sold for millions of dollars, but the market volatility has led some to question the true value of these assets.

Case Study: The Decline in the Value of Digital Art NFTs

An example is Beeple’s “Everydays”, a digital artwork NFT that initially sold for a record $69 million at a Christie’s auction in 2021. While the sale was groundbreaking, its price has since faced significant fluctuations, causing some to question if such digital art can hold long-term value.

What We Can Learn: Valuing Art and Setting Realistic Expectations

| Lesson | Explanation |

| Avoid Overinflated Prices | The price of digital art NFTs should be reflective of the artist’s work and the demand for it, not solely driven by speculative trading. |

| Focus on Artistic Merit | Buyers should assess digital art based on its artistic and cultural value, rather than just its investment potential. |

| Prepare for Volatility | The NFT art market is still in its infancy, and buyers should be aware that prices may fluctuate over time. |

The primary lesson from the overvaluation of digital art is that the focus should always be on the intrinsic value of the artwork, rather than the potential for a quick financial return.

Wrap Up: Key Takeaways from the 7 Biggest NFT Fails

Looking back at the biggest NFT fails and lessons learned, it’s clear that the NFT market is still maturing. While many of these issues stem from growing pains, there are important lessons that can guide both creators and investors as they navigate this evolving space.

By learning from past mistakes, we can build a more sustainable, responsible, and transparent NFT market that benefits all stakeholders.

Whether you’re a creator, investor, or enthusiast, the key to success in the NFT space lies in understanding its risks and rewards, promoting security and regulation, and always prioritizing long-term value over short-term gains.

As the NFT market continues to evolve, those who learn from the failures of the past will be best positioned to succeed in the future.