In New Zealand, car insurance is more than a safeguard against accidents – it’s a crucial financial tool that ensures drivers, passengers, and pedestrians are protected in the event of an incident.

Whether you’re driving in the hustle and bustle of Auckland or through rural areas, having the right car insurance policy is key to managing financial risks that arise from accidents, weather damage, or even theft.

While car insurance isn’t mandatory under New Zealand law, driving without coverage can expose you to significant financial liability, especially when dealing with property damage or injury costs.

This comprehensive guide highlights the top 8 car insurance companies in New Zealand with affordable rates, offering a clear view of what each has to offer, and helping you make a well-informed decision based on your needs.

Why Car Insurance is Essential in New Zealand?

New Zealand is a diverse country with varying road conditions and climates, from city streets in Wellington to the winding rural roads in the South Island. As a result, it’s important for New Zealand drivers to invest in a car insurance policy that can withstand the unexpected.

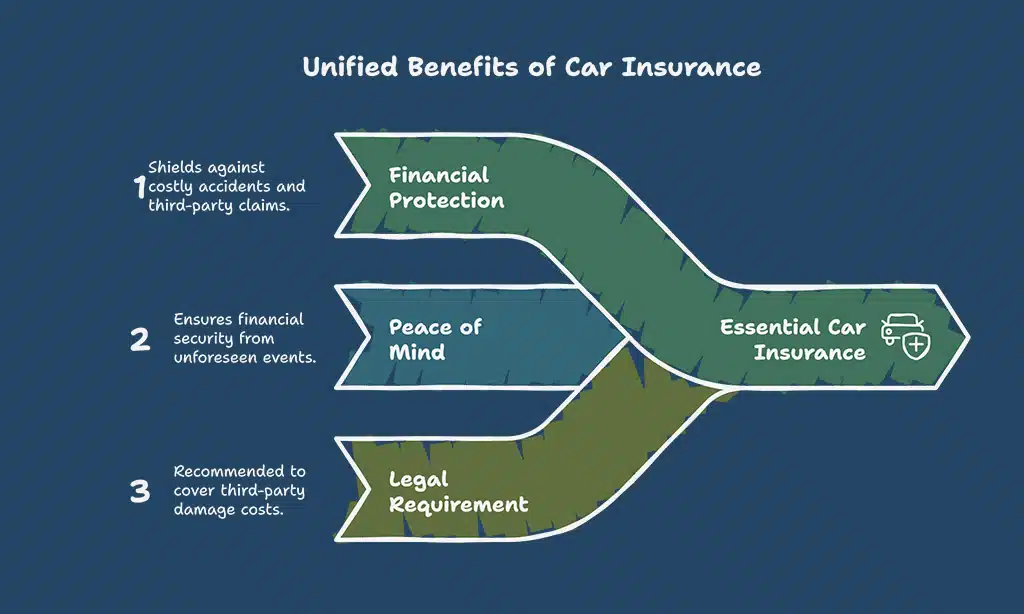

Here are several key reasons why having car insurance is essential:

- Financial Protection: Car insurance protects you from significant out-of-pocket expenses that arise from accidents, vehicle damage, or third-party claims.

- Peace of Mind: Whether it’s an accident, theft, or natural disaster, having the right coverage ensures you are not left to face the financial consequences alone.

- Legal Requirement for Third-Party Damage: While full insurance isn’t legally required, liability insurance (third-party cover) is highly recommended to protect against the costs of damaging someone else’s vehicle or property.

- Natural Disaster Risk: New Zealand is prone to earthquakes and extreme weather conditions, which could cause substantial damage to your car. Comprehensive coverage is crucial for these scenarios.

Types of Car Insurance Policies in New Zealand

Understanding the different types of car insurance is vital when comparing policies. There are three main types of car insurance that you’ll typically encounter in New Zealand:

1. Comprehensive Car Insurance

Comprehensive car insurance offers the broadest coverage, protecting you against:

- Damage to your own car (even if you’re at fault)

- Damage to other vehicles or property

- Theft or vandalism

- Natural disasters

- Fire damage

This type of coverage is ideal for drivers seeking complete peace of mind and who wish to protect both themselves and others in any situation.

2. Third-Party Car Insurance

This is the most basic form of car insurance in New Zealand. It only covers the damage caused to other vehicles or property when you are at fault. Third-party insurance does not cover damage to your own car.

| Coverage Type | What It Covers | Best For |

| Comprehensive Insurance | Damage to your car, other vehicles, and property, theft, fire | Those wanting full protection |

| Third-Party Insurance | Damage to other vehicles or property | Budget-conscious drivers |

| Third-Party, Fire, and Theft | Damage to others, fire, and theft | Those seeking more coverage than third-party insurance |

3. Third-Party, Fire, and Theft Insurance

A step up from third-party insurance, this covers:

- Damage to others’ vehicles or property in the event of an accident where you’re at fault

- Fire damage

- Theft of your car

This type of insurance is ideal for those who want more coverage than basic third-party insurance but don’t need the full protection of comprehensive insurance.

Factors That Affect Car Insurance Rates in New Zealand

When comparing car insurance companies, understanding the factors that affect your premiums is essential. These elements can significantly impact how much you pay, whether you opt for comprehensive or basic coverage.

Key Factors Influencing Premiums:

| Factor | How It Affects Premiums |

| Age and Driving Experience | Young or new drivers are often considered higher risk, leading to higher premiums. |

| Car Model | High-value cars or luxury models cost more to insure due to repair costs. |

| Location | Living in high-traffic areas or places with higher theft rates can raise premiums. |

| Driving Record | Drivers with a history of accidents or traffic violations may face higher rates. |

| No-Claims Bonus | Safe driving, resulting in fewer or no claims, usually leads to discounts. |

| Coverage Level | More comprehensive policies generally result in higher premiums. |

How to Choose the Right Car Insurance Company

Choosing the best car insurance provider requires careful consideration of various factors beyond just premiums. Here are several tips to help you select the right car insurance company in New Zealand:

1. Determine Your Coverage Needs

The first step in selecting an insurer is assessing your individual needs. Are you driving an older vehicle that may not warrant comprehensive coverage? Or do you have a new car and prefer the peace of mind that comes with comprehensive insurance? Define the level of coverage that suits your driving habits and budget.

2. Research Insurance Providers

Don’t just settle for the first policy you come across. Take time to compare different companies, coverage options, and premiums. Reading customer reviews on platforms like Canstar or Finder can provide insights into the quality of customer service and claims handling.

3. Check for Discounts

Many insurers offer discounts for various reasons:

- Multi-Policy Discounts: If you have other policies, such as home or life insurance, with the same provider, you may be eligible for a discount.

- No Claims Bonus: Insurers reward drivers who maintain a clean record with reduced premiums.

- safety features Discounts: Some providers offer lower premiums for cars with advanced safety features, such as anti-theft devices or lane-assist technologies.

| Discount Type | Available With These Insurers | How It Can Save You Money |

| No-Claims Discount | AA Insurance, Vero, AMI | Reduces premiums for accident-free history |

| Multi-Policy Discount | State Insurance, Tower Insurance | Discounts for bundling policies |

| Safety Feature Discount | Farmers Insurance, Kiwibank Insurance | Lower rates for cars with security systems |

4. Claims Process Efficiency

The ability to file claims easily and quickly is a critical factor in choosing an insurer. Ensure the company you choose has a simple and effective claims process. Some insurers, like Tower Insurance, offer 24/7 claims assistance, and many have mobile apps for submitting claims on the go.

The Top 8 Car Insurance Companies in New Zealand with Affordable Rates

Now that we’ve explored the key considerations in choosing car insurance, let’s dive into the top 8 car insurance companies in New Zealand with affordable rates. We’ve based this list on coverage options, customer satisfaction, claim-handling efficiency, and overall affordability.

1. AA Insurance: Comprehensive Coverage and Competitive Pricing

AA Insurance is a well-respected name in the New Zealand insurance market. With competitive rates and a range of coverage options, AA is a top choice for those seeking peace of mind on the road.

- Key Features:

- Comprehensive and third-party coverage options

- Discounts for safe drivers and multi-policy holders

- 24/7 claims support and efficient claims processing

| Benefit | Detail |

| Wide Range of Coverage | Comprehensive, third-party, and fire/theft coverage available |

| Claims Support | Excellent customer service, especially during claims |

| Discounts | Offers no-claims and multi-policy discounts |

2. State Insurance: Trusted for Customer Service and Reliability

State Insurance is known for offering reliable, affordable car insurance policies. It’s an excellent option for budget-conscious drivers without compromising on essential coverage.

- Key Features:

- Flexible coverage options, including third-party and comprehensive policies

- Easy-to-use online claims platform

- Competitive pricing for young drivers

| Benefit | Detail |

| Flexible Coverage | Various coverage options to suit different needs |

| Discounts | Offers discounts for safe driving and multiple policies |

| Claims Handling | Online claims submission for efficiency |

3. Tower Insurance: Offering Flexible and Customizable Policies

Tower Insurance provides a high level of customization in its policies, allowing drivers to tailor their coverage to specific needs. It’s a solid choice for people looking for more flexible options.

- Key Features:

- Customizable coverage plans

- 24/7 claims support and online claim submissions

- Discounts for drivers with a clean record

| Benefit | Detail |

| Customizable Options | Tailor coverage to suit your needs, such as adding roadside assistance |

| Competitive Pricing | Affordable rates with great value for money |

| Claims Assistance | Fast and efficient claims handling |

4. Vero Insurance: Comprehensive Options for Different Needs

Vero Insurance is known for its robust coverage options, including third-party and comprehensive policies. Vero is an excellent choice for those seeking a reliable insurer with a wide range of options.

- Key Features:

- Comprehensive coverage with add-on features

- Safe driver and no-claims bonuses

- Efficient and streamlined claims process

| Benefit | Detail |

| Comprehensive Coverage | Offers full protection for both your car and others’ vehicles |

| Discounts | Safe driver and multi-policy discounts |

| Claims Handling | Streamlined claims with easy online submissions |

5. Farmers Insurance: The Best for Young Drivers and Low Premiums

Farmers Insurance provides affordable premiums for younger drivers and those with minimal driving experience. It’s an excellent choice for first-time car owners.

- Key Features:

- Affordable policies for young drivers

- Low-cost premiums for older cars

- Discounts for no-claims and multi-policy holders

| Benefit | Detail |

| Low Premiums | Ideal for young or new drivers seeking affordable rates |

| Roadside Assistance | Optional roadside cover available |

| Claims Process | Easy-to-navigate claims process |

6. Southern Cross Insurance: Great Value for Comprehensive Coverage

Southern Cross Insurance offers excellent value for comprehensive coverage, ensuring peace of mind at an affordable price.

- Key Features:

- Comprehensive and third-party options

- Customer-first approach to claims

- Discounts for safe drivers and those who bundle policies

| Benefit | Detail |

| Extensive Coverage | Full protection for all types of car-related incidents |

| Discounts | Safe driver discounts and more |

| 24/7 Support | Always available to assist with claims |

7. AMI Insurance: Ideal for Budget-Conscious Drivers

AMI Insurance offers one of the most budget-friendly car insurance policies in New Zealand, making it ideal for drivers who want coverage without breaking the bank.

- Key Features:

- Low-cost premiums for basic coverage

- Roadside assistance options

- Flexible add-on options for additional coverage

| Benefit | Detail |

| Affordable Pricing | Offers some of the lowest premiums in the market |

| Claims Assistance | Fast claims processing with excellent customer service |

| Customization | Allows you to add optional coverage features |

8. Kiwibank Insurance: Highly Rated for Claims Processing and Support

Kiwibank Insurance is renowned for its smooth and efficient claims process, making it a go-to option for those who value reliability and simplicity.

- Key Features:

- Comprehensive and third-party coverage options

- High customer satisfaction with claims processing

- Discounts for bundling multiple policies

| Benefit | Detail |

| Streamlined Claims Process | Efficient claims handling with high customer satisfaction |

| Discounts | Savings for multi-policy customers |

| Flexible Coverage | Offers both third-party and comprehensive insurance |

Wrap Up

Finding the right car insurance company in New Zealand with affordable rates doesn’t have to be a daunting task. By understanding your coverage needs, comparing insurers, and considering factors such as discounts and claims support, you can make an informed decision.

The top 8 car insurance companies listed in this guide offer a wide range of options, ensuring that there is a policy for every type of driver, from first-timers to experienced motorists.

By balancing affordability with adequate coverage, you can enjoy peace of mind on the road knowing that you’re well-protected in the event of an accident or unforeseen circumstances.