Tax season doesn’t have to be a stressful time. In fact, it’s an opportunity to get some of your hard-earned money back. One of the most effective ways to ease financial pressure is by ensuring you receive the largest possible tax refund.

For Australians, the process can seem complex, but with a well-structured approach, it can be much simpler than expected. By understanding key strategies, you can make sure you’re not leaving any money on the table.

In this comprehensive guide, we’ll explore 10 Ways to Get a Bigger Tax Refund in Australia. These strategies will help you optimize your return, minimize tax liabilities, and ensure you make the most out of available deductions, offsets, and contributions.

Whether you’re an employee, small business owner, or investor, there are actionable steps you can take today to boost your tax refund.

1. Claim All Your Deductions

Deductions are one of the most straightforward ways to get a bigger tax refund in Australia, and failing to claim every eligible deduction can mean you’re leaving money on the table. These deductions reduce your taxable income, which in turn lowers the amount of tax you owe.

Common Tax Deductions in Australia

There are various deductions available depending on your circumstances. Here’s a list of the most commonly claimed:

| Category | Examples |

| Work-related Expenses | Uniforms, tools, equipment, home office, and vehicle use |

| Self-Education Expenses | Course fees, textbooks, travel costs, and seminars related to your job |

| Charitable Donations | Donations to registered charities (receipts required) |

| Investment Expenses | Interest on investment loans, property management fees, and related costs |

| Medical Expenses | In certain cases, medical expenses for dependent family members |

How to Keep Track of Deductible Expenses

The key to maximizing your deductions is meticulous record-keeping. Whether it’s keeping receipts, logging work-related vehicle trips, or tracking self-education expenses, every little detail counts. Consider using apps like Expensify or Receipts by Wave to stay organized throughout the year.

Top Tips for Maximizing Deductions

- Log work-related mileage: If you drive for work purposes, maintain a logbook of trips made for work. You can claim 68 cents per kilometre as a standard deduction.

- Track your charitable donations: Make sure you keep receipts for any donations made to registered charities, as these can add up significantly.

- Deduct a portion of home office costs: With remote work becoming more common, claiming your home office expenses can provide a substantial tax benefit. This includes electricity, internet bills, and office furniture.

2. Maximize Your Work-Related Expenses

Work-related expenses are a goldmine for tax deductions. If you’re employed and incur costs related to performing your job, it’s essential to claim them.

What Counts as Work-Related Expenses?

Work-related expenses include anything you spend money on that is directly required to perform your job. The Australian Taxation Office (ATO) provides clear guidelines on what counts as a legitimate expense, including:

| Expense Type | Examples |

| Clothing | Protective clothing, uniforms, and safety gear |

| Travel | Transport, accommodation, meals for work travel |

| Home Office | Desk, computer, phone, internet, and utilities |

| Self-Education | Online courses, textbooks, and professional training |

How to Keep Track of Your Work-Related Costs

To maximize your refund, keep an accurate and up-to-date record of all work-related costs. For example, if you’re required to wear a uniform or safety gear for your job, save all purchase receipts. If you use your car for work-related travel, record the distance traveled for work-related purposes.

Examples of Work-Related Deductions You May Have Missed

Sometimes, employees overlook small expenses that add up over the year. Here are a few to consider:

- Work phone usage: If you use your phone for work purposes (e.g., calls, emails), you can claim a portion of your phone bill.

- Internet costs: If you work from home and use your personal internet for work, you can claim a percentage of the total cost.

3. Contribute to Your Superannuation

Contributing to your superannuation is one of the most effective ways to get a bigger tax refund in Australia, especially if you’re a high-income earner. Superannuation contributions are an excellent tax-saving strategy.

Superannuation Contributions and Tax Benefits

Making additional voluntary contributions to your super reduces your taxable income, which in turn reduces your tax bill. There are two main types of super contributions:

| Contribution Type | Description |

| Concessional (Pre-tax) Contributions | Contributions made by your employer or via salary sacrifice, taxed at 15%. |

| Non-Concessional (After-tax) Contributions | Personal contributions that are not taxed. |

Concessional contributions are capped at $27,500 per year (as of 2024), and any contributions above that threshold are taxed at a higher rate.

Salary Sacrificing to Boost Your Refund

Salary sacrificing is a popular method to reduce your taxable income and increase your refund. By having a portion of your salary paid directly into your super, you pay less tax upfront.

For instance, if you’re earning $100,000 a year and you sacrifice $10,000 into your super, you reduce your taxable income to $90,000, saving you a considerable amount in taxes.

How Much to Contribute for Maximum Tax Advantage

While the concessional contribution cap is $27,500, it’s advisable to contribute as much as you can up to that limit, especially if you’re in a higher tax bracket. Keep in mind that these contributions are taxed at 15%, which is lower than the marginal tax rate for higher earners (up to 45%).

4. Take Advantage of Tax Offsets

Tax offsets (also known as rebates) are another powerful way to get a bigger tax refund in Australia. They work by directly reducing the amount of tax you owe.

What Are Tax Offsets and How Do They Work?

Tax offsets reduce your tax payable, unlike deductions, which reduce your taxable income. Offsets can be a great way to maximize your refund. Common tax offsets available include:

| Offset Type | Eligibility Criteria | Benefit |

| Low and Middle Income Tax Offset (LMITO) | Income below $126,000 for individuals ($252,000 for couples) | Up to $1,080 for individuals, $2,160 for couples |

| Senior Australians Tax Offset (SATO) | Eligibility based on age and income | Varies based on age and income |

| Private Health Insurance Rebate | Must have private health insurance | Rebate varies based on income and coverage |

How to Ensure You Qualify for Tax Offsets

Check your eligibility before you file. The Low and Middle Income Tax Offset (LMITO) is available for individuals earning up to $126,000, so if your income is within that range, you could receive a larger refund.

5. Claim for Dependent Family Members

You may be eligible for additional offsets or benefits if you support dependent family members. This can be one of the most effective ways to get a bigger tax refund in Australia.

Who Qualifies as a Dependent for Tax Purposes?

Typically, dependents include children, elderly parents, or a spouse with little or no income. To claim a dependent, you must provide financial support. The following are eligible:

| Dependent Type | Eligibility Criteria |

| Children | Must be under 21 years old (or under 25 if studying) |

| Elderly Parents | Must rely on you for financial support |

| Low-Income Spouse | Must earn less than a specified threshold |

How Dependent Claims Affect Your Tax Refund

If you provide significant support for a dependent, you can claim tax offsets and deductions. For example, the Family Tax Benefit provides financial relief if you support a dependent child.

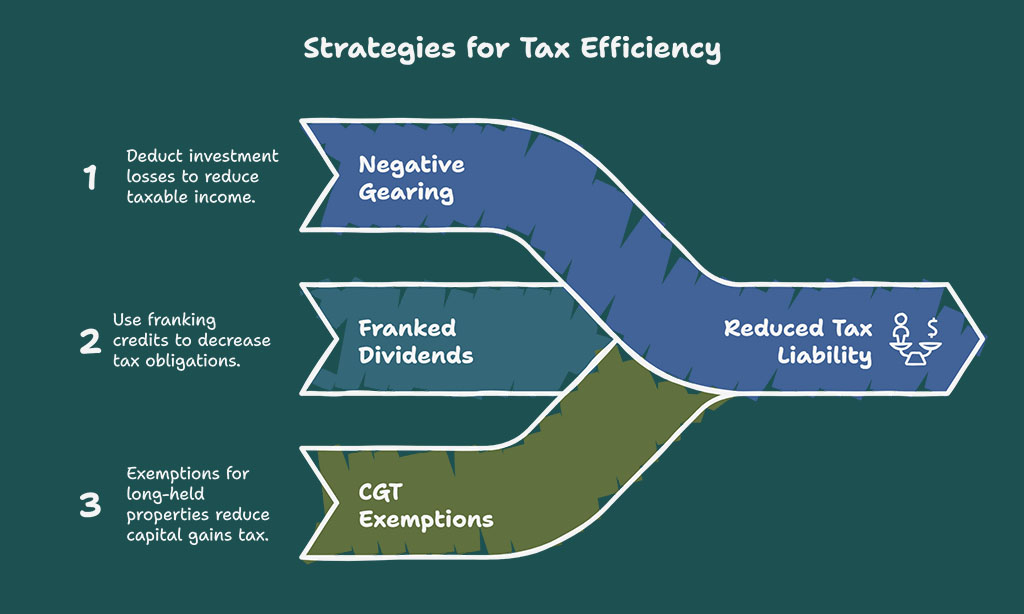

6. Invest in Tax-Effective Strategies

Tax-effective investments can help reduce your tax bill and increase your refund by allowing you to offset tax liabilities.

How Investment Income Impacts Your Tax Refund

Income from investments, such as dividends, interest, and capital gains, can increase your taxable income. However, tax-effective investment strategies can reduce your overall tax liability.

Tax-Effective Investments You Should Consider

Here are some investment options that provide tax benefits:

| Investment Type | Tax Benefits |

| Negative Gearing | Deduct investment losses from your taxable income |

| Franked Dividends | Claim franking credits to offset tax liabilities |

| Capital Gains Tax (CGT) Exemptions | Exemptions for properties held longer than 12 months |

How to Offset Investment Losses Against Taxable Income

Negative gearing allows you to deduct the interest paid on a loan for an investment property from your taxable income. This can result in a larger tax refund.

7. Keep Accurate Records Year-Round

Good record-keeping is essential for ensuring you don’t miss out on valuable deductions and offsets.

Why Record-Keeping is Crucial for Maximizing Refunds

Properly maintaining your records throughout the year ensures you don’t overlook any eligible deductions or offsets. Plus, it simplifies the tax filing process.

Best Tools for Organizing Your Tax Documents

Consider using digital tools like QuickBooks or Xero for tracking expenses and organizing receipts. These tools can automatically categorize your transactions and generate reports for tax time.

8. Understand the Small Business Tax Breaks

If you own a small business, you may qualify for tax breaks and concessions that can significantly increase your tax refund.

Tax Breaks Available for Small Business Owners

| Tax Break | Eligibility Criteria | Benefit |

| Instant Asset Write-off | Business assets under $30,000 (threshold may change) | Immediate deduction for qualifying assets |

| Small Business Tax Concessions | Must meet small business definition | Lower tax rates and additional deductions |

How to Claim Business-Related Deductions

If you own a small business, keep track of all business-related expenses, such as office supplies, equipment, and utilities. Ensure you’re claiming all allowable expenses to reduce your taxable income.

9. Get Professional Tax Advice

Seeking professional advice can significantly increase your chances of maximizing your tax refund.

When Should You Seek Help From a Tax Professional?

If your tax situation is complex, consider hiring a tax advisor to ensure you’re claiming all available deductions and offsets. They can help you navigate the complexities of tax laws and avoid costly mistakes.

How Tax Professionals Can Help Maximize Your Refund

Tax professionals can identify overlooked deductions, optimize your super contributions, and advise on tax-effective investment strategies, all of which can help you secure a larger refund.

10. File Your Tax Return Early

Filing early can give you more time to organize your documents, correct any errors, and make adjustments for the largest refund.

Benefits of Filing Your Tax Return Early

Filing early ensures a quicker refund and allows you to address any issues before the deadline. Early filing can also help avoid delays in the processing of your return.

How Early Filing Can Help You Get a Bigger Refund

If you’ve made mistakes or overlooked deductions, filing early gives you the chance to fix them before the deadline, ensuring you receive the maximum refund.

Wrap Up: Start Maximizing Your Tax Refund Today

By applying these 10 ways to get a bigger tax refund in Australia, you can ensure that you’re making the most of your tax situation.

From claiming every available deduction to making strategic super contributions and seeking professional advice, these steps will help you maximize your return and secure your financial future.

Take the time now to organize your records, track your expenses, and make the necessary adjustments to your tax strategy. With the right approach, you’ll be well on your way to maximizing your tax refund and achieving greater financial security.