When analyzing financial statements or stock performance, you may often come across the term TTM. But what exactly does it mean, and why is it important in financial analysis? In this article, we will break down the TTM meaning and its significance in evaluating companies and investments.

What Does TTM Stand For?

TTM stands for Trailing Twelve Months, a commonly used metric in financial analysis that refers to data covering the most recent 12-month period. Unlike annual or quarterly reports that focus on specific fiscal periods, TTM provides a rolling view of performance, offering a more updated and comprehensive financial picture.

Why is TTM Important?

TTM is crucial in financial analysis for several reasons:

- Provides the Most Recent Data – Since TTM uses the latest available financial results, it helps investors and analysts make decisions based on the most up-to-date performance.

- Smooths Out Seasonal Variations – Many businesses experience fluctuations due to seasonality. TTM metrics help normalize these variations and provide a more accurate representation of financial performance.

- Enhances Comparability – Since different companies report earnings at different times, TTM allows for a standardized way to compare financials across companies.

- Useful for Valuation Metrics – Many valuation ratios, such as Price-to-Earnings (P/E) TTM, use trailing twelve-month earnings to provide a realistic measure of a company’s profitability.

Common Financial Metrics Using TTM

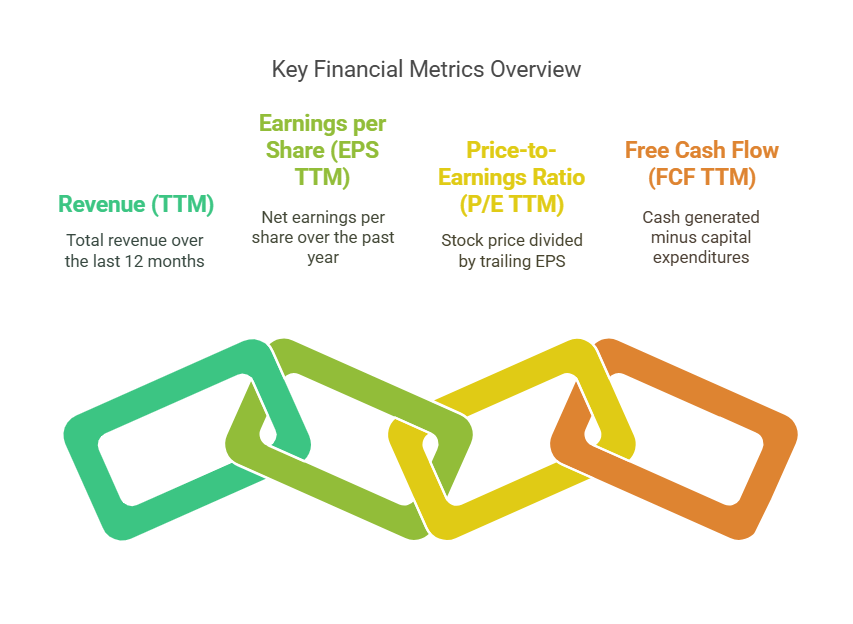

Several key financial ratios incorporate TTM data to give a clearer picture of a company’s performance. Some of the most widely used ones include:

- Revenue (TTM): The total revenue a company has generated over the last 12 months.

- Earnings per Share (EPS TTM): The net earnings per outstanding share based on the past twelve months.

- Price-to-Earnings Ratio (P/E TTM): The current stock price divided by the trailing twelve months’ earnings per share, used to assess valuation.

- Free Cash Flow (FCF TTM): A measure of cash generated by the company over the last twelve months, minus capital expenditures.

How to Calculate TTM Metrics

To calculate a TTM figure, sum up the financial data from the most recent four quarters. For example:

TTM Revenue Calculation:

This approach ensures that the data reflects the most recent business conditions rather than a fixed fiscal year.

Learn More About TTM

If you want to dive deeper into TTM meaning, its applications, and how to use it effectively in investment analysis, check out our detailed guide here: TTM Meaning.

Understanding TTM metrics is essential for any investor or analyst looking to make informed decisions based on the most up-to-date financial data. By incorporating TTM into your analysis, you can gain a clearer, more dynamic view of a company’s financial health and valuation.